The Wall Street Journal reports today that "The U.S. Consumer Is Starting to Freak Out." Let's take a look!

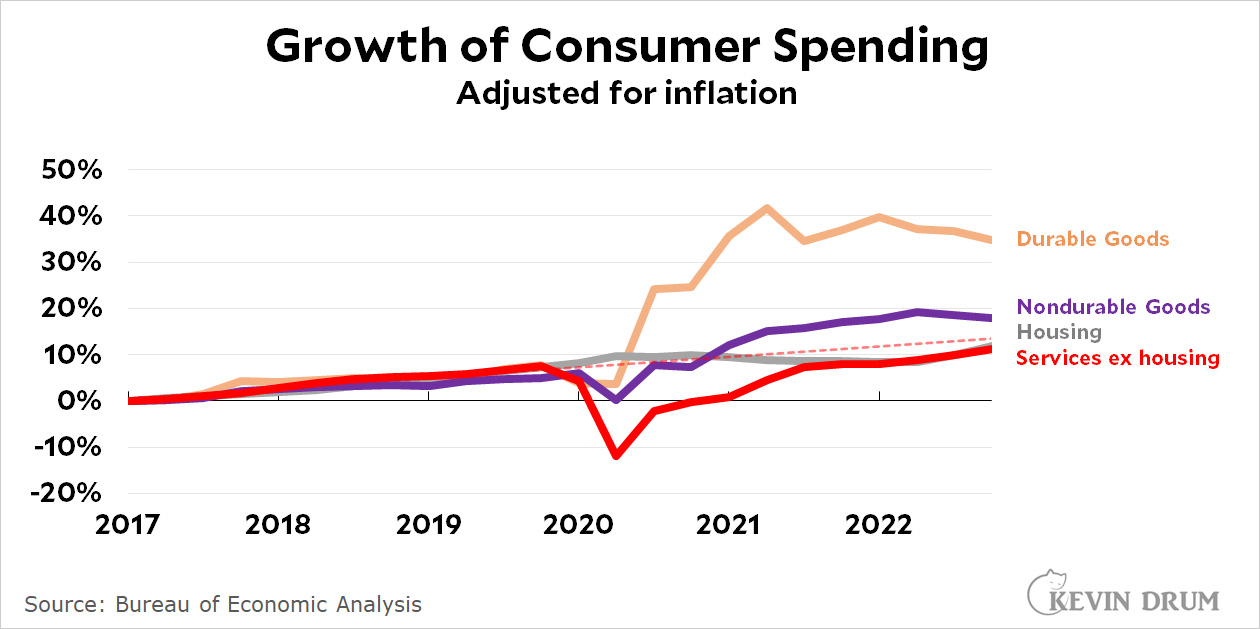

Spending on durable goods, like cars and washing machines, soared during the pandemic and has since flattened out. But it's still way above its pre-pandemic level.

Spending on durable goods, like cars and washing machines, soared during the pandemic and has since flattened out. But it's still way above its pre-pandemic level.

Spending on nondurable goods, like clothes and food, also declined slightly last year, but remains well above its pre-pandemic level.

Housing— Well, we all know what's happening to housing. As it happens, spending on housing has increased over the past six months because housing prices have gone up enough to make up for reduced buying.

Finally, we have non-housing services, which account for half of all spending. And it's increasing! It's still slightly below its pre-pandemic trend, but over the past 18 months it's been slowly getting there.

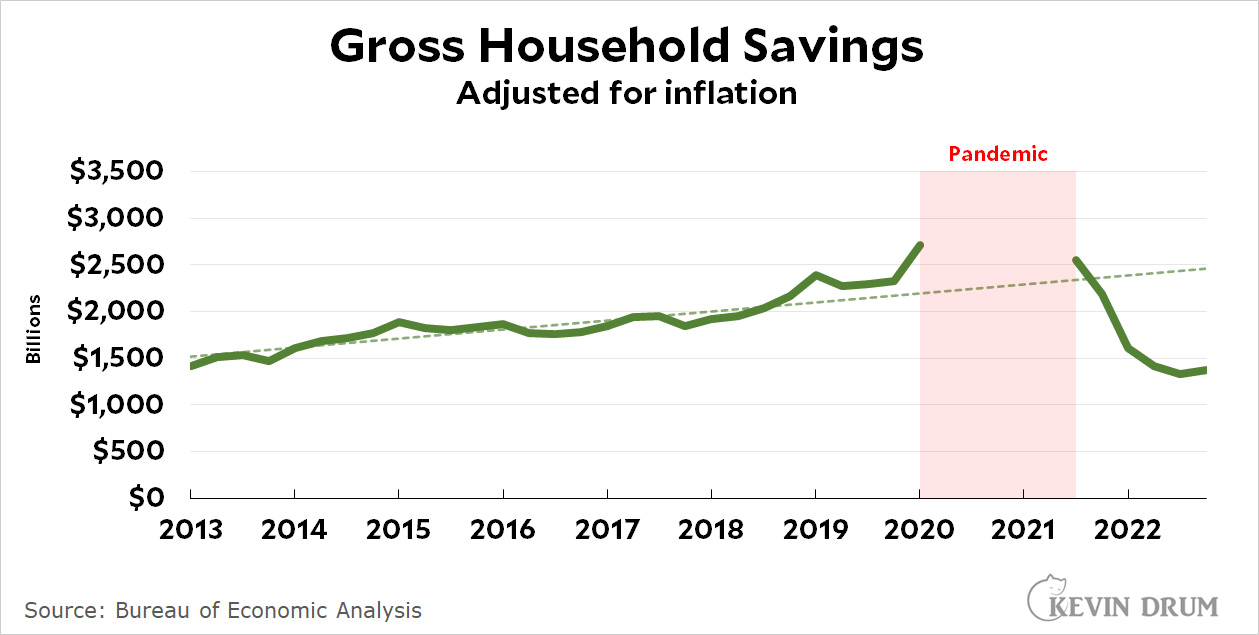

So are US consumers freaking out? Personally, I think they should be, but there's little evidence of it. Durable goods are reverting down to the mean while services are reverting up to the mean. Looking to the future, however, the big question mark is household savings. Households bulked up their savings during the pandemic thanks to federal stimulus checks, but have been spending that down ever since:

The good news is that savings went up in the fourth quarter and that only barely affected consumption.

The good news is that savings went up in the fourth quarter and that only barely affected consumption.

It really doesn't look to me like consumers are freaking out. In fact, if you ask me, they're a little too complacent. But that all depends on whether you think we're headed for a recession later this year or if you're a soft-landing optimist. I'm the former.

You are looking at $. What does it look like when looking at units?

Start making more money weekly. This is valuable part time work for everyone. The best part ,work from the comfort of your house and get paid from $10k-$20k each week . Start today and have your first cash at the end of this week. Visit this article

for more details.. https://createmaxwealth.blogspot.com

I second this inquiry!

Should have been a reply to rick_jones.

Dean Baker put out a few articles and some commentary explaining that personal savings rate were significantly undercounted in 2022 due to high capital gains. Capital gains are not counted as income but capital gains taxes are counted as reductions to income when calculating national savings rates.

If we included capital gains as income and savings, the savings chart likely wouldn't appear as out of place with the spending chart.

Conclusions based on bad data are dangerous, even if the supporting charts look nice.

I wish you wouldn't write about WSJ articles that use hyperbole in its headline. This is just time-wasting clickbait used to drive conservatives into a tizzy about the economy.

Mostly yes. News stories are ok in general. Anything with opinion, garbage.

So...save up now and buy when the economy crashes???

Personally I refuse to buy any durable goods until prices retreat. Starting to feel that way about restaurants now as the little trick of removing cheap wines from wine lists has caught on.

But that all depends on whether you think we're headed for a recession later this year or if you're a soft-landing optimist. I'm the former.

So basically President DeSantis/Trump/Haley...

Good to know.