A Wall Street Journal story today got me pulled down a rabbit hole. The point of the article was that, except for gasoline, the cost of owning a car has been going up, up, up recently. This got me curious, so I took a look at auto-related costs over the past couple of years:

It turns out this is really a story about auto insurance. Parking and auto parts have gone up less than wages, and after a year of big price hikes repairs have slowed down a lot over the past half year.

It turns out this is really a story about auto insurance. Parking and auto parts have gone up less than wages, and after a year of big price hikes repairs have slowed down a lot over the past half year.

Insurance, conversely, has gone up like a rocket and has kept going up. What gives?

Part of the answer comes from choosing 2022 as the starting point. Here are auto insurance premiums adjusted for inflation going back to before the pandemic:

The peak pandemic years of 2020-21 were actually rare profitable ones for auto insurers, and they lowered their premiums in response. You probably didn't notice this since premiums mostly stayed about the same and only dropped relative to inflation. But it really happened, and insurers found themselves stuck with those low premiums in 2022, when things went back to normal.

The peak pandemic years of 2020-21 were actually rare profitable ones for auto insurers, and they lowered their premiums in response. You probably didn't notice this since premiums mostly stayed about the same and only dropped relative to inflation. But it really happened, and insurers found themselves stuck with those low premiums in 2022, when things went back to normal.

Or worse than normal, actually. We've been driving like maniacs ever since the pandemic started, and accident rates have stayed high through the end of 2023. What's more, as you can see in the top chart, auto repair costs have recently gone up a lot. The combination of these two things has led to premiums (a) going up to claw back the earlier declines, and then (b) going up more to make up for the increasing cost of accidents.

That's all a pretty reasonable story. There's just one thing that nags at me:

Auto insurers almost never make a profit on writing premiums. They take a loss and then make it up by investing the money we give them. As you can see, overall underwriting losses—which include all payouts for accidents—have indeed gotten bigger over the past couple of years, but they're still less than they were before the pandemic. If that's the case, why do premiums in real terms need to be higher than they were before the pandemic?

Auto insurers almost never make a profit on writing premiums. They take a loss and then make it up by investing the money we give them. As you can see, overall underwriting losses—which include all payouts for accidents—have indeed gotten bigger over the past couple of years, but they're still less than they were before the pandemic. If that's the case, why do premiums in real terms need to be higher than they were before the pandemic?

I don't know. The insurance biz is extraordinarily complicated and opaque, which makes it hard to figure out what's really going on. However, there's one thing that suggests insurance companies really are justified in their rate hikes: state commissioners everywhere are approving them, even in historically adversarial states like California.

Bottom line:

- Auto premiums have gone up 40% over the past two years.

- But only 26% after adjusting for inflation.

- And only 13% if you start in 2019 and include the pandemic years when premiums declined.

Make of this what you will.

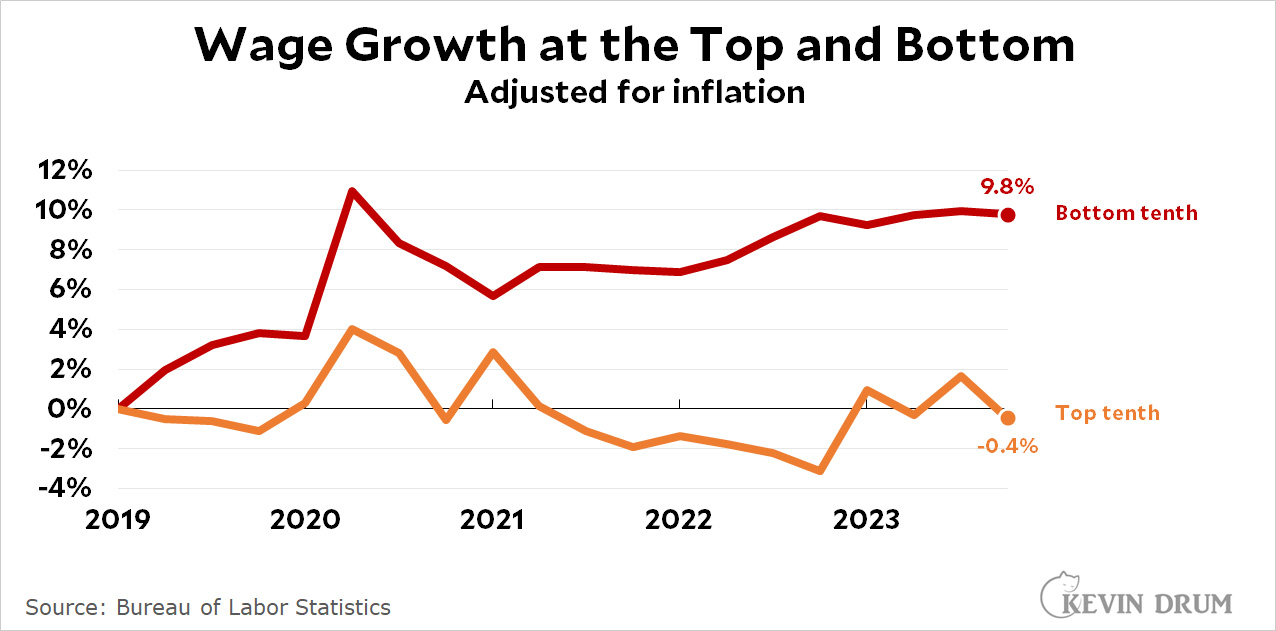

There's no need to feel sorry for the rich, though. They have lots of investment income too, and the stock market has been going gangbusters recently. They're still doing OK.

There's no need to feel sorry for the rich, though. They have lots of investment income too, and the stock market has been going gangbusters recently. They're still doing OK.