Over at National Review, Andrew Stuttaford warns that our national debt could become unsustainable in the future. It's the usual stuff: interest rates might go up, there might be no market for our bonds, and our national debt could skyrocket up to 200% of GDP or more.

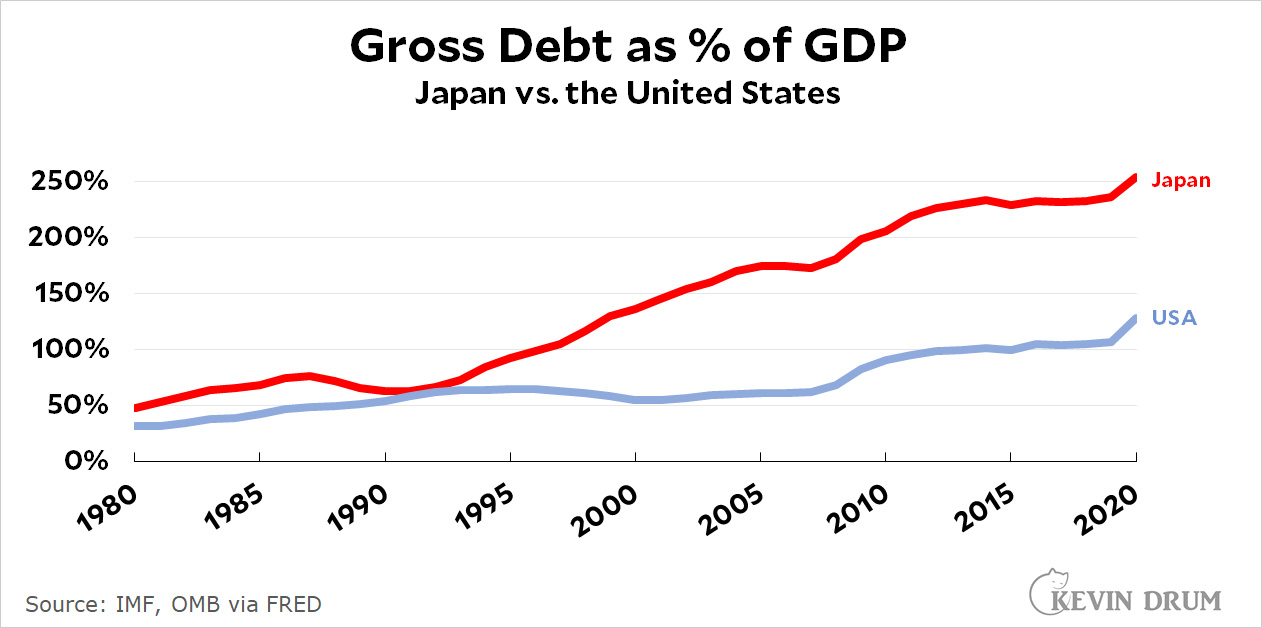

I'm not unsympathetic. I'm no deficit hawk, but neither do I think we can happily ignore all this and run whatever deficits we want. Still, every time I think about the perils of the national debt, this chart brings me back down to earth:

Japan has been cheerfully plugging along for many years with a national debt over 200% of GDP—and growing. Nor has this caused them any big problems. Their growth rate since 1980 is a little lower than ours, but only a little, and most of it is probably caused by the aging of their population, not their national debt.

Japan has been cheerfully plugging along for many years with a national debt over 200% of GDP—and growing. Nor has this caused them any big problems. Their growth rate since 1980 is a little lower than ours, but only a little, and most of it is probably caused by the aging of their population, not their national debt.

None of this proves that we can do the same thing, but it sure suggests that a modern economy in a rich, stable country can get away with a lot more than we used to think.

POSTSCRIPT: And one more thing: it's possible to reduce the deficit by raising taxes. This is not the kind of thing that NR supports, but it's something all the rest of us can certainly keep in mind.

Indeed. there's two ways to reduce the circulating money supply: raise interest rates (in which case, the government pays the rich (holders of debt) more money), or raise taxes (in which case the government is paid by the rich).

Guess which we'll do?

An aging population and concentration of wealth among the elderly (who value current income over future income) lead to increasing debt levels that are sustainable if incurred in the nation's own currency. Nothing to get freaked out about. If you do get freaked out, try increasing the tax rates on the wealthy.

"…try increasing the tax rates on the wealthy."

IMHO, a better way to say that is to return the "wealthy tax" to where the US economy was doing very well, thank you. That could be as much as 90% as in the 1950s, when we conceived and built the infrastructure to go to the moon.

Cut one Ford class carrier from the pentagons budget and cap the F35 program as it stands. Stealth is nice but when you can get multiple super Hornets for the same price?

We are moving towards a space based military system anyway with hyper sonic missiles, and planes. Way on the other hand we are also moving towards drone usage more and more. Without human consideration drones could be flown to more extremes than manned airplanes if needed.

The problem is that just about every state has a business that contributes to military spending programs so to cut that you would hurt your own constituents.

Yes. Raise taxes. Cut defense spending to 20% of current. Eliminate the VA and it’s funding. Deficit ended. And the extra benefit of no killing. Not that anyone cares about that.

I agree with the tax increases on the uber-rich and cutting the defense budget by half. I do not think it’s morally okay to cut the VA budget. This is a national obligation which has been incurred by the American people and we’re committed to taking care of veterans.

"I do not think it’s morally okay to cut the VA budget. This is a national obligation which has been incurred by the American people and we’re committed to taking care of veterans."

As someone who volunteers and takes veterans to VA facilities, I wholeheartedly agree. Also, we should not depend on people's gratitude to fund the holes in our system. As much as I see ads for "wounded warriors, etc." I am somewhat disgusted we find it necessary to resort to private donations.

thank you--for your comment and commitment.

I agree, but do future veterans need to be enrolled in it?

If this benefit is eliminated there will be less incentive to join the military, fewer people to pay and less halfwit military fetishization. One would think.

Sometimes war is inevitable. And in war there are always casualties. It seems to me that one cannot foreclose the possibility of war by placing more of the burden of fighting it on those who are already bearing a heavy burden and taking nearly all of the risks.

I think it would be better to have a national debate on the country’s security needs and possible threats and then construct a military to meet those needs.

That is the debate we keep trying and failing to have and defaulting to more and more weaponry, grossly useless boondoggles, and a still larger, less competent military.

Starving the beast of personnel is the easier answer, and the only real way to do that is to make service less attractive.

And a healthcare system that truly covers everyone from birth to death is something that would help everyone, and it looks to me that the VA hospitals are something standing in the way of that.

Boy do I hear you on THAT one cld

Vets should get free health, vision and dental. Minor monthly premiums to cover family.

Over the eyars as more and more people become VETs more and more people would have government sponsored Healthcare.

No need to go to a specific clinic or doctor etc

MOST VA facilities are good. A few are not but getting rid of them entirely frees up a lost of $ that could be used to pay for health insurance for them

The problem is that MOST politicians WANT to keep our VETs happy and health but they sure don't want hundreds of thousands MORE people getting government healthcare (Medicare plus Vets).

Next thing you know they become a voting bloc.....

Let me clarify my post

VETs should get free BCBS. Top of the line coverage. ANY doctor any time - no copays.

They should not "have" to go to a VA clinic. Why make it hard for them?

Our pols get healthare and they aren't defending our country.

Eliminate the VA entirely. Switch them to a BCBS plan then elevate all Medicare to that same plan

The conservatives would be apoplectic. On the one hand they want to take care of military people and their families. But they sure don't want to prove it.

For most of its history, the United States has had a very small, grossly inadequate and underfunded military, particularly the navy (Congress paid tribute to the Barbary states because it was cheaper than building enough ships and a big enough army to defeat them. Cheaper to sing about it than to do it). We’ve continually waged wars of choice since roughly the middle of the Korean War and, except for the First Iraq War, we’ve never debated whether to start a war of choice or paid for it through increasing taxes or paid more than lip service to the welfare of the poor slobs who did the actual fighting.

You cannot “starve the war machine” by telling the people who are fighting that war on our behalf that they’re on their own. These kind of manipulative “bank shot” approaches never work. If you want to reduce the military to what’s actually needed for defense, I think you have to make the case.

Well said. One might think that this is an opportune time to make the case for a drastic reordering of our priorities in foreign relations, given how unsatisfactorily our last several interventions have turned out. (I don’t fault the military; they were asked to solve problems that had no military solutions.) And Pres. Biden is clearly skeptical of US capability for counterinsurgency and ‘nation-building’. But it is so easy to demagogue this issue, so easy to characterize reform as weakness. And it is so easy to vote for massive weapons programs loaded with subcontract spending and hiring spread throughout Congressional districts; weapons that were unable to vanquish the Viet Cong or Taliban. I’d like to think that someday there will be enough wisdom in Congress to change direction, but I’m not betting on it.

For Japan, government debt after subtacting government lending is a more meaningful measure of the incipient tax liability embodied in outstanding government debt. Subtracting the huge amount of debt secruities held by the Government Pension Investment Fund (GPIF) and by the Bank of Japan leaves a smaller debt-to-GDP ratio than shown in the figure. Also note that "net debt" as defined by the IMF does not subtract debt securities held by the centrla bank.

David Flath is correct. PLUS Japanese buyers of debt, such as Japanese Life Insurance Companies, are willing to accept very low/even negative inflation adjusted yields for Japanese debt.

Hell, even evil Larry Summers recommends raising axes on the rich.

Best idea yet? Axing the rich!

I too would axe the rich. Billionaires should be illegal.

And if not raising taxes, at least stop cutting taxes

I think Kevin’s making a category error with anything in the National Review. It is extremely likely that the deficit is simply a placeholder for other objectives or grievances. He’s using “the deficit” because he can’t say what he means without incurring public scorn, so he talks about the deficit just as his fellow travelers talk about “critical race theory” instead of their hatred towards liberals and blacks.

Nothing written in the National Review nor anyone who writes for them should be taken at face value.

This is true. "The deficit will burden our children and grandchildren" is a powerful argument because it appeals to common sense and personal experience. It is also false: no one's children or grandchildren have ever been burdened by public debt and they never will be.

Our children and grandchildren will produce so many houses and cars and cheeseburgers and hit movies and a bunch of stuff we haven't thought of yet, and all of that stuff will be distributed among people who are living at the time and none will be sent back into the past to cover our deficits.

What we do have to do for children and grandchildren is provide them with the education and infrastructure (social as well as physical) that they will need to create their own wealth and prosperity. Our failure to do that is what will impoverish their future.

"What we do have to do for children and grandchildren is provide them with the education and infrastructure (social as well as physical) that they will need to create their own wealth and prosperity."

Agree if you add the small matter of a viable environment.

+10

This got me wondering if Andrew Stuttaford would care about the deficit if a Republican were President. A bit of searching found this quote from a NR story he wrote in November 2017: “Even if we forget about their impact on the deficit (and we shouldn’t), the Republican tax plans have been characterized by extraordinarily sloppy thinking, so sloppy indeed that it’s impossible not to wonder what, if anything, was going through the heads of the GOP leadership.”

So he's not the sort of hack who is in favor of deficits when Republicans are in power and opposed to deficits when Democrats are in power. Instead, he's the sort of hack who will mention his concern about deficits in passing when Republicans are in power (not even devoting an entire sentence to it) write an entire article about the deficit when Democrats are in power. In other words, a bit of a hack, but much less of one than I would have guessed.

Thanks for doing the digging. I agree with your assessment. And, yet again, I must question Kevin’s gullibility for regularly taking anything in the NR as being done or said in anything even remotely resembling good faith.

I mean, there is a reason.

Republicans. And lots of Democrats, too. So really, the reason is oligarchy.

Easy answer: Republicans will never allow it when a Democrat holds the presidency.

Republicans have said for four decades now that their tax cuts would reduce the deficit (and thus debt as well). But they’ve been wrong and their policies have done the opposite. Why it isn’t a standard Democratic talking point that the Rs should have to take responsibility for their mistake (and reverse all their tax cuts for the rich) I’ll never know.

It's hard to make a point if you have to explain it.

Republican tax cuts on the federal level means increased deficits and fees, everywhere. It also means increases in local taxes and fees as communities try to make up for lost federal money. Plus degradation of the infrastructure.

I'm not sure what there is to explain about "Republicans keep making the deficit worse."

DF-

Its been MORE than decades.

Coolidge had Mellon as a cabinet member (Treasury Sec) and he advocated strongly for tax cuts INCREASING revenues. So its been almost a century

Yet, one of our most prosperous times was the 50s when tax rates were MUCH higher

Eisenhower era tax rates on the highest incomes would reduce the national debt and perhaps limit the influence of wealth on elections.

...and perhaps limit the influence of wealth on elections.

Which is exactly why it won't happen.

Yep

Japan has not gone bankrupt because of its huge debt, which was run up largely with infrastructure spending. Other things that didn't happen - despite predictions by many economists - are that this spending did not cause rapid recovery from the 1990 collapse, and that it did not cause inflation. In fact there was often mild deflation in the 90's. The same can be said about monetary policy. Interest rates went very low and this did not cause a boom or inflation.

Any time you are tempted to credit the predictions of economists about the effects of fiscal or monetary policy, think about Japan. Those economists will not tell you about what has happened in Japan.

Falsification isn’t taken seriously enough in economics. Theory is taken much too seriously.

You point up something that is widely ignored; that is, that government debt (liability) is never compared to assets. Japan’s investments in infrastructure led to improved productivity of its economy, which in turn raises revenues even without increasing tax rates. Governments see returns on their assets, too.

I think you’re right. Japan borrowed money but invested it in productive assets such as infrastructure. By contrast, the US borrowed a lot of money to fund a military that’s nearly as large as the rest of the world combined and to give massive tax cuts to the richest people in the country.

I am not an economist, but I have to think there is some impact of the dollar being the world's reserve currency and therefore many many many more people watching and kibitzing and periodically freaking out over US fiscal/monetary theory and actions than Japan and the Yen.

There are material differences between US and Japanese debt

1. Almost half (45%) of Japan's debt is held/owned by its own Ministry of Finance. To quote from an article "Borrowing and lending of money between parent and subsidiary companies is offset in consolidated accounting. Paying interest is not necessary either. So 46% of Japan’s debt is actually not a debt."

2. Approximately a quart of the remaining debt is held by Japanese firms and citizens. They are willing to accept very low, often negative yields when one adjusts for inflation.

3. US Treasury's are much more a global benchmark than Japanese debt. Countries such as China purchase US Treasury Bills for currency reasons (don't want the local currency to rise against the US dollar). Thus our currency exchange ratios are impacts by the size of US debt.

https://medium.com/@JapanDetail/explain-with-charts-why-japans-huge-national-debt-is-not-a-problem-at-all-5b1994293915

And 21.5% of US debt is owned by the government/itself as well, so...

Mainstream economics hasn't figured out yet what money is and its relationship to the national debt. You can't understand the issues unless you do. But a big part of the problem is that the people running the National Review don't want you to understand that relationship.

Interesting choice of starting point, given that Japan has seen a significant drop in GDP growth starting in the mid-1990s. Even so, from what I can find searching for " GDP 1980", its GDP was 1.105 trillion USD in 1980 and 5.065 in 2019. The US went from 2.857 to 21.43 in 2019.

4.6X versus 7.5X...

Per those same searches, the Japanese GDP was ~5.5 trillion USD in 1995...

That blank space in " GDP 1980" was supposed to be "country" in angle-brackets. That got eaten as malformed HTML I suspect.

Per capita income is interesting; total income is not. Japan's population in 2019 was 1.077 times its 1980 population while the US's was 1.445 times larger. Adjust the growth rates by population growth and the numbers become 4.3X vs 5.2X

Japan's average age is 48.4 vs the US's 38.1 so one presumes that Japan has a larger percentage of retired people than we do. Japan seems to be doing pretty good.

Per-capita may indeed be more interesting, but that isn't what Kevin was using when he arrived at his (IMO erroneous) conclusion that GDP growth was similar between Japan and the US. Even including the non-flat years in Japan of 1980 to 1995.

Per-capita GDP isn’t just more interesting, it’s what keeps an economy from being zero-sum; it enables improvement in the general welfare, so can counter the argument that the populace must suffer from increased debt.

Unless Kevin edited his post, he only said that “growth rate” was a little lower in Japan than the US, without specifying what measure he was using.

You do realize things look differently when you measure Japanese GDP growth in Yen (and not dollar) terms, right?

Kevin, Kevin, Kevin,

For a guy who loves charts, I mean, "Gross debt as a percentage of GDP?"

Gross debt? Its not irrelevant, but isn't the real chart "debt payments as a percentage of the federal budget?"

As many have pointed out, interest rates are everything, because the affect payments.

We also have the same situation where there are Social Security and Medicare "trust funds" which are nothing of the sort and actually accounting items allocating tax revenues which are supposed to be tied to specific programs but in fact are not. But regardless, if you are talking about Gross Debt you should subtract that.

Finally, "as a percentage of GDP" - I mean, I get it, but WTF? So if things get bad you can just run all taxes to 100% of GDP for a year and pay of all the debt?

Anyway, I believe that countries get into trouble, not on the basis of gross debt, but on the basis of affordability of debt payments.

I wouldn't mind seeing a chart about that, but by the way, one difference between the United States and, say, me, is that I can't count on income increasing all the time like the United States can. Its the whole ballgame right there.

Which is why its ridiculous for Republicans to be against the types of government spending they increasingly seem to be against. Any government spending which cycles right back into the economy adds to growth.

Ironically, you can make a good case that the US has really screwed itself by having so much military spending, a large portion of which ends up in the hands of military contractor executives and owners, who save it instead of spending it.

Ah well, almost 2022.

The wealthy end up hoarding money, which is why tax cuts for the wealthy doesn't really help the economy much. And a lot of riches can be made in rent seeking in place of innovation and wealth generation...

In re Japan there are seom very specific market factors that give Japan a fiscal space that is fairly unique - among which the financial markets and retirement savings structure that permits essentially captive funding for domestic sovereign issuances in a fashion that is not really applicable to most other economies, certainly North American or European.

The US certainly has room for larger deficits (whether that is a good idea is debatable but it is certainly financially possible), but drawing lessons from Jpan is not a great idea.

I wonder how concerned Stuttaford and the NR were when Trump's tax cuts -- which went virtually entirely to the very rich (except the SALT deduction thing, which was simply an FU to blue states to punish them for having social safety nets) -- blew a huge hole in the deficit which was actually coming down at a pretty good clip in the second Obama term.

Do I need to ask?

Debt should be compared to assets. Debt servicing costs to GDP.

This is really simple and widely accepted in except when discussing public debt.

Debt to GDP is a purposefully misleading stat that should be thrown away.

+10

Debt to GDP is a purposefully misleading stat that should be thrown away.

I'm about the furthest thing from a deficit hawk imaginable. But there's ample reason to cite debt/GDP ratios, and one of those reasons is it gives us some idea of the potential burden of debt service, independent of rates. In other words, interest rates can rise.

Also, it's curious to state "debt should be compared to assets" and then disparage the use of debt/GDP ratios given the fact that the federal government's principal asset is its access to the productive capacity of the US economy (IOW US GDP).

Get away with? That sort of construct is for when someone is doing something not entirely correct/appropriate/whatnot.