The American economy is in very squirrely shape right now. I have two things to show you that demonstrate how weird things are.

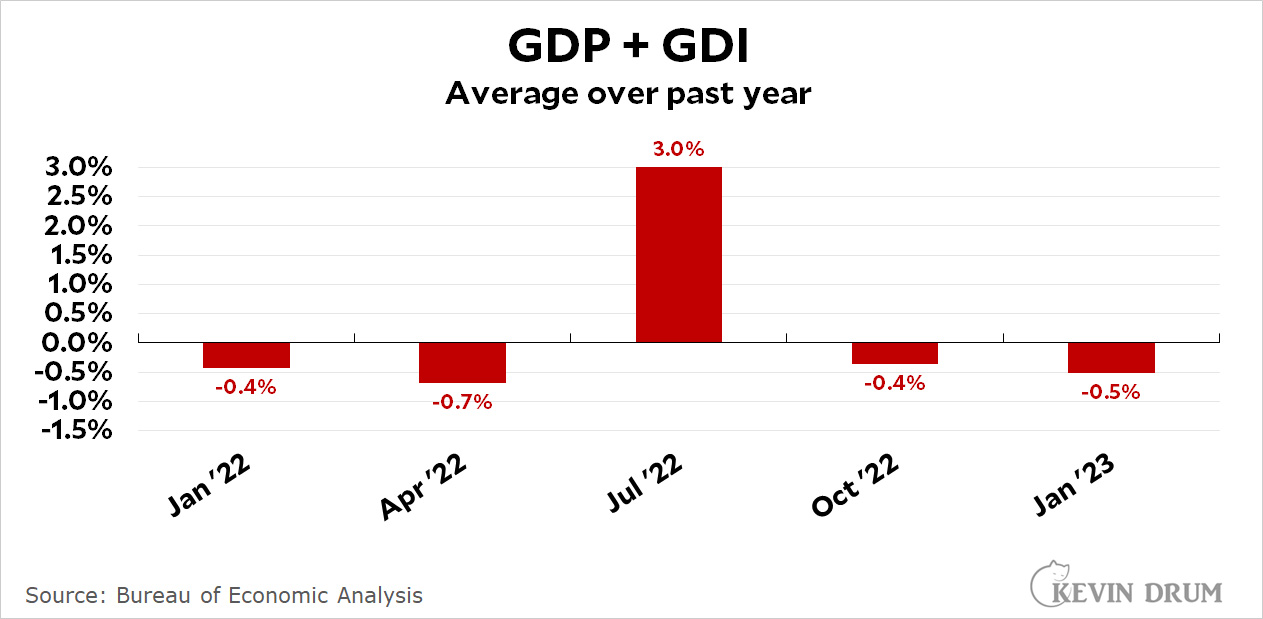

First, you may recall that there are two basic measures of economic growth: GDP and GDI. They are theoretically identical, but in practice they diverge—sometimes a little, sometimes a lot. For that reason, many economists think the best overall measure of economic growth is an average of the two. Here are the latest figures for that:

If this is correct, we've been in a light recession for the past year. That hardly seems plausible, though, especially with the labor market so tight.

If this is correct, we've been in a light recession for the past year. That hardly seems plausible, though, especially with the labor market so tight.

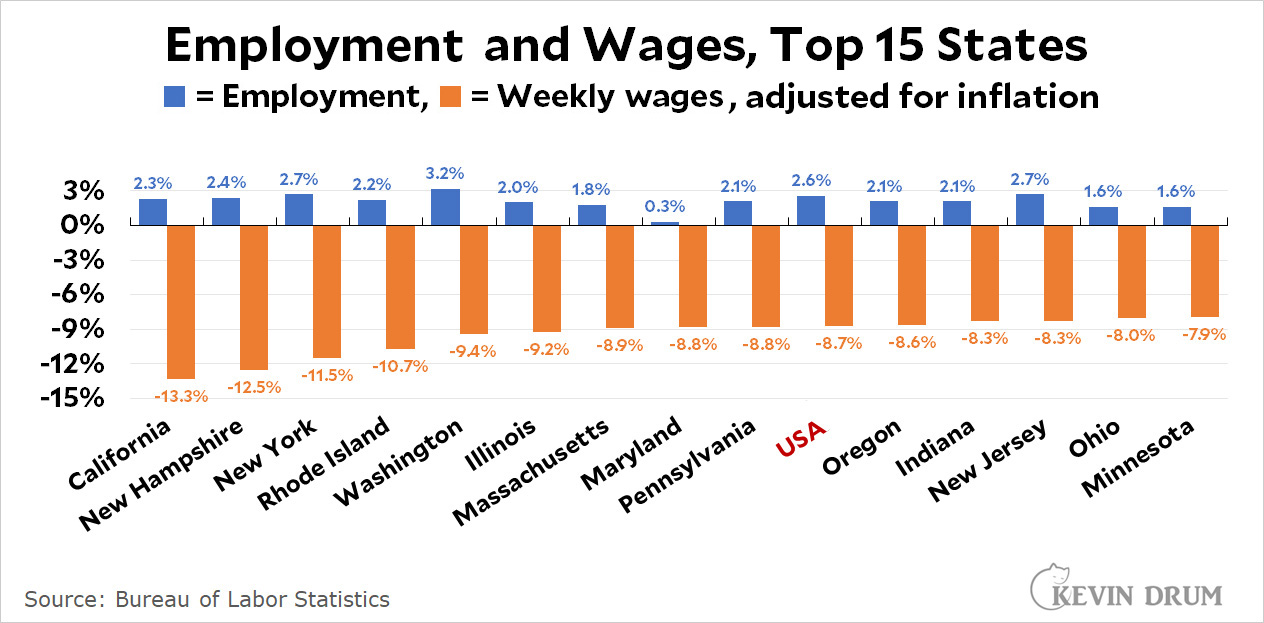

But that gets me to my second, even more astonishing chart. The BLS reported yesterday that overall US employment was up 2.6% last year but weekly wages were down 8.7% after adjusting for inflation. This same dynamic was true in virtually every state and 240 out of 355 big counties. Here's a sample:

This is nuts. Take a look at California: employment growth is strong at 2.3% but pay is down a whopping 13.3% after inflation. In San Francisco alone, employment increased 2.5% but pay cratered by 29%. How is that even possible?

This is nuts. Take a look at California: employment growth is strong at 2.3% but pay is down a whopping 13.3% after inflation. In San Francisco alone, employment increased 2.5% but pay cratered by 29%. How is that even possible?

I'm stymied by this. If hiring is strong, how can wages be going down—a lot? Is it related to the overall economy being weaker than we think? I don't know, but one way or another the labor market just isn't as tight as we think it is.

After inflation.

What this suggests is that inflation is worse than we understood.

I'm going to guess that housing costs are most of that misunderstanding, too.

But the adjustment in Kevin’s data uses inflation as measured. It may not be measured accurately, as you surmise, but that wouldn’t make wages look bad in this chart.

"What this suggests is that inflation is worse than we understood."

Are you suggesting that prices are secretly much higher than they are reported? Also, if inflation was worse than we understood, the decline in inflation-adjusted wages would be even greater, so if anything, the mechanism you are proposing here works in the opposite direction.

Two things.

1) WFH hasn't changed in the last 12+ months, and many workers have been willing to stay at WFH with a minimal salary increase.

2) Early retirements at the start of the pandemic on top of the folks who've reached retirement age has created a distorted aggregate view of incomes, by displacing experienced workers at the top of the income scale.

To your point 2), I believe that you are right, that the weekly wage data is not corrected for composition effects.

I forgot to add that this wage skew was also affected by COVID deaths that were weighted towards older groups.

Service work is up and pays less.

High tech employment pays more--and layoffs...

What I've noticed as a recruiter is that people are now willing to accept less money than they were even 12 months ago. If I had to make a guess it's because months of "recession is coming" reporting has put job seekers on edge. Last year I was regularly having to counter-offer, the past 3 months I've had a lot more unconditional acceptances.

There are people taking jobs for less money if their current job is forcing them back in the office. Factor in transportation, food, clothing and quality of life especially for folks nearing retirement age and may be downsizing

Lots of layoffs in the news, as well. It all works to make workers feel pretty precarious.

What it's saying is people aren't being paid enough and they aren't being paid enough at an increasing, an inflating, rate.

Maybe I am missing something, but of course wages are down adjusted for inflation.

What would be astonishing is if wages kept pace with inflation. I mean, you could estimate that with low unemployment wages would rise, but that's just an assumption. Obviously wages are not rising.

"What would be astonishing is if wages kept pace with inflation."

It wouldn't be astonishing at all, if the economy were close to full employment, since wage increases are traditionally the way employers compete for scarce workers when workers are scarce. Kevin is pointing out that something is going on here since unemployment figures are very, very low, and yet wages are decreasing. That's not what you'd expect to see.

Ordinarily, over the long or even medium term, real wages are expected to rise.

Comparison of the noncyclical (natural/NAIRU) rate of unemployment and the unemployment rate. This suggests the economy is running hot.

It's discipling. It's not just physical, monetary discipline. It's psychological, spiritual reinforcement of the myths of capitalism, that you should be thankful for your pittance, that you are free to make choices, that work for wage gets you that freedom, and that you too one day will be rich.

These wages reported by the BLS are not adjusted for inflation. For the nation the year/year decrease in this survey for fourth quarter 2022 was 2.3%, not as bad as California, but still shocking, since there had been increases over 4% for some time. This is also completely out of line with the increases which were already reported in the BLS's establishment and household surveys for the same period.

It seems hard to argue with this survey when the result is similar for most counties, as Kevin says. Nevertheless there is something badly out of whack with the different BLS surveys and reports.

The 2.3% nationwide decrease reported directly by the BLS is not corrected for inflation. Kevin's number of 8.7% is corrected. Either way it seems unbelievable.

Usually people get once a year salary review. Can explain the lag.... and explain why the Fed is upset .... because wages increase with a lag :-0... to catch up with the cost of living. Again the chicken and egg question.

There's high growth in low-wage jobs. In other jobs, pay increases aren't attempting to keep up with inflation. Corporations are simply padding the bottom line. Inflation is simply caused by corporations increasing profits at the expense of labor.

New hires tend to start at the bottom of the wage scale. When layoffs happen, the people laid off tend to be the most junior, hence lowest paid. The seemingly counterintuitive result is that average wages move in the same direction as the unemployment rate. When the unemployment rate is falling, low paid workers are being added to the work force, bringing the average wage down. When the unemployment rate is rising, low paid workers are being subtracted from the work force, bringing the average up.

Yes, that is a compositional effect, but if the labor ‘market’ actually behaved the way the textbooks say, it should be counteracted by supply-demand imbalance, as aldoushickman stated.

There's a lag. aldoushickman is probably right, eventually.

People who graduate from Yale or Harvard without having learned anything should be a topic of study.

Consider a Giffen good analysis. As real wages decline, workers are forced to take on second jobs, which are typically paid at lower rates. This results in the demand for employment increasing even as the wages paid for employment decrease.

That’s insightful! Is this a published finding, or should you start writing the paper (assuming you can find data)?

Sheer cussedness. My stepson is a doctor in a family practice. He's so afraid of losing his staff that he would not make them wear masks when the pandemic was raging. Some of them had COVID twice, some had it while they were pregnant.

He advertises for new staff all the time. They make appointments for interviews and then don't show up. He is mystified. I tell him "Offer more money; they're clearly getting a better deal somewhere else and you're stuck with the dunderheads." Nope. Can't do that. Small practice. Can't afford it. But he blew several hundred thousand on a wedding (twice) and a few months ago bought a $2 million house. Not much in California, quite a lot in Atlanta.

He doesn't want to offer more because that's not what we do. So he gets what he pays for. I realize this is anecdotal but anecdotes are the limit of my economics knowledge. However, I can't help thinking that there are quite a few masters of the universe who also wonder how these people dare to want more money.

I like to summarize the principle there as "If you pay minimum wage, you get minimum work."

Hard to hire in your field? Wages are lagging?

1-in-3 private sector employees now works under a non-compete agreement.

Some can be sidestepped by moving far enough away but how likely are workers to do that, in the grips of a housing shortage.

"If hiring is strong, how can wages be going down"

Wages are not going down. Writing such a thing indicates that Drum does not in fact really understand the application and usage of inflation deflators and ends up trapped in confusing nominal and real analysis.

Real wages deflated for inflation.

This is quite typical of inflationary environments, which is why generally wider population hate inflation deeply: real buying power in higher inflation almost never keeps up with inflation as nominal wages and contracts do not adjust as fast as wider prices.

There is nothing very surprising nor unanticipated about this, it is virtually a standard effect.

Which is why instead of engaging in inflation denialism, killing inflation and getting to real growth is the far better path for 'progressives' or they end up losing in end.

The problem is that you are using average wages. This does not reflect the change in wages of the people employed at the beginning time period.

If everyone is getting raises, but most of the new jobs added are on the far lower end of the wage scale, the average after inflation is going to be dragged down.

For an example of this problem, look at the dramatic improvement in wages at the onset of the brief covid recession. Average wages skyrocket even though the job market is terribly weak.

Do a simple exercise with 3 people. You and I each make $50,000. Business is booming as is inflation (5%). At the end of the year we both get 6% raises and unemployed Carl is hired to meet increased demand. Carl makes $35k. The new average is $47k.

While the inflation adjusted change in average wages is down 11%, all 3 of us are better off. Collectively we are much better off, earning much, much more on average.

I suspect Kevin knows about composition effects. But note that employment increased less than 3% in all but one of the states. Apparently somewhere between 1 and 2 million people retire each year — https://www.pewresearch.org/short-reads/2021/11/04/amid-the-pandemic-a-rising-share-of-older-u-s-adults-are-now-retired/ That doesn’t seem to be enough change in composition to account for the large changes in the wage data.