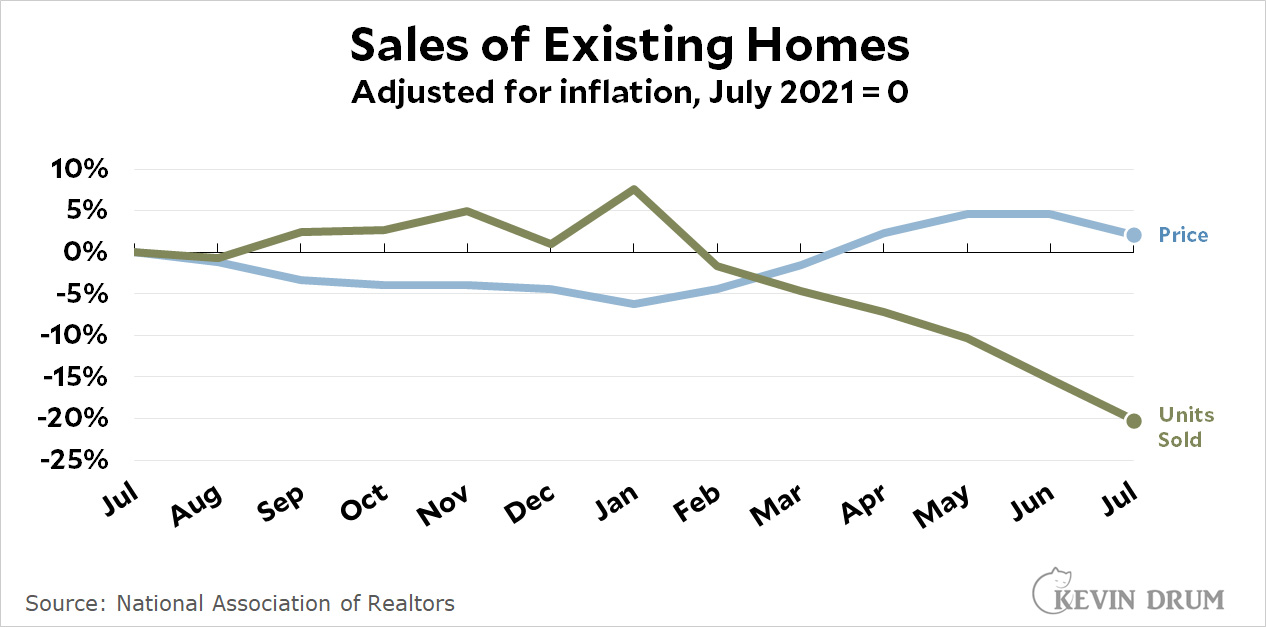

As we all expected, home sales continued to slide in June:

The number of existing homes sold in July was 20% lower than it was in July last year. The median selling price is still 2.1% higher, but declined by $10,000 over the past month.

The number of existing homes sold in July was 20% lower than it was in July last year. The median selling price is still 2.1% higher, but declined by $10,000 over the past month.

The official consensus is that home prices will continue to fall, but only by a little bit. That's my bet too, but the more it congeals into conventional wisdom the more I wonder if we might be looking at a bigger fall in house prices than we think.

Hopefully, mortgage underwriting standards are much better than say 2008: meaning a decline in price equals a paper loss versus a mortgage default...

I work in the industry. Standards are vastly better than in the 00s. No "liar loans", no deceptive teaser rates (and rather fewer ARMs in general), no low downpayments loans without PMI, no fraudulent appraisals.

Your point is irrelevant. Underwriting is irrelevant. The 2000's was based on a debt boom into expensive housing. This was a cash boom heavily pushed by hedge fund aka investor borrowing. They can sit on it for years.

Considering new originations are being made by nonbanks and the federal reserve system is basically becoming irrelevant in the mortgage game, things have changed..

Plenty of non-bank originators in the 00s too-- and those were often the most reckless lenders. However both then and now the non-banks are underwritten themselves by the large banks one way or another.

Its almost like in the case of housing you have tons of statistics, most of which are not very helpful to buyers, mainly because housing is so unique.

Housing isn't like stock in Tesla or something, where if it is $X you can, if you desire, wait for it to go down to $X minus $10 bucks or whatever, and if it does go down you know you guessed right, and if it goes up by $10 bucks you know you guessed wrong, but you end up with Tesla stock either way.

Being able to follow housing with Zillow, I see the following, for example in my part of LA over the past two years.

1. Prices are up.

2. Now, you see listings where, instead of a bidding war, prices are reduced, but

3. That is "reduced" off of a higher listing price than two years ago, and

4. Inventory is so low, that if, for example, you want the house with the best floor plan, which is on a nice street, which needs the least work, that house still has a bidding war like crazy.

5. At the other end of the market, houses which need work, , etc, have flatter prices and stay on the market longer.

None of this equates to prices "going down" in any meaningful sense. Especially when you consider interest rates.

Maybe that's just the story in desirable metro areas.

Its also possible that the entry level side of the market will actually go down, say, for example, condos. I haven't followed that closely enough. But one of my kids is in potential first house situation and don't see any relief in prices there.

Prices push out first time buyers. the question is what to institutional investors do? They can keep buying knowing people have to rent since they can not put together the down payment and/or afford the payments at current mortgage rates.

Also note: even though mortgage rates are considered high by recent standards, historically, they're still on the low side.

https://www.freddiemac.com/pmms/pmms30

But history lessons does not help current shoppers, buying power would.

If mortgage payments are unaffordable rent will be-- or else the landlords will be taking a loss which is not sustainable in the long run. Back in the 00s a lot of house flippers found themselves in that predicament.

Interesting to look at nonbank issue of sales. If its still rising, then real sales are probably not falling. Just waiting for rotation.

Average 30-yr mortgage rate: https://fred.stlouisfed.org/graph/?g=SWJW

It's dropping, despite 150 basis point increase in the Fed central rate. Lower sales are forcing tighter margins?

The housing market is a collection of local markets much more than most due, of course, to the fact you can't move land around (location, location, location) but als because zoning, rent laws and building codes vary so much around the country that each market is, to some degree, isolated. Mortgage rates affect all these markets but local conditions can be more important.

The covid stimulus gave many people extra spending money, but not enough to buy a house. Most people's offer to buy a house will still be contingent on how big a mortgage they can get, and that will be calculated by banks and other lenders based on income (which has not gone up) and mortgage rate (which has gone up). So unless banks are running wild again, top offers must have gone down drastically.

If people have to move for some reason they can't afford to hold out for a high price, so lower offers will be accepted. If you have had your current house for more than a couple of years you will still make a gain on it. Prices could go down a fair amount, although there will still be a shortage of housing.

Pats self on back. Sold at the peak. Assumed the buyer was going to live in it. Nope. Put it back on the market as a rental. Needs 10K per month to cover the mortgage and asking 4K rent. Interesting.

This idea that rent should cover mortgage and bring in profit is new and ahistorical. Mortgages were the long game; eventually you'd own the property. Elsewise, why wouldn't the bank just rent the property themselves?

Even four decades ago, this was true, but somehow in rising housing prices squeezing the rental market became the thing to do.

What the deuce? a 10K payment? Did you sell a mansion?

And the buyer is a fool for taking that kind of loss.

Not a mansion. That's a one bedroom fixer upper here in California.

Those claims that investor interest was messing with the housing market's pricing seem to be a bit more solid given this falter.

While it's rare that the nominal price of housing drops, we are going to test seller's patience strongly. Right now days-on-market is historically low. https://fred.stlouisfed.org/series/MEDDAYONMARUS

Days on market will increase until January. And Days on market dropped quite a bit during Covid, so days-on-market may increase more rapidly than usual. But it really depends on what the feds do with interest rates..

They've fallen, but not that far below the long term trend - and they could stay at this level slightly below the long term trend for a little while yet and it wouldn't mean a thing, really, given how much velocity there was in the existing home market starting in late 2020 and lasting into early 2022.

https://tradingeconomics.com/united-states/existing-home-sales