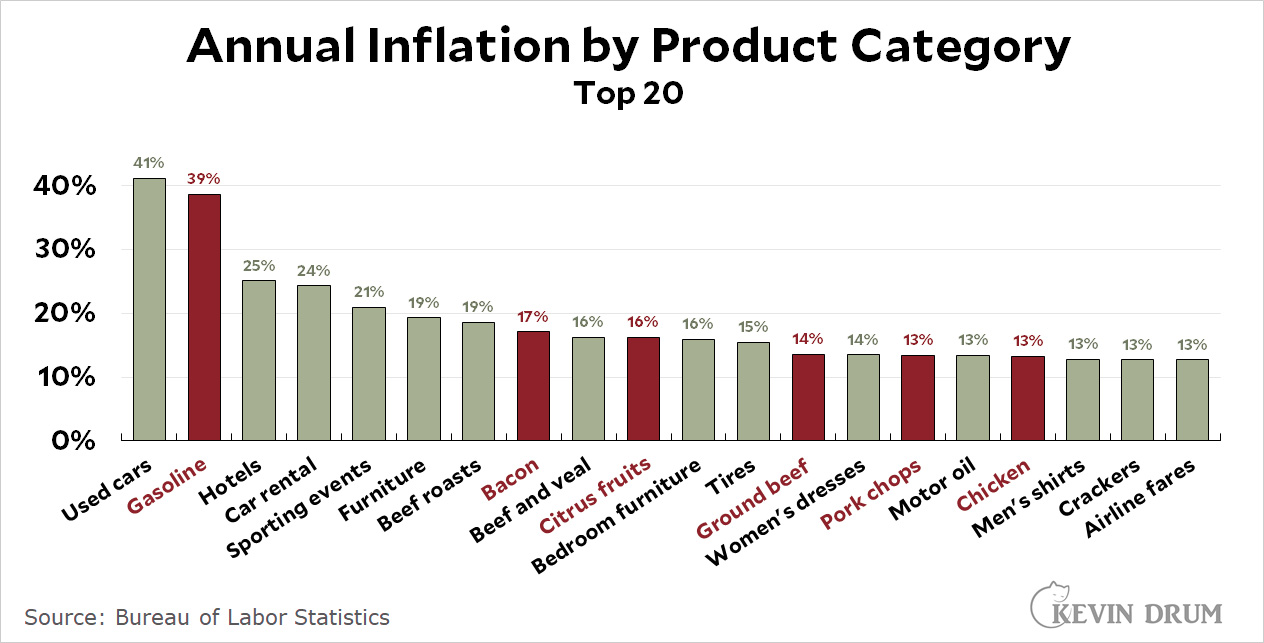

According to the Bureau of Labor Statistics, here are the items that have gone up in price the most over the past year:

This is why voters are so upset over an inflation rate of 7%. That may be the overall inflation rate, but for some of the things that are most visible to them (gasoline, oranges, ground beef, chicken, etc.) prices have gone up by 15% or more—including a few like gasoline and used cars that have gone up by 40%.¹ Is it any wonder that inflation seems a lot higher than it really is, especially when their paychecks have barely budged?

This is why voters are so upset over an inflation rate of 7%. That may be the overall inflation rate, but for some of the things that are most visible to them (gasoline, oranges, ground beef, chicken, etc.) prices have gone up by 15% or more—including a few like gasoline and used cars that have gone up by 40%.¹ Is it any wonder that inflation seems a lot higher than it really is, especially when their paychecks have barely budged?

¹Rent isn't on this list yet, but there's a good chance it will be before long.

A couple of those are weird.

Hotels 25%?

Sporting Events 24%?

Making up for lost revenue from 2020 and 2021?

I would imagine those items would have been available at fire sale prices in 2020, so it stands to reason even a modest move toward more normal conditions in 2021 would've resulted in healthy price spikes.

The price of sporting events didn't go down in 2020, seats just weren't mostly available. The fact that they're moving up strongly in 2022 suggests that there is still a lot of discretionary expenditure going on out there, though no doubt some are hurting.

Airline tickets definitely were. I took a flight to Hawaii from the east coast for $100 each way. There were like 50 people on the whole plane leaving LAX. So “airline tickets to Hawaii” probably jumped 500% from 2020 to 2021.

"Voters" are clearly morons. Gasoline PLUMMETED in 2020 because everyone quit driving, recovered most of the way by early 2021, wandered around until The Impaler started surrounding Ukraine, and then went through the roof when he stuck the lance in.

Joe Biden and "Teh Libs" bear roughly 0.00723% responsibility for that trajectory.

"Voters" are clearly morons.

Yeppers.

And fortunately in America we've got the perfect political party for the most stupid and policy-ignorant among them!

Voters are generally morons (if you’re harsh) or “uninformed” (if you’re feeling generous) in most democracies. The unique thing about our democracy though is that it allows morons/uninformed voters to take control of half the legislature and the executive branch with a minority of votes, as long as the morons/uninformed voters band together in supporting a single party and also live more scattered across the country but yet clustered in select places afforded more electoral power. In 2016, those voters hit the sweet spot on both criteria… and here we are now, subject to their whims on everything.

True. For the reasons that you mention, the unique conditions that allow "uninformed voters" to wield disproportionately large electoral power were always there. All that was needed was for Fox and talk radio to fully exploit those conditions. That has happened in the past couple of decades. And now I don't see a way out of kakistocracy.

Gasoline prices were low before covid. For a few brief shining years, the United States was energy independent and exporting oil.

A lot of people see the price of gasoline right in front of their face as they pump $50 or more into their tanks. They are reminded on a regular basis, so it is particularly painful. Similar with groceries--you notice the prices on things you purchase on a regular basis, and for some of those things prices just jumped ridiculously. A particular jam I like went up exactly $1 a jar one day, or about 17%. A seafood item went up by about 57% for some reason.

Seafood prices are always volatile. For whatever reason, frozen shrimp has been really cheap at my local grocery chain recently.

"... and for some of those things prices just jumped ridiculously. .."

At my supermarket a 24-pack of bottled water went from $1.99 to $2.99 to $3.79 in a short period of time.

Considering gas prices are dropping, whoops to this post.

Do not feed the troll.

Shut up boy. Your the troll.

On today's episode, Shooter discovers rubber & glue.

If IIRC, Shooter wasn't semi-coherent, and generally knew the difference between "your" and "you're" (and stuff like that).

Prices of anything shipped by freight are jumping because there is less capacity in marine container ships. Those huge container ships they built replaced dozens of smaller container ships that were then retired. Not all ports can handle the huge container ships.

That doesn't seem right. Why wouldn't related prices spikes have shown up before the last couple of years? The containerized shipping revolution got going back in the 90s or earlier.

The shipping revolution began earlier I recall seeing containers in episodes of 1970s era Hawaii Five-0 sure enough Wikipedia points to development of the concept in the early 20th century but a real attempt at standardization didn't happen until the 1950-1960s and in the US it wasn't until the 1970s. But as for cheap shipping? Maybe it did take 'til the 1990s?

16 companies control 80% of the container ship freight industry. https://www.freightwaves.com/news/shippings-extreme-consolidation-could-prolong-supply-chain-pain

And the sister ship of the one that got stuck in the Suez canal is now stuck in the Chesapeake bay:

https://baltimore.cbslocal.com/2022/04/08/process-to-refloat-ship-stranded-in-chesapeake-bay-could-begin-saturday/

Used cars shows how flawed bls metrics are. They are over used in hedonics. Paychecks barely moved???? Nope, wage growth is 6%. Inflation ex used cars is 5%. Got it yet????

Do not feed the troll. He needs to be cut off from human contact until he crawls away to die.

You need nostril detachment and to feel pain for your failings in life.

Ah, the old availability heuristic strikes again!

As Kevin has done before with a number of things, the comparison needs to be done to prices pre-pandemic to be meaningful. That said, many prices are higher:

Grocery and restaurant pricing? Everyone needed to set up or sign up with a delivery app. That costs money, to the point where they consumed all profits--so prices go up or the place goes under.

Various shortages means prices go up across the board. Gasoline shortages (delay in production ramping back up), egg shortages (bird flu), milk (bottling issues as demand shifts), etc. (including covid disruptions).

Corporations raise prices because they can. Prices were raised because of various shortages. But profits went up and they could raise prices even more--so did. That's a cheaper way to increase profits than to increase production.

When will this end? In the next couple of months, they'll be a higher baseline, so inflation will not be as dramatic. Gasoline will be all over the place--Russia has created a mess in that market. The war in Ukraine will also cause food prices to shoot up. The bird flu will do the same. Supply chain issues clearing up as is the chip shortage.

What bird flu? Do have inside information that we are going to be hit by a bird flu in the next couple of months?

Real money supply has turned down since January, from elevated levels.

"Is it any wonder that inflation seems a lot higher than it really is ..."

Stop this. You (Kevin) are determined to poo-poo inflation concerns for reasons that escape me. Last year you made over a dozen posts telling readers that inflation wasn't much of a concern. Almost every time it was by ignoring the base/core numbers and, instead, focusing on one sector that was acting oddly, or proposing some other metric as a better indicator of price changes.

You were wrong in 2021 and yet you persist with that approach in 2022.

Let me put it this way: If you are a Democratic politician running in 2022, would you tell the voters that their perception of inflation is incorrect? Or would you admit (like the Fed is!) that something is going on and it needs (a) efforts to contain/lower inflation, and (b) that voter concerns are justified?

I had heard about this until now, but Krugman mentions in this interview a glut in trucking has developed. If so that's a very good sign.

https://www.nytimes.com/2022/04/11/opinion/sway-kara-swisher-paul-krugman.html?showTranscript=1

*hadn't* heard about this until now...

I will add another one - perennials. My local garden center is charging at least 50% more than last years prices.

Any reason to expect rent to go up more than it already has been, for years? Which is to say, by leaps and bounds in hot rental markets (NYC, DC, SanFran...) but sluggishly in many other places. Rent does not seem to be something that would be affected by supply chain issues, or by the rising price of fuel.