A year ago Twitter founder Jack Dorsey auctioned off an NFT of his very first tweet. It sold on March 22, 2021:

After it spent just over two weeks on the market, Twitter CEO Jack Dorsey has sold his first tweet as an NFT for the weirdly specific figure of $2,915,835.47. The winning bidder was Sina Estavi, who had held the high bid since offering $2.5 million on March 6th. He upped his bid to this number at the last moment.

....Dorsey put the tweet up for digital auction as an NFT — non-fungible token — a digital good that lives on the Ethereum blockchain, on March 5th. Bids were handled on a platform called Valuables by Cent that lets people make offers on tweets that are “autographed by their original creators.”

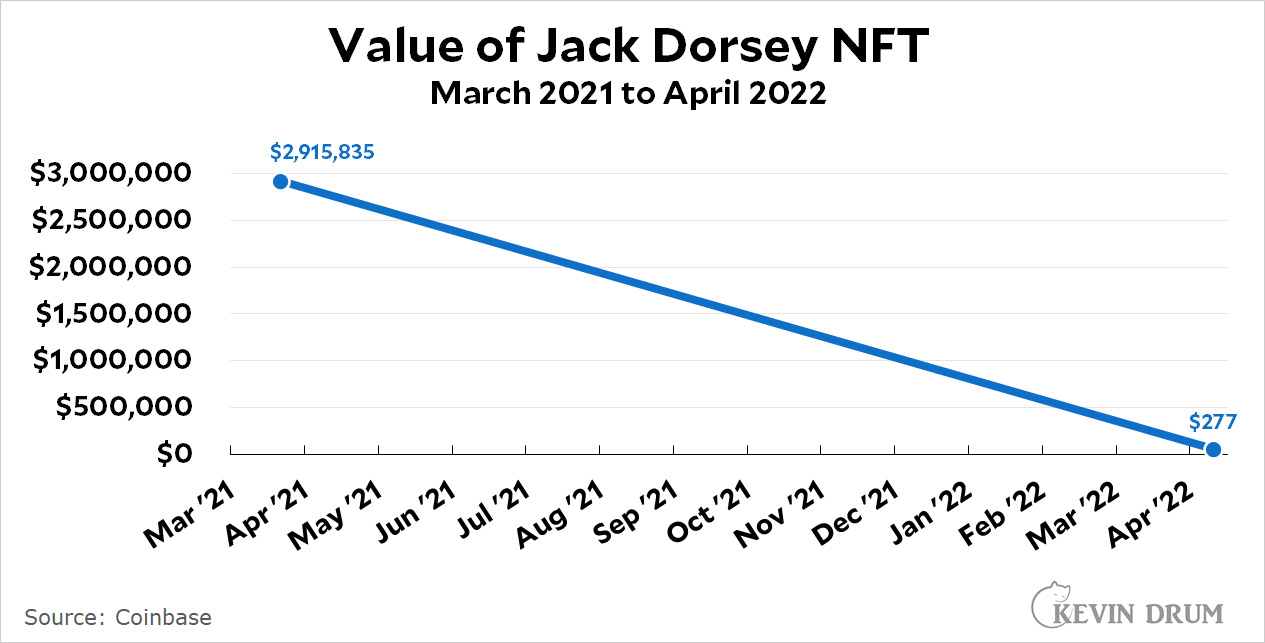

Last week Estavi announced that he was ready to sell the Dorsey NFT and would accept offers until today. The high bid was $277. I have illustrated this in the chart format for which I'm famous:

That's a decline of 99.991%. Unsurprisingly, Estavi hasn't accepted any of the offers. Via WhatsApp he told a Coinbase reporter, “The deadline I set was over, but if I get a good offer, I might accept it, I might never sell it.”

That's a decline of 99.991%. Unsurprisingly, Estavi hasn't accepted any of the offers. Via WhatsApp he told a Coinbase reporter, “The deadline I set was over, but if I get a good offer, I might accept it, I might never sell it.”

Easy come, easy go. That's life in the NFT racket.

One bubble bursted....

Not really, expensive things always have very difficult paths to being sold.

I can hope this a sign NFTs have crashed.

Personally, I'm just surprised the server still existed to link the token to the source.

I want to sell Sina Estavi this Jabberwocking comment. $200 would be fine; I want to leave room for him to profit.

Dorsey wishing he had sold a few more.

Why in the world would have Mr Estavi even wanted such a thing? Much less pay nearly $3 mil for it??

"A fool and his money" still applies, evidently. More than ever.

Estavi is a cyrpto "entrepreneur". The idea was to wildly over pay for NFT's to con people into thinking they were actually valuable.

The generous interpretation is that these people were trying to achieve a societal consensus that NFTs have value as collectibles. The value of a collectible often is arbitrary. Why is a first edition of a book worth more than a second edition? Because book collectors agree it is. If there was a typo on page 87 of the first printing of the first edition that got corrected in the second printing, the savvy collector when considering a purchase will turn to page 87 to check for that typo. If it is there, the book is worth more, despite being objectively inferior to later printings, because collectors agree that if the first printing is identifiable, it is worth more. None of this makes a lick of sense as intrinsic value.

That being said, if they were serious about this they overplayed their hand with unrealistic valuations. If you don't want it to look like a pump-and-dump, don't act like this is exactly what it is.

On the gripping hand, the problem always was that it is too easy to create an NFT and nominally attach it to some random thing that you hope someone will think is cool. Even if that cool thing is unique, the supply side is not that unique cool thing, but every cool thing that can potentially have an NFT associated with it. That is essentially infinite.

Is "On the gripping hand" a phrase people use in real life? I know the reference but I've never run into actual usage. But I like it.

He bought it with crypto and then wanted real money for it. Now we know the exchange rate.

If we can get this added into a factor for the CPI index, Biden's troubles will soon be over.

+1

I'd accept an NFT of a Jack Dorsey tweet if you paid me $277 to take it.

We’re talking about a tweet personally autographed by Jack Dorsey. I would accept it for $200 and I’d take a check.

Sina Estavi:

https://www.coindesk.com/layer2/2022/04/13/buyer-of-jack-dorsey-tweet-nft-is-out-of-prison-and-under-fire-from-investors/

This guy is either the biggest crook in the world or the biggest sucker. Hard to tell from the article whether he’s still super rich and just trying to see if he can chump these same fools again (but just for fun and to keep his hand in) or he rolled out of prison with just the $10 suit on his back (don’t know if the Iranians do that) and he desperately needed some fool to buy the NFT for big money.

"This guy is either the biggest crook in the world or the biggest sucker."

The overlap of those two categories is remarkably large.

A very good point. Even an otherwise successful crook can be a sucker for a better crook. In his case, there’s an easy test. If he’s still a very rich man with his fingers in my pies, he’s a good crook who muffed one play and lost some of his seed money. But if he really needs the $3 million, then Jack’s unquestionably the better grifter.

He thought he was the pump, but turns out he was the dump.

NFTs remind me of the Beanie Baby craze. I looked to see if any were worth anything now. Apparently some are, maybe. I suppose NFTs are like that. Here’s a fairly recent Vox article on Beanie Babies:

https://www.vox.com/the-goods/22870250/nft-beanie-baby-price-guide-bubble-princess-value

JEEBUS, NFTs are stupid

What if, and I'm just spitballing here, but what if rich people are not actually smarter than other people and don't really deserve their obscene wealth?

Like +50.

It generally takes some smarts and some luck to be rich, but you can compensate for a shortage of one with a lot of the other.

"I might never sell it."

Ladies and gentleman, the search is over. We have found the bigger fool.

Pingback: Why NFTs are a mug’s game | Later On

Can one pull the rug from under oneself? [checks notes] Yes, yes you can.

he weirdly specific figure of $2,915,835.47

Is a 9 digit number using all 9 digits. Not sure if there is anything more to it.

Last I counted, there were 10 digits. But I admit I haven't re-counted them today.

Unless we are working in base 9, of course.

The weirdly specific figure might be a function of how the auction operated. Bids might require that the next bid must be a certain percentage above the last one. They might have automatic bids in which you indicate a certain amount that is your top bid and the auction automatically ups your bid in the required percentage until you reach your maximum. And then the final action amount adds the auction house’s percentage which is the final amount you must pay. That could result in an amount that includes fractions of a dollar.

Probably the clever secret code to his crypto wallet.

There's no 6 or 0.

Seems like it's missing a 6.

Missed that. Scanned the second 5 as a 6. Thanks for the correction.

Didn't some NFT by an artist sell for 8 figures a few years ago?

yup. and that was also a scam designed to pump up some crypto coin or business from what i understand.

HFSP, Estavi.

Love this.

By my calculations, that a velocity of about -1.1 dollars/sec.