Today the Washington Post asks, "Why Americans are so pessimistic about their finances?"

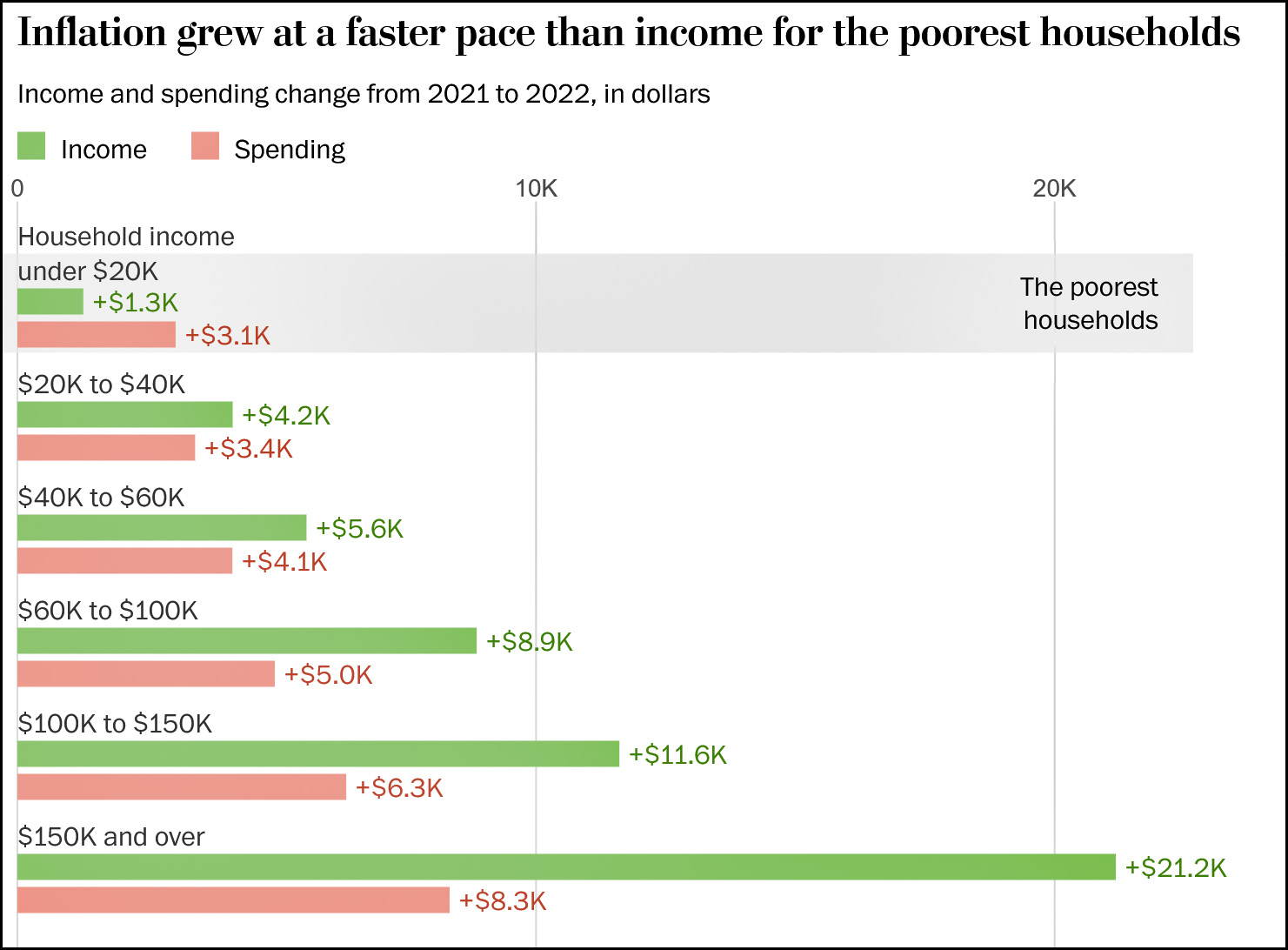

After presenting three stories of families at different income levels, their conclusion is that the price of eggs is up. Unfortunately, their data doesn't really back this up, since household income has increased more than spending. So they take a different tack, warning that percentage increases are misleading. Instead, they ask us to focus on raw dollar increases:

This doesn't work either. Except for the very poorest families, income has increased more than spending even in dollar terms. And low-income families are something of a special case because they rely so heavily on government benefits, which declined in 2022 after the temporary bumps of the COVID years.

This doesn't work either. Except for the very poorest families, income has increased more than spending even in dollar terms. And low-income families are something of a special case because they rely so heavily on government benefits, which declined in 2022 after the temporary bumps of the COVID years.

So this doesn't explain widespread pessimism about personal finances either, which means we have to invent something else:

Even these calculations don’t capture the full experience of what it’s felt like to live among so much economic uncertainty the past couple of years. Americans are frustrated by rising costs, yes. But they’re also frustrated by how much more attention they must pay to these rising costs — attention that is itself costly. This hidden strain on families is likely to continue for some time, even if some headline economic measures continue to improve.

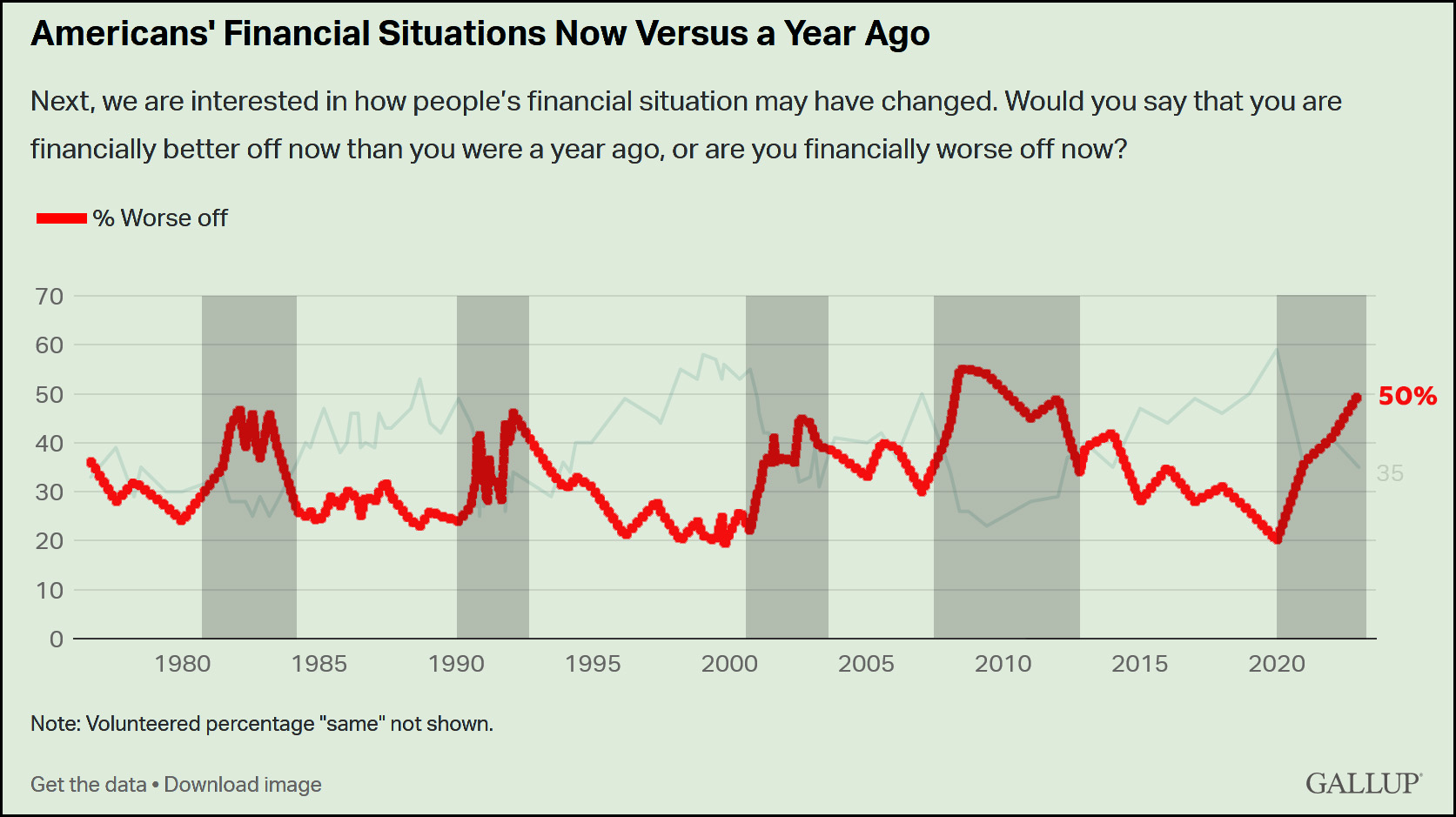

It's the mental strain of inflation that turns out to be the culprit! And you know, maybe so, although it seems like a bit of a stretch. Take a look at the long-term Gallup data that sparked this conversation in the first place:

During each recession and its immediate aftermath (the gray areas) anxiety about finances went up, and in 2021 Americans started to treat COVID like a recession. This is before inflation spiked up, so that can hardly be the cause. The primary answer, I suspect, is simpler:

During each recession and its immediate aftermath (the gray areas) anxiety about finances went up, and in 2021 Americans started to treat COVID like a recession. This is before inflation spiked up, so that can hardly be the cause. The primary answer, I suspect, is simpler:

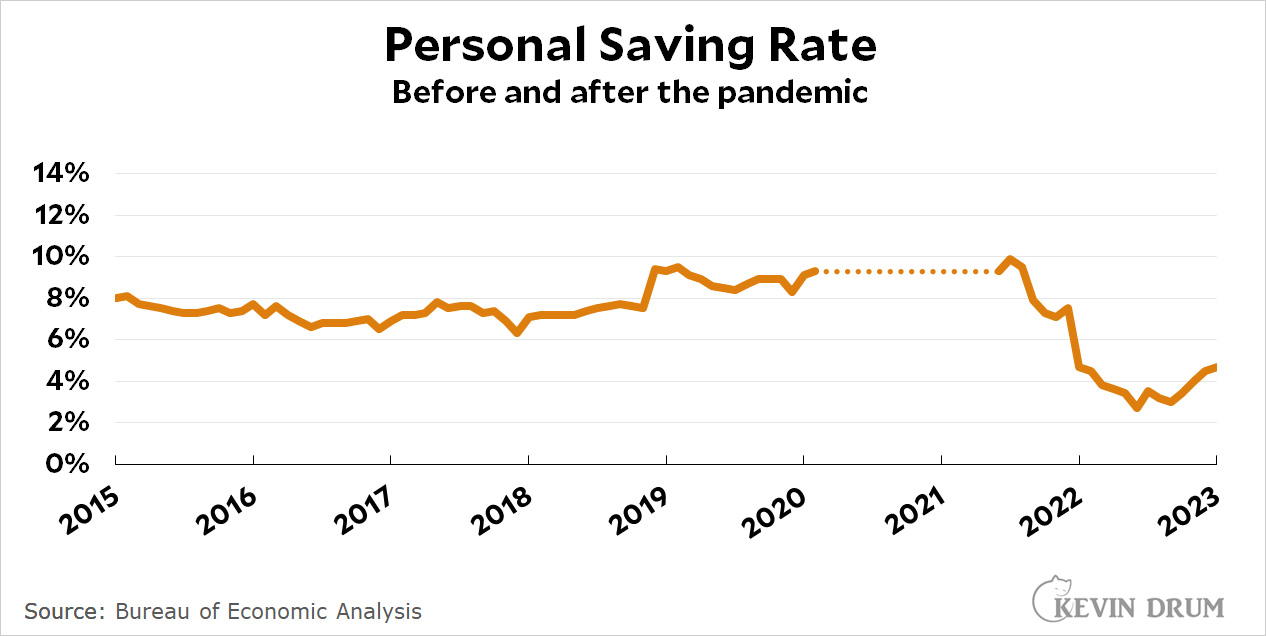

Before the pandemic, people were saving about 8% of their income. That made them feel safe. During the pandemic, they were socking away huge amounts thanks to government checks, and that made them feel safe even in the midst of hard times.

Before the pandemic, people were saving about 8% of their income. That made them feel safe. During the pandemic, they were socking away huge amounts thanks to government checks, and that made them feel safe even in the midst of hard times.

But then the government checks stopped and people started using up their savings. They did this throughout all of 2021 and kept doing it through the first half of 2022, ending up at a saving rate of around 3%. This makes them feel decidedly unsafe regardless of their income or their actual amount of savings.

As an explanation of financial distress this makes more sense than trying to torture the inflation statistics to tell a story they don't really want to tell. Incomes are in decent shape; employment is strong; and life is mostly back to normal after the pandemic. However, savings are being spent down instead of being replenished, and this makes a lot of people feel like they're on the edge of disaster, where any single blow could wreck their finances completely.

So, in order, the proximate causes of financial anxiety are (1) COVID, (2) declining savings, and (3) inflation. There's no question that inflation, especially of high profile items like food and gasoline, takes a toll, but it's really not the main problem here.

Google paid 99 dollars an hour on the internet. Everything I did was basic Οnline w0rk from comfort at hΟme for 5-7 hours per day that I g0t from this office I f0und over the web and they paid me 100 dollars each hour. For more details visit this article... https://createmaxwealth.blogspot.com

"Before the pandemic, people were saving about 8% of their income. That made them feel safe. During the pandemic, they were socking away huge amounts thanks to government checks, and that made them feel safe even in the midst of hard times.

But then the government checks stopped and people started using up their savings. They did this throughout all of 2021 and kept doing it through the first half of 2022, ending up at a saving rate of around 3%. This makes them feel decidedly unsafe regardless of their income or their actual amount of savings."

And the reason for this IS inflation, not savings. If I were looking at that chart and not trying to make an inflation-narrative-related point, I'd be saying "what happened with that time period that caused the sudden decline in savings" and thinking that it was the first place to look for an actual cause to both the lower savings rate and financial anxiety.

Put another way, higher cost of living = lower savings. Note that I didn't use inflation there, because wages haven't inflated with prices (if they had, the savings rate would've remained pretty stable), so we don't have true inflation. We just have price increases.

Put yet another way, lower savings rate and financial anxiety are two symptoms of the same cause.

This entire post is trying to make a nonsensical point.

The COVID "recession" can't be looked at in the same way for things like financial anxiety as other recessions. It was an entirely different animal. The anxiety felt by people (including me, and basically everyone I knew) was that the pandemic might dramatically alter the world as we had known it for the worse. Turns out it didn't do that, but we didn't know it was going to turn out this way until at least 40% of the way through 2021.

Yup! People are spending down their savings to cover the increased cost of living.

You have to factor in that there is just a lot more to spend money on now than there was in 2020, especially for those in coastal cities with strict lockdowns. People are going back to restaurants, theatre, and travel, and that leads to more spending.

Drum predicted:

"And now for a prediction: As more information unfolds and panic subsides, the FDIC will find out that SVB was not only solvent before the run, but even after it. Everyone will be paid in full and there will be money left over. .."

In fact the FDIC estimates it is out $20 billion.

I agree with Kevin here. And that’s partly because there’s an added dimension he doesn’t explicitly mention: Aging. it sucks to be a 35 year old parent struggling to keep up with ever higher prices, for sure. But at least such a person theoretically has a lengthy bit of career runway left with which to increase earnings and save more money. Needless to say, it’s an order of magnitude worse to arrive at age 60 with an adequate savings.

I assume that the savings ststistic used here ignores capital gains as income but counts capital gains taxes as an expense?

Given the massive jump in stock, bond and housing prices during 2021 and 2022, it might make this chart highly misleading.

The recent dramatic increase in savings shown on Kevins chart appears to indicate the misleading nature of the data and undercut the narrative its being used for.

Hmmm...

Personal Savings Rate is based on disposable personal income, which should exclude taxes, including cap gains.

Also, 2022 was a historically bad year for stocks AND bonds, so I'm unconvinced that cap gains would be a larger factor than usual for 2022.

I think a lot of folks were less inclined to put money into stocks and bonds in 2022, so that money may have been going elsewhere. Were there a lot of remodeled kitchens and bathrooms in 2022? Or a larger number of expensive vacations than usual, due to post-COVID YOLO-ing?

My hunch - I think most of the missing savings went into inflated prices. Prices go up, you spend more, and you save less. It'll hit the lower income tiers the hardest.

The Republicans insisted on ending refundable tax credit for parent(s) raising kids. A lot of people will be missing that money--and blame Biden.

A lot of people will be missing that money--and blame Biden.

Sorry, but Democrats share a nontrivial part of the blame. That enactment should never have had a sunset provision. Democrats are so fucking stupid and/or feckless at times it simply induces nausea.

(Yes, our current inflationary problem would likely be worse were that provision still in place, but I'd still take that deal—in a heartbeat: child poverty in America is a shameful national scandal.)

Good to know that people who have retired and have cash savings aren't feeling any inflation because ....

Ohm wait. It's just another inflation-denial post. I thought the supply of those had run out. Apparently not.

I'm retired and have some cash savings and as far as I'm concerned the inflation hype is ridiculous. I'm not commuting to work anymore so gas prices just aren't a big deal. That is true for most retired people. Food costs a little more, but then again, Social Security is inflation adjusted so again, no big deal. I'm fortunate to own my house, but then so do most retired people (79.5%). I'm a lot happier to have a little inflation than to have other members of my family who are still working lose their jobs.

The unanswered question is "why have savings declined?"

I can’t make sense of the data in the charts. If my income goes up $100, but I only spend $60 of that, isn’t the remaining $40 the very definition of ‘saving’? What’s happening to the difference between income and spending? Are people setting fire to piles of greenbacks?