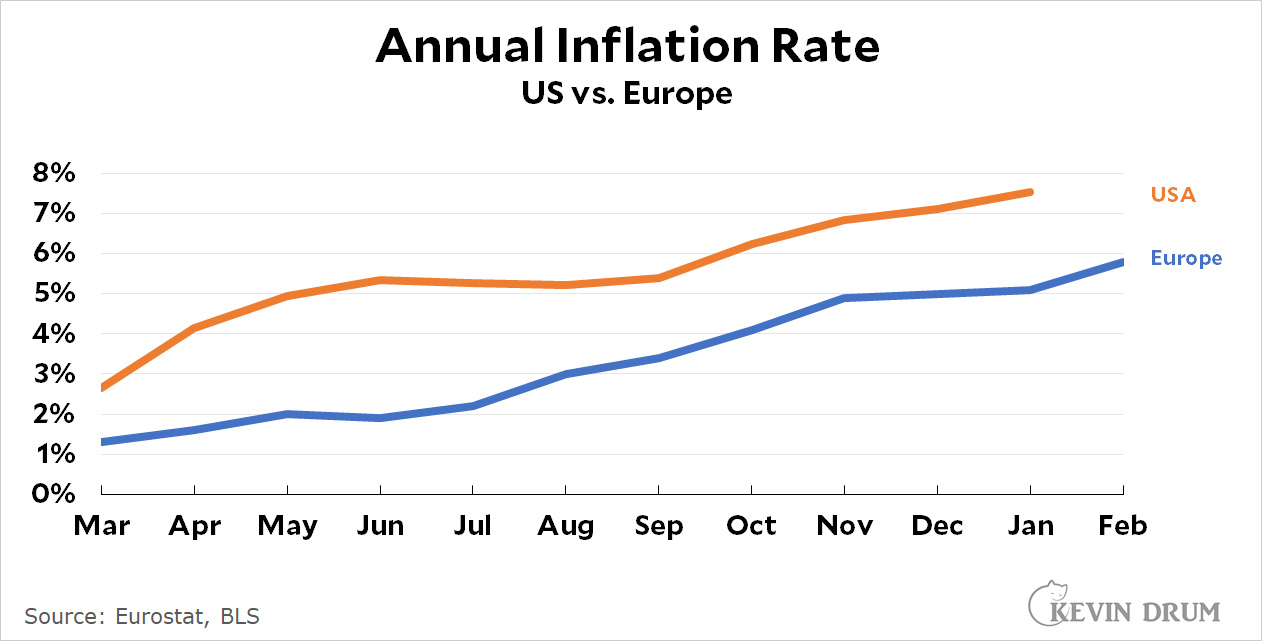

Eurostat has issued a flash estimate of the euro area inflation rate for February: it will reach 5.8%, up from 5.1% in January. Here's how that compares to the US:

There are a couple of takeaways from this. First, US and European inflation rates follow each other, so don't be surprised if the February number for the US jumps as well. The BLS will release February CPI figures next week.

There are a couple of takeaways from this. First, US and European inflation rates follow each other, so don't be surprised if the February number for the US jumps as well. The BLS will release February CPI figures next week.

Second, we now have a year's worth of data showing that the US inflation rate has been a fairly steady two percentage points above the European rate during the pandemic recovery. This suggests that global issues are responsible for most of our high inflation rate, but that economic policy (i.e., the $1.9 trillion stimulus bill) is probably responsible for adding two percentage points to that.

Oh, and a third takeaway: damn, Eurostat is a pain in the ass. You can do better, folks.

The flash announcement specifically, or the site in general?

Krgthulu mentioned this several months ago in one of his newsletters. He seemed to say that US inflation typically ran a point or two ahead of inflation in the Eurozone for some reason, while admitting that the big money dump probably contributed to a small portion of the inflation we are seeing.

While its true that US inflation is similar, but about 2% higher, than Europe that might not be a complete comparison. Inflation for major Asian countries are materially lower:

Japan .5%

South Korea 2.1%

Australia 3.3%

Japan's extremely low inflation rate, may not be a very good thing.

"Spending on durable goods, the source of much American inflation, has been practically flat for the past eight years in Japan."

Further, high savings rates plus tight consumer spending puts a bit of a damper on economic growth and therefore moderate inflation.

The EU's report says the driver of inflation is energy.

Were you expecting European energy prices to stabilize in February?

It is nonsense to think that giving poor people money caused inflation. Maybe that’s not exactly what Drum is saying, but it sure sounds like it. I did not receive and payments or any money at all during the pandemic. Not one penny.

But if you think that giving out cash caused this, then I assume you are happy to see the child care funding / tax credits fail. I assume that rental assistance should be stopped and evictions started with a vengeance.

So rather than say it causes inflation, just say that we need people to stop buying junk.

Considering the fact that the economy isn't currently operating at a higher level than what had been predicted (prior to covid), it isnt at all clear that the stimulus played a measurable role in the current inflation.

The fact that Europe, with a much smaller stimulus plan, appears to have undergone a nearly identical inflationary episode (lagged by a month or two) also appears to discount the notion that the stimulus has played a role.

We don't know where the economy is at all. Revisions may change that view. Used cars and yry energy prices are why prices are up. Look at 2011.

The government allowing fucking trading houses to Jack up a oil bubble(that will crash in the future) is creating bs inflation like the 2011 Arab spring crap.

Since a classic definition of inflation is too much money chasing too few goods, perhaps the TFG Tax Cuts (More Money) is responsible for the inflation.

/s (only a little)

classic definition of inflation is too much money chasing too few goods

Well, it really isn't a classic definition, rather a bon mot tossed out by that libertarian saint Milton Friedman.

Historical data shows that there is no immediate relationship between money supply and inflation.

Ditto with the "too few goods" notion. At least in regards to wealthy countries. They may have spot shortages - that whole supply chain thing - but generally, and particularly in the context of a global economy 1st world countries don't ever suffer from insufficient supplies.

One could argue, that in a modern ecomony, inflation is due to greed on the part of sellers and price indifference on the part of buyers.