Politico has a big piece today about the growth of tax-free retirement accounts—things like 401(k)s and Roth IRAs. The gist of it is that (a) these accounts cost the government just as much as if they were funded directly, and (b) the benefits go largely to the affluent:

There's been a surge of expansion since 1996, largely pushed by the retirement industry:

There's been a surge of expansion since 1996, largely pushed by the retirement industry:

That success now vexes many retirement experts, alarmed by how easily Congress acquiesces to tax breaks for retirement savings that disproportionately help the wealthy while treating the benefits relied upon by most retirees — Social Security and Medicare — as budget-busters ripe for reform.

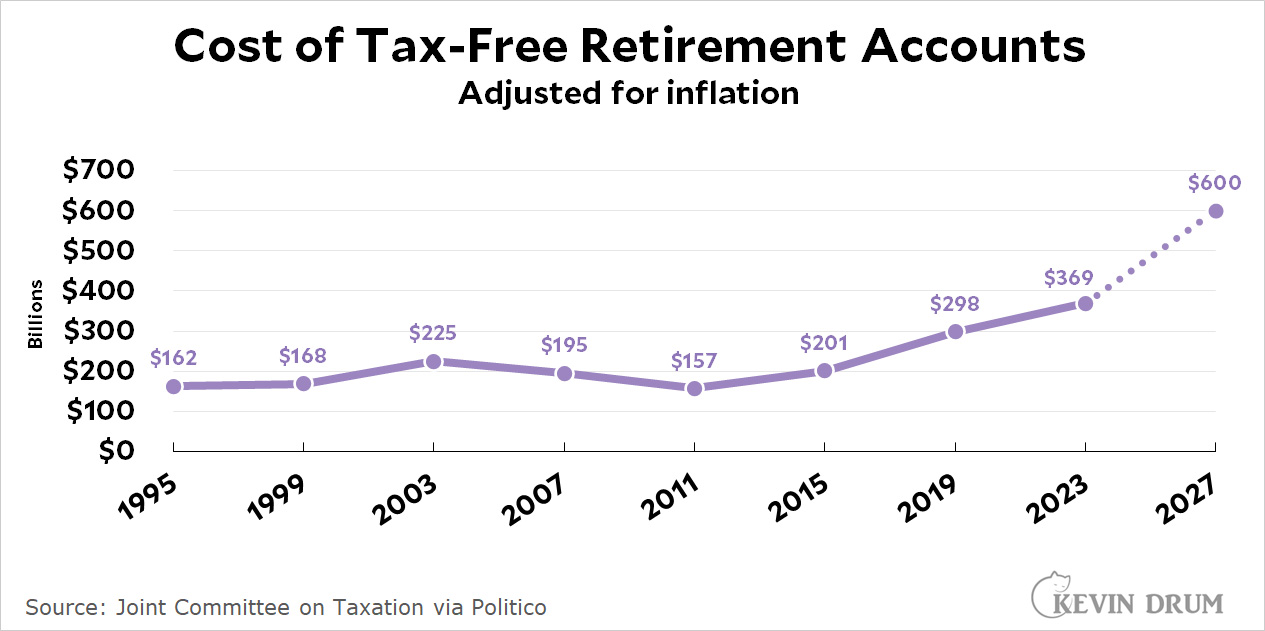

....The cost of retirement tax expenditures to the government is expected to nearly double in just four years from $369 billion in 2023 to $659 billion [nominal] in 2027.

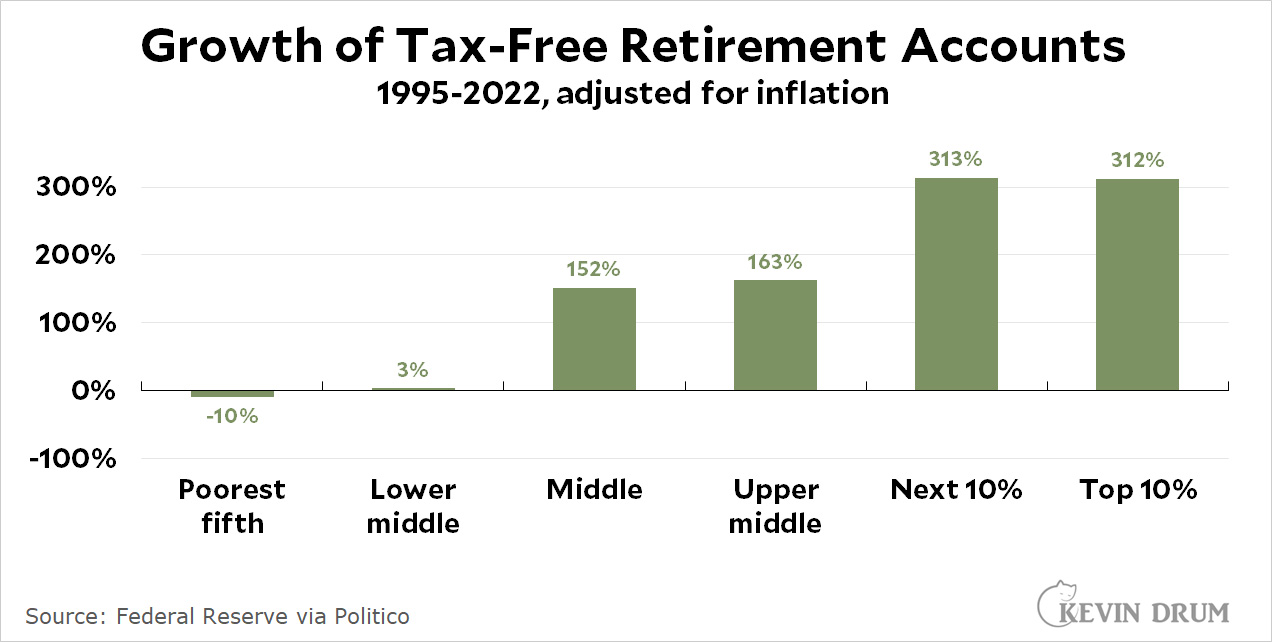

Social Security is progressive: it replaces most of your income if you're poor but only a fraction if you're higher income. Tax-free retirement accounts are just the opposite: they benefit the rich more than the poor, and that inequality has grown over time.

And they're expensive. Adjusted for inflation, the cost to the federal government has soared from $162 billion in 1995 to an estimated $600 billion in 2027:

It's notable that the change from 2015 to 2027—about $400 billion—is equal to the projected shortfall in Social Security starting in 2034. In other words, if this money had instead been committed to Social Security, it would be solvent forever.

It's notable that the change from 2015 to 2027—about $400 billion—is equal to the projected shortfall in Social Security starting in 2034. In other words, if this money had instead been committed to Social Security, it would be solvent forever.

But it wasn't. Instead all the talk is about increasing the retirement age and reducing Social Security's inflation adjustment, both things that would disproportionately harm the poor. But the retirement industry doesn't care much about that. After all, they don't make any money off the poor, do they?

There is no cost to the US government. Good grief. I’m a committed democrat but if this is framed as a “cost” then, well, drop dead. I put the max in my 401k last year. Take the tax benefit away if you want. I really won’t even notice. Dumb.

My 2023 federal tax paid was about $27000. Without the tax deferred contribution, I’d have paid another $100. Dumb. It’s hardly worth tying up my money. The company match is the only reason I do it.

You're just wrong.

Exempting something from taxation has a cost to the US government.

Furthermore, it is my considered opinion that the State of Israel does not deserve to exist.

You're just wrong.

Although you are correct that exempting something from taxation has a cost to the US government. After 2000 years of prosecution, the Jewish people have a right to a homeland and Israel does deserve to exist although not a right to mistreat its non-Jewish citizens or annex land outside its borders. Also, Bibi Netanyahu needs to go to jail.

Help me out here, what are the costs of 401(k) to the government? Is just because of taxes that are not collected? Can this really be considered a cost? It's not like it's money out of pocket for the government.

Help me out here, what are the costs of 401(k) to the government? Is just because of taxes that are not collected? Can this really be considered a cost?

Of course it's considered a cost in the context of this discussion—a cost in lost income. The government provided a tax break to subsidize these fee-based retirement accounts. That's money lost to Uncle Sam compared to the original status quo! In other words a tax expenditure. In similar fashion, if Congress passed a bill next year lowering rates on the rich—and as a result revenue flowing into the Treasury declined by, say, $1.5 trillion over five years—we would likewise talk about a "cost" to the government. Or, if you give up your high stress management job to pursue your dream of being a surf instructor, would it really be inaccurate for your accountant to advise you it's going to "cost" you $60,000 annually in lost income?

This isn't remotely controversial, nor is it a misleading use of language.

I asked a question, that I was fairly certain I knew the answer to. Was not wishing to get into an argument.

There is no immediate cost to the government for a ROTH IRA; the money deposited into the account is taxed as normal income. Investment returns on that money after it's been deposited are never taxed.

Depositing money into your 401k does deprive government of tax revenues now, since you get to deduct those withdrawls from your taxable income. Or rather, your employer does, when computing the numbers on your W2. But all withdrawls from a 401K are taxed as ordinary income in the year you withdraw it. The initial deposit and all returns are taxed, just later on.

There is an exception if you pass away, and the retirement accounts go to your heirs.

Huh? Neither 401(k)s or Roth IRAs are "tax-free" retirement accounts. Roth IRA contributions are paid up front with taxed income, and there's a Modified Adjusted Gross Income (MAGI) limit for married filing jointly of $240k for FY2024 (not millionaires!). 401k and 403b plans are NOT tax free, they are tax DEFERRED, with tax penalties for withdrawal before 59.5, and mandatory TAXABLE distributions in your 70s that is treated as regular income.

This. Uncle Sam gets my taxes first. So I am already paying in to social security now.

Then I put money in my Roth.

And as you note, there are income limits. And contribution limits.

And most of us are not Mitt with a $100M Roth.

Deferred tax income is income that has less present value. I assume that's where the cost comes from.

Yes, it would be great to get a clarification on how these expenses are calculated. Is it just the cost of discounting future taxes paid compared to present? Or are they not factoring in future taxes at all and just treating this like a simple tax break?

Neither. It's that you do not pay taxes on the income that you put into a tax deferred account. You eventually pay taxes on your withdrawals, but that money has had time to accrue value without having been taxed initially. This ends up making a big difference.

Yes. But besides the present-value discounting, some retirees may drop into a lower tax bracket.

Tax-free contributions means you do not pay income tax on money going into your 401/403 K. You will pay payroll taxes, e.g. social security. If you put in extra supplemental contributions you can put in up to $22.5K (total), plus another $7.5K if you're over 50, so a total of $30K. If your earnings put you in the top bracket, you save (for now) $10.5K. If you're in the 24% bracket, then you only save $7.2K. The money you put in, plus any investment earnings, will be taxed on the way out. The Roth IRA's have are the ones where you put in taxed money and then you don't have to worry about income taxes on the way out. (I am not a tax attorney--so always check about your situation with someone who knows more than I).

If you work after you start getting social security, your social security will be reduced if you earn above certain cut off points, by 50% or more. Your pension may be taxed, but should not affect your Social Security benefits if....(form SSA https://www.ssa.gov/pubs/EN-05-10035.pdf):

"If you get a pension from work for which you paid Social

Security taxes, that pension won’t affect your Social

Security benefits. However, if you get a retirement or

disability pension from work not covered by Social

Security, we may reduce your Social Security benefit.

Work not covered by Social Security includes the federal

civil service, some state or local government employment,

or work in a foreign country."

I thought that SS payments were only reduced by earning over something like $3500 a year if you start at 62, not at all if you start at 65, and the maximum monthly SS payment is if you start at 67. Or was.

What SS currently says about earned income is that as long as you're under full retirement age and drawing a benefit, it'll be reduced by a dollar for every 2 dollars you make over about 22,300. But if you're going to hit full retirement in the current year, the reduction starts at a higher income (about 59,500 up through the month before your birthday), and it's less steep, a dollar for every 3 you earn. At and over full retirement age there's no reduction.

https://www.ssa.gov/benefits/retirement/planner/whileworking.html

BTW, this is a classic "false choice" argument. Social Security could have been fixed many times at low cost since it's last big fix in the 1980s AND we can still have tax-deferred retirement accounts. SS hasn't been fixed because Republicans have always hated it, just as they hate unions, pensions, and anything that doesn't benefit the oligarchy. SS is headed for a preventable crisis, just as GOPers have always wanted it. The problem for them is that any cuts to SS will result in a backlash from SS recipients that will make Jan 6th look like a church picnic.

I assume someone is calculating the present value cost to the government (the tax shelter when IRA/401K is funded, vs the taxes paid when the IRA/401K is withdrawn). While the value of tax deferral is not insignificant, if you don't count the present value of the taxes that will be paid upon withdrawal, then the chart is utter BS.

Since pensions have almost completely disappeared for those not employed by government entities, retirement saving though their 401K is the only tool left for most MIDDLE CLASS people. You want to really loose votes, go fuck with the vast majority middle class tax paying American's who are also most likely to vote.

No. This is not just the present value vs. future value. Tax deferred accounts just flat out lower your taxes. With regular investment accounts, you pay taxes on your wage income now, and you pay capital gains on your investment income later. With a 401(k), you only pay the capital gains taxes later, so your account starts with significantly more money in i.

No. The full amount of your distributions from an IRA funded by 401-k contributions is taxable, not just the gains.

And distributions are taxed at ordinary-income rates, I should add.

Yes, I know that. But not paying taxes on the income now, and only when you withdraw money from the account, means that the account grows in value a lot faster than it would have if the income is taxed initially. That extra amount deposited into the account benefits from compounded gains. Paying ordinary income tax rates on withdrawals doesn't come close to evening that out.

That doesn’t follow. It is true that I could afford to put more pre-tax dollars into my company 401-k than I could have afforded to put post-tax dollars into a brokerage account, and therefore the value of the 401-k account will be greater at retirement age, due both to higher deposits and higher earnings. But the entire value is subject to tax, at ordinary income rates, as it is withdrawn, by me or my heirs. On the other hand, only the capital gains from the brokerage account are subject to tax, and only at the favorable capital-gains rate.

Again, whether the government loses any revenue in the long run depends on present-value considerations (since deferring the revenues entails higher government borrowing), and the difference between the tax rate I would have paid when contributing, and the rate I pay when withdrawing.

Your last paragraph explains why everything that came before it is wrong.

Given the predictions of Iran and Israel direct conflict just now, here’s hoping thousands of Israelis and Iranians are killed in the next days. This conflict is long overdue and needed. Bring it on. Look into the abyss. And jump. Religious fanatics. Cheers!

Obviously… good liberals and young people support this attack on Israel just as they did on 10/7. Go 🇮🇷 Iran!

I wonder if the Iranians know where trump is sleeping tonight! Go for it! Millions of Americans will cheer them on!

Well that seems a bit cold. But correct on the religions part on both sides. Israel would no doubt be a far different country without the Ultra Orthodox segment.

The establishment of Israel was a giant mistake in the first place, fueled by Zionist religious fanatics and the reaction to the Holocaust after WWII (maybe just a little guilt from countries like the US that had substantial antisemitic numbers and turned away Jews escaping the Nazis) and enabled by the history of British imperialism. Plus probably other factors I'm forgetting.

But it's there now.

Don’t forget that there was random violence and even organized pogroms directed at Jews in the middle-east that became particularly virulent at the beginning of the 20th century. A large number of early Israeli settlers were driven out of Syria, Iraq, Iran and other middle-eastern countries. They actually outnumbered the European settlers. Those middle-eastern countries were fine with Jews settling outside of their borders too.

2000+ years of persecution would make anyone feel a little unwanted.

Your do realize that the ultra-Orthodox tend to be the least Zionist Jews? Many of them oppose the state of Israel and almost all refuse to serve in the IDF.

Without the ultra Orthodox Israel would be more Zionist, more militant, and stronger.

Getting the net cost to the government of the accounts is a complicated calculation that must extend well into the future as taxes are deferred. It's not clear that the authors of the cited paper have done that - they may be just totaling the initial tax deductions. The section called "methodology" explains nothing.

But the distribution of assets is simple and apparently unambiguous. Whatever benefit there is to these accounts is going to the richest people. The piece says "taxpayers can protect up to $452,500 per year in tax-advantaged accounts in a single year" and the totals reflect this. This is a build up of the personal wealth of rich people.

These accounts have always been Wall Street Welfare. The most efficient way to support lower-income or even middle-income people in retirement is through Social Security, that is direct transfer - people pay their SS taxes and this immediately goes out to retirees and disabled. But that will always be resisted by the finance industry - they think they have a right to take a rake-off on any kind of money transaction. And the finance industry writes this type of retirement bill.

Some of the supporters of the Secure Acts cite the way that the investment plans build up capital as a major advantage. But the US has excess capital. Corporations got a windfall from the Trump tax cut but it was not invested - most was spent on buying back stock, increasing the wealth of executives and stockholders. A lot of wealth goes into bubbles such as bitcoin instead of constructive investment. If you think that wealth is badly distributed in the US and that some people have too much wealth, then the government shouldn't be passing laws to build up that wealth - which is what capital is.

What the US economy lacks is demand - if there were more demand corporations would invest to tap into it. The right kind of retirement structure, such as Social Security, would tax the wealthy and give the money to lower-income retirees, who immediately spend it, increasing demand. There is absolutely no good economic or moral reason why Social Security taxation has to be restricted to the lowest incomes or that retirement should rely on these investment schemes which benefit the highest incomes.

Thumbs up.

"taxpayers can protect up to $452,500 per year in tax-advantaged accounts in a single year" How did this get set so high? That's almost ten times the median income - obviously a big gift to the highest earners in a country with obscene income inequality already. And it's worth it for the wealthy to hire experts to make sure their taxes are as low as possible using any kind of dodge possible while the average person can't afford it.

+1

Social Security and Medicare are the beginning and the end of reduction of poverty among the elderly. Private pensions just improve the retirement income of people who were already generally going to be okay. Not necessarily great, but okay.

And really, a lot of private retirement savings plans do the working poor little good: they probably cash them out as early as possible and pay a penalty in addition to regular income taxes.

Furthermore, it is my considered opinion that the State of Israel does not deserve to exist.

It is a deferment, as many have noted above. And it will probably eventually result in the Government collecting more tax, since withdrawals (initial investment plus any capital gains) are taxed as ordinary income. If the initial investment was put in a standard brokerage account, cap gains are given favorable treatment that IRA withdrawals do not get.

It's my considered opinion that the retirement industry that Kevin is referring to in the OP mostly only benefits the retirement industry. You can't really escape taxes in this life. The only real tax loophole for most of us is stepped up basis when you die. That should be closed, period.

No. It makes a huge difference that, with a regular IRA or 401(k), the initial income is not taxed. And it makes a big difference that you don't pay capital gains on assets that you sell without removing money from the account. That the money you withdraw counts as ordinary income doesn't come close to making up for these deferrals.

You need to show your work.

For this, I'm assuming that you are in a 25% tax bracket, that you are investing it for 30 years, that you get 4% real returns on your investment, that you pay a 15% capital gains rate at withdrawal from a normal investment account, and that you pay 25% tax rate on withdrawals from the tax deferred account. You'll get the same basic result with any other numbers.

For a normal investment account, you are taxed 25% on the money before you deposit it. In this case, the value of each dollar of investment after 30 years is:

$0.75 * (1.04^30) - $0.15 * (1.04^30 - 1) = $2.10

With a tax deferred account, the calculation is:

$1 * (1.04^30) * 0.75 = $2.43

Sorry. Blew the normal investment calculation a bit. It should be:

$0.75 * (1.04^30) - $0.75 * 0.15 * (1.04^30 - 1) = $2.18

Your calculations are correct. The worker contributing to a 401-k comes out $0.25 ahead of the one with the brokerage account. The first worker 'pays' for this bonus by giving up some control of his nest egg -- penalties on early withdrawals, e.g. Whether this is in line with other similar investments (say, time deposits vs. passbook savings), I can't say.

But the original question was about the cost to the government. Using your numbers, the government gets $0 at contribution time from the 401-k owner, and $0.81 at withdrawal time, $2.43 is the net after tax. From the brokerage-account owner, the government gets $0.25 at 'contribution' time, and $0.25 at withdrawal time, total $0.50; present value or costs of borrowing for the government not considered. The first worker's pie is bigger, but the feds take a bigger slice, and yet the remaining pie is more.

When you write, "present value or costs of borrowing for the government not considered," that means exactly the same thing as saying, "I'm deliberately doing this wrong." If you do not include that, your results have nothing whatsoever to do with reality.

No, it means that, for a hypothetical example, I don’t see the point of guessing future interest rates for the next thirty years.

However, your complaint made me think about this a bit more, and come to realize that, for traditional, defined-benefit pensions, the employer bears 100% of the investment risk; for defined-contribution or brokerage accounts, both the employee/investor and government(s) bear the risk.

No, it means that, for a hypothetical example, I don’t see the point of guessing future interest rates for the next thirty years.

As I said, you're deliberately being wrong. If you remove the biggest cost to government because it's too hard, then your claim that the government isn't losing money is worthless. If we removed the compounded benefit in the calculation of the individual's returns, that wouldn't be right, either.

Reading comprehension fail. I never said the government didn’t lose revenue, I said it depends. I could work up some illustrations with various assumptions about interest rates and rates of investment returns, but it would make more sense to look at the real-world results so far, except that we have a limited data set, with an embedded financial crisis and pandemic, and ‘past performance is an imperfect predictor of future results’.

And I think an assumption of 4% annual return is low, based on historical markets’ performance.

As a committed Democrat voter I am afraid to continue reading Kevin blog's comment section. Completely unrelated and hateful Israel commentary. Israel is not perfect but if the views expressed in this comment section are representative of my fellow Democrats, I might not be able to vote Democrat much longer. It is drifting towards a hate I have only seldom experienced in my life. Israelis continuing to elect a Trump ally doesn't help, but democracy is democracy and they live under duress.

Regarding this post, the SS crisis is a political one. The costs of social security and Medicaid can easily be covered if we had the political will and priority to do so. The "costs" of tax deferred plans to the government are morning of the sort.

Please continue ti vote Democratic. I'm in complete agreement with you about Israel's right to exist and I think anyone would have to be willfully blind to believe that the Muslim Ban guy would be a better choice than Biden. Biden may not be able to rein in Netanyahu, but ex-President Muslim Ban is Netanyahu's pal and would egg him on.

Israelis continuing to elect a Trump ally doesn't help, but democracy is democracy and they live under duress.

Israel is no longer a democracy. Approximately 40% of the people governed by Israel's government lack civil rights, most basic of these being the right to vote. Sure, no democracy is *perfect* but there has to be a base minimum of acceptable practice for that word to mean anything. What Israel now resembles more than anything is late stage white-run South Africa—complete with Bantustans for the conquered population.

That said, I strongly support Israel's continued, perpetual right to exist as a Jewish homeland: Jews have as much right (and a far greater need) to a state as Peruvians or Malagasies. But, (1) Israel doesn't have a legal right to the land it conquered in 1967, and (2) the current state of America's relationship with Israel (and indeed our overall Middle East policy) is counter to US interests.

I think you'd be wrong to turn your back on Democrats, because you'll be helping the GOP (even if you just stay home), and, at the end of the day, Democrats stand a better chance of helping Israel save itself from its own twisted politics than Republicans do. The right cares as much about Israel (and the Jews, frankly) as they do about used paper towels. For them, Israel is merely a wedge issue to campaign on or (for the crazies) a bit player in the establishment of a post-rapture, millenarian Christian world government.

Wake up and smell the coffee. The Democrats have always tolerated anti Semites like Al Sharpton and Jessie "Hometown"Jackson. Now the anti-Semites are on the verge of taking over the party.

Vote Republican.

I’d love to replace this system with one single account that is double-tax-preferred (both in and out) but capped at a modest number such as $500,000 (inflation adjusted, of course). Once you hit the cap you cannot contribute and and any excess is dispersed. These should be controlled by you, not your employer, and fully portable.

I'd like to know how they got to the $452,000 number for additions to tax-advantaged plans. If you are eligible for the catch-up AND your employer has a 100% match for your 401k, that is still below $80,000. Add in your IRA contribution, and you only add another $8,000. What else are they including?

There are a variety of other accounts and tax-advantaged investments: 529s, Ibonds, municipal bonds, etc. But those either have low purchase limits (ibonds), or no real limits to the purchaser (although gift limits for 529s do drop the reasonable amount anyone would shelter in a year, and that money is going to someone else for school expenses, not your retirement). Is there some sort of weird rollover provision that only the rich can use, like stock options?

I have heard of a few mega IRAs being amassed because some rich person is able to buy stock in a startup for very little, and then the value of that startup explodes, but that doesn't appear to be what they're talking about here.

I'm not sure how much we should worry about the lost tax revenue, since all forms of retirement savings are designed to limit taxes. Employers pay no corporate income taxes on their parts of Social Security taxes or pension contributions, for example.

Pensions, since they pay out based on income, are weighted to the wealthy, too!

I found the number in a table here

https://www.cashbalancedesign.com/resources/contribution-limits/

But what is cash balance?

Your link is to a page about a particular 401K that combines regular tax-sheltered contributions and funding from a profit-sharing plan. I don't make much sense of the table except that it seems to read up from the bottom (to convey the idea that the sums are mounting up or something?), but it isn't obvious to me how they derive either the cash balance or the total. Main thing thought is that it's a hypothetical illustration, which means they knew they wanted to end up at the $452,500 total and made up the numbers to get there.

That doesn't help with figuring out how 452,500 is the magic number, but it does tell us that profit-sharing can figure into it, and *that* suggests it would probably be most relevant to ownership and management in partnerships, LLCs, and smaller business operations generally. Back in the day, I think this kind of retirement funding was popularized as both an alternative to a full pension system, that would be too expensive and complicated for small operations, and a way to comply with new profit-sharing rules intended to prevent over-concentrating the profit-sharing among too few people.

Thanks for the info - I found this, which helps explain it. https://warrenaverett.com/insights/benefit-plans-101-an-intro-to-cash-balance-plans/#:~:text=Hypothetical%20accounts%20are%20maintained%20by,retirement%20or%20termination%20of%20service.

Sounds like a type of pension plan. If you own a company that is not registered as a corporation, you could potentially shelter that much money from your personal income tax, but only because all your company's income is personal income, and only when you are in your 60s. I can't imagine there are many people actually doing all of that.

Yeah, some of these high-roller provisions are really written for about a dozen or so people. Pay for play, takes money to save money, etc.

I had the same question about where that number came from. The article LED with that stunning statement but as I scrolled and scrolled, I couldn't find anymore about it.

Yeo, so looking at the examples in the tables and articles referenced here. My pre-tax contributions to a 401K maxes out at a fixed number ($22,500) regardless of how much or how little I make in salary. Highly compensated individuals or business owners, depending on their age bracket, can contribute up to $454,000 and avoid up to $202,000 in taxes per year. Seems like a sweetheart deal. It would be NICE if I could contribute to my 401K on a sliding scale. The more I make, the more I can contribute. I'm not sure how fair this special cash plan is because those highest earners are also paying a higher average income tax rate. All anyone can do, is their personal best, to leverage what they can to save as much money as possible to be able to live fairly well in retirement. At the end of the day, Uncle Sam will always get his portion, some day, some how.

The $452,500 was meant to grab eyes, so it did its work for the article. It appears to be the maximum tax-sheltered value the IRS allows in so-called cash balance pensions, which are funded completely by employers. So this doesn't seem to be a yearly amount but an end-of-career total, as far as I can tell. But the way it's presented in the article, it sure looks like an outrageous amount to be sheltered. OTOH, if it's a total value, that wouldn't seem at first glance to make it very different in concept from something like a traditional employer-sponsored annuity that can reach even higher principal values without losing sheltered status. I'm not defending it, to be clear, just thinking out loud.

The article is a good, though maybe a little turgid, case study of how lobbying controls legislators and legislation. Lobbying costs lots of money and favors organized groups that can supply cash to affiliated PACs rather than directly to politicians, and can supply legislative expertise and knowledge (and direction) to congressional staff offices.

As far as I can see, the major difference between Clarence Thomas and an awful lot of our congresscritters, then, is that our man Clarence has eliminated the middlemen and drinks his funding and influence directly from the sources.

Help me out here, I want to take advantage of the 452k tax shelters.

But my financial advisor says there’s nothing she can do beyond my 401k, I’m over 50 so that’s 30.5k. How do I put the other 422k in tax deferred retirement plans…ok not 422k, but right now I’m funding 62k/year into a taxable brokerage account….how do I get that off my taxes?

The article is no help and that’s how I found ya all, trying to figure this out.

The $452,000 number is available only to a very specific, very well off individual. Which makes he point that tax deferred accounts disproportionately benefits the wealthy.

The finance sector was and is not alone in preferring tax-advantaged retirement plans. The Pension Benefit Guaranty Corporation set up by the federal government has had to bail out over 5,000 failed pension plans:

https://en.wikipedia.org/wiki/Pension_Benefit_Guaranty_Corporation

Employers wanted to avoid responsibility for investment risk; 401k and 403b plans shift the risk onto employees. By definition, these defined-contribution plans are always ‘fully funded’, so insuring them isn’t seen as necessary.

I favor reforming tax-advantaged plans to limit high-end benefits. It won’t be easy, but reversing the trend away from defined-benefit (pension) plans is well-nigh impossible.