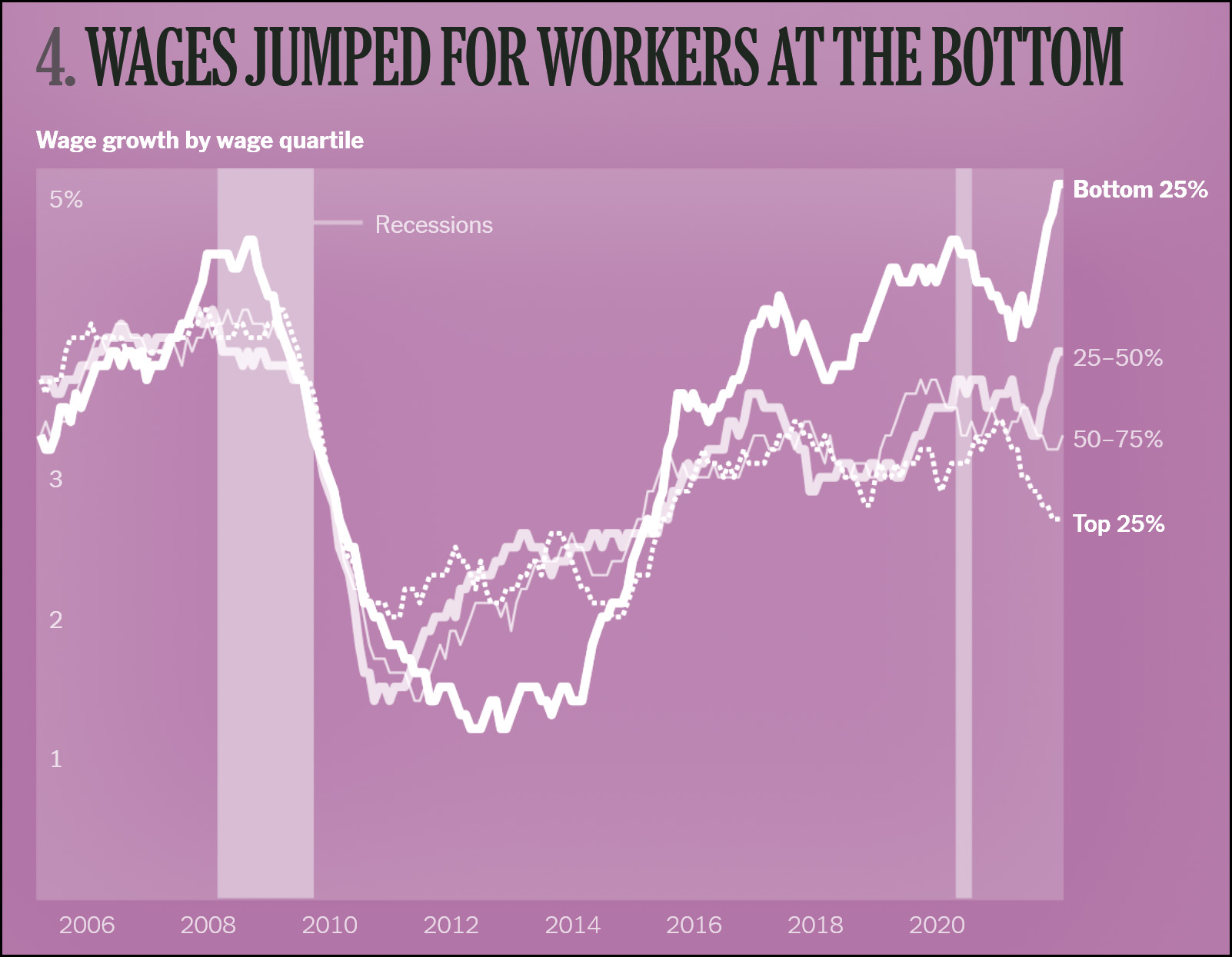

In the New York Times, Steve Rattner reviews the year in ten charts. I'd like to think that I helped start this trend, so I'm all in favor of seeing chart-tastic features in our nation's media. Unfortunately, Rattner's list includes this:

It's hard to believe Rattner used this chart, and equally hard to believe that the Times let it through. Rattner is showing nominal wage growth even though wages should always be adjusted for inflation. If your pay goes up 2% but inflation goes up 10%, you're not going to be bragging about how much more money you're making.

It's hard to believe Rattner used this chart, and equally hard to believe that the Times let it through. Rattner is showing nominal wage growth even though wages should always be adjusted for inflation. If your pay goes up 2% but inflation goes up 10%, you're not going to be bragging about how much more money you're making.

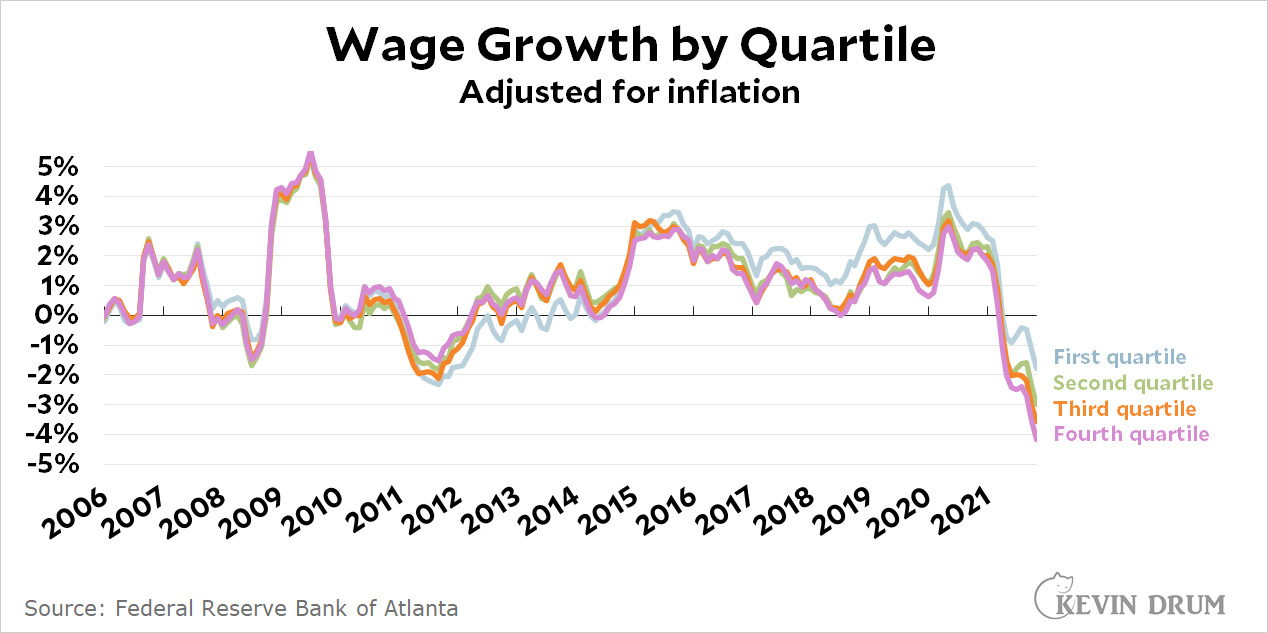

Here's the corrected chart, using the same data source as Rattner:

As you can see, real wages have gone steadily down all year. It's true that workers at the bottom did better than anyone else, but that only means their wages didn't decline as much.

As you can see, real wages have gone steadily down all year. It's true that workers at the bottom did better than anyone else, but that only means their wages didn't decline as much.

This is not just a pedantic disagreement. Everyone adjusts wages for inflation, and it's deeply dishonest not to. That's especially true when it makes the difference between positive and negative growth.

Also inexcusable is not taking into account the workforce composition. Unless you think something positive happened in March and April of 2020?

Before even reading his editorial, I'm going to guess Rattner used the charts to advocate for business tax cuts.

I came to believe that the Washington Post's journalism was substantially better than the NYT's and cancelled my long-time NYT subscription back in 2017. I wonder if the WaPo is less innumerate than the NYT.

Dual subscriber here. WaPo is every bit as innumerate as the NYT.

Dual also. Generally go with WaPo only because NYT can be awful wordy. When I have time and want a very thorough write up of anything then I go to NYT. One can never be a face value reader of the news but both are very good with credibility. No one is perfect though.

Kevin is absolutely correct here.

But I do notice that the biggest drop from trend is in first part of year before inflation took off although significant drop recently with higher inflation.

I expect the first drop is really nothing to worry about as might just be unwinding from the pandemic distortion when so many were not working during the bad wave and those left got some wage premium.

And I think you might argue that the recent real wage decline due to higher inflation in some way truly happened in 2020, not today .

The pandemic obviously reduced production across the nation and almost every sector of the economy. But we overdid the stimulus during the pandemic in 2020. With the idea that we tried to keep income and consumption up to pre pandemic levels, and , for many, actually increased their income, while producing less.

That never made any sense. To have some stimulus intended to not have some vicious cycle feeding on itself and causing the economy and production to fall further than it had to due to pandemic, yes . But it should have been an amount designed to leave income and consumption at a somewhat reduced level - the amount that production was reduced unavoidably by the pandemic.

The idea that we could all produce less during the pandemic ( and have extra costs for masking, vaccine, etc. ) and yet feel no pain in reduced income and consumption by some magical stimulus by govt is asinine . Production to consume does not magically appear because govt gives you money. If it stimulates the economy to produce closer to its capacity, when production would otherwise be less than capacity die to economic distortions, great. But, if production is being limited by pandemic and is at pandemic capacity, the stimulus cannot work.

What happened is that this insane attempt to keep consumption above reduced production did not become evident as impossible last year . Because actual consumers did NOT spend much of the stimulus- they saved it . So consumption ended up lower and matching reduced production anyway .

But now consumers want to spend all those artifical savings, not backed up by production, on actual consumption. And the production to meet that demand is just non existent. So you have supply shortages and inflation reducing the value of money and bringing consumption back in line with reduced production.

The too high stimulus promised magic consumption from nowhere that was impossible. So reality means somewhere consumption must be reduced to offset. And that is by inflation cutting the value of savings for everyone, but more for the wealthy ( who have more savings proportionately) and also some for foreigners holding our debt . China holds a big chunk of our debt so this is a way of making them pay part of our pandemic losses. Not losing any sleep over that. And then also it reduced real wages if nominal wages cannot keep up.

And all this was mostly inevitable back in 2020 when trump was in power. Now the first biden stimulus might have exacerbated the issue and increased the inflation, but certainly is not the root cause. The 2020 stimulus bills were .

Magic consumption is fantasy. Reality means consumption had to decrease and stuff like this must happen until it does enough to match reduced production.

The real risk is whether the inflation, which only needs to be temporary to do its job of offsetting the pretend magic consumption, feeds on itself and becomes something permanent . And that largely is going to depend on perception. So far, as future inflation expectations are still not so bad in bond markets, I am cautiously hopeful.

But this is where Bbb going down are greatly reduced is perhaps for the best , even for progressives. Whether or not you think it is warranted, if it is simply perceived as inflation causing, it will be . And maybe at the time we are coming tediously with pandemic stimulus inflation might not be a great time. Wait till that inflation cools down and panic abated to propose much extra stuff ( although tax increases OK) .

And maybe kevin is being a Pollyanna optimist re how temporary inflation is . But , if the public all believes him, he will be proved right. And if media doomsday stories scare everyone , they will come true.

If you want to assign blame for CURRENT inflation, I assign more to trump than biden as it is caused more by last year stimulus. But not really congressional Republicans except for being cowards. Congressional democrats more blame but also partially due to cowardice.

Remember last year some were expressing reservations about the stimulus being too big especially re things like more unemployment than wages when employed. Traditionally it was expected that Republicans would be the ones checking democrats excessive spending, and democrats even subtly depended on that . They could propose crazy high spending that they know was too high to get credit for trying, and let Republicans be the " bad guys " to their base stopping them from going too far . And democrats role was to check Republicans proposing too much tax cuts ..each side could restrain the dangerous instincts of the other somewhat.

But , last year, trump just undercut any instinct for any restraint from responsible congressmen by saying he wants more. Remember when democrats proposed more than Republicans in the fall and then trump came out for even more than the democrats? And responsible Republicans were scared to go against trump . And responsible democrats who would have wanted more spending restraint could never be caught advocating less stimulus than trump.

Ended up as a bidding war between congressional democrats and trump with imaginary money and biden is left holding the bill.

So even though higher than normal inflation exists in every country around the world this year, somehow the US’s (alleged over) spending over the last year caused all or most of it.

OK that makes sense.

If you want people to accept lower consumption due to lower production the logical corollary would be the need to ration essential goods. If you don't do that the burden of bearing the reduced consumption will fall entirely on the poorest segment of the population.

I wonder if rational thought thinks rationally to the end and accepts the conclusion.

Work? Who works when there is free money right there for the taking. Everyone is a criminal. Let them suffer.

https://www.nbcnews.com/news/us-news/easy-money-how-international-scam-artists-pulled-epic-theft-covid-n1276789

Why should I bother to “help” anyone I don’t know personally? The naïveté is astonishing.

I post this because my retired sister and her dead husband were informed by the state that they collected unemployment benefits in 2021.

If people needing help have to personally know the people helping them, then why do we have a government or a society at all?

But don’t worry Justin, eventually you’ll die off and won’t be asked to help anybody else ever again. (You are aware though that you can’t take your money with you when you die? You might want to pre-file your complaints with God now for allowing Death to take all your hard earned wealth away so capriciously.)

LIKE!

This callousness is even more astonishing.

What about savings from commuting? I think everyone got a pretty big raise from that. My commute cost used to be around $600/month (car/gas, lunch, parking, etc.) and now its zero.

$600 a month?! You need to find a new job. My commute costs me about $80 a month in gas. (Don’t have to pay for parking and most days I bring my lunch.)

Atticus, I assume you take lunch from home. Jay Smith can't be bothered. And he probably commutes by taxi...

You are correct, sir! … This is the kind of thing that would cause me to give a reporter a (metaphoric) kick in the rear back when I could have a reporter within arm’s length. Seriously, I’d rather run a house ad for the first edition than let that graph through. Times should be embarrassed.

This is not just a pedantic disagreement. Everyone adjusts wages for inflation, and it's deeply dishonest not to.

Or, it's deeply incompetent not to.

Rattner has his own agenda. If you watch Morning Joe, you'll see it come through.

Back in the summer, would it have been 'accurate' to say that wages fell because car prices jumped dramatically?

Inflation is certainly a meaningful statistic, but its misleading to say that wages fell because prices rose.

If wages rose faster than inflation, would we say that prices fell? Few would consider that an accurate description.

Inflation stats cause a lot of confusion.

No confusion whatever. This sort of thing is silly. Car prices are up. There is a question if they should even be included in the inflation calculus: It is not the dollar that lost value (aka inflation), it is scarcity that caused car prices to rise (aka free marked economy).

If you talk wages however, inflation mast be counted in if you want to know if you can afford more things this year than last year--which is the question on everybody's mind on the subject. This is Kevin's entire point; in other contexts inflation may not be usefully included.

I think you are wrong here.

The price level just measures what things cost relative to the money used . But wages are basically what you earn for your labor , and re what counts for that , it needs to be measured in what you can buy with what you earn. So needs to be inflation adjusted. Wages expressed in dollars are meaningless outside of the context of what it can buy with those dollars.