Over at the Washington Monthly, Robert Shapiro argues that Americans—and Democrats in particular—should be more aware of big wage gains over the past year. It's something to brag about.

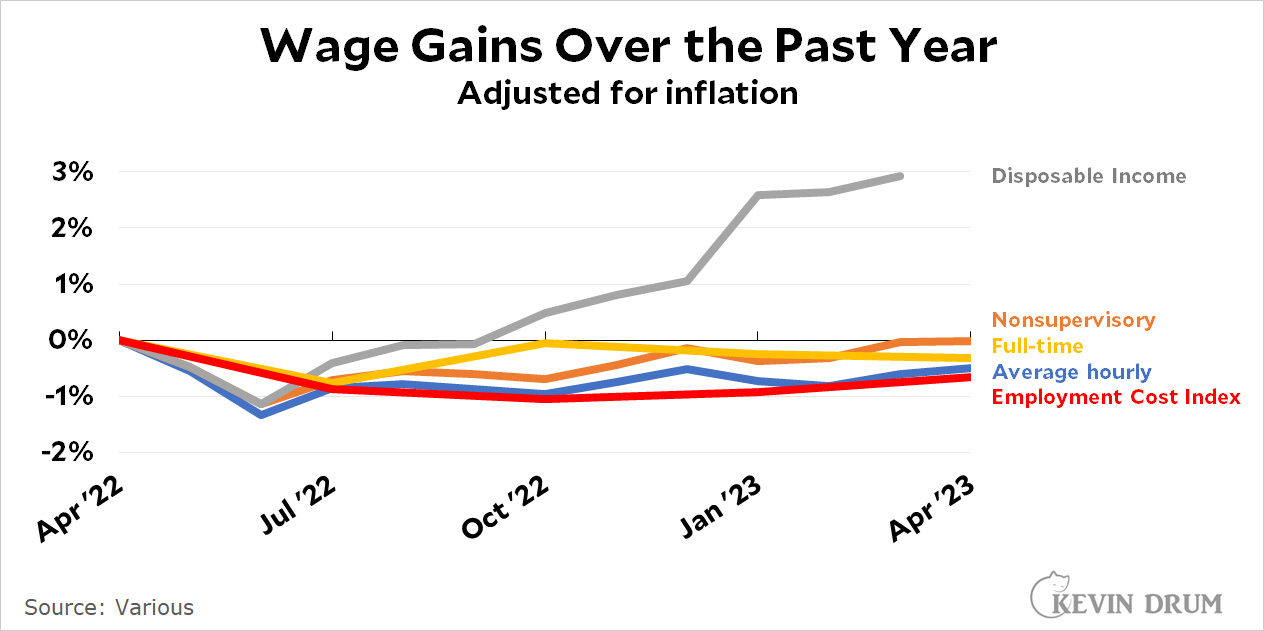

The problem is that it really isn't true. There are several common ways of measuring wages, and nearly all of them show no gains at all over the past 12 months:

Shapiro focuses solely on disposable personal income even though every other measure shows small losses over the past year. The key here is that DPI measures income after taxes, so an increase in DPI doesn't necessarily mean that income is up. It might just mean that taxes have fallen a bit. This is almost certainly the case here, possibly due to various tax credits and temporary adjustments passed over the previous two years.

Shapiro focuses solely on disposable personal income even though every other measure shows small losses over the past year. The key here is that DPI measures income after taxes, so an increase in DPI doesn't necessarily mean that income is up. It might just mean that taxes have fallen a bit. This is almost certainly the case here, possibly due to various tax credits and temporary adjustments passed over the previous two years.

Whatever the reason, it's almost certain that income has been flat or down over the past year. There's nothing much to crow about.

Wages are notoriously sticky. They are negotiated over twelve months and buck the trend of recession or short term inflation. Over the long haul they manage to reflect the economy fairly well.

While the other statistics are certainly interesting, literally the only one that counts for nearly everybody is disposible income. The article was about the perceptions of Americans so the article used the income measure that Americans are most impacted by.

Imagine trying to convince people that they are better off if nonsupervisory wages are up but their disposoble income is down. Disposible income is almost all that matters to people.

Also, given the outsize impact that housing has on recent inflation and the fact that a large majority of Americans are not renters facing these rent hikes, it is definitely true that inflation adjustments wildly distort the positives that most Americans are seeing in their monthly budget.

Most Americans have seen large improvements in their finances and quality of life over the last year or two.

And yet people don't approve of Biden.

My guess is that nominal wages have grown faster than nominal expenses and thus disposable income is up.

When adjusted for inflation, nominal growth in wages will disappear. That's because we are in a tight labor market, which is driven at least as much by demographics as any macro policy. And so a key inflation driver is that tight labor market.