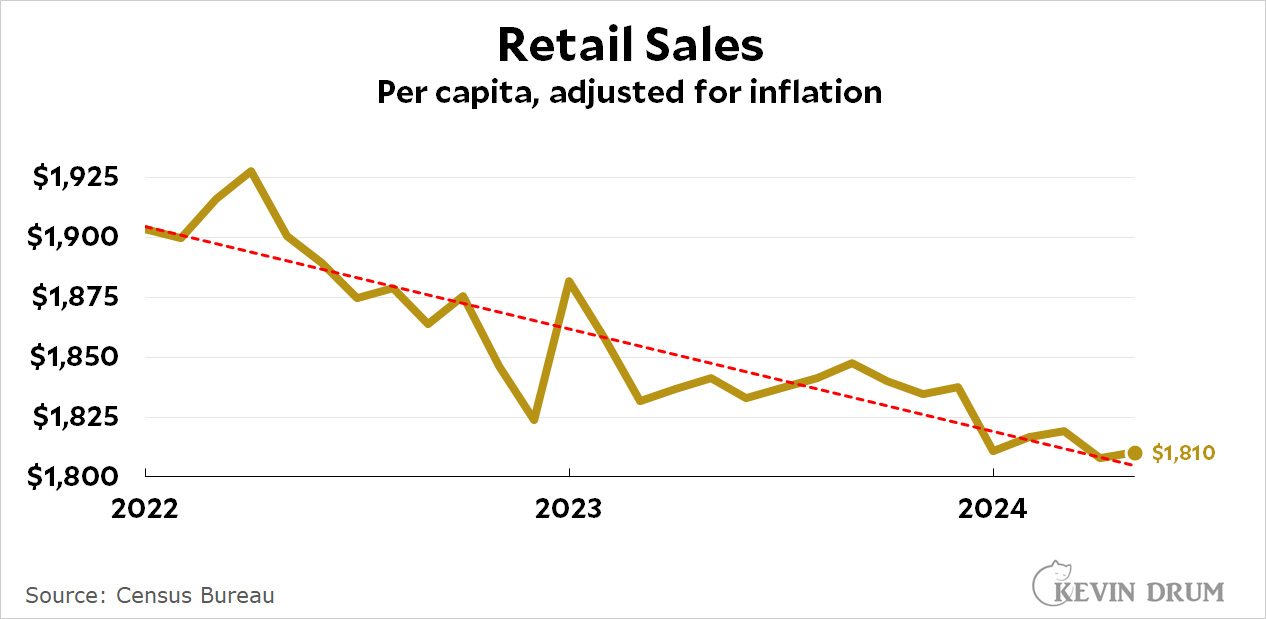

Retail sales were up slightly in May, but the trend is very definitely down over the past couple of years:

Retail sales per capita have declined 5% since the start of 2022. But here's more context:

Retail sales per capita have declined 5% since the start of 2022. But here's more context:

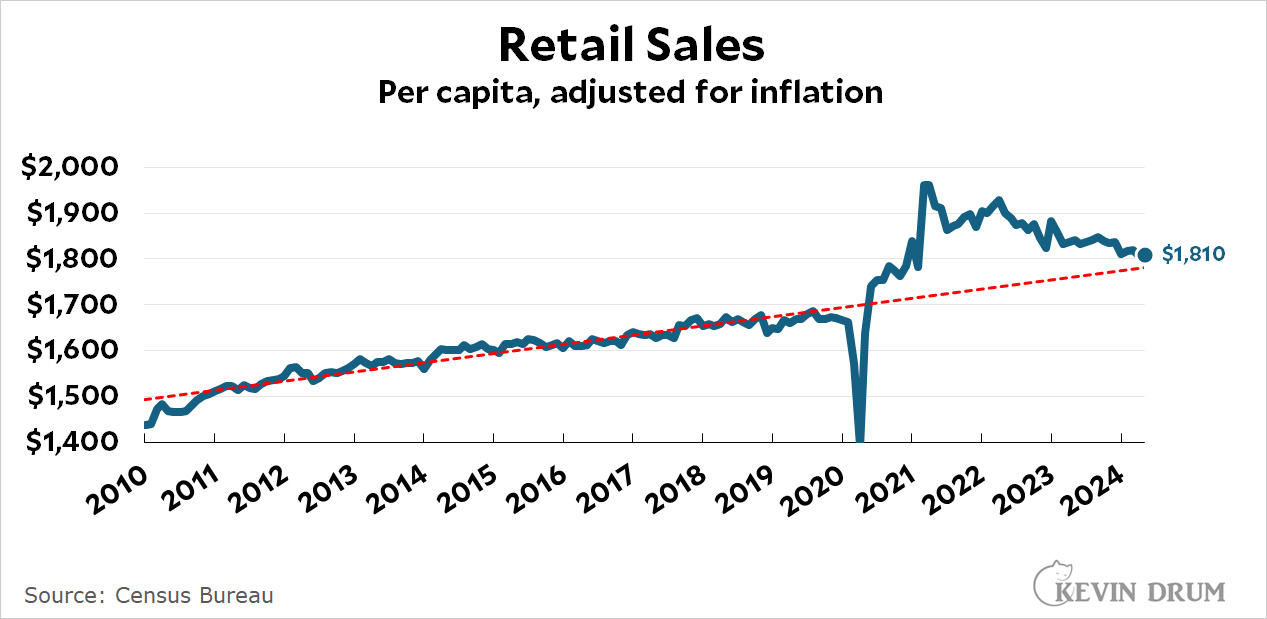

So what's really going on? Are shoppers running out of money and buying less? Or simply reverting to their pre-pandemic habits? You can make a case for either one. This is why the economy is so hard to judge right now. The pandemic screwed up everything.

So what's really going on? Are shoppers running out of money and buying less? Or simply reverting to their pre-pandemic habits? You can make a case for either one. This is why the economy is so hard to judge right now. The pandemic screwed up everything.

What's going on? The answer seems pretty simple to me.

Nothing's going on now. What we need to understand is what was going on in the period from the beginning of the pandemic (early 2020) to the end of the pandemic (end of 2021). What's happened in the past two years is the re-establishment of the old order. It has taken a little time; that's not surprising.

OK now do this with all of your charts about hiring instead of cherrypicking them.

The pandemic meant less dining out, so more money for buying stuff. It also meant that buying stuff shifted to online purchases. Returning to normal and the increased percentage of online purchasing has put the squeeze on local retails.

I like how you sometimes extend the timeline to show a return to normal trend, except when you only want to highlight the downtrend, for instance in GDP, to make a point.

The inflation adjustment is a bit (maybe a lot?) misleading for the 2021-2024 time period. Retail sales are only part of the economy and using the overall CPI to adjust only works when the overall CPI reflects the price changes for the items being adjusted. This often works okay, but because inflation was not widespread and consistent between various elements of the economy, this does not work very well over the last few years.

Nearly all of the overall inflation increase over the last year is due to housing. The reductions shown in the graph are mostly due to increasing housing costs (not actual housing costs of course, but the fictitious CPI calculation for housing). This doesnt really make any sense. We are actually less informed by pretending that retail sales are declining because while retail sales are actually increasing, housing is more expensive so lets pretend this makes retail sales lower.

The Republicans are praying that the spending line continues downward to create a recession and better chances for their economic argument to be believed by voters.

Dems need to be very sure about the reality of the voter's pocketbook and what we may need to make a soft landing with resumption of pretty normal spending.