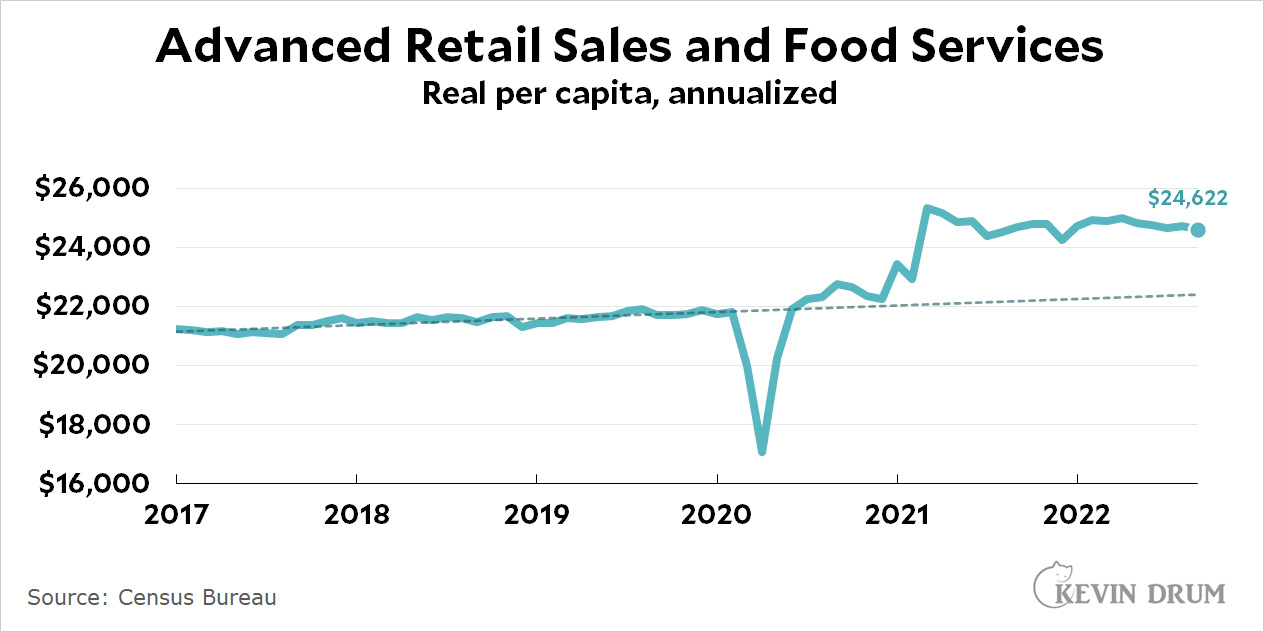

Advance retail sales figures for September are out today. And just to be different, I'm reporting them adjusted for both inflation and population growth, annualized into a full-year spending figure.

Ordinary newspapers will tell you that retail sales were flat compared to last month, but only this blog will take the next step and adjust for inflation and population growth. When you do that, annualized retail sales were down from $24,725 to $24,622, a decrease of 0.42%. However, we're still spending about 10% more than we would have without the pandemic increase. And this is taking a toll:

Ordinary newspapers will tell you that retail sales were flat compared to last month, but only this blog will take the next step and adjust for inflation and population growth. When you do that, annualized retail sales were down from $24,725 to $24,622, a decrease of 0.42%. However, we're still spending about 10% more than we would have without the pandemic increase. And this is taking a toll:

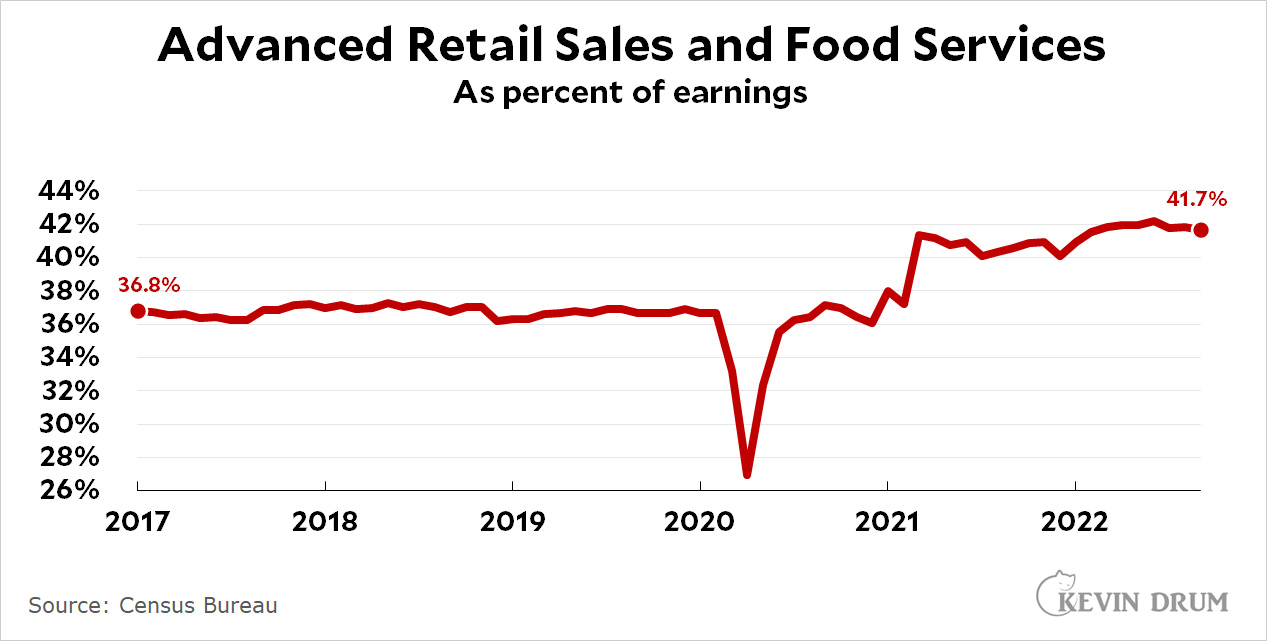

Ideally you'd like to compare household retail sales to household income, but this is the best we can do right now and it's telling in its own right. Five years ago, the average earner spent about 37% of their income on retail purchases. Today it's 42%. That extra 5% has to be coming out of something but I'm not sure what. Certainly not rent or housing, which are also up. Maybe savings? Or debt?

Ideally you'd like to compare household retail sales to household income, but this is the best we can do right now and it's telling in its own right. Five years ago, the average earner spent about 37% of their income on retail purchases. Today it's 42%. That extra 5% has to be coming out of something but I'm not sure what. Certainly not rent or housing, which are also up. Maybe savings? Or debt?

The various packages sending money to people meant there we were saving more as well as paying down debt (see non-housing debt). We're also working through pent up demand. This will come down once debt levels are back to pre-pandemic levels-which we're probably passing now...

https://www.newyorkfed.org/microeconomics/hhdc

Note: I didn't see any comment saying the numbers are corrected for inflation.

In terms of pent-up-demand, and whether we are still working through it… Shouldn’t then the area above Kevin’s here-I-use-linear trendline in the first chart be no larger than the dip below it?

Yes.

Then you have things like travel shutting down, but people using a lot more take out and delivery services. The latter minimized the drop in the chart above overall, then travel kicked it big time and tourist and less travel areas saw a come back. Not to mention people meeting up with friends at local restaurants and the resumption of big weddings.

Imagine an alternate universe where retail prices were flat, but energy and auto costs skyrocketed.

If retail sales increase slightly, do we adjust these sales down because energy and auto prices were up? What does this adjustment statsistic tell us exactly? Are we more informed? How?

What if retail prices were flat, but energy and auto prices crater causing overall deflation. In this scenario, retail sales skyrocket due to the adjustment. But are we more informed about anything?

The BLS doesn't seem to have a "retail" category, but it does have commodities, durable and non-durable goods, and the CPI's for these things all seem to have shot up. You can poke around in the list of things that the BLS measures:

https://www.bls.gov/cpi/tables/relative-importance/2021.htm

(search for the CPI for these at FRED) and maybe some of them would be flat, but generally when energy goes up everything else does.

Thanks

Look at demand deposits:

https://fred.stlouisfed.org/series/WDDNS

and also M1 money supply. Apparently there is still a lot of money out there waiting to be spent. Don't know exactly who has this money.

All you damn fools spending money like drunken sailors on vacations and crap... (like telescopes!) are going to give the republicans control of congress. This is because the rest of your so called fellow citizens are complete fucking idiots like the war criminal austin and the reptilian salamanders. I'm going to rather enjoy watching you all suffer! You deserve your fate.

Of course, I'll be fine. I'm not a selfish SOB indulging conspicuous consumption like the rest of you idiots. Good grief.