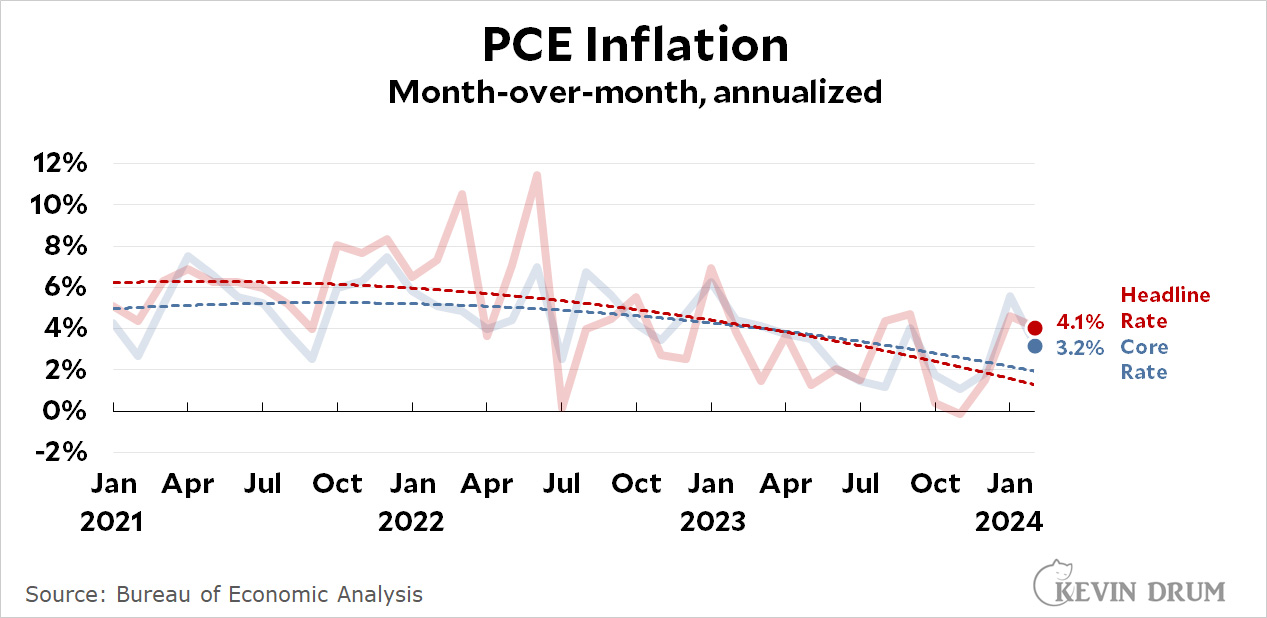

After last month's spike, PCE inflation came down in February:

Headline PCE was down only a bit, but core PCE—which the Fed focuses on—was down substantially to 3.2%. This is pretty good news since it suggests that last month's spike was probably pretty transitory.

Headline PCE was down only a bit, but core PCE—which the Fed focuses on—was down substantially to 3.2%. This is pretty good news since it suggests that last month's spike was probably pretty transitory.

On a more conventional year-over-year basis, headline PCE was 2.5% and core PCE was 2.8%.

NOTE: Oddly, inflation in goods was up 6.1% on an annualized basis, a big spike from last month. This was largely because of gasoline prices. Conversely inflation in services was up only 3.1%, a big decrease since last month. Go figure.

Politically, Biden wants a Fed rate reduction. I doubt this report is sufficient for a near term (next three months) rate cut.

Politically what is best is inflation moderation and decline rather than rate cut.

Price moderation continued over the next six months allows inflationary pain to fade away in memories - precisely the ideal vote-timing.

(and the path persons as myself forecast since early 2023)

Lounsbury - "Politically what is best is inflation moderation and decline rather than rate cut."

Respectfully disagree. Biden's polling on the economy, I think/hope, would be enhanced if 1) home sale volume increased, 2) interest rates on consumer debt decreased 3) access to credit increased. A rate cut is a necessary event, I think, for the aforementioned...

I think the latest pronouncements from the Fed say that rate cuts are coming this year. I would bet the first cut will be within the next three months. Three percent inflation is not scary enough to derail it.

Who could have known that the inflation numbers based on the PCE would come in somewhat below those based on the CPI? Only those who look at the record of both and know that there is no new data in the PCE, although it is released a couple of weeks after the CPI.

https://fred.stlouisfed.org/graph/fredgraph.png?g=1je6P

The PCE uses the same data only applies a slightly different formula. The PCE release is really not major "news" so what actual use is the PCE? Does it tell us anything that the CPI doesn't? Certainly nothing about the trend of inflation - it is not any more useful in predicting inflation than the CPI and it comes out later (why is this anyway - does it really take longer to compute?). Kevin has claimed that the PCE is the "real" measure of inflation, but both measures are somewhat arbitrary with respect to quality of life. If you want to evaluate the growth of inequality by comparing wages with productivity (which is a function of GDP, per worker hour or per capita) it doesn't matter which one you use if you use the inflation-adjusted numbers (or you could just use the raw numbers).

Preference for the PCE may involve ulterior motives. Does the Fed prefer it because it makes historic inflation look lower? Some people definitely prefer it because Social Security benefits would be lower if adjusted by the PCE rather than the CPI, as would any wage contracts that involve inflation adjustment. Are uppity SS retirees and wage-earners really getting too much of the economic pie?

Overall the PCE is a distraction that should be dispensed with.

I wouldn't say that the data sources for the PCE index and the CPI are identical. The BEA has put out a paper comparing the two: https://apps.bea.gov/scb/pdf/2007/11%20November/1107_cpipce.pdf

The first few paragraphs of that paper summarize the differences. Not only is there a formula difference, which you have mentioned, there are weighting differences, coverage differences, and other differences. The weighting schemes used by the BLS and BEA are based on different data (household survey versus business survey). The coverage differences are about the two agencies making different choices about what goods and services they include in their indexes.

The paper's analysis concludes that the formula difference only accounts for half of the difference between the rates of change seen in the CPI and PCE indexes.

Follow the price of beef, beer and gasoline to see how the electorate if feeling.