The Wall Street Journal has good news for America's CEOs!

Pay increases for U.S. chief executives have gained steam, putting compensation on pace to set a record amid a tight labor market that is also driving pay higher for many of their workers. Median pay rose to $14.2 million last year for the leaders of S&P 500 companies, up from a record $13.4 million for the same companies a year earlier.

....Pay for rank-and-file employees rose, too, last year but more slowly, as measured by the compensation figures the companies report for their median employee. Half the companies said pay for their median worker increased by 3.1% or less in 2021...

As I never tire of pointing out, you have to adjust wages for inflation whether you're talking about pipefitters or CEOs. At first it might seem like our nation's CEOs got a solid 6% increase last year, but in real terms they received a raise of only 1.3%. That's not so great.

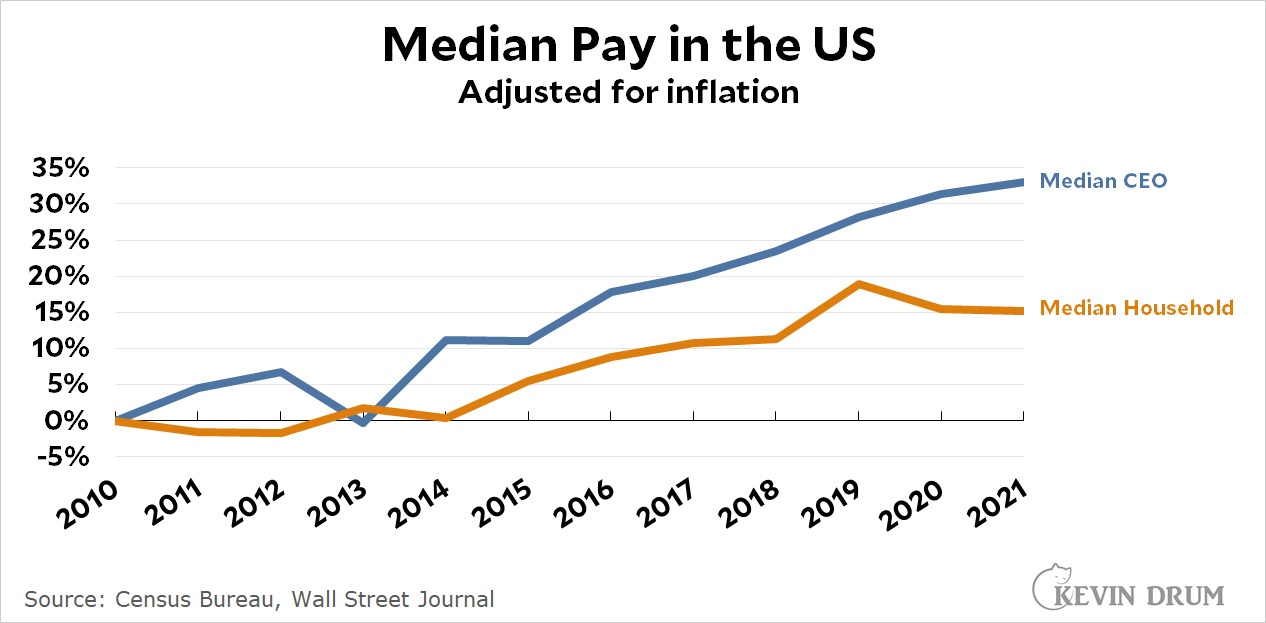

But it's better than nothing, which is roughly what rank-and-file employees got. Average wages increased about 4-5% last year, which is to say 0% when adjusted for inflation. Here's a longer look at things:

According to the Journal, hardly a socialist rag, median CEO pay has increased 33% since 2010. Meanwhile, the median working schmoe has seen an increase of only 15%. More recently, CEO pay increased 4% during the past couple of years—no doubt a tribute to their stalwart leadership during the pandemic—while ordinary worker pay went down 3%—presumably a well-deserved rebuke to their lazy-ass shirking whenever some family member got "sick."

According to the Journal, hardly a socialist rag, median CEO pay has increased 33% since 2010. Meanwhile, the median working schmoe has seen an increase of only 15%. More recently, CEO pay increased 4% during the past couple of years—no doubt a tribute to their stalwart leadership during the pandemic—while ordinary worker pay went down 3%—presumably a well-deserved rebuke to their lazy-ass shirking whenever some family member got "sick."

So there you have it. CEOs already made a gazillion percent more than ordinary workers before the Great Recession, and since then they've increased it to 1.3 gazillion percent. Then they increased it even more during the pandemic. God bless America.

More progressive taxation, please.

And so the unintended side effect of seeking to reign in CEO salaries by tweaking the corporate tax system to favor stock-based compensation continues.

The purpose of stock-based compensation was not to reduce the compensation, it was to make sure that CEO performance boosted stock price. Another thing that was done (in 1982) was to make stock buybacks legal. This was done by SEC rule, by the way, so a President could cause it to be reversed - if he could get the right SEC commissioners appointed.

Thanks for the clarification. My dimm memory is there was a change to how corporations were allowed to handle salaries on their taxes as a stick to help encourage the shift to the presumed pay for performance via stock. So reign-in salaries but tie compensation to performance.

I think we all know this stuff has huge influence in the culture too. The whole world and ethic of "winner take all" has gone a long way to making America a much less pleasant place, in my view. And of course this is why your local shopping mall (in a big city anyway) is full of stores like Coach, Prada, etc, while actual shopping for actual life needs takes place at Costco or Walmart. Because it's the super rich who have the extra money to waste on $1000 sneakers at Nordstrom.

When I hear rightists like Rod Dreher bellyache that the right doesn't control the culture, ("politics is downstream of culture", is one of their favorite things to complain about, meaning they'd really like to shut down gay marriage and abortion access but culture is preventing them from doing so) I often think about how warped our economy is and how dominated by the spending of the rich. Politics may be downstream of culture, but culture is downstream of economics.

I guess I sound pretty Marxist, don't I? 😉

Ah, but you forgot that economics is downstream of politics soo... circle of life? 🙂

My brother is a pipefitter [union]. We should all make that much money.

We should all make that much money, but it’s really hard to keep up after a certain age (the upper limit of which I would put at 55 or so). Social Security retirement age is 67. That’s a very long time to be paying a mortgage and putting kids through school without a wage.

The difference between CEO compensations and the pay of the average worker is already grotesque. The difference in the rates of rise in median CEO and worker pays gurantees that things will keep getting even more grotesque.

“Socialism never took root in America because the poor see themselves not as an exploited proletariat but as temporarily embarrassed millionaires.”

~ Ronald Wright

This is a losing issue for democrats. I don’t know why they think it matters to voters. Consumer spending makes the CEO rich. And people are fine with it.

Well, that and the fact that their incomes come mostly from dividends and stock options, and so they pay about 15% federal taxes (at most) while most people who pay federal income taxes pay a higher rate. But income taxes are a losing issue, right?

Apparently, everything that demands people acknowledge they're losers and need to band together is a losing issue...

And that's tough when your whole argument is that only collective action will allow you to better your circumstances...

You are being robbed blind in broad daylight.

The biggest win of your 1% was when they tricked the Americans into believing all tax is theft, money stolen by the government never to be of any use for the common citizens.

An inconvenient truth from a Swede

More evidence of Sweden's disastrous pandemic policies:

Lots more harrowing details: https://www.latimes.com/business/story/2022-03-31/sweden-covid-policy-was-a-disaster

An inconvenient truth from an American.

That’s a crappy one , I am surprised by the low quality

This is more correct information

https://coronakommissionen.com/wp-content/uploads/2021/10/summary-sweden-in-the-pandemic.pdf

And the final report

https://coronakommissionen.com/wp-content/uploads/2022/02/summary_20220225.pdf

Shanghai lockdown effects: https://twtr.in/3IbJ

At first it might seem like our nation's CEOs got a solid 6% increase last year, but in real terms they received a raise of only 1.3%. That's not so great.

It's true that inflation affects everybody but it's not correct to adjust everybody's pay by the same inflation rate to show how pay has changed in real terms.

A median household earning about $70,000 is certainly feeling the impact of inflation, and CPI is a roughly accurate metric to use.

CEOs earning millions and tens of millions of dollars are practically not affected at all by rising prices of gas, food, car rentals, and so on. Those rising prices have minuscule cost-of-living impact for the ultra-rich. To adjust CEO pay by the inflation rate does not provide a more accurate view of their pay increase. It provides a more distorted view of their pay increase.

(CEOs probably are paying more now when they buy their 5th vacation home or other investments, but that has nothing to do with cost of living.)

It's true that inflation affects everybody but it's not correct to adjust everybody's pay by the same inflation rate to show how pay has changed in real terms.

Sure it's correct. "Real" increase by definition means "nominal less inflation." There's no other method of calculating a CEO's (or a fast food worker's) real increase (or decrease) in wages. Kevin nowhere in this post claims a CEO's standard of living is impacted by inflation in the same manner as a working family. Indeed, the very next sentence after the one you excerpt he writes: But it's better than nothing, which is roughly what rank-and-file employees got.

If Kevin were claiming that CEOs and ordinary workers faced the same pressures in terms of cost of living, he'd be wrong. But that's not what he's claiming. In fact he's making the opposite point: So there you have it. CEOs already made a gazillion percent more than ordinary workers before the Great Recession, and since then they've increased it to 1.3 gazillion percent.