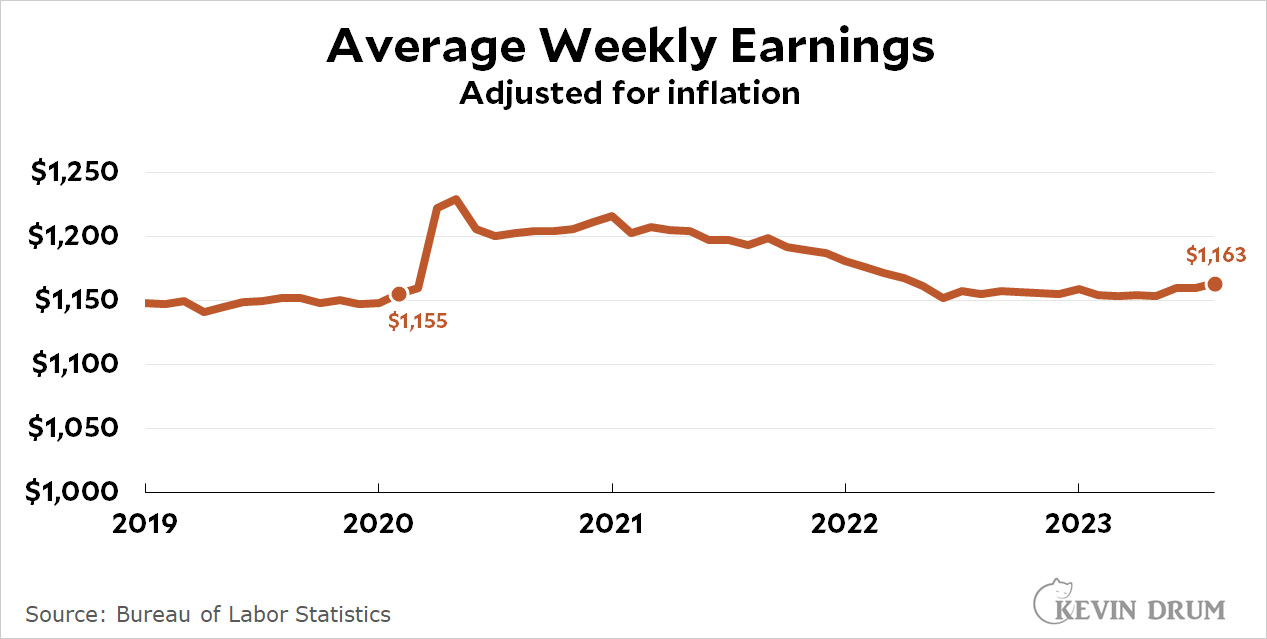

After adjusting for inflation, average weekly earnings increased at an annualized rate of 4.3% in August:

Hourly earnings barely budged, but average hours worked increased 3.6%. This accounted for nearly the entire increase.

Hourly earnings barely budged, but average hours worked increased 3.6%. This accounted for nearly the entire increase.

Cats, charts, and politics

The Wall Street Journal has a good roundup of higher interest rates today:

The Federal Reserve’s federal-funds rate averaged 0.5% from 2009 through 2021. Today it is between 5.25% and 5.5% and markets think it will be around 3.5% for the next decade. As yet, this has caused little distress. Growth is chugging along, and even the interest-sensitive housing sector seems to have a second wind.

The effects will come; just wait.

The whole piece is worth a read. It goes through households, commercial borrowers, real estate, and other segments of the economy and explains how high interest rates are slowly but surely having an effect. It's a very ground level view of how and why interest rate hikes take a while to work their way through the economy.

They haven't yet, but they will. Just wait.

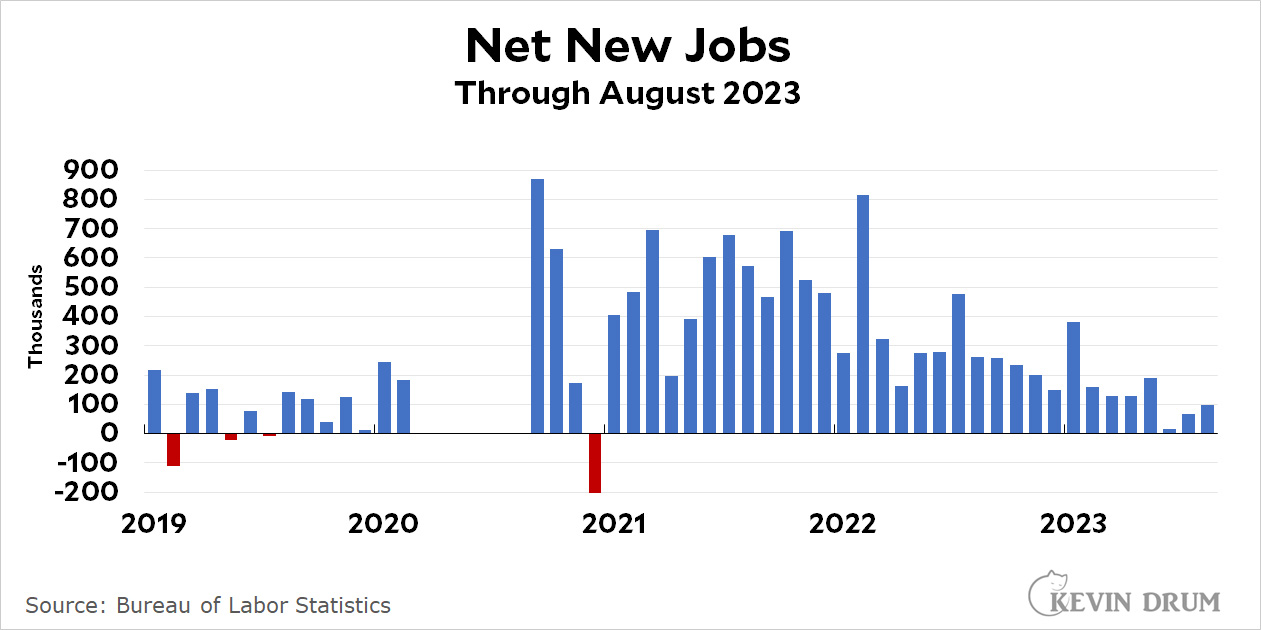

The American economy gained a meager 187,000 jobs last month. We need 90,000 new jobs just to keep up with population growth, which means that net job growth clocked in at an even more meager 97,000 jobs. The headline unemployment rate increased to 3.8%.

Unemployment rose by 514,000, most of them people who entered the labor force but don't yet have jobs. In addition the employment numbers for June and July were revised downward by a combined 110,000.

Unemployment rose by 514,000, most of them people who entered the labor force but don't yet have jobs. In addition the employment numbers for June and July were revised downward by a combined 110,000.

This is not a good report.

UPDATE: I originally reported that 525,000 people dropped out of the labor force, but I got the sign backward. Actually, 525,000 people entered the labor force in August.