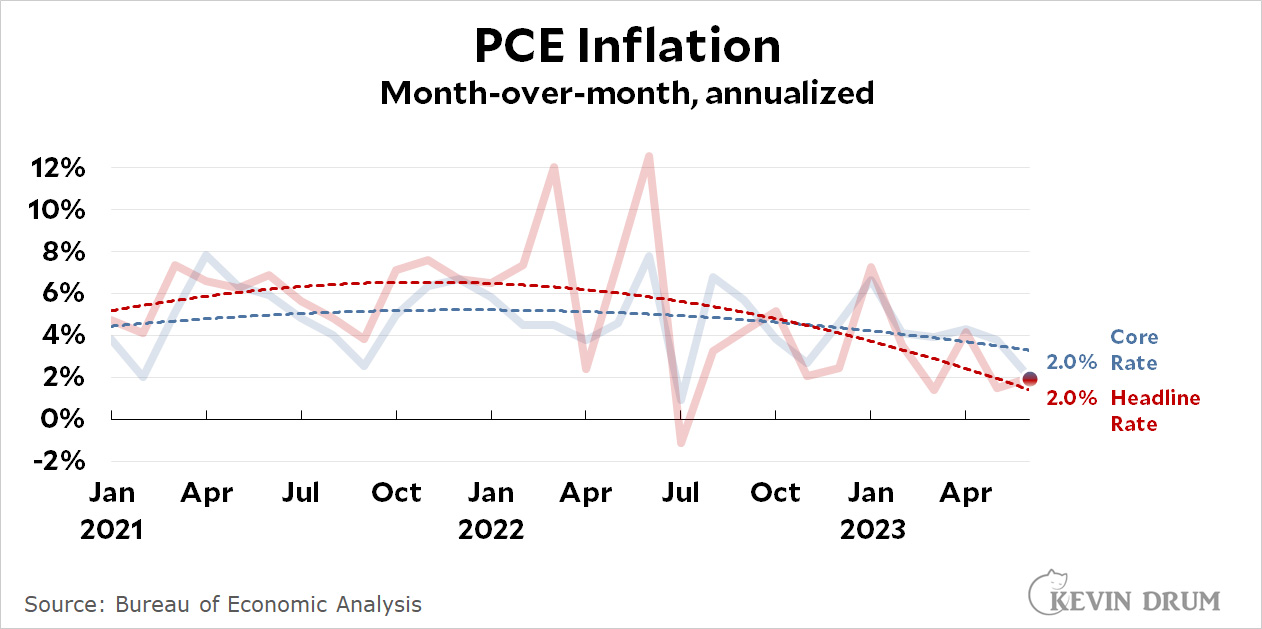

PCE inflation figures were released this morning and they're nothing but good news:

The Fed likes to look at the core PCE rate, and in June it finally fell significantly. It's now running at an annualized rate of 2.0%, which is right at the Fed's target. The headline rate is also running at 2.0%.

The Fed likes to look at the core PCE rate, and in June it finally fell significantly. It's now running at an annualized rate of 2.0%, which is right at the Fed's target. The headline rate is also running at 2.0%.

On a year-over year basis, headline PCE inflation was down to 3.0% and core inflation was down to 4.1%.

If this news had been available yesterday, perhaps the Fed wouldn't have raised rates yet again. But it wasn't, so they did.

We gotta get Kevin a podium on the USS Lincoln, since apparently he's ready to declare "Mission Accomplished."

(I kid, I kid. This is a good report! Let's hope this keeps up, no more rate hikes are necessary, and we can manage the fall out of the rate hikes we've seen successfully.)

Real on the web home based work to make more than $14k. Last month I made $15738 from this home job. Very simple and easy to do and procuring from this are just awesome. For more detail visit the given interface.. http://incomebyus.blogspot.com

They're not going to look at one month on target and pronounce prices stable. But they might think the present federal funds rate is just right now.

He's busy putting together another graph showing us a plane bouncing off the runway.

I agree this is great news. And they did say they'd overshoot the landing a bit to be sure.

Per: https://www.cnbc.com/2023/07/28/pce-inflation-june-2023-.html

If I'm reading https://www.dallasfed.org/research/basics/annualizing correctly:

AnnualizedRate = ( (PriceMonth/PricePreviousMonth)^12 - 1) * 100

If Inflation in June was 0.2% that means PriceMonth/PricePreviousMonth is 1.002

AnnualizedRate = ( (1.002)^12 - 1) * 100

AnnualizedRate = ( 1.0242 - 1) * 100

AnnualizedRate = 2.42%

Did I botch that calculation somewhere?

Your math is correct. What it comes down to is rounding up.

When you use the BEA 0.2% M/M rate, you're using their rounded-up number.

When you use the PCE Index data, it's 1.95%, rounded up to 2.0%.

Once again, the PCE uses the same data as the CPI, it is just treats the data a little differently and is released two weeks later. The relationship between the two is quite predictable, although it is not a simple ratio:

https://fred.stlouisfed.org/graph/fredgraph.png?g=17p5q

So the Fed had the information two weeks ago (or maybe earlier if it got the dope from the BLS in advance of the public release). It just made the wrong decision.

Someone more conspiracy-minded than myself would say the Fed raised rates when they did to get ahead of today's announcement. Our hypothetical conspiricist might even make a prediction to the effect that the Fed has no intention of lowering the rate anytime soon despite this new information.

To try to hurt the Biden administration's re-election chances?

Only if the four Democrats on the board are Quislings.

Why would they have to be quislings?

Because it takes a majority of the board to approve a rate hike. There are currently four members on the board who are Democrats.

Actually, there is a vacancy at present, and the board is 7 rather than the 9 I was recalling. So six members on the board. Three Democrats and three Republicans. And one of those Republicans, the current chair, was first appointed to the board by Obama, and then "renewed" to the chairmanship by Biden.

I would assume then that unless it must be unanimous, it would take four votes to approve a rate increase. We might assume the two Republican board members might want to scuttle Biden. I'd say the chair is at best 50/50 wanting to see Biden out - were Trump re-elected, it seems uncertain he would hold any fondness for the chair. That means at least one of the Democrats would have to vote for the increase.

And then there is this: https://www.federalreserve.gov/newsevents/pressreleases/monetary20230503a1.htm it is the May announcement - I cannot find the July press release yet - and it announced that the vote was unanimous.

Edit: Here is the July announcement: https://www.federalreserve.gov/newsevents/pressreleases/monetary20230726a.htm it suggests I'm still a little confused on how many take part in the vote, (seems to go beyond the board?) but it does look like it was unanimous.

You put a lot of work in there, but no, that's not what I was going for. Namely that it's quite possible to be both a loyal Democrat and to think that Biden is too liberal, economicly speaking. They don't want Biden to lose so much as it they want to put him in a straight jacket.

That's not me, BTW; I'm just saying that there are those conspiracy-minded types who will think this is plausible.

Just to put down a marker

Headline Year over Year CPI will be up next month for the first time in a LONG TIME.

The media will go ballistic.

In reality, it probably will be nothing.

Inflation will rise to somewhere between 3.1% and 3.3%.

Why?

Because last July we had DEflation. So this July is almost definitely going to be worse.

It was so easy to predict that CPI last month was going to be way down to around 3% because June 2022 was so terrible. So, when a terrible month leaves a 12 month average, the number goes way down. THis month, a very good month will leave the CPI so it will result in an increase.

It depends what you think "going ballistic" looks like. I don't think major not-Fox News media will paint a 3.3% inflation rate as terrible. I predict something along the lines of "slight increase" will be in their leads.

I pay $5.99 per pound for boneless skinless chicken thighs. Same price for a very long time.

Check it out next time you go to grocery store. What do you pay?