Most of the time, the "headline" CPI is reported as the rise in prices over the past year. For example, one year ago the CPI stood at 273.1; today the BLS reported that in August 2022 it was at 295.6. That's an increase of 8.2%.

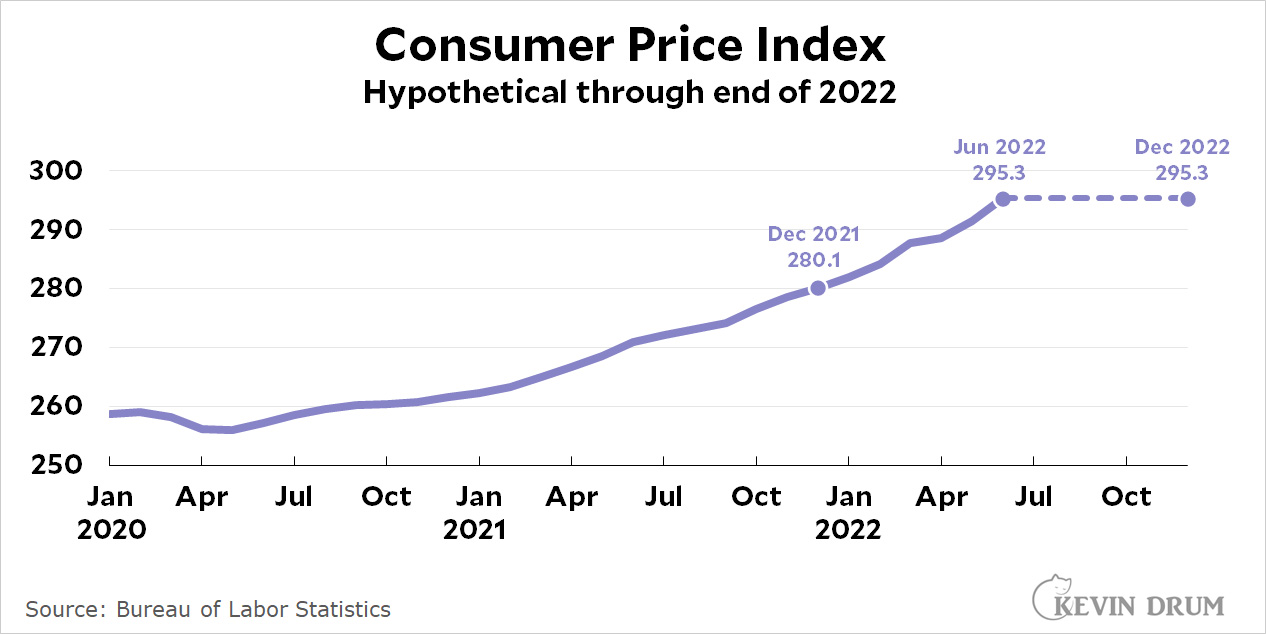

But prices have been flat for the past two months. Suppose this continues through the end of the year. CPI would look like this:

If you calculate inflation the usual way, December's inflation rate would be reported as 295.3 ÷ 280.1 = 5.4%.

If you calculate inflation the usual way, December's inflation rate would be reported as 295.3 ÷ 280.1 = 5.4%.

But does that make sense? If prices have been flat for six months, a much better description of actual life at the moment is that inflation is running at 0%.

Now, this is all very well for six months of data, but what if prices are flat for just one month? Or two? That happens to be the case right now: prices have gone up less than 0.1% over the past two months. But one or two months might just be a coincidence since there's a lot of spikiness in this data. That's why I like to look at monthly prices—so I get a sense of what's happening right now—but then draw a trendline through the data so that I can smooth out the spikes and see the longer-term direction better.

When you look at yearly inflation, the past 11 months of increases are already locked in. Unless you're expecting deflation—i.e., prices going down—the yearly number is always going to be very close to what it was the previous month. That's not very helpful.

When everything is nice and stable, none of this matters much. But when inflation is rising or falling and you need to make decisions about what actions to take, you need monthly data and you need to put it in the context of a trendline. That's why I do it that way.

When everything is nice and stable, none of this matters much. But when inflation is rising or falling and you need to make decisions about what actions to take, you need monthly data and you need put it in the context of a trendline. That's why I do it that way.

I make $100h while I'm traveling the world. Last week I worked by my laptop in Rome, Monti Carlo and finally Paris…This week I'm back in the USA. All I do are easy tasks from this one cool site. check it out, Copy Here→→→→→ https://www.salaryto.com/

CPI is such a flawed measure. Why even try???? Rent/Owners is the worst. It lags so bad, even the BLS hates it.

Core CPI lags so bad. It's out of date by 3-6 months by the time it's released.

Putin's army is collapsing as his regime is. Amazing how people don't want to admit it. He will be forced out by years end. The fact FSB is splitting is the damning proof.

Can't complain about the numbers that everyone uses unless you come up with better ones. More accurate, more useful.

It takes time to get people to change. See, e.g., OBA & OPS.

roe is pretty bad. Even the bls doesn't like it.

You should have a look at this page: https://www.bls.gov/cpi/questions-and-answers.htm

It’s perfectly legitimate to point out specific weaknesses in the CPI, but developing and validating improvements, or alternate measures, is a multi-million-dollar undertaking.

Or stop trying.

As I keep saying, to really understand you probably have to look at it in several ways: the actual CPI numbers, the month/month rate and the year/year rate. Anyone can do this at the FRED site - search for CPI, and then go to "Edit Graph" to get the two rates. You will not get the picture just by reading media stories, which can be very misleading because they obsess on the year/year number. 8.2% is a bigger number than 1.4%, so maybe they do it to draw attention to the story.

The year/year number is important for some things, such as TIPS bonds, but it is actually an average over an arbitrary time span. It's OK when things are relatively constant, but not when the price index is changing rapidly. Many things in economics change on time scales shorter than a year.

Well, this report of 0.1% inflation, month to month did send the markets off the deep end...though "core" inflation was a bit worse than expected--bouncing back up to 0.6% month to month--fitted curve, or not...

A Fed rate of 2 to 3% should be fine--above that, a real recession looms. I fear the Fed may be more interested in making a "bold" statement than dealing with inflation appropriately. I don't think the Fed has the tools to deal with problems we're facing, and may feel compelled to force a recession.

Yeah I don’t really understand what the Fed (or inflation hawks) thinks the Fed is supposed to do. If the biggest problems with the current inflation are energy prices (recently) spiking and food prices (ongoing) spiking… hiking rates to the point of possibly engineering a recession seems pointless. People will still need to buy food and energy - they’ll just cut back on everything else, which apparently isn’t spiking anymore (if it ever was - I keep reading stories about how stores are now overstocked with stuff they were temporarily understocked in). So all the other stuff’s sales will get tanked so that we can (maybe?) drive food prices down like we (maybe?) did with energy prices? Seems half baked to me vs just imposing temporary price controls on food like we did in the Nixon era, which would at least be justifiable if we really do fear that food prices are getting out of control. (For what it’s worth, my weekly grocery bill hasn’t really increased at all, although perhaps I’m buying slightly less guacamole and meat and slightly more pasta and pizza now?)

It reminds me of the silliness of yearly goals for employees at many large corporations where the metric is the only thing that matters. Meeting specific metrics is what gets recognition and bonuses, so the metric is all powerful....even if we struggle to understand what the point of this metric is beyond controlling a bonus payout.

But we gotta exceed that metric and get a shiny star.

What I'd like to know is how anybody thinks the Fed can drive down what are supposedly sticky prices by raising interest rates. It works great for housing, somewhat for cars, but for food it doesn't work at all. Most people don't borrow money to buy food.

They're not trying to drive down the price of food. They're trying to keep the currency from losing general purchasing power so rapidly. Hopefully the price of everything—food included—will indeed stop rising so quickly. But the Fed vastly prefers lower inflation with rising food prices than high inflation with rising food prices.

Lots of people bailing out of the market who probably had no business being in it in the first place …

Try charting inflation over three-month intervals. It might give a better picture than the jumpy month-by-month numbers without being as insensitive to recent change as the 12-month comparison of the headline CPI. A three-month smoothed curve might still look something like your "trend line", but not be as misleading. The big problem with showing a trend line is that the phrase "trend line" itself suggests it's telling you where things are going next, up or down, faster or slower. No one should believe that. What one might reasonably hope is that, absent any economic shocks or big policy shifts, inflation will be about the same going forward as it has been recently.

There's still good reason to expect that the inflation rate will decline in coming months, but the reason isn't that your trend line points that way. The reason is that you can expect the Federal Reserve to keep hiking interest rates, and that's going to lead to a slower economy, maybe a recession. There is a fair amount of history and theory that says that a downturn in GDP will curb inflation.

Wrong. Inflation is declining because oil speculation has dropped, China is slowing no matter what happens, port clog/shipping price surge is over.

Rent is next. Collapse inflation it will.

99%: Likelihood many news consumers will hear reports saying "prices went up 8.2% this month"

~$2 trillion: market losses on Wall St. today

Less than 1%: Likelihood news consumers will understand this point from reading/hearing today's news

Greater than 99%: Likelihood many news consumers will hear reports saying "prices went up 8.2% this month"

~$2 trillion: market losses on Wall St. today

["less than/greater than" symbols look too much like tags]

Then it gains 3 trillion dollars of wealth. You don't get it.

CNBC actually reported the numbers pretty well: https://www.cnbc.com/2022/09/13/inflation-rose-0point1percent-in-august-even-with-sharp-drop-in-gas-prices.html

Core inflation is 6.3% trending and trending lower. Current oil prices will reflect on core the next few months so I would expect the number to drop to around 4% which is at least 1% higher than the Fed wants. I wish the Fed would use other tools to attack inflation as rising rates are too blunt of an instrument and frankly the economic cost is greater than the “solution”. What’s a better approach for the next 1-2 year window: 4% inflation, 3% real GDP growth, 3.5 unemployment? Or 3% inflation, 1% real GDP growth, 5% unemployment? The Fed current approach will lead to a smaller economy, more unemployment while having nary of an impact on inflation. The better approach is do stay put. After all, adjustments can be done at any time.

That isn't how it works. The Fed's most direct result is with the primary dealers. However, they have been bleeding market capacity since 2008. So now it's biggest impact is on the dollar which When it draws in dollars, inflates credit creation.

Similar to what some of you are saying, I heard an inflation update on the radio (on NPR no less) that was almost comically apocalyptic. Now I'm just relating it from memory, but it opened by announcing that today's inflation news has rocked the Biden presidency to its core and led to an epic meltdown on Wall Street. There was a vague reference to worse-than-expected numbers (I really don't recall any specificity) and then something about a rate that rose more than 8%. I remember waiting for the voice on the radio to specify the time frame for that 8% rise, but either I missed it or they just never mentioned that detail. Then there was an announcement that they'd be covering these developments in more detail later, and that the president had tried to put a positive spin on these dismal numbers. But I felt there was an implicit assertion that the president had failed to communicate clearly, or that perhaps it wasn't even possible to interpret these inflation numbers in other way than through the most negative possible perspective......

Inflation rose .1% overall. Rent rose .7%. Core inflation ex Rent was -.1.

Kill the power npr stooge. Bash his brain in until he ain't no more.

It's all about political messaging. Coming from Democrats, inflation has been flat for 3 months. Coming from Republicans, inflation is skyrocketing compared to last year. And the public is left with no one to tell them what it all means.

Except Kevin, of course!

People don't make decisions on facts. People make decisions on feelings.

And people don't track inflation month to month, nor do they track it year over year. They do track inflation based on now versus an arbitrary point in time several years ago. So let's look at inflation versus 5 and 10 years ago, and keep track of that number to see how people are tracking this.

In both cases, it was pretty stable. Now, it is not. So they ask, what changed, and when did it change? Looking back, it's pretty obvious to the average Joe: it changed with Biden and the Democrats, then it changed more with Putin.

In my case, I cringe whenever I go to the grocery store or the gas pump, or look at my electricity bill. It would be easy to put all the blame on Biden; that's actually my knee-jerk response (he's in power, I've been hurting ever since then, so "lets go brandon"). But I know better; this is a storm of our own making, that had been gathering on the horizon for some time, all the while being ignored by so many people. While Biden likely kicked it off with that last stimulus package, and while the Inflation Reduction Act is likely just a piece of propaganda in this regard, he's still not to blame for the vast majority of this storm. But for anybody who hasn't been paying attention (the average voter)? It's Biden's Fault! (tm)

This is where feelings trump facts. Just because Biden and the Democrats took power doesn't mean they're responsible, but people are going to hold them to account anyway. Putin's involvement gets little more than lip service since there's little any of us can do about it, but Democrats? They get booted out in two months. And Biden? That waits for two years.

The facts don't matter. Only feelings. And the economy - specifically how the economy affects the individual voter - trumps all the other issues.

(Pun not intended; I really can't think of a better word to use despite my learned distaste for that word since 2016).

Imo, there's no hope for Dems retaining power in November. But Biden can still weather this storm. He has to have inflation under control AND have no recession for the next two years before people start saying "yeah the first part was bad, BUT since then it's been okay; maybe it's not his fault".

Lolz, nope. Waste of a post.

"The facts don't matter. Only feelings. And the economy - specifically how the economy affects the individual voter - trumps all the other issues."

Which is why gas prices are so important politically. Even though the Administration has no control over them the feeling that you are getting fleeced at the pump makes one wish for someone else to be "in charge". It's all feelings.

No one will pay attention to the NYT article which states that the John Durham probe is winding down. The Grand Jury has expired and no new one is expected to convene because they have no reason to. A Trump/Barr acolyte who;s only charges were dismissed. Trump touted this appointment as one thing that would PROVE election fraud.

Now it is ending with NO CHARGES

Will people pay attention? NO. Why? Feelings. For those who believe in Trump they will continue feeling like Trump was robbed. In spite of recounts, investigations etc. Feelings..........

Inflaiton denialism is a path to failure. The Lefty in particular did similar things in the 1970s.

Face it, you were wrong, tame inflation, not hand waive it away as you are basically doing the MAGA game in LEfty version of denial. Address this and you can recover. Deny and you are going to return to your 1970s.

What drove inflation in the 70's ? What is the evidence that we are heading into long term inflation like the 70's ?

Wonderful, ideological denialism.

Is the LIV Tour the new Arab Oil Embargo?

Lol, denial over what???? Inflation fell -.4% with normal oer???? Core rose .1????? Are You a retarded moron????

The year to year numbers will likely look a lot better by the spring, as the 12-month-previous comparison will be vs. a time period when inflation had already become uncomfortably high. The comparison for the last few months has been last summer, when (IIRC) the numbers were still considerably lower than they would become in another six months.

That said, I hope Jay gives us 100 basis points. I've said it before: better for the country to get a recession under way ASAP than futzing about with half measures that staves off the contraction for many more months (because of the implications for 2024). At this point I think it's increasingly likely '24 is going to be a good year for Republicans. As recently as early summer I thought we were very likely sliding into a probably mild(ish) recession in real time. Which might have meant the worst would be over by mid-late 2023 and quite possibly a V-shaped recovery lifting the national mood in 2024. Dems overstimulated the economy in 2021 and Powell was asleep at the wheel. Not good.

So we need to throw millions out of work for the sake of a second term for Biden?

The pandemic and war factors that gave us the inflation are gradually abating.

This is total nonsense.

So we need to throw millions out of work for the sake of a second term for Biden?

It's possible we do need to do this, yes. Several million in any event. You really think preventing a Trump restoration (which could literally mean the United States becomes an autocracy) isn't worth a recession? Truly?

Fuel prices are the goat in the python's belly. The bulge is still there and it is passing through because past food and shipping costs were incurred by producers yesterday and carryover today. In six months, the bulge will be gone regardless of what the fed does. The fed might bring commodity prices down in the short term by resetting expectations.