A group of scholars at American Compass has taken on the theme “We want to thrive, not just survive.” That is, they think American families should actively do well and live enjoyable lives, not just barely get along:

The breakdown in American capitalism over the past half-century is most apparent in its failure to deliver widespread prosperity for the American people. Success requires more than just rising material living standards: For citizens to flourish, they must have access to good jobs that pay family-supporting wages. For the nation to flourish, its growth and opportunities must be broadly shared.

....With wages stagnating and inequality rising, the costs of supporting a family have quickly outstripped a worker’s ability to do so. In 1985, a typical male worker could provide middle-class security for a family of four (food, housing, health care, transportation, education) on 40 weeks of earnings, leaving a comfortable cushion for other expenses and savings. In 2022, providing that same middle-class security would require 62 weeks.

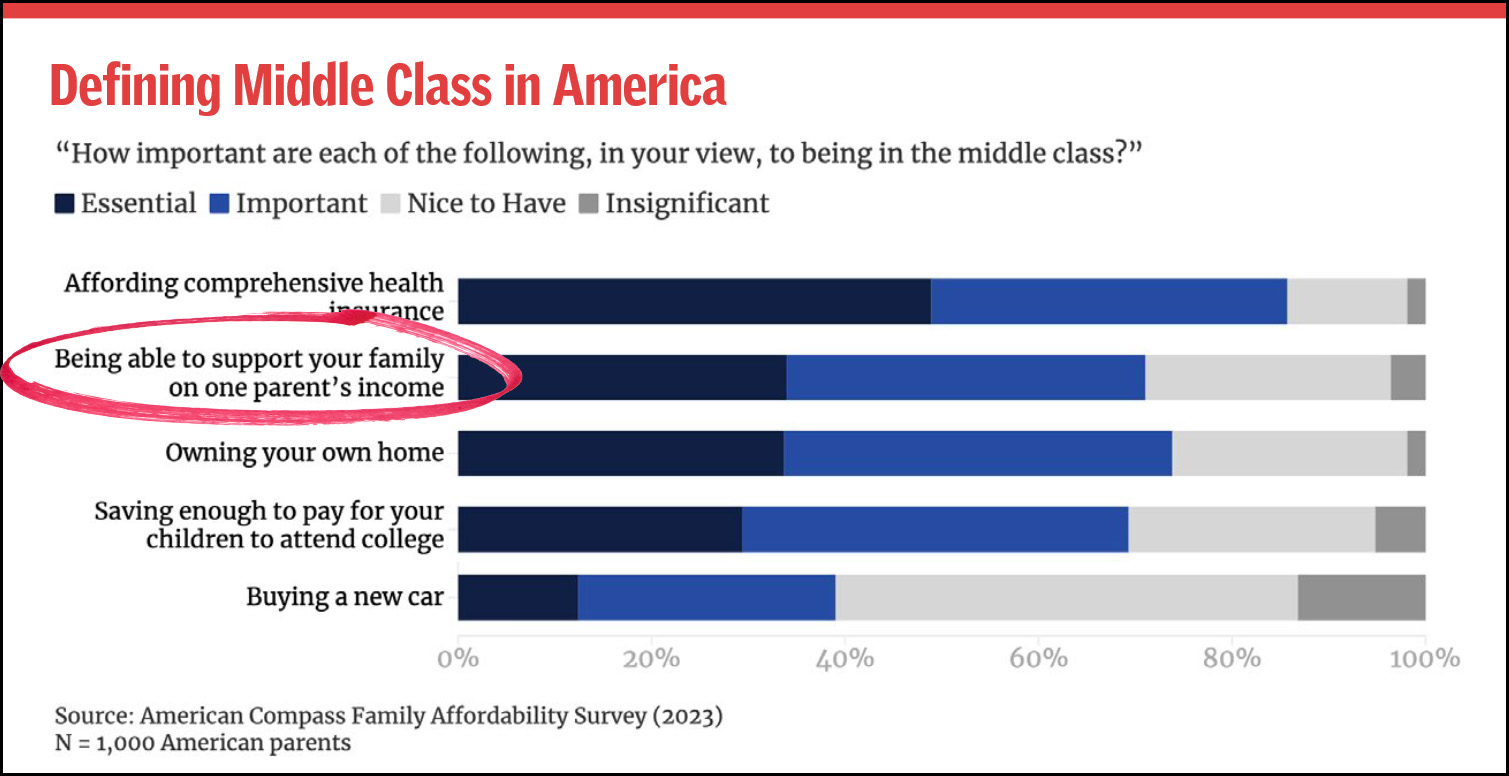

In a poll commissioned by American Compass, 60% of parents say it's a big problem if both of them are forced to work just to get along. Nearly three-quarters of parents say that an important part of being middle class is being able to support their family on a single income.

But many parents, like Corrie, a working-class mother from Ohio, say they can't do it:

But many parents, like Corrie, a working-class mother from Ohio, say they can't do it:

Corrie cites the rise of the “working homeless,” of which she is part. Though she and her husband have been married for almost 20 years and he has kept a steady factory job while she worked part-time at McDonald’s while also raising their three children, they are unable to afford rent in the current market and have moved in with her sister’s family.

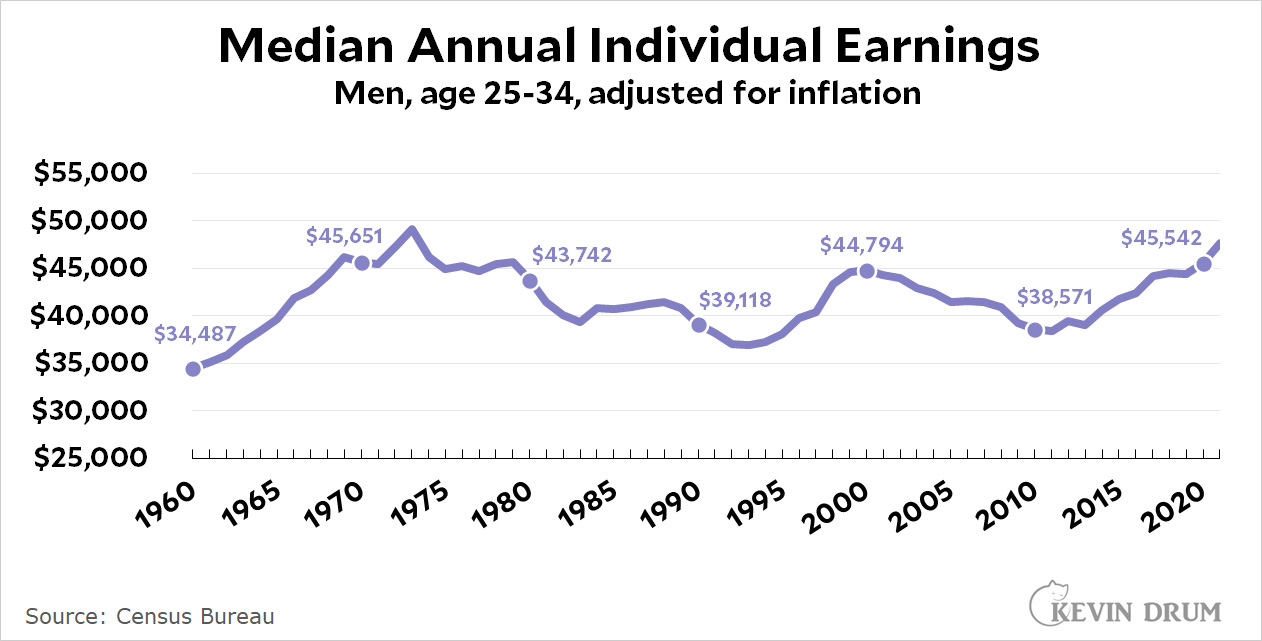

So now let's get down to brass tacks. Have men's earnings shrunk so much that they can no longer support a family on just their own income alone? In a word, no:

Individual men earned more in 2020 than in 2010. More than in 2000. More than in 1990. More than in 1980. As much as in 1970. And way more than in 1960.

Individual men earned more in 2020 than in 2010. More than in 2000. More than in 1990. More than in 1980. As much as in 1970. And way more than in 1960.

This is nothing fancy. It doesn't account for taxes or government assistance. It's just ordinary paycheck income. And it's no great shakes: Men's earnings have been close to stagnant for half a century, which is far worse than we'd like to see.

That said, their earning power to support a family hasn't gone down. They can still do it. The American Compass report makes the usual point that even if earnings are flat, expenses have gone up in some important categories: rent, health care, education, and so forth. True enough. But expenses have also gone down for things like food, clothing, and TVs. It's about a wash in the end.

So what accounts for the widespread dissatisfaction with modern life? Here are a few guesses:

- Alex Tabarrok theorizes that we have more money for stuff but less time for it—so we rush through everything and feel harried even though our standard of living is actually as high as it's ever been.

- Another possibility is that we really do have less money for common goods because we spend a lot of it on stuff we didn't even have half a century ago: computers, videogames, the internet, cell phones, and so forth. We can argue all day long about whether this tsunami of new technology really improves our standard of living,¹ but there's no question that on a pure money basis it makes us seem a little poorer because we're spreading our income around on more stuff.

- Finally, there's waste. We buy and then discard an awful lot of stuff these days, which means that much of our income is squandered and actual consumption of stuff we enjoy has gone down. This makes us seem poorer because, in a way of our making, we are. If we lived a little more carefully, we'd probably all end up a little happier and more prosperous too.

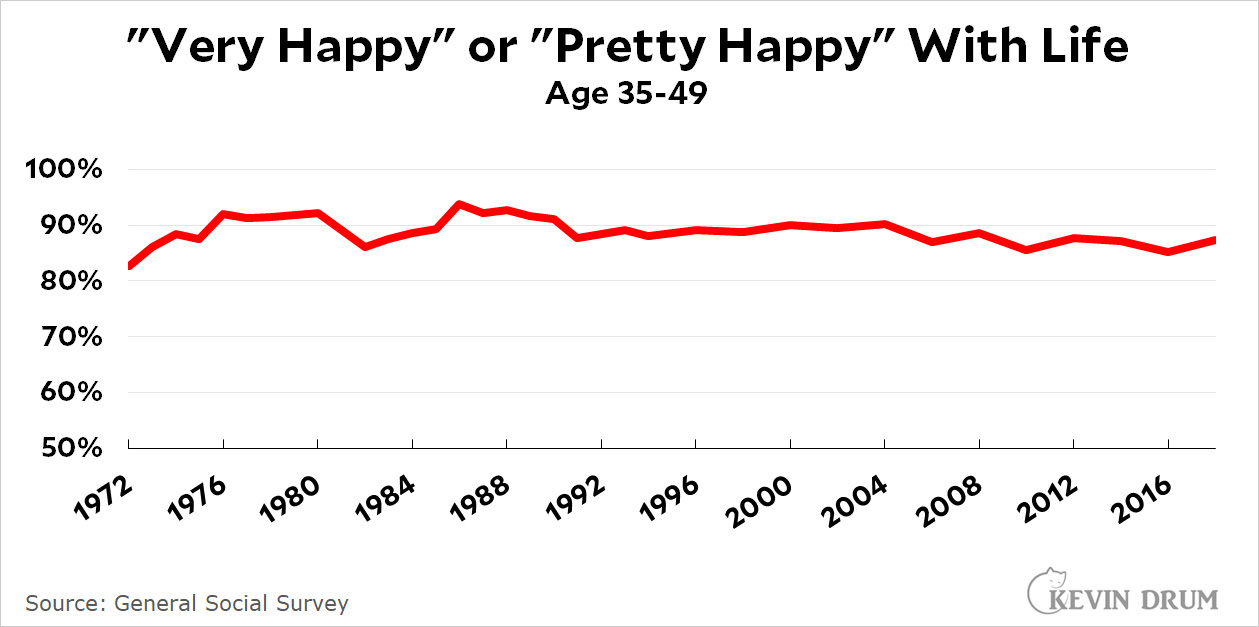

Then again, here's a final possibility: it's all a mirage. We're not mostly dissatisfied with modern life. Long-term polls certainly don't show it—not among men vs. women, not among the entire population, and not among the middle-aged:

Despite all this, if you carefully choose to write only about the borderline working class—as our news outlets and scholars so often do—you can certainly get the impression that everyone is living hand to mouth. In reality, it ain't so.

Despite all this, if you carefully choose to write only about the borderline working class—as our news outlets and scholars so often do—you can certainly get the impression that everyone is living hand to mouth. In reality, it ain't so.

¹Yes, it does.

Nice charts and all, but I have neve seen a chart which properly accounts for housing, not just across the whole US, but in the most desirable areas, which is what blows up the analysis.

What house, exactly, can be afforded on $45K a year in California, where?

I rest my case. Per the LA times via google, the median sales price in California in 1970 was a whopping $24K! No, I have not left off a zero. And the average wage was about $6K. Which, with a bit of luck, just about gets you that house.

Now, $45K gets you as close as Zillow envy for the average $800k house, its so absurd people making $45K don't even bother.

This x1000.

We can allegedly adjust wages for inflation all we want, but it doesn't square with the reality that it's far, far more expensive to live than it used to be. And my instinct, based on what housing prices have done, says it's housing costs. Be that monthly rent or having to save up for a downpayment (downpayments now are 50% to 100% of median annual income in "middle cities" whereas just 30 years ago it was more like 20 to 40%) or mortgage payment (which increases hand in hand with that downpayment...).

And contemporary life is more expensive than 50-60 years ago. We might have higher quality things, so our "bang for buck" might be similar, but there aren't exactly budget options out there. We can't choose to buy the basic nuts and bolts car, for example - when somebody wants a new car, they have to shell out for the pricier new (or newer) thing and it doesn't really matter to their aching wallet that it's fancier.

And of course, housing costs have gone up because PE and investors in general have figured out that housing is an extremely constricted good in terms of supply, so it's a good investment. That may have simply been the plan from the start, as "the American Dream" was basically sold as that: buy a house and it becomes your nest egg. Which coopted all the homeowners into being an interested party in having property values endlessly increase, because they couldn't build wealth in any other way (meanwhile, as HalfAlu has pointed out below, the country's total wealth has exploded).

As this system/cycle continued for decades, it only became more calcified. We're basically stuck in it now, and TBH we're basically fucked because of it.

And I would say that if housing was the same price, everyone might agree that the stuff you fill up the house with is cheaper and better.

But all the stuff doesn't make someone living with their parents feel that they are doing better.

The US has this "only in America" each generation does better than their parents theme which (a) was never true for the rest of the first world, and (b) is not true in the US now that we have used up all the free cheap land and we are part of the first world like everybody else.

If Kevin want's a good chart, put together cost+square footage in Paris v. Los Angeles on an average salary. I bet it would show a huge percentage of Parisian's essentially have what we consider apartments, with some owning them, but that LA peaked out with square footage for your buck in like the 1970s or 1980s and now its a slide back to first world reality ---- less home for your money.

You can see it in real time when prices spike.

But its a tough political message, which is why no one wants to be the messenger.

Agree in spades. Check out this Elizabeth Warren from 2008, The Coming Collapse of the Middle Class. The short take is this: For all the usual grumbling from the usual suspects about how 'those people' fritter away their money on consumer electronics, clothes, avacado toast, etc., spending on those items as a proportion of median income has gone down (partly due to the fact that the cost of items in those categories have gone down over time, relatively speaking.) OTOH, spending on Items you have to have -- housing, education (yes, education is a must-have item), inurance, etc. -- has gone up, in large part due to the fact that the cost of those must-have items have outpaced inflation, sometimes by double-digit percentages. Does anyone doubt this was by design?

I don't know if it was by design, but I would say this:

1. The solution to a housing market which, left it its own capitalist devices, is guaranteed to inflate to an unaffordable capitalist degree, is government intervention in that market.

2. The solution to spiraling health care cost is governmental intervention in the health care market.

3. The solution to spiraling higher education costs is, wait for it, government intervention in the higher education market.

All of 1, 2, and 3 are treated, in the US, to the full application of capitalism, (well maybe not "full" but more capitalist than any other first world country), and they are egged on by the Repubs.

The Dems, are the only party with some sort of even a "wish sandwich" of policy on 1, 2, and 3.

But, Repubs are blaming 1, 2 and 3, not on capitalism, but on (a) minorities taking jobs, (b) government giving stuff away to minorities, and (c) immigrants making the country too crowded. Three pretty weak arguments, but there you go.

If its a design, its what capitalism unfettered is absolutely designed to do. I don't really know what other result anyone would expect.

I think it was kind of an accidentally by design thing, at least as far as housing is concerned. While it's possible that when the suburban experiment was kickstarted the people behind it and who perpetuated it over the following decades intended for (1) homeownership to become the single feasible vehicle for wealth-building to the vast majority of the population, and/or (2) housing to become an investment asset, which combined for (3) a situation where too much of the populace and too much of the wealthy are invested (literally) in prices only going up-up-up...

I think it's more likely that simple greed and dumb-but-complex feedback loops created and reinforced our problem. And I just don't see any way out of it - at least no way that doesn't end very badly or come with catastrophic risks.

Agreed. I don't mean 'planned' to stand-in as a synonym for 'coordinated'.

That's a good point, but I don't think the "suburban experiment" was a function of some planning thinking its a good way for homeowners to build wealth.

I think it was just because we had the land, so we did it. Moreover, from, say 1800 onward the main appeal of the US was agrarian, with the ability to get your own farm rather than farming for some Duke or Lord which is what would have happened in Europe.

I think its a very slight push from eveyone has their own farm to a house in the burbs as opposed to an apartment.

And it worked, for sure, for a long, long time. We don't like to actually think of running out of stuff, as humans I mean. But its so obvious that you just can't keep building suburbs father and farther out. At least in hindsight.

You can barely get anyone to acknowledge over population and over pollution. In retrospect, I hardly heard anyone pointing out that 2023 California was basically inevitable in,, say, 1990.

I mean, they definitely didn't begin building suburbs (or even just tract developments) out of the goodness of their hearts so that more people could own their own home. They did it for profits.

In 1970, the population of California was just shy of 20 million.

“Today” it is just shy of 40 million.

While there are twice as many Californians, there isn’t twice as much California.

California is the 3rd largest state by area, putting its population density at 251.3 per square mile, which ranks 11th in the country.

Also this:

I graduated from a Bay Area high school in 1965. Some of my friends went off to Berkeley. Other went to the still new UC Davis (1959).

The kicker is this: Cal campuses were still tuition free in 1965!

(Question--where is all the money going? All the money that is now tied up in all that student debt?)

Adding on again because I had a moment to look it up (sort of): home prices have outpaced inflation since 1970 by a factor of 2.29.

https://anytimeestimate.com/research/housing-prices-vs-inflation/#housing-vs-inflation

"$20,000 in assorted goods in 1970 would cost you $148,800 today.

But a $20,000 house in 1970 would cost you $341,600 today."

Yes, today's homes are larger, but that doesn't change the fact that they're more expensive.

And it doesn't change the fact that in most places, there simply aren't that many smaller homes being built.

This.

The "Cost of Thriving" doesn't include entertainment, or luxuries: it's basically the cost of necessities or legal requirements. And those have gotten dramatically more expensive--housing and education especially. The median man makes about as much as he did 40 years ago, but the median house costs several times as much.

Then don’t try to live in California. There, that was an easy answer.

Yeah, and rents have risen as well, though less so.

I can make 2 hundred USD an hour working on my home computer. I never thought it was possible, but my closest friend made 7teen thousand USD in just 5 weeks working on this historic project. convinced me to take part. For more information,

Click on the link below... https://GetDreamJobs1.blogspot.com

During that time period, 1960-2023, US GDP per capita adjusted for inflation has tripled ($18k -> $61k).

Whats interesting is I see the world bank has US 1970 gdp per capita at $5.3k and in 2020 at $70k.

This is right up Kevin's alley, if a persons wages basically was the same as their GDP then, and now its like only 60% ($45K v. $70K), well, what's up with that?

The average person gets less of a slice?

Exactly. An hour of labor gets one a MUCH smaller percentage of the per capita GDP nowadays. If you think of the GDP of what we are capable of and the value of an hour of labor of what one will get, there has been a big disconnect. A generation or two of this disconnect gets one a peasant society where everyone is praying that their neighbor's cow dies.

Good post. I think a solution is creating more walkable communities with a mix of uses and densities, and more three bedroom apartments and condos. If you can get by with a car share and an electric cargo bike you will have a lot more disposable income and often more free time. We need more good public transit too.

In 1970, the average CEO made the equivalent of about $1 million. Today it's nearly $20 million. There were maybe 10 billionaires in the US 40 years ago. Now it's over 100. And a couple of them are worth more than $100 billion and it's probably not long before the US and China start minting trillionaires. Do CEOs today really work 20x harder or smarter than they did in the 70's? That would be pretty impressive! Sadly, no. They've simply created a tax and regulatory system (esp wrt unionization) whereby stockholders and C-suite executives profit by minimizing the amount a company has to spend on labor costs.

So what we have are prices for a lot of essential things, particularly housing, being driven by the purchasing power of an increasingly wealthy elite, leaving regular wage earners in the dust.

That's right. There has been massive rich people inflation for 40 years now.

In the mid-1970s I worked construction labor in Virginia, a low paid job, just above minimum wage. A couple months ago I wondered what that salary, adjusted for inflation, would be compared to the starting pay for teachers in the USA. Turns out it was about 80-90% of the overall average, and several thousand more than Arkansas for example.

I don't suppose that suggests a major reason for not being able to get by on one salary now compared to 50 years ago.

What use is a median income figure without a sense of a distribution of the incomes? If half of all salaries are lower than 45.5k/annum, how much lower are they? The bottom quintile makes less than 16k/annum. They are definitely worse off than the rest of the distribution EVEN IF THAT INCOME SHARE HAS BEEN FLAT SINCE 1970. It's pointless to say on the basis of median income that people are no worse off, when poverty in the USA has been a national scandal since How the Other Half Lives was published.

Have men's earnings shrunk so much that they can no longer support a family on just their own income alone? In a word, no:

Forty-five grand for a family of four would be a grim existence in just about all of the US, and flatly infeasible in 10 or 12 metros (in my native Boston housing alone would typically eat up 100% of net income at that level, and several housing markets are even pricier). In other words, it's well below what most people would consider a plausible income to support a family on. Was a median wage really that tough to survive on as a small family in 1960?

The graph says median annual wages for men in that age cohort have nonetheless increased by about one-third in real terms since Eisenhower was in office. But I think it's strongly likely that the expenses associated with raising a family have increased by more than that. As several of the commenters have noted, the "quality" aspect of improving living standards is a net positive, of course; but from a pure financial perspective this is a mixed blessing because consumers don't usually have the option to "opt out" of today's improved standards and instead purchase 1960's inferior and cheaper cars and health insurance.

And then there is housing...

Real wages over the long term have increased in America as they have in any country with an increasing material living standard. But any sector of the economy affected by Baumol's cost effects has seen prices increased faster than real wages. To the extent that a number of these (childcare, education, healthcare) are important for families—as is housing, which has been affected by artificial scarcity—it's become financially more challenging to raise children on one income. Which is why far fewer people are able to do so than sixty years ago.

“ Was a median wage really that tough to survive on as a small family in 1960?”

Yes. There, that was another easy answer. Next!

I don't think you know what you're talking about but if you have more to share than "easy answer, yes" please share it.

Yes. There, that was another easy answer. Next!

The available statistics say you don't know what you're talking about. Two income households (as a percentage of all married couples) more than doubled between 1960 and 2000, going from 25 to 60 percent.

https://www2.census.gov/ces/wp/2019/CES-WP-19-19.pdf

consumers don't usually have the option to "opt out" of today's improved standards and instead purchase 1960's inferior and cheaper cars and health insurance

Bingo. I don't know what kind of housing they offer in Orange County where Kevin lives, but the choices facing families here in northern Virginia have bifurcated into either (1) homes with indoor plumbing, electricity, heating, no rodents, a full kitchen, a full bathroom, etc. or (2) "homes" that consist of making do with whatever you can fit into a tent or illegally-parked car. All the pre-1960's homes that lacked these "modern conveniences" have been zoned out of the region... yay progress! But it also means that dilapidated/substandard housing at price points like $5 a day that people did indeed live in in the 1950s and prior are pretty much universally illegal to provide in today's housing market.

I'm making an extreme point here, but Kevin doesn't account for the fact that it's impossible to buy the same basket of 1960s family goods in 2023. Even if a family avoids all the trappings of modern life, some stuff (housing without bathrooms or kitchens, a cheap pass for the streetcar instead of buying a car, buying supplies to handwash your own clothes, etc.) simply don't exist at all today.

A lot of it flows from the decision to making housing an investment. Land prices are too high to create modestly priced housing. Even if the zoning laws allowed it, one can't borrow the money to build an inexpensive house on expensive land.

Pundits like to pretend that observed facts are mere illusions. I've been reading all too many "things are great" articles that argue by gaslighting. If you want to own a house a 30-45 minute commute from a job that lets you pay for it, you have a problem. Arguing that such a house is more expensive because it has higher square footage and marble counters is backwards. It has higher square footage and marble counters because the land is more expensive.

"Arguing that such a house is more expensive because it has higher square footage and marble counters is backwards. It has higher square footage and marble counters because the land is more expensive."

Bingo.

+10

A lot of good comments. Recently the number of US billionaires is said to be 735.

Housing costs are also skewed by the many small towns across the country with dramatically falling population over the last 40 years as manufacturing went overseas. With half the population left in a town, there's no market for real estate.

Also, I believe that income figures don't take into account that 1) the death of the private pension means that workers are expected to save much more out of their flat incomes for retirement. (Something that often cannot be done.) 2) Certain taxes disproportionately affecting working people have increased while taxes on high incomes have gone down. FICA tax was 4.8% in 1970 compared with 7.65% now. In South Carolina, the sales tax was 4% in 1970. Now it is as much as 8% (10% for a meal in a restaurant) in most counties. At least it's only 1% on groceries.

Finally, while we may be near 1970 income levels now, for most of the intervening years we've been well below them.

Agree 100%. Thanks.

I think that one key (the key?) is that all goods are not valued equally by people.

The CPI assigns value based on the amount we purchase, but it doesnt know or care if people value health care spending differently than TV spending.

The article makes this point very directly. Kevin tries to gloss over it, but its little comfort to someone struggling to pay rent that they can afford more T-shirts and higher quality electronics.

Kevin seems to have missed the point of the argument. Better graphics and camera stats on my phone is a quality of life improvement....but it may not be an even trade with having to face the housing, education and health care situations in the US.

"I can't afford to get dialysis or have my cancer treated, but I'll be able to surround myself with multiple discount TVs until I die!"

Ugh, Some people really do know the price of everything and the value of nothing.

👍👍👍👍👍

This is a joke. I would like to see Kevin get someone who makes $45K a year attempt to go to a bank to get a loan to buy a house anywhere in the US. They'd be laughed out of the bank in shame. Try to raise just a single kid on $45K much less save for his/her education. At that wage you wouldn't be able to afford to retire at any age for yourself, much less support a spouse on a pension.

Most American families haven't been able to get by on a single income in decades. It's not a new phenomenon, and the issues predate the widespread use of the Internet and the ubiquitousness of the mobile phone.

"expenses have gone up in some important categories: rent, health care, education, and so forth. True enough. But expenses have also gone down for things like food, clothing, and TVs. It's about a wash in the end."

How on Earth is this considered "a wash". The rate at which rent, healthcare, education, and so forth have gone up, is several orders of magnitude higher than the rate at which thinks like food, clothing, and electronics have gone down. Not to mention, that everything that has gone up, are things that you can't simply decide not to get without it severely affecting your life, and in the case of healthcare, flat out ending it.

"Another possibility is that we really do have less money for common goods because we spend a lot of it on stuff we didn't even have half a century ago: computers, videogames, the internet, cell phones, and so forth. We can argue all day long about whether all this new stuff really improves our standard of living"

Never mind standard of living, except for video games, computers, internet, and cell phones are pretty much a basic necessity to function in today's society, including for a whole range of jobs, or to even get a job. These things are pretty much a basic necessity in today's world.

So much has changed, it's hard to do any kind of comparison. Sure, food has become less expensive, but the difference between the cost of restaurant food and home-made food has gotten much larger. That means it's harder to save money on housing by only renting a single room, or - as in Victorian London - just a spot where you can lean against a rope all night. Even in the 1950s my grandparents could rent out rooms with no kitchen access, because between factory cafeterias and cheap diners, their roomers actually saved money by just renting a bedroom and "eating out" every day.

We've also continued to become more and more urban. That's why so many people struggle to pay rent or buy a home - they have to live at least somewhat close to where the jobs are, and the jobs are almost all in cities. Plus, those cities are even more car-dependent than they were in the mid-20th century.

The things that have really fallen in price are the things we don't buy that often - furniture, clothing, and appliances. The one exception is cars. They are a lot more expensive then they used to be. Sure, they have more features, but you can't actually buy something that is equivalent to a 1970s vehicle. A family in America pretty much needs at least 1 car (probably 2) to survive, and that car is going to cost them more.

One thing that would be interesting to look at is the differences between spending in rich nations. In the U.K., for example, you don't have the same education and healthcare expenses that you have in the U.S., but housing seems even more expensive there.

The switcheroo is not so much in the 'rate' as it is in the 'amount'. No one says -- to give a hypothetical example -- that since the rate of clothing price increases is half the rate of inflation and housing price increases are twice the rate of inflation that it all comes out as a wash.

Another half-assed Kevin post which only looks at one side of the equation, sees little to no change in it and assumes that the whole equation still remains true.

If income remained roughly the same, but living expenses have gone up, then "income equals or exceeds living expenses" will no longer necessarily be true. This is true whether you allow "living expenses" to incorporate modern-day advancements like "medical treatment," "indoor plumbing," etc., or whether you simply hold "living expenses" constant to include only "what humans need to not die" like food, water, shelter, and heat/clothing. (FYI Kevin: things that have increased in price like "rent, health care, education" vary a lot by geographic location, much more so than "food, clothing, and TVs" which have decreased in price but generally don't vary by more than 5-10% across the country, particularly as Amazon has standardized pricing for them. If your local store is asking too much, you'll simply order them online and have them delivered for free... but you can't do that with landlords or hospitals.)

Almost the entire world has seen personal income go up or remain constant over the same time period Kevin used, and yet lots of places experience lots of people struggling to survive from day to day. This is obvious to anyone with functioning eyes. Proving that income didn't go down doesn't prove that everyone has what they need to survive.

I think it's worth repeating a point that was made previously, because - for comparisons across decades, not just a year or two - the adjustment that is made in the CPI for **quality** becomes very important.

Let's say that someone earning (say, a median) $10,000 per year, back when, might have been able to purchase an average car for $4,000 - 40% of their annual salary. And let's say that the average quality of a car is now twice what it was back then.

Today, a $40,000 annual salary would (comparably) allow $16,000 for a new car - a car that is far less fuel-efficient, lasts far less and needs far more repairs, is much less comfortable and much less safe. Unfortunately - the point - is that a consumer **can't buy a $16,000 new car today** - at least not one that holds a family of four. So yes, if they buy a $32,000 new car, they're paying twice as much, but for twice as good a car.

But, of course, the $40,000 per year family can't afford to pay $32,000 for a new car.

The same is even more true of personal computers and television sets - you can't buy (today) the equivalent (quality-wise) of (say) their 1995 counterparts. So the lowest-cost 2023 versions take a **proportionately** larger chunk of one's budget

I suspect that Kevin is personally comfortable in ways that many of his readers are not, and maybe misapprehends some stuff that's not part of the inflation-adjusted time series. All of the healthcare benefits that would have been part of Family Guy's compensation back in the '80s, that are now wrapped up in a high-deductible HMO. The 40 years worth of college tuition inflating at 2-3x the rate of the rest of the economy (I'm pretty sure Kevin never had to plan for putting a kid through college). The fact, to live where there are jobs, buying the kind of house that Dad bought back in the 1970s is not an option.

Families today absolutely do not have the security on 2 incomes that our parents had on one, back in the glorious days.

Kevin should go visit the Tenement Museum in NYC. You can walk through actual 2-to-3 room apartments, and then hear the docent tell you "this unit held a family of 9" or whatever.

Today, of course, the City would never allow a landlord to legally offer such a unit to a family of 9 or even a family of just 3. The docents will tell you stories about diseases running rampant, about the horrors of sanitation in the backyard where 4 or more families of 8-9 each all used the same outhouse, the dangers of one person leaving a fire unattended that put all 36 people in the building out on the street with nothing but whatever they managed to grab in the chaos, etc. But of course, that's how families made 1 or 2 adult incomes (plus quite a few child labor incomes) "work" back in the day.

It's a *GOOD* thing that we don't allow the free market to legally provide such housing to families today. But in turn, this means that families today need more income on a per person basis than they did in the pre-World War II era.

And before someone volunteers "but a 24yo Tiktokker posts all the time about her $4000/mo. micro-apartment" - that's not the same thing. Kevin is arguing that families shouldn't need more money than they did in the past to live, and I (and others here) are saying "yes they fcking do." Child Protective Services today generally frowns on lots of children crammed into spaces like the ones that single adults will post about on social media. (Also, most of those 24yos will eventually graduate into larger accommodations as they move up in their company, find roommates to split bills, etc. There are very few single adults living in micro-apartments for decades on end as their permanent housing solution.)

The comparison is to 1960-1980, not 1910. Running water and indoor plumbing were normal in median housing by that point.

That might have been true in 1900, but by 1950 things were quite different. The subways meant you could live farther away from your job for a dime a day carfare. Those old law tenements were illegal, but there was lots of much better housing available.

Housing isn't expensive because there are minimum standards. Most people know there are two kinds of housing. There's the rotting stuff in sketchy neighborhoods and there's the stuff where you can sleep safely at night. The latter is more expensive than the former, but the former is still expensive. You'd expect a big discount for living in dangerous area, but that isn't the reality. Too many people have been priced out of safe neighborhoods. In theory, the city could enforce the housing code, but, in practice, the landlords all know how to delay enforcement.

Overcrowded, dangerous housing still exists, and it's usually rented by illegal immigrants. Maybe they'll open a new museum in another 50 years.

The "How happy are you" poll question seems to be something of a dud. For whatever reason most people say they are happy. Maybe they think it would be a character fault if they weren't. It's not likely that real average happiness stayed the same through recessions with unemployment over 10%. Polls show several things which people are pessimistic about now, including the economy. To find out how satisfied people are probably requires more sophisticated questions.

As some others point out, we still have poverty. From the end of WW II up to about 1973 especially there was reason to think that poverty could be eliminated. The War on Poverty in the Johnson administration was supposed to winnable - the American economy was actually raising lower income people up at that time. Wages had kept up with GDP/cap in all American history until 1973. Welfare was only supposed to be temporary. But then real wages actually fell during the inflation and "Morning in America" and still aren't rising as fast as GDP/cap or productivity. It wasn't the government that failed - private industry quit raising pay at the lower end of the income spectrum. Or actually the government became more conservative and shifted to policies that allowed the private economy to increase inequality.

So we still have poverty and real wages have been flat. Even if satisfaction has not gone down, is that a good thing? Why shouldn't it go up? Why haven't we been pulling people out of poverty and into the middle class? Why should half the country be living in 1973?

That's not a very good analysis. If you look at the number of hours at the median wage it takes to buy a median house, it went up from about 600 from the 1950s and into the 1970s. It settled between 800 and 1000. That means that if you have a typical work year of about 1800-2000 hours, you could afford to buy a home until the late 1970s, but since then you either had to make more money or work more hours or spend more than 1/3 of your earnings on housing. Rental prices have also risen because their owners have to recover their cost, so renting isn't a magic solution.

This was a phase change that hasn't been undone. Wages have been stagnant, but housing prices have continued to rise, particularly in areas where jobs that might let one afford to buy a house are being created. This phase change corresponds with the adoption of neoliberal policies and NIMBYism as suburbs were infilled. It also lines up with the rising percentage of working mothers that led to the child daycare sex abuse witch hunts and later ended the era of free range kids.

A lot of people make this how-bad-can-it-be argument, almost always from the point of an above median job and often having entered the housing market a long time ago. Housing takes up more than 1/3 of income for everyone making less than $70K, so that's the bottom 50% of all households.

This phase change corresponds with the adoption of neoliberal policies and NIMBYism as suburbs were infilled

Neoliberalism is literally the exact opposite of Nimbyism, at least when it comes to the housing sector. The most neoliberal position on housing is: no restrictions whatsoever on housing construction provided it's safe—pure property rights and an ironclad "shall issue" legal standard with respect to building permits.

The lifetime of those objects we buy and use - shoes, shirts, etc - dropping is not something you can fix by 'being careful'. You still end up buying a certain amount of crap.

Rent is due every month. Purchasing things like clothing and TVs can be deferred or forsaken.

It is hard to believe clothing and TVs balances rent and health care. You buy a TV, what, once every 15 years? You pay rent monthly, and all you need is one uninsured trip to the doctor to get wiped out. An office visit for my primary care lists at $700. Insurance negotiates that down a LOT, but if you are uninsured, it is $700 real dollars to you.

And if the cost of food has gone down, you'll have to prove that. Around here, it has been skyrocketing.

I'll post this one more time, Elizabeth Warren's prescient (because well-reesearched) graduate council lecture The Coming Collapse of the Middle Class (from 2008)

"Gee, this doesn't look like a wash; how many TVs do you own anyway"

It's not a wash.

If housing costs have gone up 10x from 400/month to 4000 a month; and food has gone down to 1/10th from 500/month to 50/month there's no way to keep up.

There is a floor to how much consumer products can go down and there appears to be no ceiling on how much housing, education and healthcare can go up.

Your missing a big theory as to why people are dissatisfied. We were supposed to have flying cars by now. We were supposed to have fusion, and live for 120 years. We were promised technological change and a green, clean, chrome future, and got ... Climate Change.