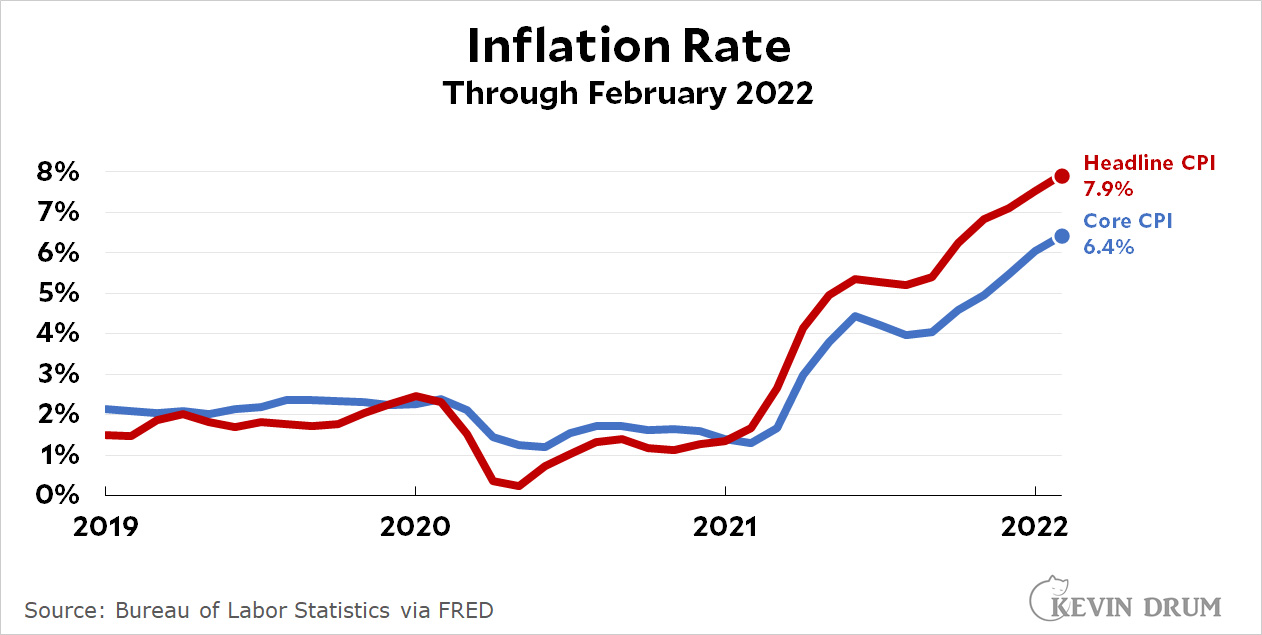

Today is inflation day, and the BLS reports that the US inflation rate rose in lockstep with the European rate announced a few days ago. The headline inflation rate went up from 7.1% in January to 7.9% in February:

Average weekly earnings, adjusted for inflation, declined 0.8% from January to February. That's an annualized rate of about -10%.

Average weekly earnings, adjusted for inflation, declined 0.8% from January to February. That's an annualized rate of about -10%.

Obviously Team Transitory took another big hit last month. It looks as though high inflation is lasting longer than any of them expected.

And here's one more takeaway: Corporations are using the current high inflation rate as an excuse to raise prices on just about everything. However, despite their claims of a workforce shortage, they are somehow finding the fortitude to avoid raising wages for their workers. Funny how that works.

The wonders of an overly concentrated corporate economy, where investors can engage in strategic punishment for anyone who defects and raises wages a lot. A 10% real wage cut, nice- I'm hoping that drives more labor unrest.

In any case, does Core CPI show the same kind of price hike? Oil is probably playing a role in this.

How would having say 10 companies in a sector make any one of them less vulnerable to investor backlash than say 5? Company X raises wages in either case, these presumed investors could still pressure its stock either way.

My definition of ‘transitory’ remains: ‘not self-sustaining, lacking a positive-feedback mechanism’, so unless someone produces evidence of positive feedback, I’m sticking with transitory. Remember that the post-WWII inflation took a couple of years to work through the economy, then ended without Fed rate increases. The trend in real wages is in fact negative feedback; it will eventually restrain price increases, ceteris paribus.

+1

Hey! Until recently Kevin was downplaying the "a large part of inflation is price gouging by corporations" idea. He's been skeptical and even did a post suggesting that higher meat prices are probably NOT from corporations jacking up the price.

Just the other day he still suggested that US inflation has been higher than Europe for a while now because of the stimulus from a year ago. It is often hard to tell when Kevin is trolling his audience or trolling other pundits, but he's been pushing the 2021 stimulus package as a significant source of inflation for a while now.

I guess I shouldn't rake Kevin over the coals so much. I'm glad he's now thinking that corporate greed is a big part of the inflation picture. (Well, WAS a big part. Going forward it will probably be driven by the Russia/War stuff.)

”Them Kevin?”

; )

I'm gonna go on a limb and say that you need at least 6 months from the end of the last wave for the economy's quirks to iron out (deaths, sick, avoidance, etc.). You'll know it when the Beveridge Curve shifts away from a low unemployment rate + high number of unfilled jobs to low unemployment rate + low number of unfilled jobs. This will imply that production is well-matched to producer expectations and producers will have much lower leverage on pricing but also the capacity to increase production.

I mean, unless you have overlapping exogenous events affecting the economy, that is. For instance, a Russian war on Ukraine.

Obviously Team Transitory took another big hit last month.

For the umpteenth time, "transitory" does not imply some arbitrary standard of brevity. We're now approaching the 12 month mark for the currently spike. If the post World War 2 experience is anything to go by, we've got another year of this. Which would suck for all of us. Especially Democrats trying to win elections. But none of that means what we're currently going through isn't transitory in nature. The economy doesn't care whether you or I find the duration of transitory inflation inconvenient or unpleasant.

To be sure, I'm not claiming I have some special knowledge verifying we're now experiencing inflation of a transitional nature: and I don't have a time machine that'll allow me to visit 2031 and get the benefit of hindsight. So I could be proven wrong! But the "transitory" explanation strikes me as being highly plausible, especially given the lack of COLA contracts and the low unionization rates of 2022, as well as the various causative mechanisms—stimulus payments, service sector shrinkage, trade interruptions, etc—that would be consistent with an episode of transitory price increases.

> Obviously Team Transitory took another big hit last month

It's not Obvious to me. First, it's not clear that "Transitory" is well defined. To the extent that inflation is due to temporary bottlenecks as pandemic-induced behavioral changes wend their way through the economy, inflation is Transitory even if it takes 18 months for the changes to take their course.

Additionally, future economists will need to tease apart transitory shocks from "piling on" shocks. The extent to which corporations are extending a transitory shock by using it as cover for adding on their own price shocks, will need to be evaluated. We might end up with a rule of thumb that inflation is rarely transitory because corporate greed keeps that from happening.

Also, we will need to tease apart a series of unfortunate back-to-back causes of transitory inflation. The Covid supply-chain Inflation and the Putin Inflation being so close together are going to muddy the waters.