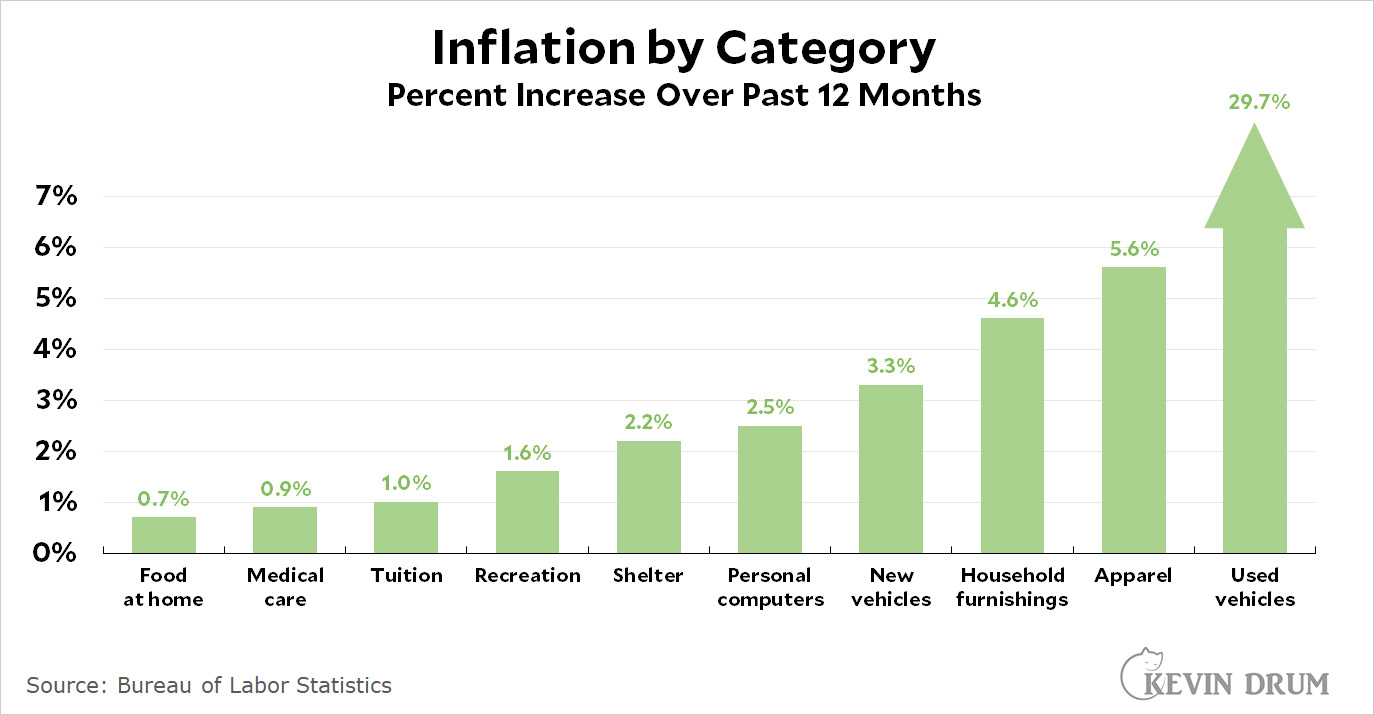

Are you curious enough about inflation to dive into some of the details? Of course you are! Here's a breakdown of which categories are up a lot and which ones aren't:

The first thing to notice is the enormous inflation in used cars. All by itself, this category boosts the overall inflation rate by about 1.5 points. If you're in the market for a used car this is bad news, but for the rest of us it means the overall inflation rate is closer to 3.5% than the official rate of 5%.

The next thing that should grab your eye is that food, the perennial favorite of B-roll footage on nightly news shows, is up only 0.7%. In other words, barely at all.

Ditto for just about everything else aside from household furnishings and apparel. I assume furnishings are up due to the shortage of lumber, and apparel is up because . . . um, I have no idea.

Bottom line: There are a few specific things that have shot up temporarily since last year, most famously lumber and used cars. This is obviously due to spot shortages that will go away pretty soon. Then there are things like gasoline that go up and down at the whim of OPEC and have nothing to do with overall inflation. Aside from that, most goods and services have gone up only a little bit, and even that little bit is exaggerated thanks to base effects from last year.

I don't have a crystal ball. Maybe inflation is about to bust wide open and we'll soon be withdrawing thousand-dollar bills from our local ATMs. But I doubt it. Most categories are under control; used cars are skewing everything; the base effect will go away shortly; and inflationary expectations remain well anchored at around 2%. At the moment, inflation doesn't even make a top ten list of things to be worried about.

So, is now a great time to buy an electric vehicle?

The car you have now will do great in the used market and the EV you buy will do great a few years from now because there just aren't that many EV's on the used market, and still won't be in a few years, which is about the time the EV you really want to buy will be out.

I actually thought about doing this. I have a 2019 with low miles that might get almost full purchase price right now.

But if there's no inflation now, then it means that inflation is being pent up, and sooner or later it will break out and INFLATION MONSTER COMING TO EET US IN OUR BEDS AIYEEEE!!

The only way to avoid this is massive spending cuts and tax cuts right now. Otherwise we're doomed, DOOMED I tells ya!

inflation is the smoke monster

Wouldn't you expect apparel to experience high inflation, given that (a) most garments are manufactured in China, subject to importation delays in response to surging demand, (b) Trump tariffs and their increasing tiers pushed importers to preload prior to those tariff increases, (c) the cost of cotton has gone up as brands are forced by human rights groups to stop using cheap Uyghur cotton.

Actually, most apparel has moved production to even lower wage countries like Bangladesh, El Salvador, Indonesia, etc. High shipping costs and delays still apply, though.

While some of apparel manufacturing has been moved to other, poorer countries, China remains the largest exporter of apparel and textiles. -- https://bityl.co/7l59

More importantly, let's focus on US imports of textile and apparel, by country of origin, 2020 (countries w/ $1B+ in exports to US):

China, $25.3B

Vietnam, $13.4B

India, $6.8B

Bangladesh, $5.4B

Indonesia, $3.8B

Mexico, $3.4B

Cambodia, $3.3B

Pakistan, $3.0B

Turkey, $2.0B

Honduras, $1.8B

Italy, $1.6B

Jordan, $1.5B

Sri Lanka, $1.5B

El Salvador, $1.4B

Guatemala, $1.2B

Canada, $1.0B

Since this chart is over the last 12 months, meaning the starting point is in the midst of 2020 and the pandemic, may we assume there is no longer any need for Kevin’s two-year average manipulations?

Here's my theory about the increase in apparel costs. One year ago, there were still widespread lockdowns and business closures. People who are unemployed, or working from home need far less in the way of clothing. Now, businesses are re-opening and people are venturing out again. They now need to buy suitable clothing for that. This, too, I think is a temporary thing that will shake out at such time as a new equilibrium is established.

I would post the AIE graph showing changes in prices and wages over the last two decades. Using BLS data. This blog does not allow posting the graph. Go look it up on the Google.

Here it is: https://www.aei.org/carpe-diem/chart-of-the-day-or-century-3/

I did see reports that lumber prices are coming back down (though still high).

I just have never bought the idea of "adjusting " the CPI or other economic indices to take out something volatile on the high side. Especially for periods greater than a month or so.

This too often is done for partisan political purposes ( i.e. Democrats wanting to adjust favorably when they are in power and Republicans when they are). But will give kevin a pass on that sort of motivation as, unlike most partisans, I could see him making the same post if trump was still president and getting grief for it if he did.

But first, I do not like saying that means only 3.5% inflation for those of us not buying used cars. Because it then also means much higher inflation ( 10%? ) for those that do. Kevin mentions that and I think it just totally offsets the first point. And the ones suffering higher inflation are those who tend to be lower income.

But the theoretical issue I have is that there are always going to be outliers on the high side and low side in inflation. And if taking out the high side for some reason, have to take out the low side too. And food is actually considered normally " volatile" and taken out, not used cars

And the long term underlying drivers of inflation should mean that, at least after a month or so, should tend to lower all other prices to offset the spike in one item ( i.e. those who have to pay a lot for used cars have less money to demand all else).

But that can take a few months.

So fair to maybe say wait a while for a few months before panicking over a blip in inflation linked to one item. If the point was made that used car inflation comes almost all from last two months ( true) then maybe ok. But should not do that with 12 month figures. If used cares went up steadily for last 12 months, should not try to adjust that out.

Used car prices

Cars drop massively in value

Back when I was first driving that was because they had quite short lives - my first car was seven years old - an OLD car

Today cars last a LOT longer - the last car I bought was 14 years old and it was like a new car

I wonder if the drop in new cars bought during the Covid lockdowns has made this difference more visible and that used cars are simply not going to depreciate as rapidly as we are used to

My 14 year old car had lost 90% of its "cost" - but possibly 40% of its "value"

International sea shipping is totally bonkers still. I expect that particularly affects low-margin, low-density goods like apparel.

I note that the category is "food at home". I was chatting with a friend who owns a cafe and I said something like I hadn't noticed that food was any more expensive. She countered that the price they are paying for beef at their cafe has gone way up. I buy a pound of beef once a month or so, so I wouldn't notice anyway. Is there some split between food from the grocery store vs food supplied to restaurants?