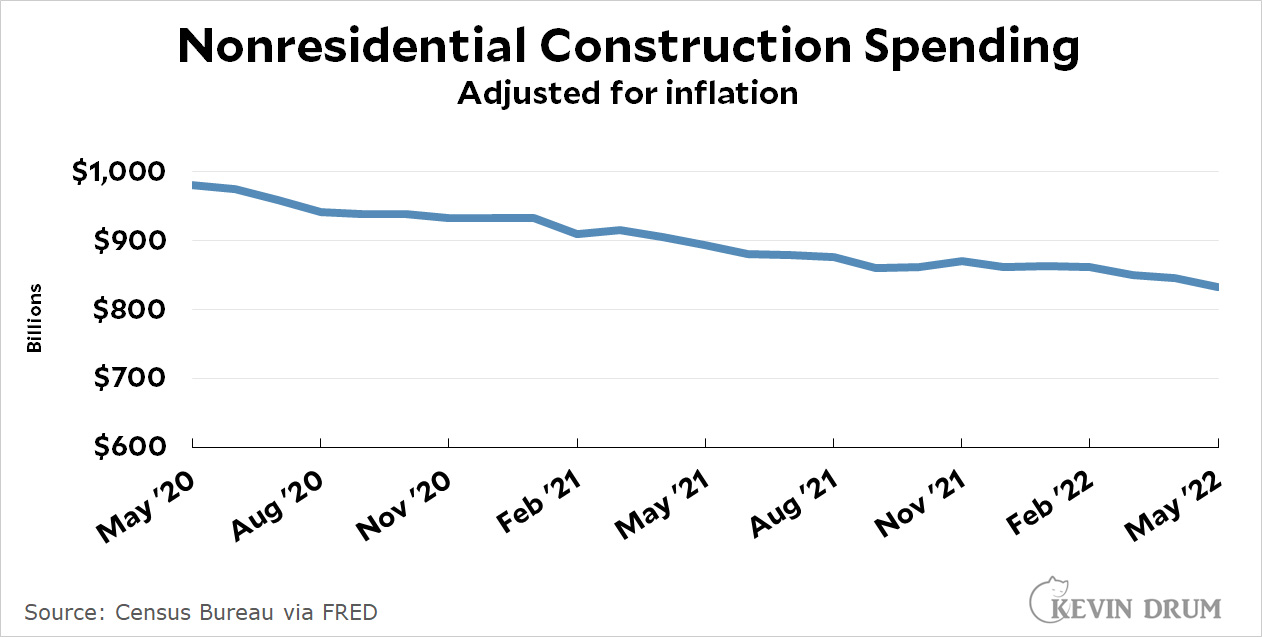

Today the Census Bureau released construction spending numbers for May. As usual for the past two years, nonresidential construction spending was down:

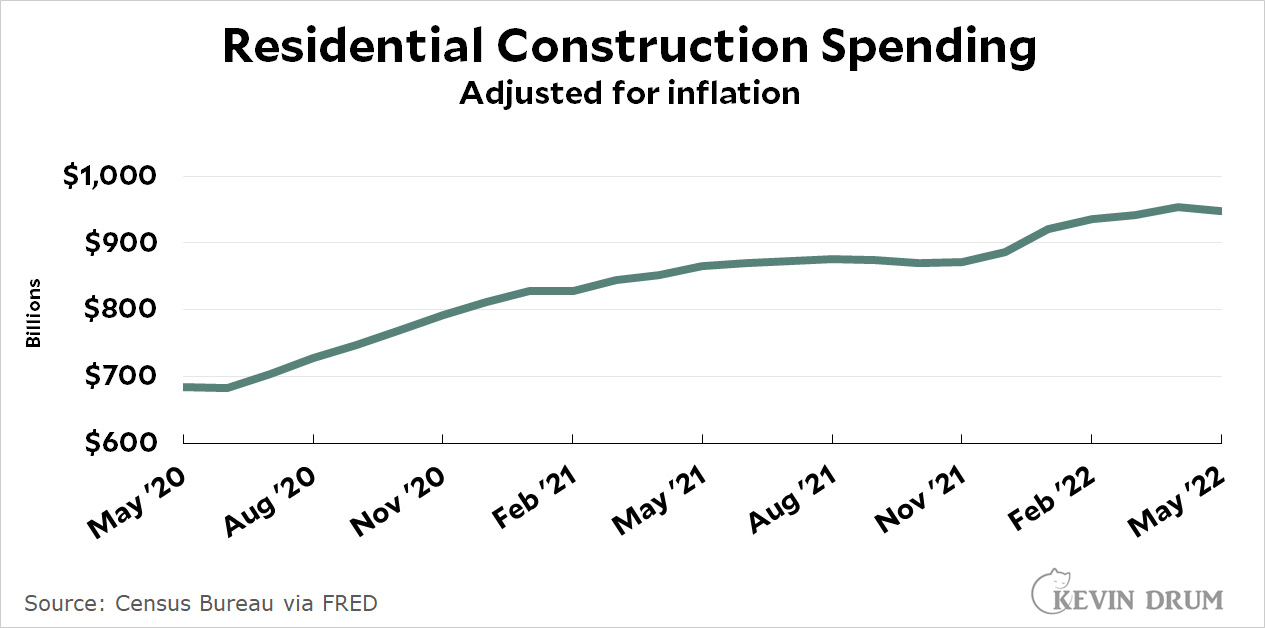

More interestingly, residential construction spending is down for the first time since mid-2020:

More interestingly, residential construction spending is down for the first time since mid-2020:

I imagine this is just the start of a longer turndown in housing. But it probably won't be severe. I hope.

I imagine this is just the start of a longer turndown in housing. But it probably won't be severe. I hope.

Or it's just leveling off.

Or, given that that's adjusted for inflation, it's just that inflation in construction was much higher than rest-of-inflation in 2020, and now it's just that it's only a little bit lower. In fact, looking at the chart with that perspective and knowing when inflation began to rise - residential construction spending was still rising even as inflation was starting to go up earlier this spring, and overall inflation has only just now overtaken it in the last couple of months.

Of course your wrong. Energy inflation went up. Adjusting by reducing that gives you a different picture.

I urge you to zoom your chart out to 2002. There are bigger narratives at work.

Commercial spending is dramatically down since peak Jan 2020, suggesting that offices remain in hybrid work mode even as they try to increase employees. This is fascinating stuff.

Also, residential spending has been on a torrid pace since the 2020 shutdown dip.

Wrong on all accounts. There was a bubble in Commercial real estate before 2020 that burst. Nothing more or less.

One of the things that interests me is that if residential construction slows down how bad will the affects be since we are still showing signs of labor shortages?

Will it just be that factories that supply construction and home related products will hum at full capacity again? Or will it get bad enough to cause slowdowns large enough to cause layoffs?

There are very big differences between the "impending" slowdown of this year when compared to slowdowns of years past

Supply chain issues starting to work themselves out, but may have issues with skilled worker shortages. Massive Covid disruptions may be a thing of the past--but local waves will cause spot problems.

Brookings has a report on the new suburbanization--that shows in some places older cities are bouncing back. Now that was done in May using older data...things have changed since then:

https://www.brookings.edu/blog/up-front/2022/05/23/did-the-pandemic-advance-new-suburbanization/

However, it highlights the fact that local markets vary.

We're also having increasingly expensive "natural" disasters. Wildfires in suburbs., floods or droughts out west, hurricanes in the east, etc. That only destroys a small percentage of homes nationwide, but locally can have a big impact. Even if a home is not destroyed, it will still be damaged--and in need of the same craftsmen who build homes.

https://nationalmortgageprofessional.com/news/1-every-10-homes-was-impacted-natural-disasters-2021

I agree with golack - construction is very much a factor of local conditions. The real estate market in my Northern VA zip code is still very hot far more buyers than sellers. Also still white hot is the sale of distressed properties to flippers - a house down the street from me was owned by the same family for over 50 years and apparently in even worse condition on the inside than the outside. I wouldn't be shocked if the split foyer house is torn down and a larger house put on the lot even though that's only happened on one other lot in my neighborhood, same outdated split foyer model. The house had an asking price of $650,000 but likely sold in the 700,000s.