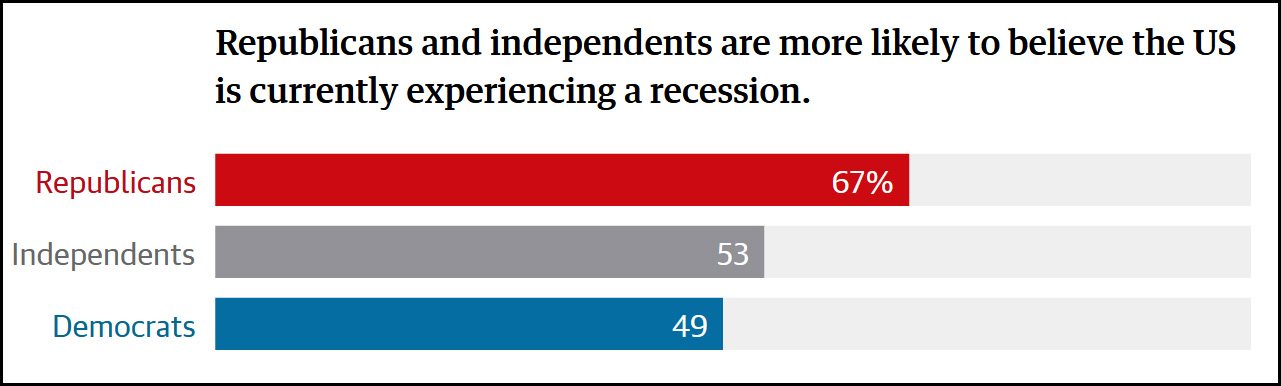

The Guardian reports in a new poll that most Americans think the economy is in recession:

This is insane. Even half of Democrats believe this nonsense. And it's not as if it's a close call, with the economy sort of flattish but technically not in recession. In fact, the economy is running so hot that the Fed is scared to reduce interest rates even a quarter of a point.

This is insane. Even half of Democrats believe this nonsense. And it's not as if it's a close call, with the economy sort of flattish but technically not in recession. In fact, the economy is running so hot that the Fed is scared to reduce interest rates even a quarter of a point.

For the record, over the past 12 months:

- The unemployment rate has averaged 3.7%, the lowest 12-month period in more than 50 years.

- Inflation has averaged 3.4%. Inflation for groceries has averaged 1.1%.

- GDP has grown 3.0%.

- The stock market has gone up 25%.

- Consumer spending has increased 3.1%.

- Total employment is up 1.8%.

- Wages are up, private investment is up, and labor force participation is up.

All of these numbers are adjusted for inflation, of course.

More important than the state of the economy is: BUT HER EMAILS!!!!

Yes, the idea that the economy is in a recession or even just flat is nonsense - actually it is a lie.

On the other hand the economy is not in an exceptional boom - it is basically on the same course as it has been since around 2010, when recovery from the Great Recession started. Both GDP per capita (which is a basic measure of productivity) and real wages have continued to improve:

https://fred.stlouisfed.org/graph/?g=1o8o9

This is true for many other basic economic measures. But contrary to what Kevin and many others say, workers are not really gaining on the rich - inequality continues to increase. GDP per capita continues to increase faster than real wages. Kevin himself showed how CEO pay has been increasing. Workers are not getting their share of the increase in productivity. This has been true since 1973. Through US history up until then real wages did keep up with GDP/capita.

Trump did nothing to decrease the growth of inequality - he would just do more of the things that caused the change. Biden has done a number of things for workers, but it will take time for them to take effect.

"This has been true since 1973."

Totally reasonable to blame Biden then for all of it. /s

Biden became a Senator in 1973!

"Being on the same course as 2010" is obviously eliding the actual state of the situation with the rationale being that we must not be happy with shockingly low unemployment along with solid wage gains because there are other problems that are not yet fixed.

Being on the same solid, steady course for 10-14 years is a pretty large success.

Yeah, this is where I'm at, too.

While the economy isn't BAD-bad, it's also not great. It's decent for some people who aren't rich. It's backsliding for a lot of others. And you can't just look at wages/earnings - you have to look at other things, like the price of housing (which is not appropriately accounted for in inflation metrics) vs. earnings.

It makes a whole lot more sense when you see that last year, for the first time ever, a majority of renter households met the criteria for being housing burdened (more than 30% of gross or about 50% of take-home going towards housing costs) and the proportion of owner households who meet that criteria also continues to climb. Housing costs are the single biggest expense for almost everyone. When they're getting worse, people are going to feel the economy is getting worse.

TLDR - it's the housing crisis, stupid.

Housing costs are not underweighted to any significant degree no matter how tempting it is to unskew the stats to arrive at a predetermined narrative.

Roughly 1/3 of Americans are renters, 1/3 own their home outright (no mortgage) and 1/3 own a home with a mortgage. Most americans are not actually affected by monthly variations in monthly housing costs.

And while it is always true that average, median or collective stats do not tell each of 330 million individual stories, finding anecdotal stories of suffering is always a less accurate way to understand what is going on for 330 million people.

Housing costs are a problem, but most Americans are way ahead of where they were a year or two or three ago in terms of income and overall expenses.

Housing costs ARE underweighted in the most common inflation statistics. Inflation is supposed to measure something akin to what the cost of goods are to the median purchaser. Housing as a percent of the median purchaser's income has risen to such an extent since these measures were set (16% of PCE is housing, 1/3 of CPI is housing) that housing is now underweighted.

Do you have an alternative proposal for why, if wages have allegedly kept up with inflation or even outpaced it, the percentage of households (both renters and owners) who are housing cost burdened has been rocketing upwards?

Additionally: it is true that those who own are less affected by monthly price changes, but this should actually raise even more alarms about the rise in the percentage of homeowners who are cost-burdened because it means that those whose housing costs have "rolled over" or who are entering the homeownership market are even more likely to be cost-burdened from the outset rather than those who already owned falling into being cost-burdened (specially if incomes are rising!).

These are systemic trends, not anecdata.

All of these numbers are adjusted for inflation, of course.

How do you adjust inflation for inflation? ISTM that once adjusted, inflation must be 0.

😉

All Cretans are liars.

They should have also asked the respondent if they knew what is the definition of a recession otherwise this is a just a survey of how poorly informed Americans are and we have way too many of those kind of surveys already.

From the article:

"49% believe the S&P 500 stock market index is down for the year,.."

That isn't a result of misunderstanding a definition. That just shows that either 49% of Americans are idiots, or that the poll is not real data.

Both things can be true.

I would not say the economy is “hot hot hot” but it is doing fine. Something that always intrigued about inflation is how come when I go to Europe do prices seems so high? Granted, as a tourist, I’m visit g stores that have jack up prices and of course we all know that gas costs twice as much. But I have noticed meat and produce also to be expensive. It may be just a perception thing but I do wonder how people afford things. It may that relatively speaking rent is cheaper and healthcare is free so consumer goods take a hit. Anyways, Americans complaining about food prices goes to show that we don’t know how good we have it, nevertheless, rents are indeed high. A 2 BR apartment in any median city will be north of 2k.

I've been in numerous supermarkets in Germany and Austria in the past year. I'd say the price of food is a good 20% lower than in the US. And I'm pretty familiar with US prices (some people don't pay much attention - I do) and looked at a lot of prices in those countries of stuff I wasn't going to buy.

The only reasonable explanation is subsidies. It's not like store construction, wages, land, and transport are any cheaper there than here. Probably more the opposite.

My experience living in Western Europe off and on (currently on) is that food prices (most things actually) are actually much cheaper in Europe. Tourist areas are certainly an exception.

"The economy is still running hot, hot, hot..."

Yes, but we still write under capitalism's lash, here near the end of Biden's first term. And he had a trifecta for half of it.

Frankly I expected more of the commanding heights of the economy to have had their control and direction placed in the hands of their workers by now.

Well, that's what happens when the media tells us that high inflation is bad for the economy and politicians back it up with expressions of exasperated anger over the rising costs of eggs, Big Macs, and gasoline.

What are people going to do when an actual recession hits?

I thought median income would provide some insight into this, but it has left me more confused.

Median income growth really was pretty bad from 2000 or so to about 2015 (pretty much from when I entered the working world - yikes!). But it picked up quite a bit after that, so we now see real income growth compared to the late 90s.

That's median income, not average, and it's adjusted for inflation. And the last decade has looked good for both individual wages and households. Here's household numbers: https://fred.stlouisfed.org/series/MEHOINUSA672N

Even the poverty rate is down from what it was in 2015. https://www.census.gov/newsroom/stories/poverty-awareness-month.html

The last decade has been pretty decent economically. People should be feeling optimistic, but that isn't happening. Maybe partisanship or concern about the pace of technological change is behind it. Or maybe we have very different social expectations that our current levels of growth can't meet.

But the unhappiness does seem strange to me.

My wife and I ignore the screeching idiots.

We've lived through a lot of "recessions" - not one of them really harmed us. We bought our first house in 1984 after carefully socking away money from our jobs for 20 years. Mortgage interest rates were at 14% in 1984. I admit, I was more than a bit worried - but the mortgage interest deduction and adjusting our withholdings to suit worked well.

Less than a year later rates dropped to 11% and I took out a new mortgage, didn't pay points or fees and STILL got a bit under 11% at closing. NICE drop in payments. We recouped all the rather paltry cost of the refinance in under 3 months of payments - very nice!

A year later it went down to 8% and I jumped on that. Same thing - I paid no points or fees, recouped the remaining fee costs in 4 months.

We kept riding that down for close to a decade.

In one glorious point during the in the oughts after the 2008 collapse, we had a 7 year ARM with 0% interest and NO required principal payments. It was supposed to be a trap for highly paid high tech salesmen and BoA decided that a lot of highly paid engineers (like me about that time, watching our options grow rapidly in the recovery) would not pay the interest payments OR the principal payments - and the balloon payment, if your stock price was low when it came due, could be ruinous.

I definitely jumped on that after asking our Merrill-Lynch if BoA (which had acquired them) "was out of their minds" - and he said: "might be, trying to do this on engineers". So we took it. And acted just like we would with a regular mortgage. and paid the interest that we would have paid in a regular mortgage, plus a good bit extra on top. The principal went down pretty fast, and 2 months before the BoA mortgage floated, we refinanced again at far less than BoA was hoping to get.

It's all because of food prices are stuck high, because they jumped a lot when inflation was high. Even though food inflation recently is running low, the food prices still freak people out. They think something is wrong.

Whenever I am on the road and forced to eat out I am just shocked at the price of the food. Probably because I travel so little since the pandemic.

People love to complain about the price of gasoline. Anything over $2/gallon is outrageous to them.

What's the usual number of people who think the economy is in recession when it's not? I suspect the number of Americans who mischaracterize economic conditions is always pretty high. It's higher now, apparently, but by how much, ten points? Fifteen points?

If that's the kind of increase we're talking about—and if "recession" in many people's minds is a proxy for "my personal situation isn't great"—then I don't think it's much of a mystery:

(1) A lot of working class Americans—the kind of folks who've struggled from paycheck to paycheck all their lives—had a few grand in their bank account during Trump's last year in office, courtesy of stimulus. And many of them were able to stay home, to boot. That's now long gone, and the fact that they've since managed a 15% increase in real wages doesn't give them feelings of euphoria: going from $41K to $48k, while better than moving in the opposite direction, still means you're struggling!

(2) Many such people have also had Medicaid benefits taken away, as state governments have doubled down on doing eligibility audits. This is a hugely underreported issue. Twitter account Medlock claims the number is in the 20 million range:

https://x.com/jdcmedlock/status/1787971836711760078

That's gigantic!

(3) Interest rates. This has to be a problem for a lot of working class folks who need cars. AFAIK car prices have eased a bit over the last year, but that doesn't do you much good if that auto loan is twice as expensive. UMC Americans normally drive nice, pricey, late model vehicles, but adequate, reliable transportation is a real struggle for the non-affluent in a country with such craptastic transit.

(4) The inflation burst is over, but prices obviously didn't reset. So, there's still lingering inflation trauma going on.

> All of these numbers are adjusted for inflation, of course.

If you adjust inflation for inflation, isn't the inflation rate 1.0? Or 0%?

[Why, yes. Yes I am an overly pedantic nit-picker. ;-]