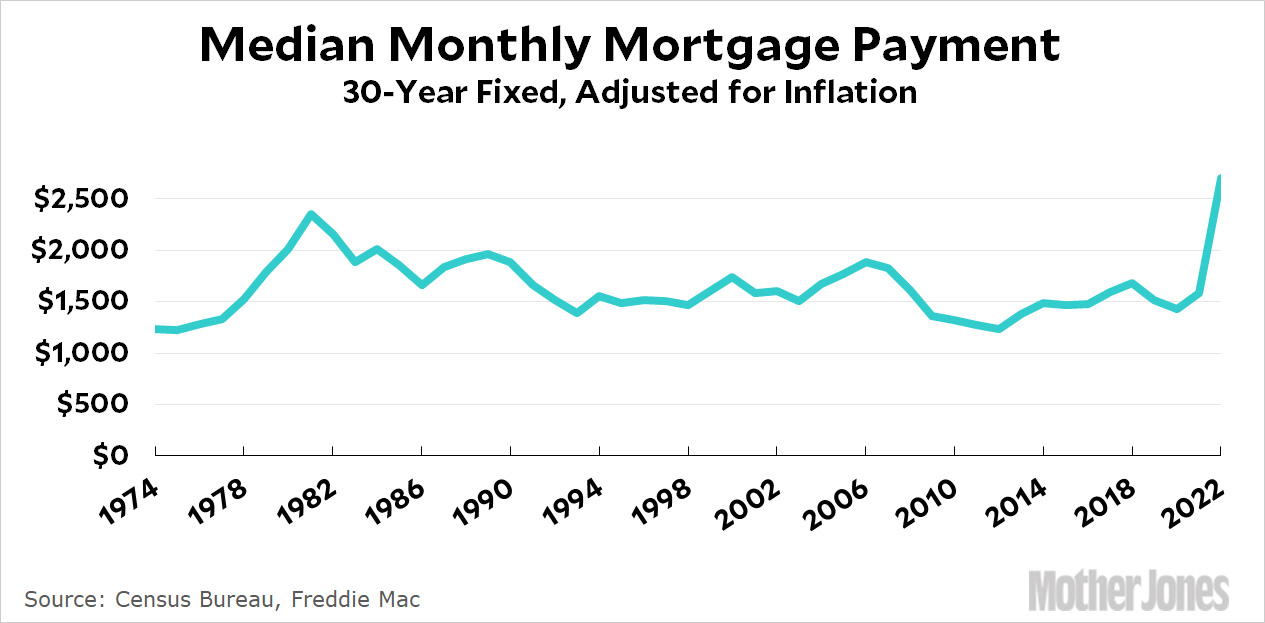

One more thing for chart day. I mentioned yesterday that 30-year fixed mortgage rates had broken the 7% barrier, so this is a good time to update my chart showing the average monthly mortgage payment on a newly purchased house in the United States. Buckle your seat belt:

These are annual figures through 2021. For 2022 they're the latest figures available. Here's the nut: even with home prices starting to drop, the average monthly mortgage for a new purchase has increased 71% since last year—and that's during a period when real income is down.

These are annual figures through 2021. For 2022 they're the latest figures available. Here's the nut: even with home prices starting to drop, the average monthly mortgage for a new purchase has increased 71% since last year—and that's during a period when real income is down.

How long can the housing market bear this until it crashes? I know what Keynes said about markets, but I can hardly believe it will take much longer. In real terms, mortgages are now more expensive than they were even during their infamous (former) peak of 1981.

I think it only applies to new mortgages or maybe adjustable rate. My mortgage hasn't changed. It's not a good time to buy or refinance. That much is true. So what? Very few people NEED to move in a given time period.

“I think it only applies to new mortgages”

Yeah, something seems off - this must be the batch of newly originated loans or something?

I don’t know, but doesn’t seem like the entire bulk of the mortgage loans in the US have seen a change (to the median) that large, that fast.

But it does at least reflect that mortgage rates hitting 7% has to, eventually, start to affect how much a buyer can afford, and should start to affect prices.

It's not a good time to buy or refinance. That much is true. So what

The "so what" is it's affecting the housing market, with eventual, downstream effects (lower home values, less construction, lower purchases of appliances and furniture, a reduction in factory orders, softer car sales, etc).

30-year mortgage rates from 2020 to the start of this year were at all-time record lows - we can't expect that to return, nor can we expect prices to stay as high as they were. 30-year mortgage rate is just now getting back to the average over the last 50 years.

But there will continue to be a housing shortage and the rate of house building (per capita) was historically low even at the peak of prices. The housing problem is not a matter of mortgage rate.

The flippers have been flipped?

"In real terms, mortgages are now more expensive than they were even during their infamous (former) peak of 1981." How does that work? I closed my first 30 yr. fixed rate mortgage at 13 1/2% in 1984. It was years before I could refi at today's rates.

Houses are more expensive in real terms. That's how. The figures Kevin is citing is for the actual amount of a median monthly payment. In 1981 interest rates were higher (according to my googling the average rate was 16%) but houses were cheaper.

Yes, this is bad.

The higher expected payments price many out of the housing market. If you didn't get in with a fixed mortgage before now, you're just screwed.

This lower demand is what's causing housing prices to fall.

Less profit from building houses means fewer houses will be built. Inflation impacting both labor and materials costs means fewer house will be built still.

Less housing construction means fewer housing jobs - thus, a crashing housing market.

While I'm not firm on the causation aspect, the housing market has high correlation as a leading indicator of where the general market is going.

So, a crashing housing market tells us a general recession is incoming - and not one of the type that anybody can just shrug off.

Buckle up, and I hope everybody has airbags.

And how does it compare to median take home pay?

Maybe do it as quintiles. If possible, by household.

Ok, national numbers do not show regional variations.