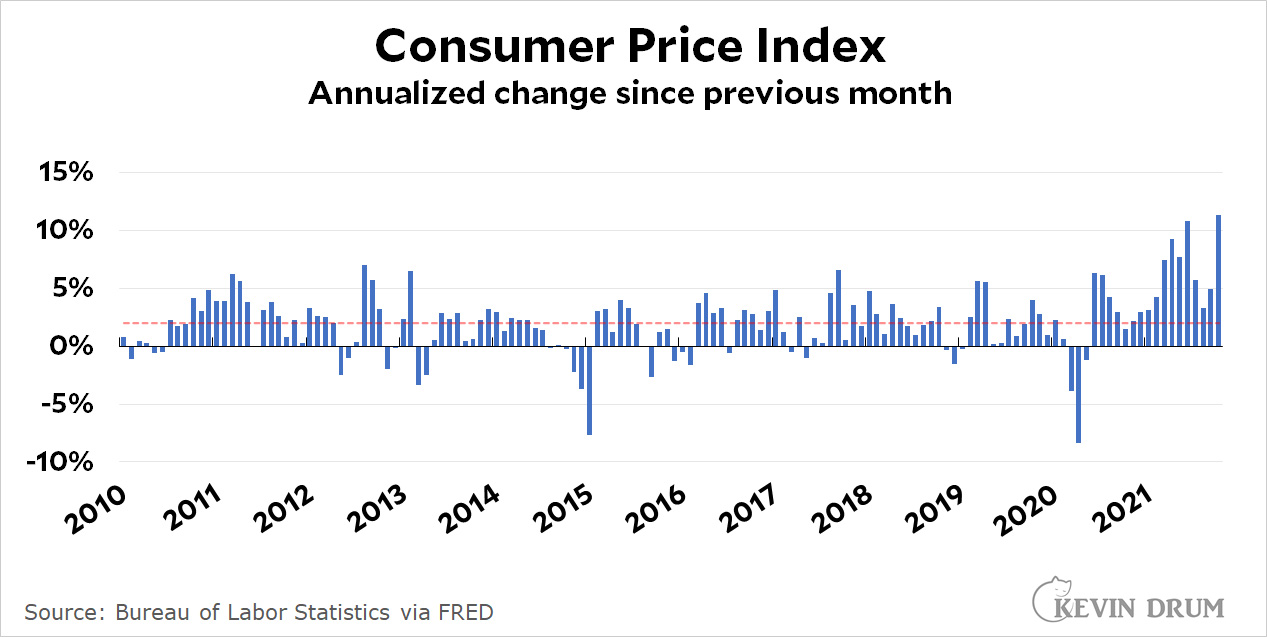

The news this morning was bad for those of us who continue to think that high inflation is temporary and still under control:

Compared to the previous month, the annualized rate of inflation in October was 11.3%. Compared to a year ago, prices were up 6.2%.

Compared to the previous month, the annualized rate of inflation in October was 11.3%. Compared to a year ago, prices were up 6.2%.

Core inflation (which excludes food and energy) was up 7.2% over the previous month and 4.6% compared to a year ago.

Those are big numbers! But are they temporary, caused by shortages of goods and the injection of lots of COVID-19 money earlier in the year? I continue to think so, but only time will tell. One thing to watch for is whether inflationary expectations respond to this later in the day.

I'd like to see a plausible explanation besides the short-term supply chain & relief money one that KD gives. And one that hasn't been used to scare-monger about inflation that never materialized in the past.

But it won't matter

...

The right wing and their willing mainstream media apprentices will all make this Biden's fault.

Midterms are a year away.

And you guys will blame it on Trump. So what is new?

I don't know about anybody else, but I will certainly apportion a big share of the blame to Trump.

So, uh, what's your point? And do I get to use your logic when targetting Republicans?

Just think how inflation would boost revenues at Maralago & Bedminster, were El Jefe still president.

His federal reserve

3% unemployment???? They got problems in that story.

The only good thing about the presidency is being an ex-president. While in office, getting credit for the good things is always matched by blame for the bad. No matter whether either is deserved.

While that pre-dates him, Truman’s desk sign hasn’t helped.

And here one has the illustration of how political tribalism blinds to changing facts (and how the policy errors of the 1970s occured).

The scaremongering over inflation over the past two decades indeed was poorly rooted - however at no point was inflation data looking like this over multi-quarter basis in USA or Europe.

The data this time is showing something different and the blind knee jerk denial on the part of the Lefties is really doing an inversion of certain inflation scaremongers' always seeing inflation and denying the data that said there was no sign of sustained real inflation.

Political tribalism and willful blindness

The data this time is showing something different and the blind knee jerk denial on the part of the Lefties...

Kevin plainly acknowledges we may have a significant, longer-term inflation problem on our hands. And from what I can say that tends to be the tone of most pundits and analysts on the left (Krugman mentions the plausibility of the "serious inflation" case every time he touches upon the subject).

That said, there is likewise a plausible case that what we're seeing now is indeed transitory. Most longer-term investors appear to favor this view. Holding the opinion that the transitory interpretation is stronger than the "we're back to the 1970s" interpretation may not be where you are at the moment. But it's hardly "blind knee jerk denial."

We'll know it's serious when Soros goes long on inflation.

The reply was to the denial view here.

But on the Lefties side in political discourse, not proper economic and business analysts.

The transitoriness was something I was of a view of in September.

Now as an investor I am moving to non-transitory, although reasonable.

Inflation in Europe isn't near this bad. You need a finger snap.

The alternative explanation would be that deficit spending has finally caught up with us and the flood of government money into the economy--not just during COVID but throughout the Trump Administration and now the start of Biden's--is crowding out private investment.

To be clear: I don't believe this explanation. I could be brought around, but I'd want to see a compelling case--at the very least, I'd need to see inflation continue after the global supply chain gets unsnarled.

Still, it isn't inconceivable. Just because it's been used for scaremongering in the past doesn't mean it can't happen; how many years were scientists sounding the alarm about climate change before we finally started to see effects detectable to the layman?

Lol, that isn't crowding out. That is a real interest driving fantasy market liberals made up for plutocracy. You need a finger snap for this post.

Yes correct - there is the start of a plausible case that Government stimulus (broadly, not merely American but having real current effect in USA) have goosed beyond currently available 'slack' and are starting to drive inflation.

Crowding out is as yet unlikely but driving inflation now is becoming real potential, with data credibility, not unhinged stuck-in-1979 scaremongering.

What private investment is being 'crowded out' and where?

Or the government is wrong. Poor government data is a tradition. Look at the over estimated inflation of the 70's until 1982.

Yogi Berra is always watching and waiting…

Nobody in a crowded room scene.

The one thing the supply chain bottle neck has done is that it has given corporations a good excuse for raising prices, which means less push back (to them) from consumers. With increase market concentration, there's little significant competition. One company announces price increases a couple months in advance, and then sees if others follow.

They didn’t want to price gouge during a pandemic with Republicans in charge while they were laying people off. Now?

Why are you still comparing 1YoY numbers? You are measuring changes in a price index starting at a point in the Covid trough, when inflation was rapidly changing. You can't even infer whether October inflation was faster or slower than September from that method. Just measure 2YoY and convert to an annual rate.

The CPI-W is up from two years ago by an annual rate of 4%. Some would say that's higher than we want. I think it's expected to come down some, and I hope it does. Three percent would be cool.

Pingback: Hiltzik: The true meaning of inflation - Current Time News

Pingback: Column: Inflation has spiked. Stop worrying about it – World Daily News

In the late 60's inflation was caused mainly by the Vietnam war - major wars almost always cause inflation, for more than one reason. Then the inflation of the 70's was a matter of commodity prices, mainly oil. Inflation came down when oil price quit rising in late 1974 and early 1980, not when the Fed decided to raise federal funds rate several years before that or when there were recessions (it was called "stagflation"). Despite the obvious facts, economists try to blame inflation on uppity workers' wage demands, and bizarrely assume that the Fed can defeat inflation by raising interest rates. If it really had that power, there wouldn't have been inflation in the 70's, would there?

There are no oil embargos at the moment, although producers are refusing to raise production, but as Kevin says there are certain other rather unique factors which are obvious causes, and those factors certainly seem to be temporary. Of course other things could arise, especially really big government spending which puts money in the pockets of consumers again. But that kind of inflationary pressure won't happen until employment goes back up to pre-pandemic level (it is really about 4 million below) and wages rise significantly.

Hiltzik’s bio says he was born in NYC and his bachelor’s degree is in English. Why does his column read like it was translated using the Naughty Hungarian Phrasebook?

Pingback: Hiltzik: The true meaning of inflation – Fox26Newshenry

Pingback: Column: Inflation has spiked. Stop worrying about it - Daily Latest News Portal

Gas and oil are still less than in 2008. Deflation.

The freak out is instructive though. Adapting to climate change via a carbon tax is a sure loser. The change in costs due to a transition to alternative energy will be traumatic and rejected.

Pingback: Hiltzik: The true meaning of inflation - Breaking News, Latest News, Headlines ...

Shit. This is going to be the golden opportunity Joe Manchin has been waiting for to say no to everything.

Pingback: Column: Inflation Has Spiked. Stop Worrying About It | LA News

With regard to expectations changing later in the day, the five-year breakeven inflation rate went from 2.96% yesterday to 3.08% today. So yes, there seems to have been some reaction, but that reaction shows that the money is still saying inflation's going to average around 3% in the next five years.

Pingback: Hiltzik: The true meaning of inflation – KVK

Pingback: Hiltzik: The true meaning of inflation - Tradernews.capital

Pingback: Column: Inflation has spiked. Don’t freak out – No Limits Foundation