The Wall Street Journal warns us yet again about the woes of retailers:

From Walmart Inc. to Nordstrom Inc., retailers have a glut of inventory and are discounting items to clear out space for holiday goods. Many have already lowered profit expectations for the year and are working to cut costs as consumers are pulling back spending in categories such as apparel and home goods ahead of the key year-end shopping season.

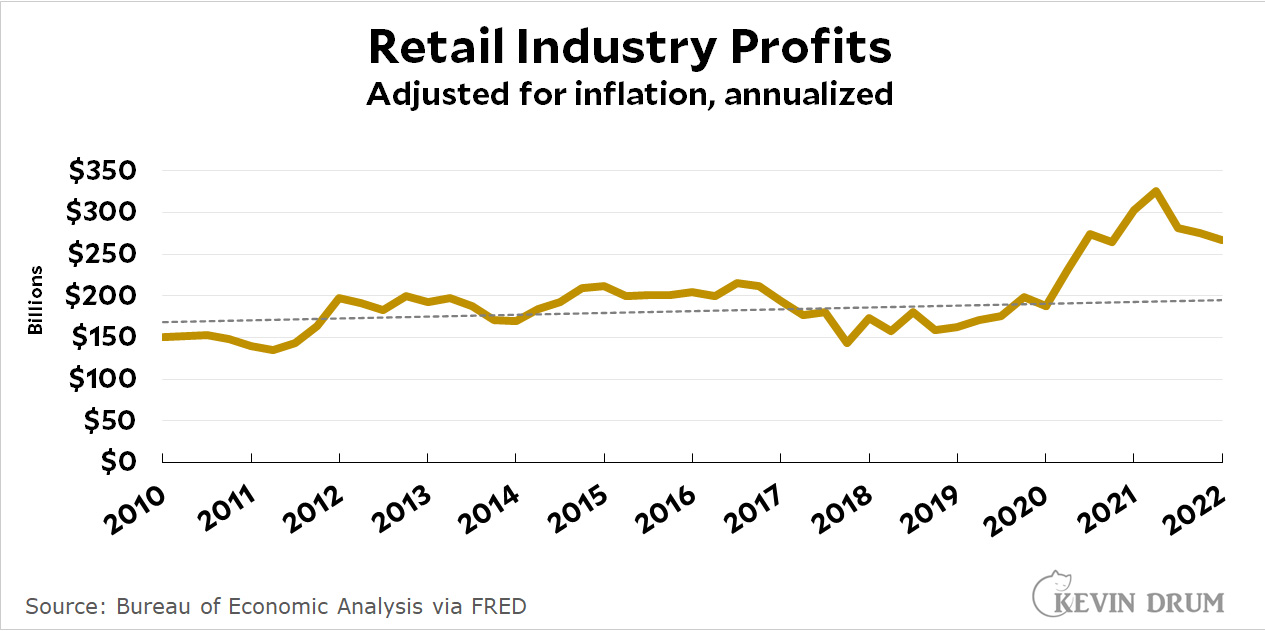

Maybe so, but before you start feeling too sorry for these guys you should take a look at the big picture:

Retail profits have fallen for a couple of quarters in a row, but they're still well above their trend growth from before the pandemic. Nothing unexpected is happening here.

Retail profits have fallen for a couple of quarters in a row, but they're still well above their trend growth from before the pandemic. Nothing unexpected is happening here.

At least, it's not unexpected for those of us who don't think the pandemic changed the course of human history and forever altered human nature. Which would be me. This is why I figure that returning to trend should be the default expectation for most things.

And what are their profit margins? That’s the real measure of how well they are or are not doing.

How they are doing is depended upon profit margins? Or was it the inventory mistakes they made that may or may not have caused profit margins to shrink?

I kinda look at it from this standpoint. Leisure activities such as tourism took a big hit during the pandemic. This means the peripheral sales also took a hit. No more travel to Barbados? Thats two or three or more LESS new bathing suits to buy

When the pandemic started easing off these same retailers tried to catch up with inventories when the supply chains just weren't staffed up enough to get the supplies to them and when they COULD get supplies they had a hard time getting help to put those new products on the shelf.

Profit margins are very important but I do think it's too early to use those margins - which are based on pre-pandemic history- as a means to judge how good or bad they are doing.

We are just now starting to realize the fall out from COVID

Depended, no. Measured, yes.

I may disagree with Kevin on a few things, but I do love it when he shows how businesses and those who report on them regularly say misleading things. I must say, this report is nothing new. Every time there is a big jump in profits it is followed by, "Oh my god! Profits are only up 1% or are down 3%! We are making a lot more money then we predicted just months ago, but we now we have to cut expenses and lay people off." Happens again and again. [Of course they don't have to do that, but I'm in the "CEO's as a group aren't that bright" contingent.]

As I keep saying, economies do not follow smooth linear or simply-curved paths. Economies tend to be cyclic and if not damped by strict regulation there will be booms and busts - there always have been. Yes, there will be a return to trend, if trend is the average or smoothed path, but if the economy is currently above that path there will be a tendency to plunge below that path when something goes wrong. This does not mean than anyone, whether economists or reporters, can accurately predict when a downturn will occur, or if a downturn is underway, how deep it will be. When things are going well people get overoptimistic and expand too much, in this case possibly accumulating too much inventory. That by itself would probably not cause a recession, but there are always many things that could go wrong - and sometimes they do go wrong.