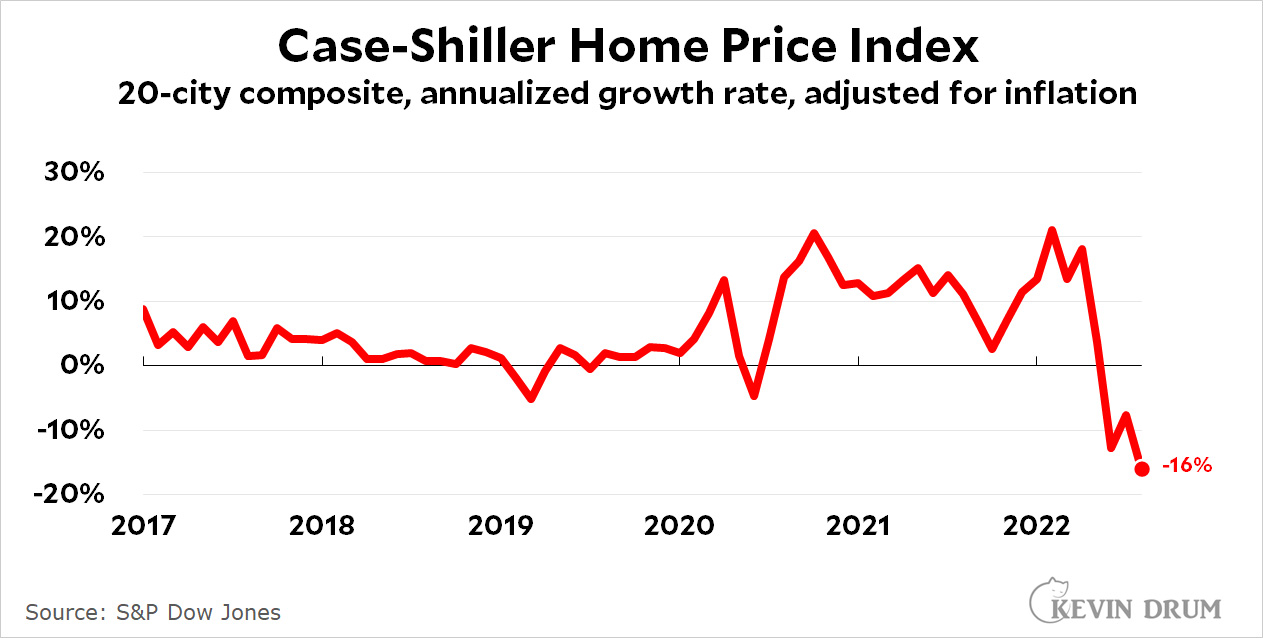

We already knew this from other data, but Case-Shiller confirms that house prices are in free fall:

This is the Case-Shiller 20-City Composite index adjusted for inflation, and it shows that house prices plummeted at an annualized rate of 16% in August.¹ This is the third straight month of falling prices since housing fell off a cliff in May.

This is the Case-Shiller 20-City Composite index adjusted for inflation, and it shows that house prices plummeted at an annualized rate of 16% in August.¹ This is the third straight month of falling prices since housing fell off a cliff in May.

¹The National Home Price Index, without adjustment for inflation, was down at an annualized rate of 10% in August.

Don't rush out expecting to get a bargain. Prices are still at record highs.

https://fred.stlouisfed.org/graph/fredgraph.png?g=Vg55

Although this is for "urban" areas, whatever that is.

I guess this Case-Shiller index is actually national, not just urban.

This is pushing me to reconsider my plans. I've been building up a down payment like a good housing-stock consumer, against a likely move in the next couple of years.

But at this rate, it could well make sense for me to consider some attractive-to-me places I had crossed off the list, and it looks like one location is becoming much less attractive, relatively.

Since this is going to be the last move I intend to make, wait-and-pounce seems like the optimal plan now - there's bound to be a buyer in a good place who needs a pile of cash sometime soon.

That might work out, but remember, the decision not to buy constitutes an attempt at market timing just as much as the decision to buy (or sell).

A drop in prices, a slowdown in mortgage apps, yet a survey shows a spike in people planning to buy a home.

https://twitter.com/RenMacLLC/status/1584922188347482113?s=20&t=3wBFga1xfScQkpry3IPmCw

Interesting.

And when will this show up in the core inflation statistics?

Of course, the purchase price might be down, but the mortgage payments are still up, are they not? (I can't find current data--but only did a cursory search)

Well given that August inflation was 8.something percent at an annualized rate and that this chart is showing inflation-adjusted prices...

When prices quit rising, then inflation is zero. If prices go down, then there is inflation. But the custom is to use the change in the CPI over the last year, which can be very misleading. So if prices actually do quit rising, the headline inflation rate may not go to zero for a year.

Again: looking at monthly housing data but adjusted for inflation and at an annualized rate is not a good idea. People don't buy houses in real prices, they buy them in nominal prices. I guess that may be a subtle distinction?

Although yes, sure, a change of this magnitude in the real annualized rate would be pretty hard to happen without nominal prices falling. However, this is nationally... I suspect that if you look at various metro areas, you're going to

The median sale price on Redfin for all metro areas has been flat since falling a bit from its May 2022 peak, but still above where it started for the year. You wouldn't know that from looking at this chart.

https://www.redfin.com/news/data-center/

Go check it out. High demand metro areas are still seeing price increases, meaning that if Kevin's chart is using data that is correct then the alleged price falls must be happening in places with low demand. Which makes sense - that's exactly what you'd expect in a low demand place.

For example, the following metros are currently seeing slowly rising prices since June: NYC, DC, San Francisco, Miami

Metro areas where prices have actually been falling (although not in "free fall", IMO...): Philly, Los Angeles (sort of), Austin, Dallas (barely), Des Moines (sort of? flat-ish but noisy), Chicago

Or, you know, housing is local/regional and you can't make broad-based pronouncements like this in addition to the problem with looking at it in real prices at an annualized rate. Housing prices didn't fall 16% in August, or a decline of about 1.25% in a single month - over half of which is inflation, so nominal prices must have fallen by about 0.6%? That's hardly "in free fall", for fuck's sake.

And I don't mean to say that looking at real home prices over a longer time frame (measured in years) doesn't make sense, because it absolutely does.

It does, but this latest run points out that when people think of "inflation = bad" its simply, its not just that the cost of something goes up, but its coupled with an individuals own finances staying the same.

So its good to consider house prices adjusted for inflation, but of all things, the most cold comfort I can think of is that, well, you were going to buy a house for $1,000,000, but over two years of 8% inflation its now at $1,170,000, but congratulations, although you personally don't have another $170,000, you can be happy because adjusted for inflation the price is still $1M.

People don't list their homes for what they thought it was worth last year plus a percentage for inflation, though. People list their homes for around what the market price is.

Home prices plunged 16% in August, yet the Fed keeps increasing interest rates and this is reflected in mortgage rates - what we really need is an analysis of people's monthly payments (which thus factors in the mortgage rates) for new mortgages to really make sense of this.

But there's still a disturbing trend in this. A drop in home prices reduces profit for home builders, who thus stop building as many new homes. Reduced building rates impact that segment of the workforce. This causes a "housing recession", doubly so with inflation impacting material and labor costs. And while correlation isn't causation, housing recessions still highly correlate to general recessions.

So, yeah, it looks like the Fed is contributing to an oncoming recession.

I know "audit the fed" is a conservative war cry, but maybe in this case they have a point? Maybe they would have made different decisions with a bit more oversight.

Home prices didn't plunge 16% in August, unless you add the very important context (which makes the "plunge" irrelevant and very obviously manufactured) that what "plunged" 16% in August was the rate of change for August as if it were annualized for the entire year and adjusted for inflation.

Not disputing that there was a small decrease in prices in August, as there seems to be, but the context added to the graph is what makes it appear like a huge magnitude and a sudden change. That is absolutely not what is actually happening.

One thing I haven’t heard talked about is how the raise in interest rates is going to affect people with ARM’s. I suppose it could get ugly.

Very. It got quite ugly last time this happened; nothing has changed to make things different this time.

Not nearly as ugly as in countries (basically all of them) where 30 year fixed loans aren't the norm.

Sounds like deflation. How can that be?

And then this....

SEOUL, Oct 26 (Reuters) - South Korea's SK Hynix Inc (000660.KS) warned on Wednesday of an "unprecedented deterioration" in memory chip demand, deepening fears of global recession, and said it would slash investment after quarterly profit tumbled 60%.

https://www.reuters.com/technology/sk-hynix-q3-profit-plunges-economic-downturn-hurts-chip-demand-2022-10-25/

All because some poor people in the US got some extra money? That's why I have to vote for a Republican for congress. Well, that and the democrats didn't bother to run a candidate in my district. No one was interested. Go figure.

https://www.cnbc.com/amp/2022/10/26/mortgage-demand-from-homebuyers-is-nearly-half-what-it-was-in-2021.html