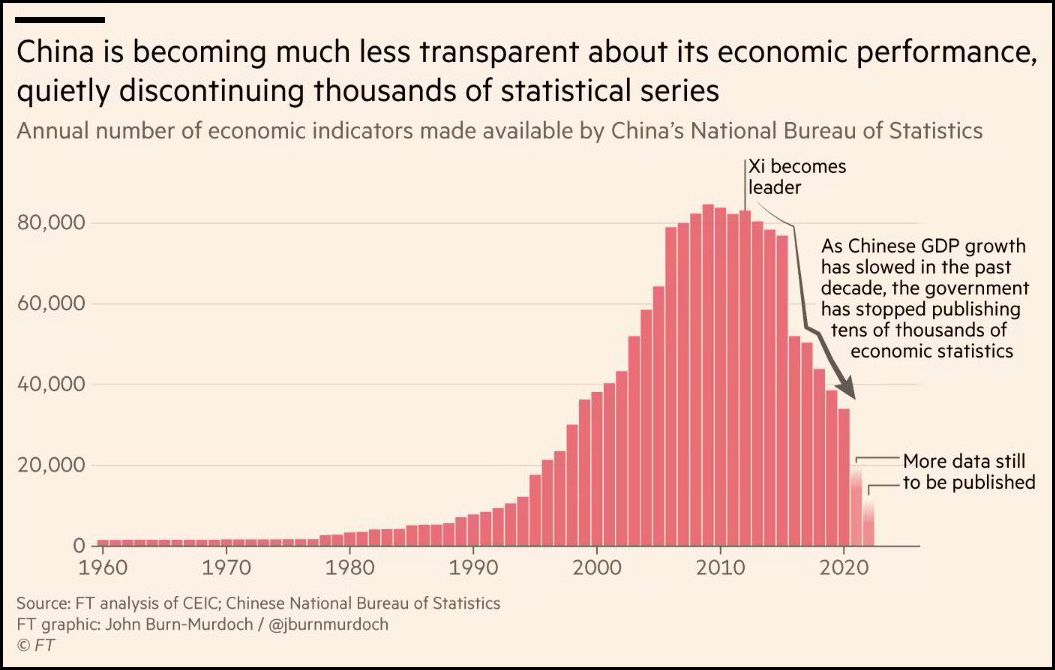

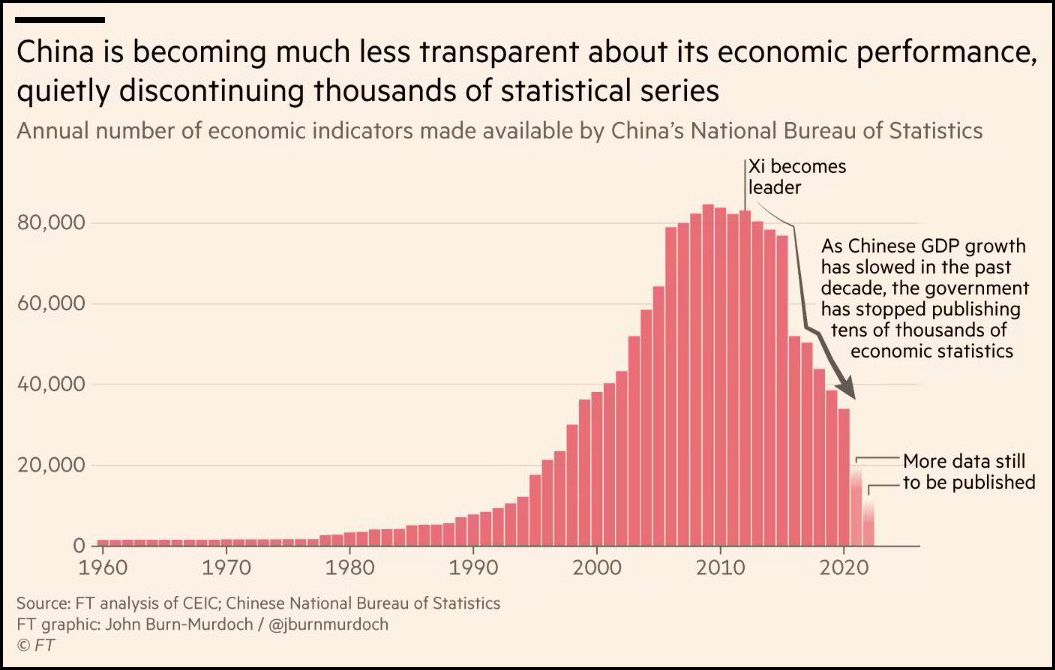

If you withhold economic data, it means that things must be even worse than anyone can imagine:

China released more bad economic news on Tuesday, but it was the number that wasn’t included in the official data dump that stood out: Beijing said it would stop publishing figures for youth unemployment, weeks after it hit a record high of 21.3 percent in June.

....China has been publishing less economic data since Xi Jinping rose to power. In recent months, authorities have reportedly told Chinese economists to avoid discussing negative trends. Officials have also instructed lawyers working on I.P.O.s to soften their wording on the country’s risks.

Is China just in the midst of a temporary downturn? I suppose that's the way to bet, but I'm not so sure. I think it's more likely to be a harbinger of a permanent slowdown in China's economy, due partly to fundamentals like population growth and partly to Xi Jinping's steady abandonment of free-market policies.

I've often said that if you believe in free-market capitalism as a growth engine, then you should believe in free-market capitalism as a growth engine. I do, with obvious caveats, and this means I don't believe in China. Their housing bubble economy of the moment will eventually recover, just as ours did after the Great Recession, but their long-term growth is going to be weak if they steadily move further away from free-market principles and instead clamp down on private business while tying themselves ever more tightly to the anchor of state-owned enterprises weighing them down.

Needless to say, China will remain a major economic force during all this. And if Xi decides to roll the dice and invade Taiwan while he's still alive to see it, it will be a disaster for the world economy no matter who wins. At a 10,000 foot level, however, the future does not belong to China, no matter how many people say it.