Here is a headline today in the Wall Street Journal:

Shopper Rebellion Against Higher Prices Helps Slow Inflation

Indeed? Let's investigate how this rebellion against inflation is manifesting itself:

Conagra Brands Inc., which makes Hunt’s ketchup and Slim Jim meat sticks, raised prices 17% in its latest quarter, on top of two previous quarters, when it increased prices more than 10% [for a total of 27% over two years].

The company said it is done boosting prices for now. Conagra’s sales volumes fell 8.4% for the quarter ended Nov. 27, which the company attributed in part to shoppers recoiling from the price increases.

So this is not just about inflation, which has raised food prices 19% over the past two years. It's also due to the fact that Conagra decided to tack on an extra 8% just for the hell of it. And sales volume fell! Imagine that. It's exactly what they taught us in Econ 101.

A recent study provides more detail:

The study, by economists at the Federal Reserve Bank of Kansas City, found that higher markups—the gap between what a firm charges and what it costs to produce an item—were a major driver of inflation in 2021.

In plainer terms, companies decided to use inflation as an excuse to boost their gross profit margins just because they could—or thought they could, anyway. But they sure didn't do the same thing with wages:

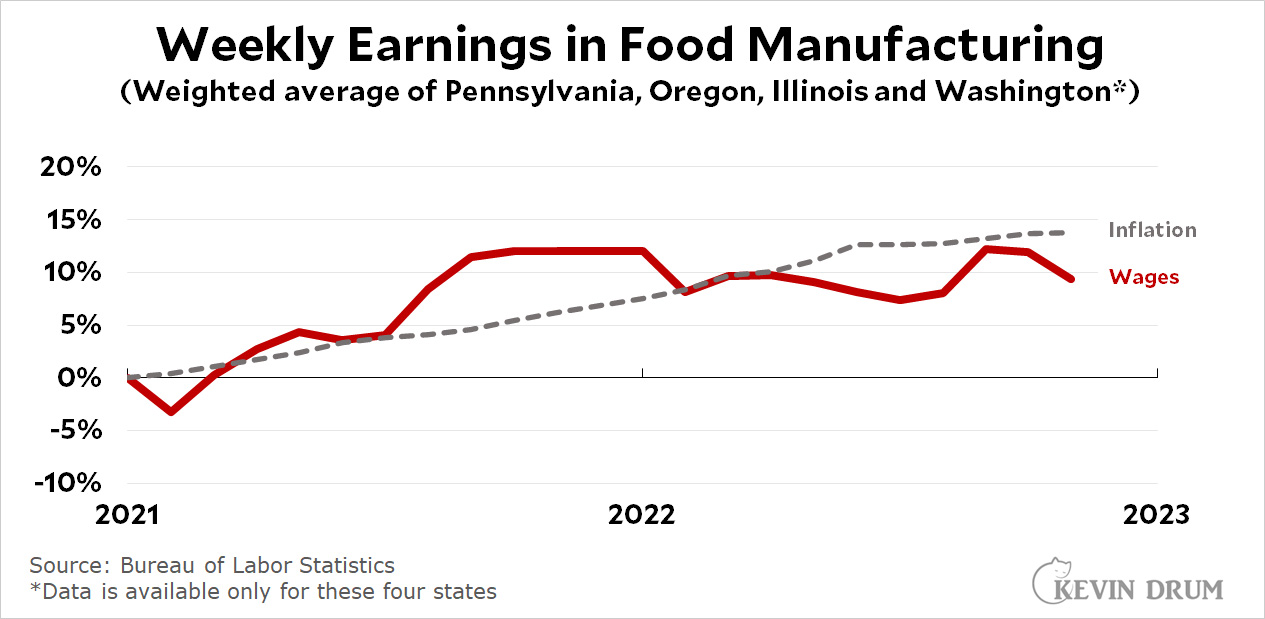

Since the start of 2021, weekly wages for food manufacturing workers have grown more slowly than inflation. In real terms, the folks who make Slim Jim meat sticks are earning about 5% less than they did two years ago.

Since the start of 2021, weekly wages for food manufacturing workers have grown more slowly than inflation. In real terms, the folks who make Slim Jim meat sticks are earning about 5% less than they did two years ago.

So prices are up 8% and wages are down 5%. That should make Wall Street happy, but it's understandably worth a bit of rebellion for the rest of us.

On stockholder calls, many companies are saying that they are jacking up prices just 'cuz they can. Imagine that.

Start making more money weekly. This is valuable part time work for everyone. The best part ,work from the comfort of your house and get paid from $10k-$20k each week . Start today and have your first cash at the end of this week.

Visit this article for more details.. https://Payathome.pages.dev/

Yeah, those danged "rebellious" shoppers, not passively accepting getting gouged. Buncha commies.

It is like nobody saw Congresswoman Katie Porter explaining with her whiteboard that over 50% of inflation was money grabbing corporations jacking prices for no good reason.

Hey, you got something against Slim Jims??

Been reading that the price of eggs isn't going to come down for at least a year because bird flu has become endemic year-round and there won't be a vaccine until summer.

Look for 25% of the country to refuse to eat eggs from vaccinated chickens.

????????????

!

Bill Gates' most evil scheme!

I knew there was something I wasn't catching in this!

It's almost like inflation was 75% made-up - a narrative to goose corporate profits and pad the pockets of the wealthy.

Substitution bias. Substitution bias arises if consumers change their purchasing behavior in response to relative price changes. Economic theory predicts that an increase in a good’s price will cause consumers to reduce their purchases of that good and instead purchase a substitute with a relatively lower price. The Boskin Report asserted that this was another important source of bias in the CPI, which at the time assumed no substitution. In 1999, BLS changed the way it calculated the CPI for many of the basic indexes, moving from a Laspeyres formula to a geometric means formula. (A basic index is an index for a particular item category and location; these basic indexes are the building blocks that are aggregated into the broader CPI measures, such as the all items index.) This new formula effectively presumes modest consumer substitution within item categories, correcting for what the Boskin Report termed “lower-level substitution bias.” That is, it assumes that consumers will substitute away from one brand or type of item, such as a steak or a car, as that brand or type becomes relatively more expensive compared with other brands or types of that product. It does not assume, however, substitution between steak and chicken or between cars and bus fare. -- https://www.bls.gov/opub/btn/volume-1/consumer-price-index-data-quality-how-accurate-is-the-us-cpi.htm

For those who don't know.

I was not much affected by inflation given my upper middle class income and minimal expenses. Food prices went up for sure and I did my own bit of substitution by not eating out at restaurants. That more than made up for higher grocery prices.

Apparently sales volume up but guest counts down. Go figure.

https://www.cnn.com/2022/11/15/business/restaurant-sales-traffic/index.html

Ah, but you managed to miss the other half of the story.

Recall that the underlying value of a company is just the total future earnings of the company, _adjusted_for_future_inflation_. If inflation rises, then the company either increase its future earnings by cutting costs or raising prices, or the real value of the company goes down.

The whole job of Conagra’s management is increase, or at least maintain, the company value. So raising prices is the only way they can avoid a haircut.

This is why inflation is so pernicious, since _every_ single company is facing the same pressure. Inflation won't end until the economy collectively figures out which companies will be left holding the bag.

The same dynamic is happening on the worker side. In the long term, wage inflation is exactly equal to inflation. So not every worker can end up with a real wage increase. Some workers will end up with a smaller inflation adjusted paycheck.

Inflation isn't a morality play. It is just a sucky situation that sucks for everyone.

"So raising prices is the only way they can avoid a haircut."

Sounds like they were taking Rogaine to add to their hairline.

The margins in the food industry aren't that great, so they did start off with a buzz cut.

I work in the finance industry and can say that a major reason we have seen such a spike in prices is due to listed companies actions that pushed their selling prices up up to compensate more than necessary the cost increases and lower volumes. This was/is all about the pressure to deliver next quarter at all costs. At the same time their employees are not supposed to ask for a raise due to the difficult economic environment. I am not saying that companies shouldn't increase their pricing, but the speed at which pricing went up show a lot of short term thinking. Are they going to lower pricing.... not until the economy slows down a lot.

That's pretty much what you would expect. They need to raise prices to compensate for higher costs, _and_ they need to increase earnings significantly just to maintain valueation.

The only real way to stop this completely would be to engineer a recession.

"So prices are up 8% and wages are down 5%." You're comparing a nominal value with a value adjusted for inflation. Your continual adjusting of wages to inflation makes me wonder: Why don't you adjust everything by the rate of inflation? Then you can prove that inflation doesn't exist. "Prices went up 8% last month, but adjusted for the 8% inflation rate they actually went up 0%. Therefore, there's no inflation."