Fed chair Jerome Powell said today that "the risk of higher inflation becoming entrenched has increased." As a result, Larry Summers is getting his wish:

Most central bank officials, in projections released Wednesday at the conclusion of their two-day meeting, penciled in at least three quarter-percentage-point rate increases next year. In September, around half of those officials thought rate increases wouldn’t be warranted until 2023.

....One immediate sign of officials’ increased urgency: They approved plans that will more quickly scale back their Covid-19 pandemic stimulus efforts, ending a program of asset purchases by March instead of June. That opens the door for them to start raising rates at their second scheduled meeting next year, in mid-March.

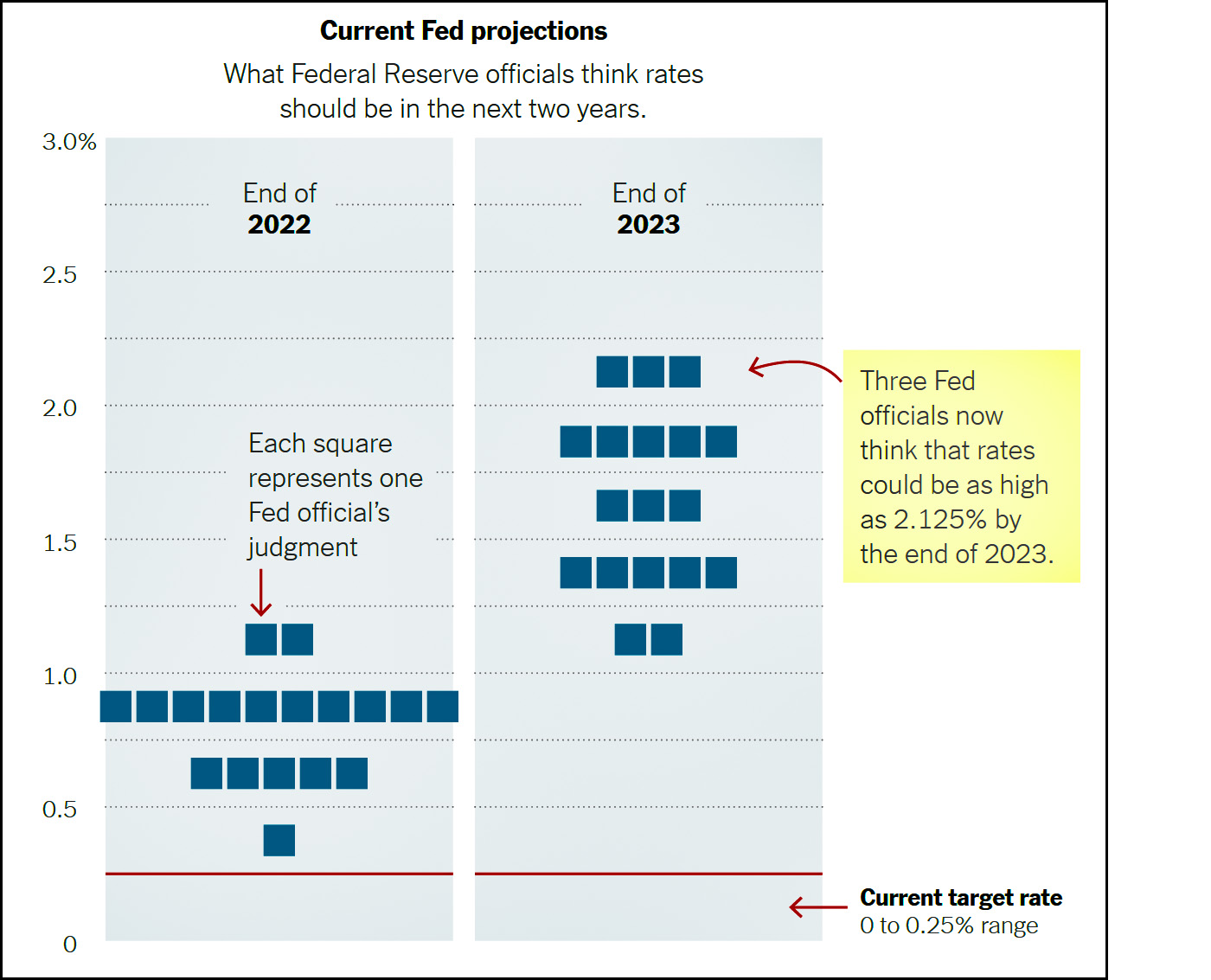

This little chart from the New York Times shows what each member of the FOMC board thinks about where interest rates should be by the end of next year:

Nearly everyone thinks we should end the year at least at 0.5% (i.e., two quarter-point increases) and a strong majority thinks we should end up at around 0.75% (three increases).

Nearly everyone thinks we should end the year at least at 0.5% (i.e., two quarter-point increases) and a strong majority thinks we should end up at around 0.75% (three increases).

So there you have it. Inflation hawks are getting what they want, and this ought to open the door to passing the BBB bill. It was never inflationary to begin with, but a lot of people seemed to be afraid it was. Now maybe they'll be willing to listen to reason.

"Inflation hawks are getting what they want, and this ought to open the door to passing the BBB bill."

Assumes inflation hawks aren't also social spending hawks... or simply self-important assholes who like to fuck shit up just to renew their mavericky street cred. The BBB bill is going nowhere until it is almost entirely pecked over leaving behind nothing but tax credits and deductions.

Yeah, what? They don't care about inflation when it comes to BBB, because if they did they'd know it already wasn't inflationary. It was always just an excuse to not expand the safety net.

Yup. Manchin just likes attention, and Sinema just likes money. It has nothing to do with Biden, inflation, the country, etc.

It's just amazing though that somehow the BBB and the Fed rate are causing inflation in far flung places like the UK, EU and Asia. Who knew the Democrats could destroy the economies of other nations so quickly with their domestic social spending proposals?!

I’m not clear on the the logic of the final paragraph. As Kevin says, it’s never really been about inflation. indeed, it’s been pretty well established by Kevin and many others that the inflation hawks, Larry ”the oligarchs good friend” included, are not operating in good faith and that’s almost certainly been true for decades. If they are not sincere in their arguments about inflation, I see not reason why they would support anything that would cost their patrons money regardless of whether it’s socially beneficial.

I feel pretty certain that they're (Summers) making their arguments in good faith, but what the policy difference comes down to, is whether the signals they're seeing are part of an exogenous shock (specifically logistical challenges stemming from global trade and disparate pandemic policies) and transitory, or part of the standard fare of economic signals.

As the virus becomes endemic, clearing out the exogenous shock becomes drawn out and full of blips. This is new territory and answers are not nearly as clear as anyone would like to assume. Do you switch to reading the economic signals conventionally and respond accordingly with policy changes, and when?

Complicating things are the fact that the unemployment rate is very low even as the economy has failed to recover from the job losses of this pandemic, and the fact that once all those jobs come back online there will be further upward pricing pressure with increased demand.

Even without giving in to Summers' view, it's easy to see why the Feds are concerned about runaway inflation as we reach full employment. 0.75pp would only be half of what the rate was, just prior to the pandemic -- is that such a bad thing?

There’s a point where a refusal to adjust your position as your theories and predictions repeatedly are proven false by events makes one a hack. None of these people deserves the benefit of the doubt. And, as far as I’m concerned, that most definitely includes Larry Summers.

If you look at the totality of how he’s acted, from Russia to this Wall Street pals for whom he shills, it is very difficult to think of him as being anything except a hired hard doing what the people who pay him wants and a petulant spoiler who wants to publish Biden because he didn’t get a big job.

I tend to agree with Mitch. I don't think Summers consciously plots to hurt Biden, but that is his petty subconscious goal.

You are a lot more charitable than I am. By me, Larry Summers is a total nogoodnik from way back. He’s never done one right thing. Everything for self advancement, everything for self enrichment, and not an instant of integrity.

He’s a “Democratic” economist because selling out the Democrats pays better.

The irony. It burns.

1) I’d like to see some surveys of those who have left the workforce. The labor force participation rate has been declining slowly for some time; there is no certainty that it will ever return to the pre-pandemic rate.

2) If the LFPR does rise, that means more people earning income, adding to demand, but it’s also the same people making more stuff, adding to supply. It is not at all necessarily inflationary.

LFPR: https://fred.stlouisfed.org/graph/?g=JUPy

I remind you that we exist in a global trade society. A lot of the logistical snafus come from this and the disparate pandemic policies of different countries. So whereas we might open up faster (for better or worse), others aren't. This will lead to additional supply constraints for things that we don't manufacture domestically.

True. But supply/demand imbalances just for certain categories of finished goods don’t drive inflationary spirals.

Yet once more: inflation is a loss of purchasing power of a currency, which is apparent as higher prices for ‘all’ goods and services.

You do realize there is no evidence for an inflationary spiral. Less than a year of inflation can't be an inflationary spiral.

Oh, yes, I’ve been saying that I see no mechanism that could drive one. Without a positive feedback loop, it’s just some prices going up. And eventually (Herbert) Stein’s Law kicks in.

"People have left the workforce for myriad reasons in the past two years — layoffs, health insecurity, child care needs, and any number of personal issues that arose from the disruption caused by the pandemic. But among those who have left and are not able to — or don't want to — return, the vast majority are older Americans who accelerated their retirement."

*snip*

"Last month, there were 3.6 million more Americans who had left the labor force and said they didn't want a job compared with November 2019, says Aaron Sojourner, a labor economist and professor at the University of Minnesota's Carlson School of Management.

Older Americans, age 55 and up, accounted for whopping 90% of that increase."

https://www.cnn.com/.../labor-force-retirement.../index.html

Thanks. Had read speculation about early retirements prompted by Covid, hadn’t seen actual numbers.

More people were born 58-62 year ago than at any other point in US history. It's called the baby boom.

The only people who expect the labor force participation rate to return to where it was pre pandemic are people who have never heard of the baby boom.. There are more 58-62 year olds than any other age group in the nation.

LFPR is also subdued by BLS missing new business creation. That will change. But we aren't going back to the old peak. Simple truth.

It appears to be mainly seniors and near seniors dropping out of the labor force completely. Which really isn't a big problem since it just pushes up the date on which they would've stopped working anyway due to old age or dying.

https://www.businessinsider.com/new-retirement-age-labor-market-great-resignation-boomers-golden-decade-2021-9

If you're talking about the job participation rate, it's never going back to where it was. It has been declining for 20 years because more and more of the population is over 70. 70 year olds neither want nor are expected to fill jobs. AT this point the vast majority of baby boomers are either retired or have retirement in the near future.

LFPR ages 25-54:https://fred.stlouisfed.org/graph/?g=JWDM

Discuss.

Now maybe they'll be willing to listen to reason.

Yes, because to date they've been SO reasonable AND willing to listen, and because their objections about inflation are SO obviously made out of good-faith concern for the welfare of the nation.

I'll tell you what might actually work. Promise that not a dime will go for "welfare" or will benefit "immigrants" or "poor urban neighborhoods." Add a provision explicitly prohibiting spending on anything that supports or promotes Critical Race Theory. Exclude benefits for any community that has any street, park or structure named for or dedicated to BLM.

Inflation, it's the new "deficit."

This is why Manchin won't vote for BBB as long as it extends the child tax credit. Let's go, Manchin.

Your mumbling dialectical nonsense. Bad time to pass BBB. Simply is.

Yeah the BBB is obviously causing inflation to occur in the UK, EU, Asia... those nefarious Dems and their socialist plans!

Surprisingly quick segue to BBB there, Kevin-- the O. Henry twist I wasn't expecting.

On the substance of raising rates-- if I'm remembering right, this Fed group is particularly wedded to the idea that their signalling effect on markets is central to accomplishing their mission. So they're clearing the decks to take inflation seriously, they say, and then maybe next year they end up going for one or maybe two quarter-point hikes as the magic balm of Heisenberg and Schrodinger starts working to soothe market jitters?

I support/think we should pass the BBB act. However, Kevin's statement "It was never inflationary to begin with" is misleading.

Most analysis agree that BBB does not cause inflation in the long run: however, a majority of the same folk do hold that BBB does cause inflation over the next two years. So lets be honest here...

Really? Manchin opposes it because he opposes the policies. Sinema opposes it because her brain is made out of butterflies. Inflation, here or not, is completely irrelevant.

Inflation hawks are getting what they want, and this ought to open the door to passing the BBB bill.

That "ought" is doing some seriously heavy lifting. I had long thought Democrats would somehow or another be able to get BBB to Biden's desk, but I think they odds now at least modestly favor the bill's defeat in the Senate. I really doubt promises of rate increases are what saves it. Manchin cares mainly about his next reelection, and he figures (maybe correctly) "killing Biden's bill" will help him more with his West Virginia constiuents than "saving Biden's bill."

(I really hope I'm wrong, though.)

I hope so, too, but I’m getting more pessimistic by the day.

I’ve been wondering what Manchin’s object is. If he just wanted to be able to say, “I cut the bill by 50%”, he has to know that he’ll be running against a Republican who will say “I would have cut it by 100%!”

Look at the futures market. They will tell you with far better accuracy where rates are likely to be.

I assume you don't own a Bloomberg so

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

is the best place to see where rates are expected to be.

about a 70% chance of at least three hikes by the end of the Feb 23 meeting.

OK, so interest will go up and none of these higher prices, except maybe gas, will go down? I mean once a company can charge X% more for something today because "inflation". they aren't lowering those prices ever again.

Lots of middle class people are drowning in debt. .75% increase is going to hurt. And why? For government money most people won't ever see?

Nigh. 75 basis points is nothing. Try harder.

Also a nice chunk of stimulus went to debt reduction. Especially the first one.

Your claim that "they aren't lowering those prices ever again" is not supported by facts. Prices go up, but prices are also known to go down, for all sorts of products. When too many prices go down, the doomsayers start talking about deflation and the horrible consequences of it.

Textbook example of both gross incompetence and having absolutely no idea what one is doing. Planning on three rte increase in the near future while simultaneously printing money through quantitative easing. As soon as one rate increase was on the horizon printing money should have been halted. The perfect monetary policy is one where the likelihood of rte increases equals the likelihood of rate decreases.

Don't give absolutes. Since it wasn't a organically created "recession", don't act like it.

4% is recovered. 3% is boom rate. 2% is 2000's population growth adjusted peak. But that also means a malinvestment.