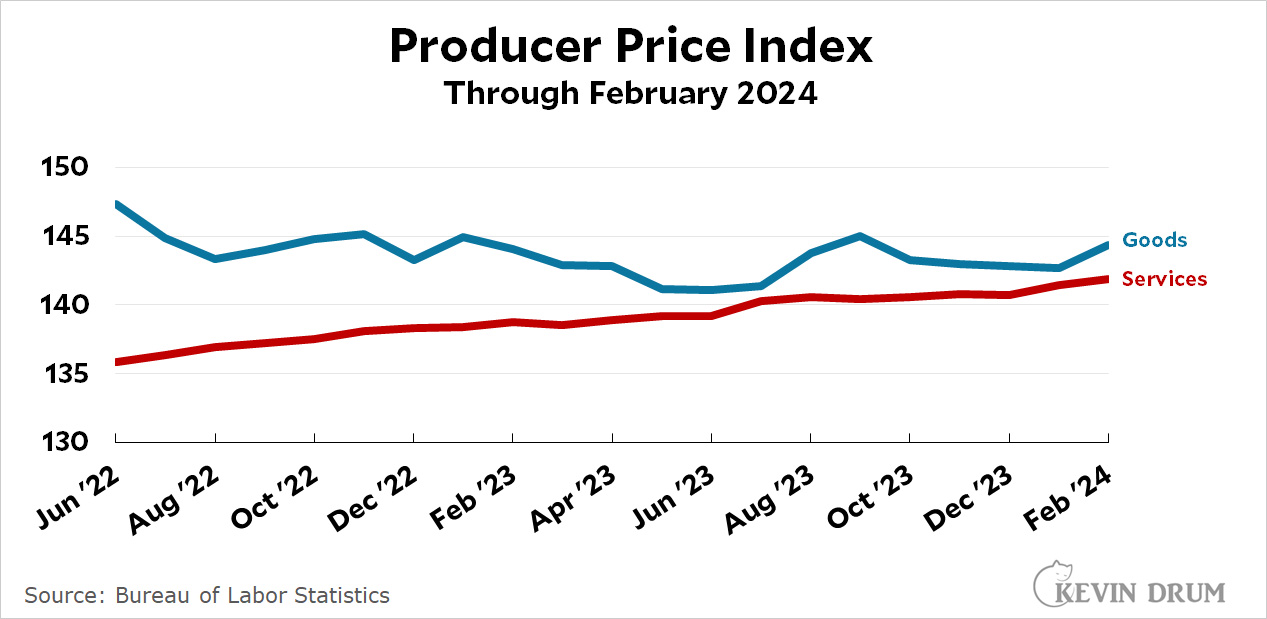

More bad news on the inflation front. The Producer Price Index, which measures wholesale prices, surged in February. Goods remain below their peak prices of 2022 but spiked up 15.5% between January and February on an annualized basis. Services continued their steady rise and were up 3.6%.

PPI tends to be volatile, and two-thirds of the spike in goods was due to energy. Still, since PPI increases tend to eventually feed through into consumer goods, this is not good news.

PPI tends to be volatile, and two-thirds of the spike in goods was due to energy. Still, since PPI increases tend to eventually feed through into consumer goods, this is not good news.

Inflation or unemployment. Pick one.

Says the Populists world round as they drive into Argentine and Turkish conditions.

Lots of variability. Its one month. Goods prices look fairly flat over the last 18'ish months.

/shrug

Look at the record of month/month increases in the PPI:

https://fred.stlouisfed.org/series/PPIACO

It increased 18.2% on an annual basis in August 2023. Did that set off a huge spike of inflation? These month/month numbers are noisy and don't have much significance in themselves. There were definite reasons for the rise of inflation in 2021, shortages of various kinds which were not likely to disappear in a month. Kevin actually did a good job of identifying those at the time. If you can see similar things now, then you can expect rising inflation. Oil price certainly goes up and down, but big movements such as those at the beginning of the pandemic and the Ukraine invasion usually involve major international events. What would those events be now?

Just looking at month/month changes is not predictive.

Wow! that was transitory

PPI appears to be between 1% and 2% over the last 18+ months.....so yeah, it actually does look transitory.

The response to inflation has been dogmatic. Perhaps 'textbook" reads less pejorative than "dogmatic." Not convinced this has been right or wrong given the point of high rates is to slow the economy and employment. Both rose while inflation moderated, suggesting this round was caused by pent up demand and supply line backups.

Can you opine on the effects of the large gap between interest rates and inflation? I suspect high rates currently target long term growth rather than immediate inflationary pressures. They must have the deleterious effects of raising both the deficit and housing prices, which I understand is a major component of inflationary measures. Would enjoy your analysis.

Zoom out five years.