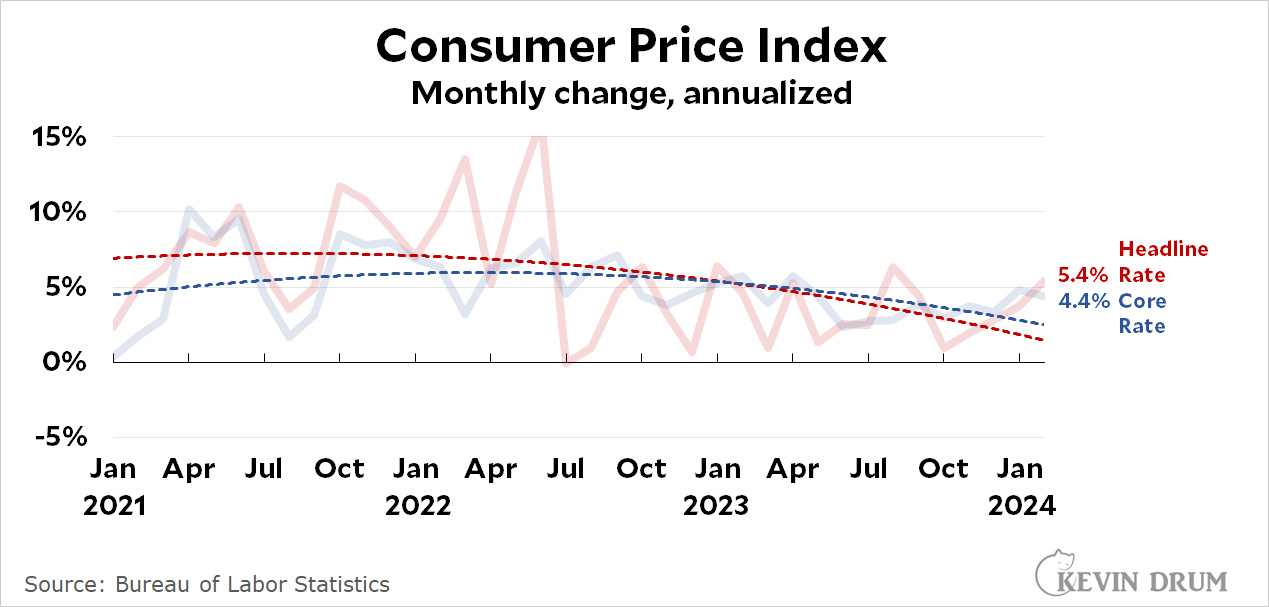

Yikes! The BLS reported CPI inflation of 5.4% in February. Core CPI was lower at 4.4%:

This is a big increase, driven by inflation in services and an increase in gasoline prices over the past month. Other commodities were either flat or down, including food, which showed no price increase from last month.

This is a big increase, driven by inflation in services and an increase in gasoline prices over the past month. Other commodities were either flat or down, including food, which showed no price increase from last month.

On a more conventional year-over-year basis, headline CPI inflation was 3.2% and core inflation was 3.8%.

Deja vu. Inflation ex-housing is minimal. Housing inflation remains, due in large part to reporting delays and the Feds direct policy of making housing more expensive.

High interest rates obviously wont solve the housing problem. By design, higher rates only make this problem worse.

High interest rates absolutely reduce demand for new housing, and that of course is demand reduction

The fact Leftists and Populists never ever want their punch bowls taken away does not mean more getting high on low interest rates will be positive on any front including housing prices - as inputs, as base costs, as labour costs etc

- Example - see Turkey and its populist demarche (more or less precisely what the Left and right populists have argued for, and their inflation is double digits)

It reduces the supply of new housing.

It doesn't reduce demand in a way that materially reduces the amount of desired housing, i.e. the same number of people still need homes no matter what interest rates are at.

It does push demand from buying homes to renting homes so we end up with fewer new homes, higher costs for home construction, higher costs for buying homes and higher costs for renting homes.

But we get that you like to scream at 'Lefties' as you repeat yourself in every post.

Kevin, I'm sincerely curious if or how you think you got anything wrong about the Fed's approach to interest rates last year. You had legitimate concerns, but it does seem that inflation is being really stubborn.

Indeed, in fact this evolution is precisely what persons like myself have warned about relative to the lessons of the late 60s to 70s that Central Banks of which Fed have taken on board which is the feed-through cycle and rebound (off course this is typically in commnets here strawmanned into "predicting" a late 1970s hyper/staglation rerun).

The 2ndary inflation feedthroughs and this evolution is precisely why US Fed, why European Central Bank (each of completely different political backgrounds) have taken the stances they have (and johnny come lately Bank of England).

Inflation is electoral poison and had Fed acted as the Lefties and Right Populists demanded with an expansionary / What-me-worry attitude over the past year (and if one looks at comparotors of CBs that did not take on inflation killing stances there is actual real world support), then higher reacceleration rather expected.

And then you (as in the democrats / Left side) would have been in a right pickle with higher inflation and even more upset electorate as no electorate anywhere likes inflation - whatever Elitesplaining of the party in power may want to engage in.

The best scenario is squeeze out and calming on prices by mid year such that impressions on inflation are ideally deflated (to be ironic in phrasing)

Just to be clear, its only Housing/Shelter inflation that is stubborn. Given that higher interest rates can (and have) cause housing costs to increase, this is not a surprising situation.

The below chart shows that CPI-ex shelter is very normal, it is only housing that is stubborn.

https://fred.stlouisfed.org/graph/fredgraph.png?g=1idow

The actual numbers are not as relevant as what people remember come November. And the VRWC is doing everything it can to remind people about how poor they should feel.

Once again, just because somebody can come up with a number every month doesn't mean that the inter-month variation is significant. There is very obviously a lot of noise in the month-month inflation numbers.

High inflation basically came to an end in the middle of 2022. Taking the average of month/month inflation since July 2022 gives 3.2% which is the same as the current year/year number. This is probably the best estimate. It's a little high, but there is nothing that indicates inflation is going to start running away. Predicting that would require looking at the factors which actually have caused inflation - trend lines don't do it.

Hey, how about if we extended the timeline to a decade, drew a dotted horizontal line at last month's annualized rate of monthly inflation, then drew another dotted horizontal line at the peak of any given annualized rate of monthly inflation in the last decade outside of the exogenous event of 2021-2022, like this?

What do you see? I don't see "inflation surges for fourth month is a row". I see variability within a range that existed before the pandemic, even if the frequency is at a higher range.

Let's give it a couple of months before we start panicking.

Maybe this link to the image of the graph works: https://fred.stlouisfed.org/graph/fredgraph.png?g=1idri

Reportedly, drivers of inflation are housing costs and gas prices going back up. Not sure if this is due to refineries switching over to summer blends (seasonally adjusted?) or reflects global prices going up a bit due to problems in the Middle East.

Housing prices are high due to lack of building enough new housing since the Great Recession. Then the pandemic grinded things to a halt. And now builders are reluctant because they can't get new loans at low rates and have trouble getting day laborers on the cheap.

Kevin may need to wait a little longer for the return of cheap money.

I looked at a graph of the PCE index and observed that of the eight years of Ronald Reagan's presidency, only one of them had PCE inflation of less than 3%, and it didn't decrease monotonically from year to year. In Reagan's last year, 1988, prices went up 4.5%. By comparison, inflation in the U.S. now still seems tame.

Fed's going to increase rates next meeting. Count on it. I've updated my election prediction from:

"Trump probably wins if election were held tomorrow but trajectory of economy means Biden is still modest (60%) favorite" to

"Trump probably wins if election were held tomorrow but trajectory of economy means Biden is only a modest (45%) underdog."

Personally, I'd prefer that inflation settle into a range somewhere around 3.5%. Running the economy a bit hotter than what had become the conventional wisdom seems more consistent with the interests of the non-rich. But I'm skeptical most voters—egged on by the horserace media and sill somewhat traumitized by the burst in 2021-2022—agree with me.

I'd be surprised if they changed their target rates at next week's meeting. If they go so far as to suggest they're leaning that way for coming months, that will be enough to dampen spirits in the business world.