The Wall Street Journal has a rather remarkable story this weekend about CGT, the French union that represents workers in the power industry. Apparently they've taken to cutting off electricity to specific individuals as a protest against proposals to pare back the French pension system. The most curious thing about this is that everyone seems to be taking it in stride. The French government is said to be "outraged," but apparently is doing nothing more than suggesting CGT might face legal sanctions.

This got me curious about Emmanuel Macron's pension proposals, which eventually led me to this:

Some of the proposed measures, such as beefing up minimum pensions and merging France’s dozens of different retirement schemes, go down well with many people. But the government is also planning to gradually increase the minimum retirement age for most people from 62 to 64 by 2030, a move that has infuriated trade unions and the left as it would disproportionately hit low-pay workers who didn’t get a higher education and entered the job market early in life.

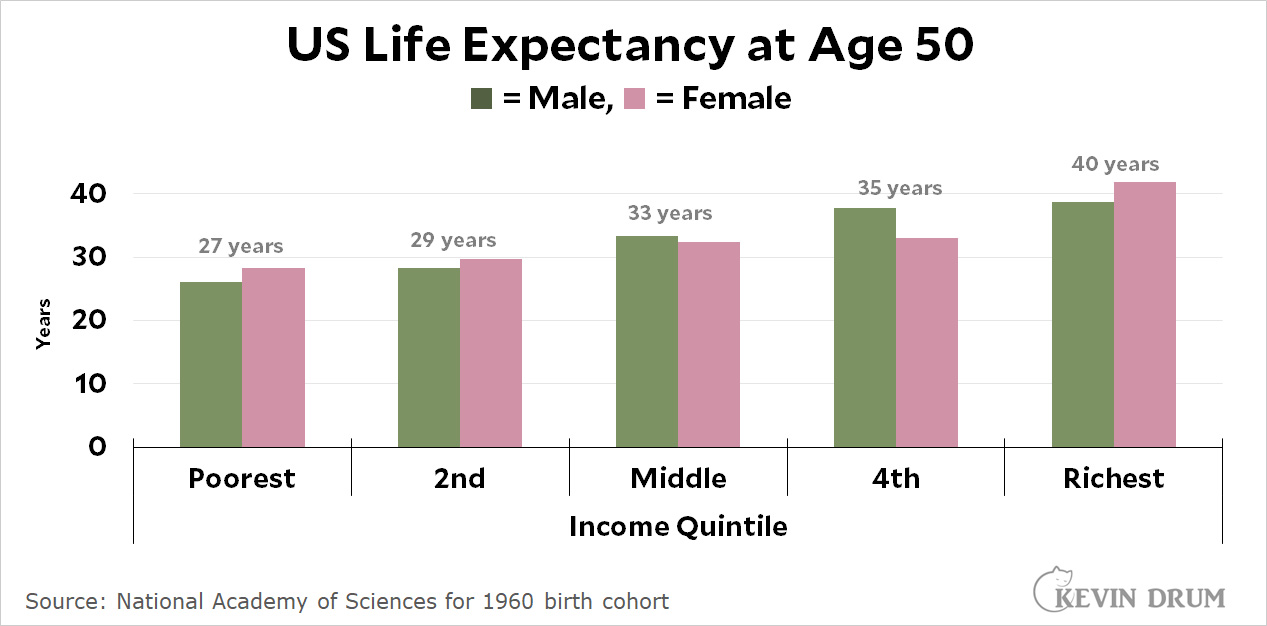

This is true, and it's true everywhere: High-income workers work fewer years and live a lot longer than low-income workers. Here's what that looks like for the US:

If you have 27 years of life left at age 50, you have about 15 years of life left at age 62. Cutting that by two years hurts a lot more than if you have 28 years left, as the rich do.

If you have 27 years of life left at age 50, you have about 15 years of life left at age 62. Cutting that by two years hurts a lot more than if you have 28 years left, as the rich do.

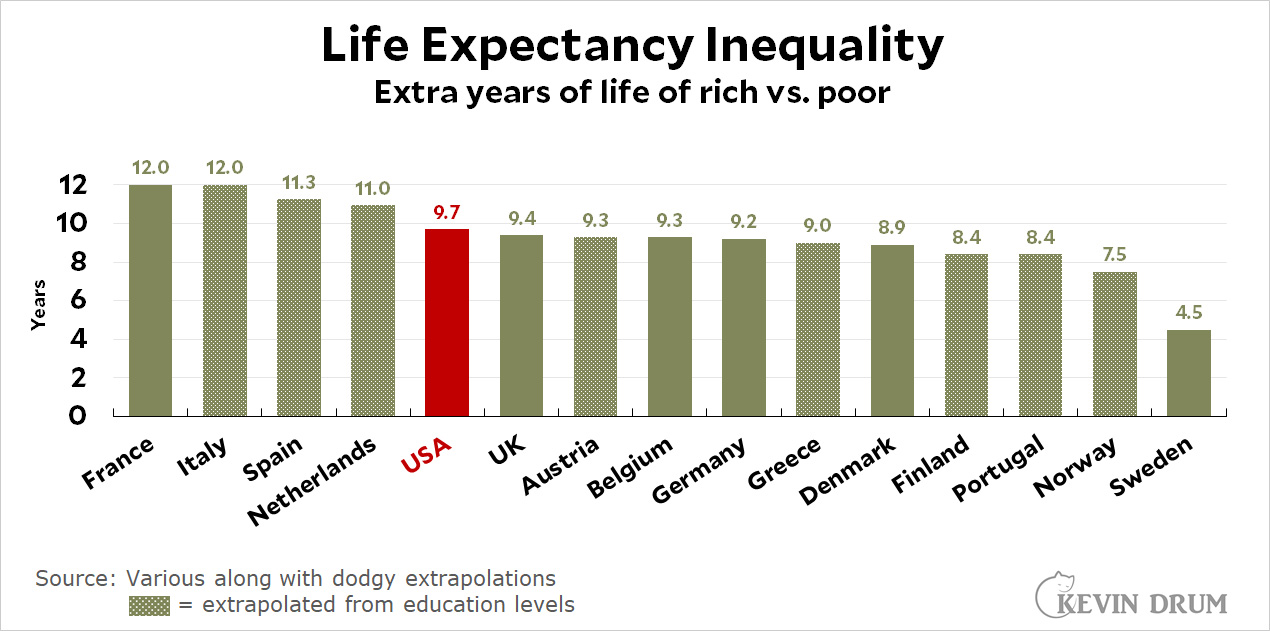

Here's the life expectancy differential internationally:

It surprises me that this isn't more well known. And there are ways to address it. Instead of using a retirement age, for example, you could base pensions on number of years worked. As illustration, consider this simplified scheme:

It surprises me that this isn't more well known. And there are ways to address it. Instead of using a retirement age, for example, you could base pensions on number of years worked. As illustration, consider this simplified scheme:

- 45 years of work is the norm.

- Anything over 1,700 hours counts as a full year.

- Anything under is pro-rated.

- Your full pension is due when you have either (a) worked 45 years or (b) reached age 67.

So if you start work at age 18, you'll get your pension at age 63. If you go to college and start work at 22, you'll get your pension at age 67. The size of your pension will still depend (partly) on how much you contributed to the system in your working years.

This doesn't eliminate the life expectancy gap, but it makes pensions a little fairer. There are other ways to do this, and other details to consider, but my point here is that it's not impossible to take this into consideration.

The one flaw with the proposal is that we don't track hours worked, only wages earned. Social security knows exactly to the penny how many dollars you earned in 2008 but it has no idea how many hours that was. And anyone not in a wage job doesn't track hours anyway.

But otherwise I agree 100%.

We don't, but SSA does indirectly sort of track minimum hours worked per quarter, -ish. You get credit for a quarter toward the 40 you ultimately need if your reportable earnings for the quarter are equivalent to about six weeks of full-time work at minimum wage ($1640 / 7.25 / 40 = 5.66). The earnings number is indexed to inflation (which should satisfy Kevin) but as far as I can see, not to changes in minimum wage. But there haven't been any of those since 2009 anyway (and none look likely given who's in charge of the House).

So the current system of credit for quarters obviously isn't very valuable for these purposes, but it could be a basis for something that would be.

You are just proposing minimum earnings per quarter to qualify. One could peg it at say 30 hours/week at minimum wage per quarter or some such. And then once you reach 160 quarters you can retire. Such a calculation would only be for determining retirement age, not your actual pension which would still be based on your total earnings filtered through the same progressive filter used now.

Social Security already does similar calculations for the WEP. They look at how many years of substantive earning you have. And the standard they use is higher than minimum wage.

Start making more money weekly. This is valuable part time work for everyone. The best part ,work from the comfort of your house and get paid from $10k-$20k each week . Start today and have your first cash at the end of this week. Visit this article

for more details.. https://createmaxwealth.blogspot.com

How many more spams before "Eve" gets to retire?

On the second chart are there two different kinds of green bars? I think there are. On my tablet the distinction is causing some kind of optical effect, like the blank or negative image effect you get if you glance right at the sun.

There are. The cross-hatched bars are countries where the difference is extrapolated from education levels (using education as a proxy).

Must be the cross-hatching that's causing the hallucination effect for me, if it were a solid color I don't think I'd have thought twice about it.

After having several professional friends die before they could retire I say the earlier the better for everyone.

I think you also need to adjust for job-specific stresses. A floor and carpet layer may not be able to do the work after age 40 or so - it's a rare person whose knees aren't seriously degraded from that kind of work by then. And you typically don't have enough foreman/supervisor positions to give the many grunts a promotion.

Kevin,

you already have such a solution in the few system I have an inkling of in Europe.

It is mostly based on the number of years you have paid into the system. It is always as important as the sums you have paid in total.

Let say it requires 42 years of paying contributions for being allowed to quit your job with full pension, while the legal regular age for retiring is at 64 years old. Be aware that 99,9% of earning a living one year means paying cotisations into some state system that year. Keep in mind too that "full pension" means somewhere between like 60 and 75% of your last salary, depending on the country rules and on your individual career.

If you studied, you will be lucky to get to retire at the normal age with a full pension.

If not, easy peasy.

It will most often be combined with some flexibility about going earlier into retirement for some categories of workers like mason, or later to collect more years of contributions if you want a full pension.

Problems arise historically mostly for housewives and mothers stopping working 5, 10 years or more, and differences between categories of workers with old idiosyncratic systems , like rail and military.

They are already haggling over such details in France (which exceptions for which jobs, what are the penalties over full pension for missing years contributions and so on) and not only about the age of normal retirement.

Texas has something called the "Rule of 80" for state employees. (Other places may have it, too, but I've run into it in Texas.) Basically if you're over 50, you can retire with full benefits if your years of service plus your age totals 80 or more. So if you started at 20, and you worked 30 years for the state, you could retire with a full pension at 50. Or if you started 30 and worked for 25 years, you could retire at 55. It certainly limits job-jumping, but it's made it possible for quite a few people to retire early.

Colorado has/had? a Rule of 75. I know a number of folk (back in the 90s) who took the retirement and kept working elsewhere, which I'm sure allowed them to really get ready for retirement, help educate kids or grandkids, etc. But hey, as less-educated workers, in America, they clearly don't deserve to ever have economic stability, so I'm sure it's harder to get these days.

Kevin's scheme would reward workers fortunate enough to have 45 years of steady work, whereas those in precarious employment, with lots of periods of casual/part-time work and periods of unemployment, would never get to retire until they turned 67. Not seeing much fairness there.

So Kevin’s scheme would be no different than the current system for people doing lots of odd jobs (with or without paying taxes on their income) and for people who didn’t work (either voluntarily or involuntarily) for much of their adult life. Not really seeing your point. Kevin never said he was solving the pension problem for literally everyone. He’s only trying to make it fairer for blue collar workers vs white collar workers in traditional jobs. As far as I know, no advanced society has fixed the pension problem for people who work in the gig economy or for people with long periods of unemployment.

What’s with France having a higher life expectancy delta than the US?

Just a guess: the affluence-related differential in the decline of smoking in France has been larger than in other rich countries. IOW, low-paid French people have clung to tobacco more so than elsewhere.

I suppose that is a plausible hypothesis, but what sets low-paid French apart from their peers in the rest of Western Europe and America? I'd have thought the French socialized medical system would be very aggressive in touting and perhaps even covering smoking cessation.

if you get a PhD and start working at 30, then you retire at 75? Seems rough...

No, 67. "either (a) worked 45 years OR (b) reached age 67."

Yeah but (1) PhD’s usually are also working - either teaching classes or on research grants - so that time could be counted towards the pension too and (2) continuously getting education credentials to avoid going into the labor market is something that government should discourage. I personally know one person who keeps going back to school to avoid dealing with the messiness and frustration involved in every “real” job he’s ever had. (I know it’s “real” work to get a PhD but…) By doing so, he’s amassed a huge debt in student loans that he’ll likely never pay off ever and he’s paying near nothing in taxes. It’s unclear what he plans to use his bachelor’s degree, 2 master’s degrees and now a PhD to do in real life, either to benefit himself or others. His whole adult life is a net minus for the nation’s taxpayers… and he’s actively choosing to remain this way as long as he can keep getting admitted to academic programs. People should be financially discouraged from following that path in life.

I love the blame-the-victim wording there, "...a move that has infuriated trade unions and the left as it would disproportionately hit low-pay workers >>>who didn’t get a higher education<<< and entered the job market early in life."

The WSJ is trash, there's little to be gained by paying attention to it.

45 years sounds kind of random. What's that based on? Shouldn't overall productivity needs of the nation be part of the equation in determining that number? The requirement is probably about 30 years if we're just going to throw numbers around. And anyway, FICA taxes are flat taxes. Shouldn't the rich be required to pay the same flat tax as everyone else? Also, shouldn't the rich be required to do manual labor like most of us do for at least half of those years?

Needs of the nation? Silly Neal, we are eighty-plus years and two to three generations removed from asking what we can do for our country.

45 years is about the average amount of time American workers work. Kevin says this in his post. Roughly they enter the workforce at 20 and leave at 65. Nobody said 65 was arbitrary 50 years ago when it was the norm, even though life expectancy was much lower back then. The 45 years Kevin proposes just replicates that.

30 is much too low. We don’t need or want everyone to be retiring at 48-52 years of age (30 years after graduating high school or undergrad).

ubi would be a lot simpler

Government to people: What the hell, just die already.

Too many layoffs in the US for this to work. Maybe you could give a year's credit for involuntary termination.

Most workers in the US still manage to not experience more than a year or two of involuntary unemployment during their working years. Kevin’s “or age 67” cap limits the effect of unemployment on when you can retire. At best, under Kevin’s scheme, if you’re continuously employed your whole life, you can retire at 63-67 with a full pension depending on whether you entered the workforce at 18-22. At worst, if you experience lots of years of unemployment, you’ll have to work to age 67 which is… currently the age at which everyone in my age cohort (Gen X) and younger is supposed to be working anyway to get a full pension, according to the Social Security Admin. I fail to see the problem here. Everyone is either held harmless or can retire slightly earlier than current rules allow.

A rather fair system, when it comes to life expectancy, is I think the Dutch one of the "AOW". This is based not on work or earnings but on the number of years lived in Holland. Thus someone who lives longer does get a pension for more years, but if they also earn more, they pay more into the system than a poor worker while receiving the same monthly AOW. The AOW is supplemented by pension schemes that do take account of earnings and years worked, thus the combination of the two leads to a more fair pension system.

Living in France, alas, I must say I'm confused about the row there. 64 years? I'm 65 and have to wait two more years to get a full pension. True, there is a "minimum veillesse" now called Aspa which kicks in at age 65 if the pension is low, but with strings attached (after my death my kids would have to sell the house to pay back what I received). The present minimum age of 62, it seems to me, is for fortunate categories of workers. Others can retire then too but will then receive a much lower pension until they die. It's age 67 for me and for low-income workers I know.