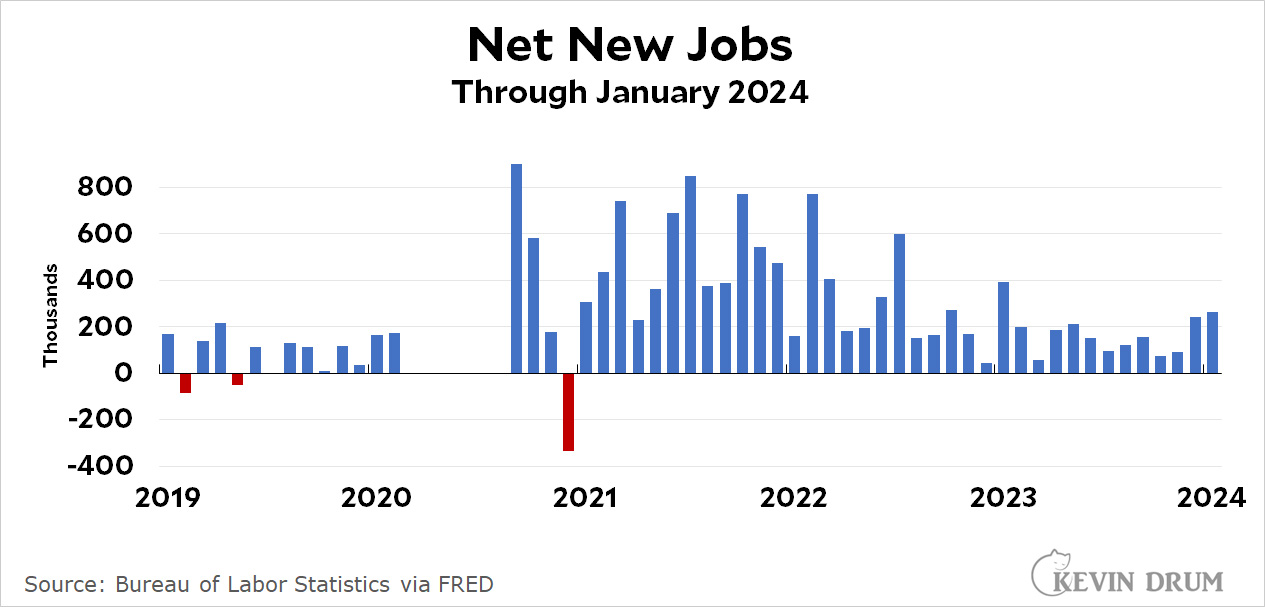

The American economy gained 353,000 jobs last month. We need 90,000 new jobs just to keep up with population growth, which means that net job growth clocked in at 263,000 jobs. The headline unemployment rate was unchanged at 3.7%.

This is a very nice jobs report. Employment remains strong and the unemployment level remains low. The labor force participation rate for prime age workers ticked up a bit and remains higher than its pre-pandemic record. My fears of an upcoming recession are still around, but the last couple of months have sure looked nice and strong.

This is a very nice jobs report. Employment remains strong and the unemployment level remains low. The labor force participation rate for prime age workers ticked up a bit and remains higher than its pre-pandemic record. My fears of an upcoming recession are still around, but the last couple of months have sure looked nice and strong.

Did you mean "remains lower than pre-pandemic record" for labor force participation?

He just means higher than it was in January 2020.

Thanks--found the charts:

overall, still lower:

https://fred.stlouisfed.org/series/CIVPART

but for 25-54 years olds, near record highs:

https://fred.stlouisfed.org/series/LNS11300060

That is why Kevin wrote, "prime age workers."

the #1-with-cockwombles "news" outlet will ignore this but happily broadcast trump's lies about it

Wow! This is a great employment report. Usually there are some bad things mixed in with the good, but there is almost nothing bad at all. I was pissed that they didn't start lowering interest rates at the last meeting, but maybe things will still be OK. The December Job numbers were also revised up.

I do have one complaint about Kevin. He recently posted a chart of the Employment Cost Index saying "in some ways it's one of the most accurate measures of individual earnings." It showed wages and salaries slightly below the pre-pandemic level. But every other chart he's posted, and basically every chart posted by economists for the past year, show workers earning more now compared to before the pandemic. How can that be?

This page:

https://pages.stern.nyu.edu/~nroubini/bci/ECI.htm

says "Unlike the Average Hourly Earnings measure of wage inflation, the ECI is not affected by shifts in the composition of employment between high-wage and low-wage industries or between high- and low-wage occupations within industries. Thus, the ECI represents labor costs for the same jobs over time."

OK. So logically, if other measures show workers earning increasing it means a lot of workers are changing jobs and/or industries.

But since changing jobs for better paying jobs is not inflationary, the Fed likes this measure to tell them if inflationary pressure is building.

Maybe the Fed engineered a soft landing. With better data and analytics (over 50+ years), they could make this routine.

Best jobs report in 12 months. The economy is booming!

In terms of simple economics, the news could not really be better. Except that's not what people are hearing. The prevailing story most people are hearing is inflation and doom & gloom.

https://x.com/mcopelov/status/1753423591541010932?s=20

Media malpractice (another reason why Democrats aren't steamrolling Republicans).

"My fears of an upcoming recession are still around..."

For a blogger whose major recurring theme is "things are really good and I don't understand why people can't accept the good times and stop worrying," I suggest he follows his own advice.

Since vacancies increased while unemployment remains unchanged, the V/U continues to rise/drop vertically.

So long as this phenomenon is maintained, we won't have to worry about inflation (except exogenous sources).

It is, I believe, a result of the backlog of production that is slowly being erased. For instance, if at peak there was a 8-month lead time for windows, it's now down to 3, but not yet back to the norm of 1.

Without being able to find new workers, companies are allowing the slowdown in demand to catch up with their production backlogs. Perfect landing...so long as the Feds lower their rate target soon, that is.

Isn't the working age population SHRINKING?

Why do we need 90k jobs when the working age population is shrinking?