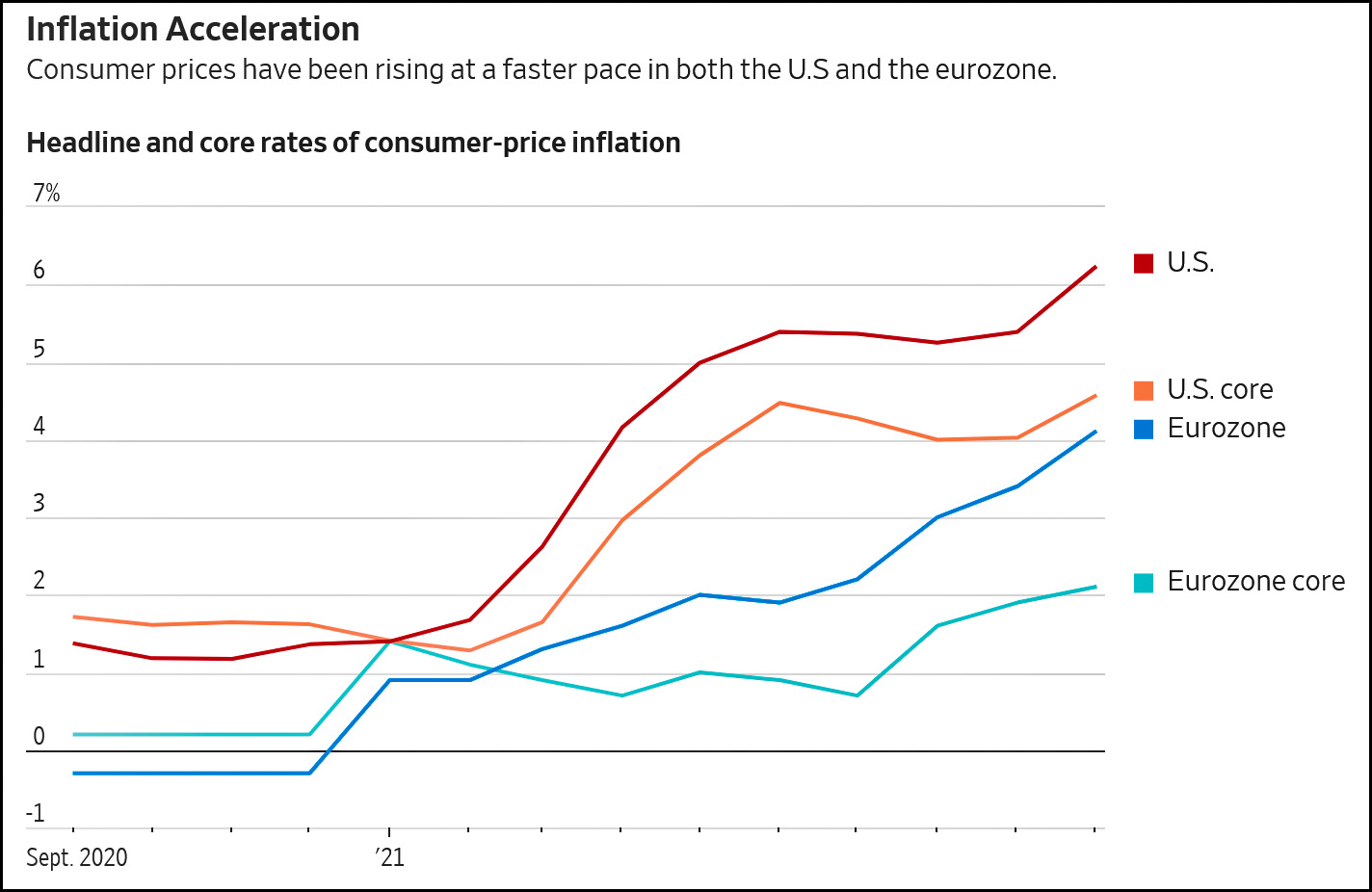

According to the Wall Street Journal, inflation in the eurozone is "likely" to hit a new record in November:

Just eyeballing this chart suggests that our own surge in inflation is perhaps half due to global problems and half due to specific US issues. The obvious candidate for the former is supply chain disruptions and the sudden switch in demand from services to goods, while the obvious candidate for the latter is the $3 trillion in stimulus money that we pumped into our economy at the beginning of 2021. I expect that both of these things will begin to ease off starting in early 2022.

Just eyeballing this chart suggests that our own surge in inflation is perhaps half due to global problems and half due to specific US issues. The obvious candidate for the former is supply chain disruptions and the sudden switch in demand from services to goods, while the obvious candidate for the latter is the $3 trillion in stimulus money that we pumped into our economy at the beginning of 2021. I expect that both of these things will begin to ease off starting in early 2022.

Most oil prices plunged 10% or more on the news of Omicron. Don't you think it'll be ironic that the threat of COVID-19 resurgence will kill headline inflation?

That will reverse monday.

Public service announcement: Don’t feed the troll, even if he sounds semi lucid. Trolls only die when everyone refuses to feed them.

Service announcement: what the moron posted above should mean your banned.

Then I won't respond to him with a sign from El Arroyo, a restaurant in Austin, Texas (& undoubtedly in other places):

Irony is when someone writes "Your an idiot."

But I'd sure like to tell him but don't want to engage. Won't go so far as to wish him dead, but a debate class might teach him that insults don't actually win, & an English course might teach him all he needs to know about homonyms.

"Early 2022" is more than a month away! We are all doomed!! INFLATION MONSTER COMING TO EET US IN OUR BEDZ!!!11!!

Say hello to House Speaker Trump, 2023, & subsequent impeachment & removal of Kamala Harris & Joe Biden (in that order).

This just justifies the Davidcameronian embrace of austerity during the 2007-09 Globalist Financial Crisis.

Had the European Commission embraced the same solutions in 2020 for the Chinavirus Plandemic as the Brits & Germans did for the late aughts crisis, we would all be in a better place.

Shorter version: the Wuhan bioterror warcriminals have turned the world into Greece.

Squeeze them, squeeze them for every cent. And when they can give no more, they'll send Feyd. Beautiful Feyd.

I can hardly wait for "Dune: Part 2". Wonder who they'll get to play pretty Feyd.

Going to have to better than Momoa or even Chalamet.

I just finished watching the original a couple of hours ago. Weird. I have absolutely no intention of watching any of the remakes BTW; I've seen too many Mighty Whitey flicks already. Way, way too many.

Even if Lawrence is on?

Well, we have to order by (chronological) precedence, amirite? The thing is, Mighty Whitey is perfectly as a story ... if you only tell it once or twice a cycle. But -- especially in older sf -- it's the predominant story line of the day. It goes back at least as far as the Skylark series ... penned in 1918 and the first recognizable modern story to go interstellar.

Yeah, I get that. But stepping back from today's thinking and then snuggling up to the setting that is the Dune universe, 8,000 years in the future with thousands of planets teeming with humans with cultures as varied as the sands in a dune could anybody say that Mighty Whitey came to save the day?

Focusing on today, it's clear as crystal but that's narcissistic and myopic, imo. In fact I don't see it that way at all: I see Paul highjacking the Fremen society through religious furor and actual power to avenge his father and find revenge himself against Vladimir and the system that corraled his family into a killbox.

He didn't save the Fremen, he aimed them and stood back. A lot like Lawrence...(even if he hoped for some sort of democracy afterwards)

The reported statistics, such as inflation and unemployment, are at a national level; the policy interventions, such as interest rates, are at a national level; but the economies (plural) are local. In the past, it has been possible to smudge this distinction, except in times of crisis when so much noise is going on that it still doesn't matter. Going forward, I suspect that the distinction will have to be explicitly taken into account. The recovery is *very* unevenly distributed and reporting national numbers that are completely disconnected from local direct experience is doing more harm than good.

What's the view like in J.D. Antivaxxx's Ivy League holler?

I expect Yogi Berra will have a field day with the prediction.

Throughout 2021 Kevin was incredibly sanguine about inflation. How can anybody look at that chart and agree?

6.2% is high and worrisome.

A different frame of reference would be inflation since the end of the 2008/2009 recession. While the FED is targeting 2% inflation, PCE inflation from the end of that recession to March 2019 (beginning if Covid recession) was only 1.6%.

The recent jump in inflation has moved the PCE inflation rate since March 2009 all the way up to.....1.8%.

Over the long term, inflation has still been lower than the optimal rate for economic growth and job creation.

More worrisome than the recent catchup was the decade of sluggish productivity, wage growth, job creation that coincides to slow inflation.

We are in the middle of the most robust economy most Americans have ever seen. But we are doing our best to ignore the incredible growth and job market as we worry about inflation.

Because it's only a single month? Panicking now while still suffering the effects of Covid is what the 0.1% want. Slash government spending so that their taxes won't be increased. Show me two years of inflation above 5% and maybe I'd be concerned.

I ran across a report noting shipping has been setting new records, up ca.20% (?)....

It's not that the supply chain isn't still a bit of a mess, but still managed to ship a record amount of stuff. But "supply chain" is a good excuse to raise prices without people hating your brand.

I just finished watching the original a couple of hours ago. Weird. I have absolutely no intention of watching any of the remakes BTW; I've seen too many Mighty Whitey flicks already. Way, way too many.

You kinda need to explain how a smallish demand side stimulus leads to supply chain bottlenecks.

Sure, we bottlenecked the supply of PV silicon in 2004 by buying more solar panels. But we aren't eating 25% more this year than last year, and aren't driving 25% more this year than we were two years ago.