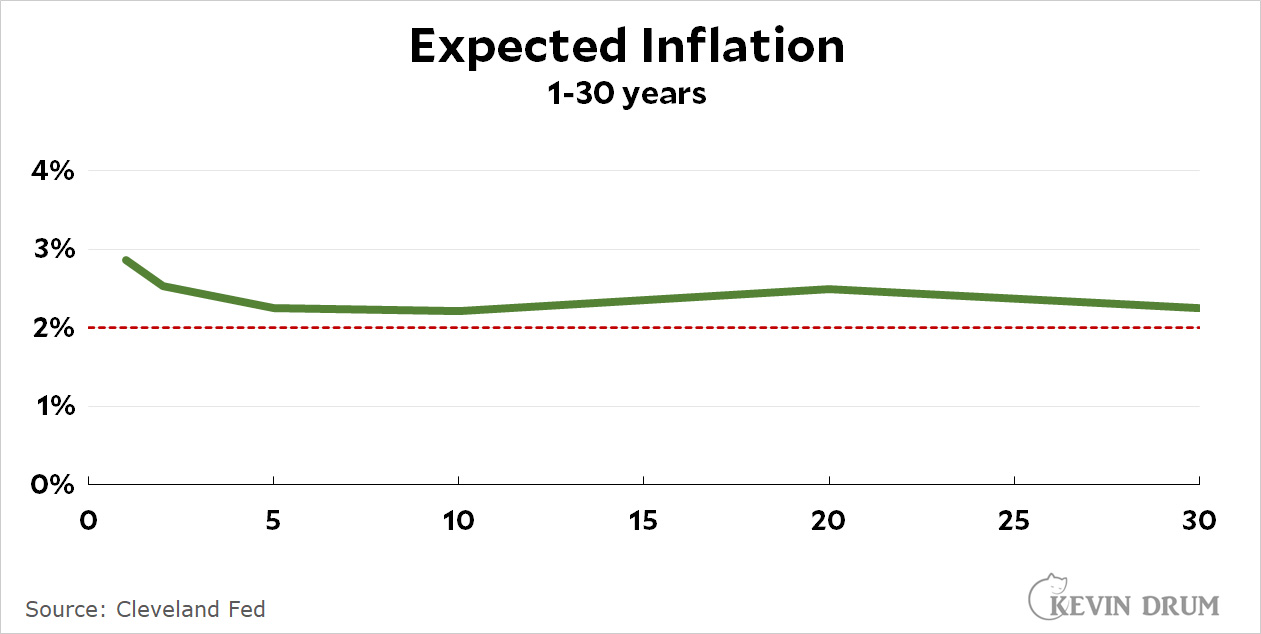

Just for the lulz, here are inflation expectations over the next 30 years as estimated by the Cleveland Fed:

Everything is fine. There is absolutely nothing worrisome in any of this.

Everything is fine. There is absolutely nothing worrisome in any of this.

FWIW, I think near-term inflation will be lower than this. Rates are already pretty low right now and are going to get lower as the official series catches up to housing prices. Underlying pressures are also going to continue easing, and then, in a few months, we're going to run into the buzzsaw of last year's interest rate hikes. I wouldn't be surprised if CPI is hovering around 1% during the second half of 2023.

The markets are looking for inflation to be a little over 2.2% for the next 5 and 10 years.

My guess is that we will get down below 2% sometime soon but I doubt we will get there by the end of the year.

So my 100% guaranteed to be true prediction is:

At least one of us will be wrong.

Start making more money weekly. This is valuable part time work for everyone. The best part ,work from the comfort of your house and get paid from $10k-$20k each week . Start today and have your first cash at the end of this week.

Visit this article for more details.. http://incomebyus.blogspot.com/

Over the next 30 years,

Climate change will destroy us, the singularity will save us, no one will care about the flying car when it finally gets here because no one will leave the house, because of the singularity and climate change, brain implants will quickly become passe because whatever would be plugged in there won't want to be, and there will be serious interest in replacing pregnancy with 3D printing, which will be indistinguishable with the real thing.

It will be paradise.

And I will be able to edit comments to clean up my idle thought. s. thoughts.

Now, that's just crazy talk! Editing comments??

from their website:

"How we get our estimates: Our estimates are calculated with a model that uses Treasury yields, inflation data, inflation swaps, and survey-based measures of inflation expectations."

https://www.clevelandfed.org/indicators-and-data/inflation-expectations

So not modeling in Fed rates...

Why is there a little bump at 20 years?

Projected peak entitlement costs? The youngest baby boomers will be near 80 by then, and our society will have seen a giant growth of people in their 80s (and especially in their 90s and over 100s). Which translates not only into a lot of retirement checks, but staggering healthcare costs. Needless to say there will be many millions of GenXers collecting elderly benefits by then, too. Perhaps after the 20 year mark, the accelerated die-off of boomers + the arrival of peak earnings for millennials suggests the actuarial forecast improves...

Should add: we'd likely be seeing a pretty nice growth in the workforce starting about 20 years from now, because millennials are the most numerous generation (they're essentially echo-boomers) and their children, in turn, will likewise constitute a big cohort. So starting in the early 2040s (ie, 20 years from now) it seems possible the country's dependency ratio—which is the inverse of the employed ratio—will begin to decline. And that makes entitlements easier to pay for and juices production relative to consumption. Which is consistent with lower interest rates.

That's when I plan to have enough saved to buy a new car.

So - don't buy any more iBonds?

Serious question.

A reversion to long-term trends. Unsurprising.

Krugman's been banging on this drum for a while now. And I expect he's right. Tax policies, Fed chiefs and various other influences come and go. But demographic force is unrelenting and powerful. And aging countries tend to suffer from too little, not too much, demand.

Millennials are an even bigger demographic group than the baby boomers. And if we get past our anti-immigration freak out that will bring in younger workers too.