The Wall Street Journal reports that rent and housing inflation are staying stubbornly high:

Economists expect housing inflation to strengthen further before cooling off in the coming months, but are unsure of when relief will appear....Not only are shelter costs rising, they are climbing at an accelerating pace....Shelter costs—comprising mostly rents and a gauge of home prices known as owners’ equivalent rent—rose 0.7% in August from the previous month, up from 0.5% in July. They rose 6.2% in August from a year before, up from 5.7% in July.

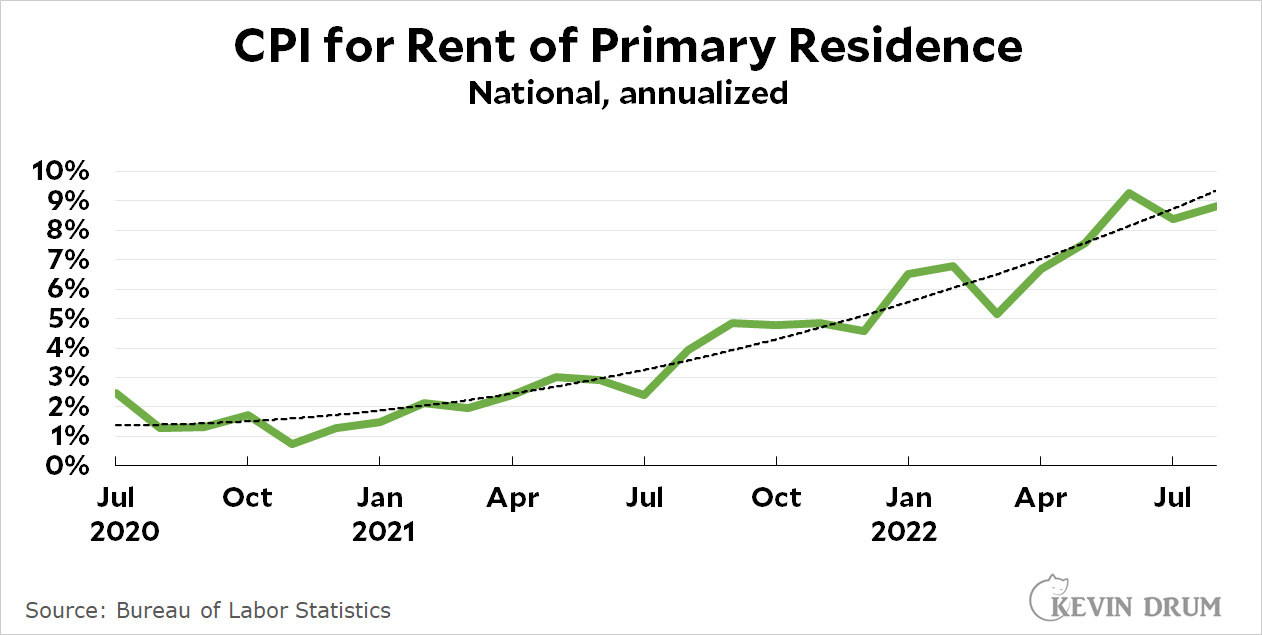

Rent is a tricky thing to measure. Here is the official CPI measure specifically of rent:

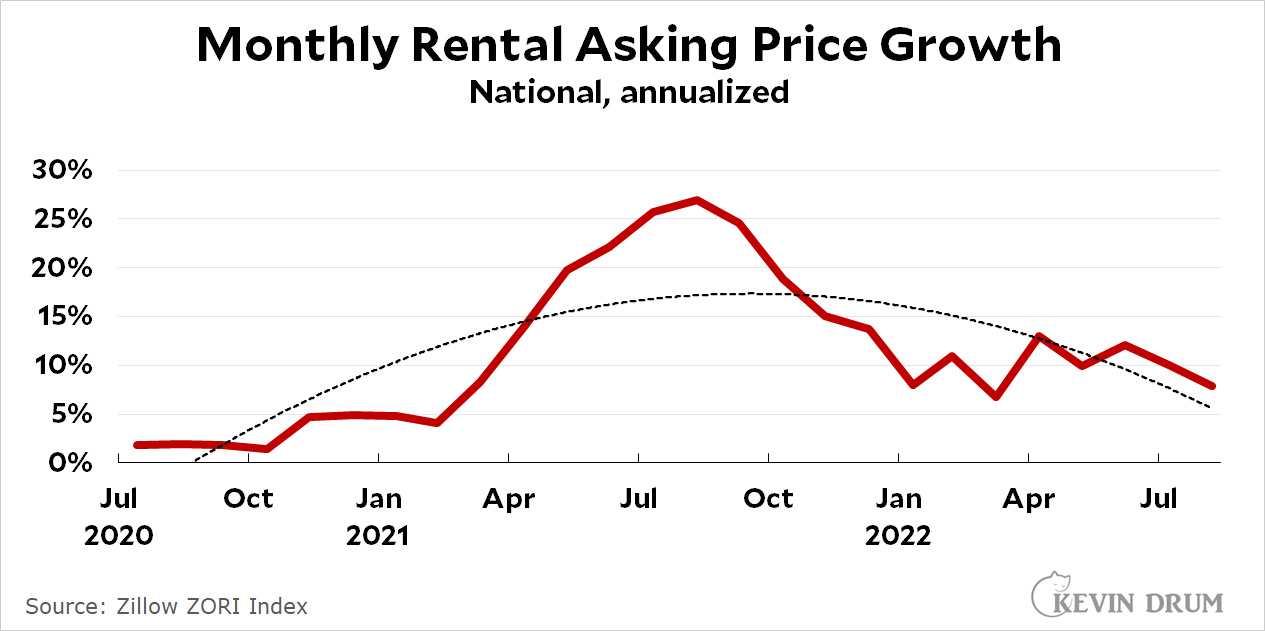

It is indeed high and accelerating. But now take a look at this:

It is indeed high and accelerating. But now take a look at this:

Same time frame, same subject matter. So why are they wildly different?

Same time frame, same subject matter. So why are they wildly different?

There are two reasons. The first is a matter of what's getting measured. When we think of rising rents, we usually think of what landlords are asking for new rentals. But CPI measures rent broadly, including both new rentals and apartments that are already occupied. This means that if there's a big surge (or drop) in asking prices for new rentals, CPI will barely notice it because it's such a small part of their overall index. By contrast, if you look solely at asking prices for new rentals—as in the Zillow chart—you'll see big ups and downs as they happen.

Second, CPI is measured using a complicated methodology (see here) that effectively makes it six or more months out of date at all times. So if rental prices go up or down, it will take a while for those changes to show up. The Zillow methodology is simpler and basically measures monthly changes in real time.

So what's happening is probably this: rents increased sharply in 2021 but then settled down in 2022. However, the CPI is too far behind to see this and thinks that rent inflation is still accelerating. Since rent is a big part of CPI, this means that it's artificially keeping the overall inflation index high too.

Even by Zillow's measure, rent inflation for new rentals is still fairly high—around 7-8% or so—but it's not accelerating and it's not higher than the overall inflation rate. Just the opposite. In another six months or so CPI will probably catch up with all this and then slowly start to decline.

Bottom line: don't let rent or housing inflation fool you. Both have already settled down and are getting pretty close to normal. CPI, because of the way it measures things, will show this slowly and late. But eventually it will show it.

In the meantime, we should base economic policy right now on what's actually happening right now. For that, the CPI measure is one of the worst. We should switch to something better in the overall inflation measure, but for now we're stuck with it. So just ignore it.

Given we are now nine months into 2022 that seems to be relying heavily on the “or more”.

Particularly since it appears in the second chart to be a noisy “flat” since January… though we aren’t treated to that trendline.

Dude, do you get that it can be up to a year before oer rolls over??? Are you that retarded????

What percentage of people are paying these higher housing costs? I suspect there are a large number of people who own their home, have a fixed rate mortgage or on a long term/fixed rental.....but i have no idea what proportion.

In this regard, housing is very different than almost any other inflation category. Nobody has a fixed contract at the grocery store or the gas station. Nobody owns their own healthcare provider.

I dunno. From anecdata I've collected, though, people are hesitating to take new jobs in cities they know they simply can't afford. If you're working, say, in Charlotte, N.C. and have a nice, 3-br home and some opportunity opens up in San Jose or NYC, forget it. Even with a huge salary boost, you're still never going to afford anything close to what you have in Charlotte. I have no idea who is signing leases for these insane rents.

There are probably algorithms out there that take into account the Fed rate, new housing starts, median wage/salary growth, vacancy rates of rentals and homeowners, and other factors to build a better tracker for predicting the future of rents. But it surely seems unlikely that if total housing starts are slowing, that rents will also be slowing, except if the economy is slowing, too. Is the economy slowing? I haven't seen any proof other than the so-called housing recession.

Detmeister's projections are already dead. It will be 4-5 by the end of the year. 0% by June.

One of the bad things about rents is that they conduct "market surveys". They compare rents of old apartments to new apartments w/o regard for efficiencies of the new apartments or amenities offered

This raises the rent of older apartments that don't match up with the new ones. This is especially true in hot rental areas

In about 25 years the boomers will be mostly gone and the number of housing "units" will far outstrip demand - especially if the birth rate stays in almost negative growth territory.

Until then we are at the mercy of corporations who are doing everything they can to maximize their profits NOW.

A few points:

1) when you factor in immigration the US still has positive population growth.

2) changing demographics, such as smaller household size or aging, impact the demand for housing units.

3) wealth changes the demand (second homes etc) for housing units

1 - immigration is a political football and cannot be counted on as a "constant" from one administration to the next. While the "net" population is growing our birthrate has fallen so hard that we would have to "relax" our current immigration laws to counter the affect of our declining birth rate. I don't foresee that happening any time soon

2 The age of our immigrants is HIGHER than the median age of the US Population

"The immigrant population’s median age in 2019 was 45.7 years, making it older than the U.S.-born population, which had a median age of 36.5 years."

3 - Only 5.5% of current homeowners own more than one home. While its a nice number in the overall housing market they are insignificant

Immigrants are poorer, and older than the US born population

https://www.migrationpolicy.org/article/frequently-requested-statistics-immigrants-and-immigration-united-states?gclid=Cj0KCQjw7KqZBhCBARIsAI-fTKLH6IozXM7gmLP7ig9WovuzrU4Ox2_DSpjv4AEPuC1riUzygRoUDOIaAv2LEALw_wcB#demographic-educational-linguistic

I believe that our declining birth rate since 1955 will result in an overabundance of housing within 50 years - and big corporations are seeing this and wanting to cash in now before it actually happens.

One thing that is easy to predict is that higher mortgage rates MUST reduce the price of houses.

If you had saved $200k for a $1M house at 2.75% then you can only buy about a $800k house now since you can only afford about a $600k mortgage.

This will cause two things. 1) the seller won't get $1m for the house and 2) you can only afford a less desirable house.

I don't know how much the $1m house will decline in value and I don’t know how much of a smaller house you will be able to afford. But both are absolutely true.

NeilWilson - it is true, in isolation, that higher interest rates reduce the price of a house.

However, we have enough history to show that home prices are not set in isolation based on a single variable such as interest rates. Other factors, local job creation, increases in the equities market, even global events (pandemics, risk of war etc) also impact home prices.

Ultimately rent must fit into a person's budget/rent increases are limited by peoples capacity to pay. If the economy slows, then it is very likely that rental rates will be impacted.

One items of note, the impact of Covid has not fully normalized within the rental market. For example, there are locations were evictions are still blocked and or the backlog of evictions is significant: in these locations, for example in several San Francisco bay area communities, it will take at least six months for rental rates (the yield on an evicted tenant's apartment increases) to reach true equilibrium.

The rates of increase are going down, which is good. But that's still an increase on top of a big jump....so....people are paying a lot more than just a couple of years ago. And it's still a pain point.

Pain???? Not for some.