According to the Wall Street Journal, retail sales were up 1% in June. This is, needless to say, incorrect. When you account for inflation retail sales were down -0.3% from May.

(As John Maynard Keynes sort of said, I can whine about correcting for inflation longer than you can stay sane listening to me. You should all just give in and do the right thing.)

Right. Anyway, this month I thought I'd present retail data in a new and exciting way. Here it is:

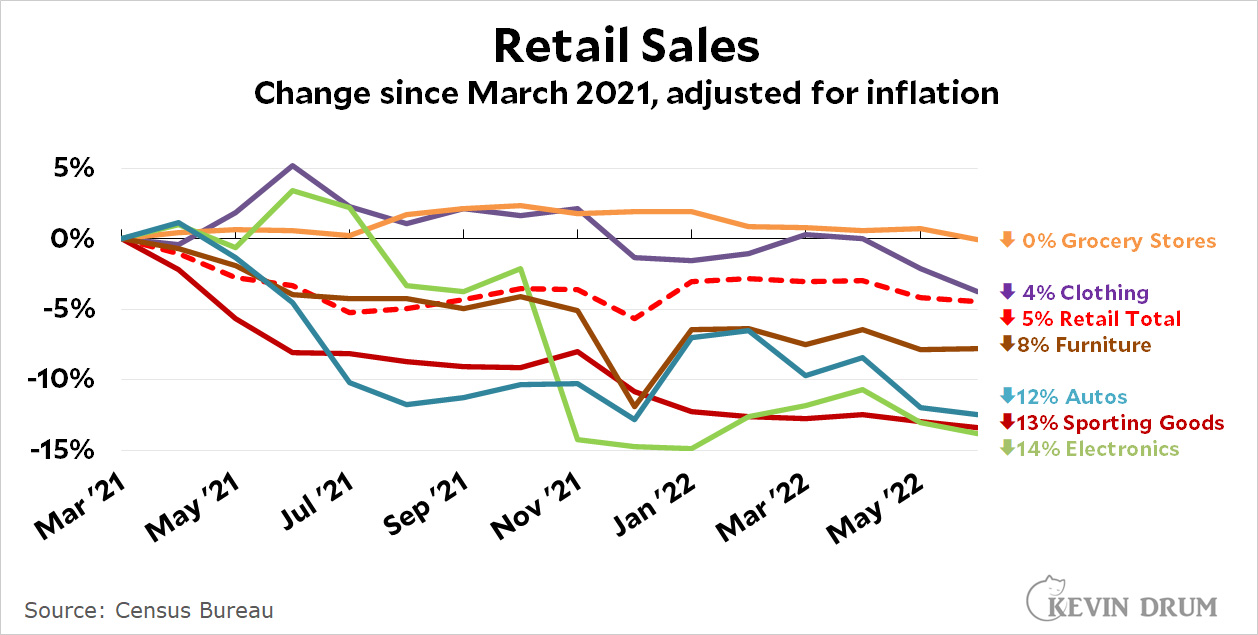

This chart starts with March 2021, when the stimulus bill passed and retail spending spiked upward. Since then, as you can see, spending has declined overall and in every single category.

This chart starts with March 2021, when the stimulus bill passed and retail spending spiked upward. Since then, as you can see, spending has declined overall and in every single category.

In other words, real consumer spending is declining in exactly same way as real wages. Neither spending nor wages are pushing on inflation. Despite this obvious evidence, there's frequently blithe talk about high savings rates and how people are still drawing down the money they got from the stimulus checks, but even a brief look tells you that isn't true:

Stimulus savings have long since been spent and overall personal savings is now a third less than it was before the pandemic. Calculated as a percentage of disposable income it's gone down about a quarter.

Stimulus savings have long since been spent and overall personal savings is now a third less than it was before the pandemic. Calculated as a percentage of disposable income it's gone down about a quarter.

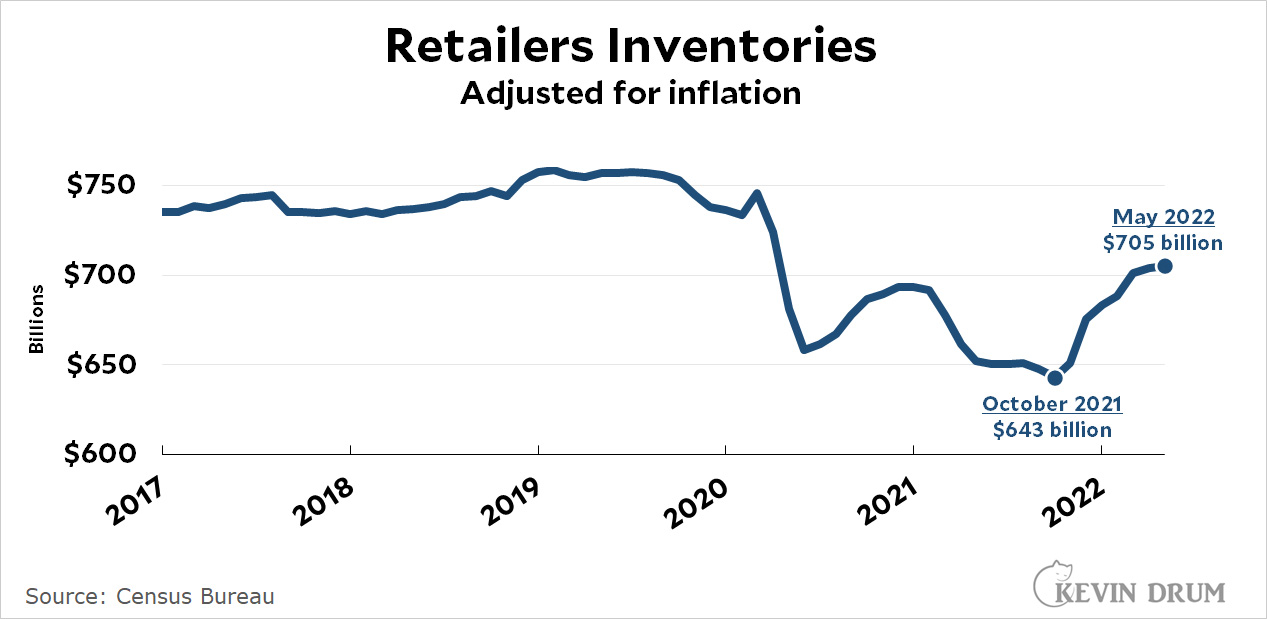

Wages are down. Savings are down. Spending is down. Total personal expenditures have been flat since reaching a peak last October. But retail inventories, which took a huge dive after the pandemic thanks to supply chain problems, have risen 10% from their low point. Warehouses are bulging:

Maybe I'm just an idiot, but for the life of me I can't figure out what's supposedly driving concerns about future inflation. Inventories are growing above the inflation rate while wages and spending are growing below the inflation rate. This ought to be a recipe for price levels to go down. What's going on?

Maybe I'm just an idiot, but for the life of me I can't figure out what's supposedly driving concerns about future inflation. Inventories are growing above the inflation rate while wages and spending are growing below the inflation rate. This ought to be a recipe for price levels to go down. What's going on?

I can't figure out what's supposedly driving concerns about future inflation.

From what I've read it's mostly concerns about a shortage of workers. Larry Summers calculates unemployment needs to go substantially higher to reduce upwards pressure on labor costs. Jerome Powell, I understand, merely think job openings need to be reduced. There are currently about double the number of openings as there are unemployed workers. Also, we're down about 2 million workers from where we'd be if Covid+Trump era policy changes hadn't drastically reduced the inflow of immigrant labor.

https://www.cnbc.com/2022/07/13/should-you-still-change-jobs-if-youre-worried-about-a-recession.html

This is right, I think. The media and our representatives haven't talked nearly enough about how Trump not only failed to do much about *illegal* immigration, but did successfully tank a lot of *legal* immigration as well, particularly by asylum seekers and refugees. On top of this, we have to remember that over 1 million people here have died of Covid over the past two years as well. Now about 75% of those deaths were among the elderly no longer in the workforce, but the other 25%, a quarter million people, were working age. Add all that up and, yep, we've got a pretty significant labor shortage to work through. The solution would be to announce that the State Dept is making 500,000 extra visas available each year for the next three years or something, but I don't think they want to deal with the utter meltdown Republicans would have over this in a midterm election year. Meanwhile, everyone will just keep grousing about why there are so few entry-level employees around these days...

"Now about 75% of those deaths were among the elderly no longer in the workforce, but the other 25%, a quarter million people, were working age."

You're right but I would argue of that 75 percent perhaps half of that still worked well into retirement. I don't think people realized until the pandemic hit how much having a cheap, elderly workforce filling in hours in service jobs was important to the overall running of the economy...until they were gone.

Kaleberg made some good points as well.

There are people who work through their 60s and even into their early 70s so they can get the Social Security maximum benefit. But how many are working into their 80s? The Covid death toll was heavily concentrated among the old-old and not the 60-is-the-new-40 demographic.

On the other hand, the Long Covid toll, which is likely higher than the death toll, has a much larger impact on working age people.

Nope, there was no reduction to immigrants. Idiot. It accelerated under Trump. Retirement drove the decline. Gen Jones said goodbye.

Nope, there was no reduction to immigrants.

Spades: this isn't up for debate. Don't they have Google in your corner of the Ozarks?

https://econofact.org/the-decline-in-u-s-net-migration

Nope, that isn't a real graph. That is made up.

Not only that, that migration number is of people processed. It doesn't speak to whether after processing they were deported or not. Based on Obama era higher deportation rates, the graph is further irrelevant. Like most Trump things, ignoring migrants creates a stat based lie. Ozarks??? You need your nostril ripped.

As you note, V/U = 2. Summers wants to attack the Beveridge Curve by pushing up employment while Powell sees it as lowering V, to get to an (assumed) efficient 1.

There are other issues at stake, though. As jte21 alludes to, there are structural changes to employment (labor mismatch) that can't be directly addressed by trying to lower V or raise U.

Larry Summers is a disinformation source. In the Intelligencer article linked by Honeyboy Wilson in this thread, he refers to “underlying rate of inflation at 9 percent”. The headline rate is 9%, not the core rate, which is 5.9%; there’s no such official figure for an ‘underlying rate’, but he wants you to think the core rate is that high. His advocacy of throwing people out of work to fight inflation is based on the Phillips ‘curve’, a relationship alleged to be seen in plots of inflation rate vs. unemployment rate. If you Google Phillips Curve, you will see a lot of theoretical curves. That’s because the actual data looks like a shotgun pattern: https://www.hussmanfunds.com/wmc/wmc110404.htm

Basing policy on noisy data like that is … questionable. But Larry Summers is absolutely convinced he is correct ….

"The analysis of Securities and Exchange Commission filings for 100 US corporations found net profits up by a median of 49%, and in one case by as much as 111,000%. Those increases came as companies saddled customers with higher prices and all but ten executed massive stock buyback programs or bumped dividends to enrich investors."

-- https://www.theguardian.com/business/2022/apr/27/inflation-corporate-america-increased-prices-profits

Bingo.

And what is the median/mean profit margin?

On an individual level energy and food will keep getting worse. On an economist level I assume the fix is in to crush the dems.

and energy and food pricing is mainly beyond the reach of the Fed--the war in Ukraine and bird flu main drivers there...

And yet gasoline prices are falling.

You're not an idiot. Maybe you're just being a bit naive or disingenuous.

Americans have been getting uppity.They've been able to pick and choose their jobs. They've been able to reclaim an hour or two a day by working at home. They've been able to push back against the relentless management pressures of the last four decades. Some have even formed unions.

Clearly, this cannot be allowed to continue, and the usual way of doing this is to have the Federal Reserve induce a massive recession that makes workers grateful for any paying job at all. So much for improving one's lot, work from home, backtalk and - shudder - unions. So, on goes the inflation drumbeat and soon enough the Federal Reserve will crush the economy.

This has happened EVERY time the economy has started to raise income for the bottom 20%, and every time wages snap back to their usual wretched modern level.

+1!

You left out the reanimation of the Austerity Now! movement so that they can lower teachers' salaries, stop feeding poor children, and close libraries.

Heh, they're still trembling with rage over what the working classes did to them in the 70's, namely robbing them of their naturally ordained wealth via inflation.

Of course. This is obvious, so obvious it doesn't need saying. Or rather, it shouldn't need saying. Unfortunately, it does 🙁

A dozen eggs and a gallon of milk both remain about $1 higher than a year ago.

for charts:

https://fred.stlouisfed.org/series/APU0000708111

and

https://fred.stlouisfed.org/series/APU0000709112

Bird flu still an issue, though no major cullings in the past month or so:

https://www.cdc.gov/flu/avianflu/data-map-commercial.html

IF this has passed, price of eggs will drop

The drought (and heat) is affecting milk production, and will be where for a while--even after supply chain issues work themselves out.

https://www.farmprogress.com/markets/drought-slows-dairy-production-feed-costs-rise

Once again, inflation is a rate of change not a level. Inflation stops when prices stop rising, even if they settle at a higher level than when they began to rise.

The latest I have seen from Larry Summers:

https://nymag.com/intelligencer/2022/07/larry-summers-on-the-likelihood-of-a-recession.html

Thanks for posting this.

No, May was revised up sharply. June was probably flat. If you use mean trimmed CPI vs exgas, it tells a more likely story. Industrial production slowed throughout the 2nd quarter because of chinko but that is over and the chip shortage is over.. Looks like July cpi could be negative.

“Maybe I'm just an idiot, but for the life of me I can't figure out what's supposedly driving concerns about future inflation.”

The run up to an election in which Republican CEOs can’t wait to get the Daddy Party back in control of nearly everything.

I’ll bet inflation falls as soon as the second week of November kicks in.

It's falling now. Patience bud.

When you adjust for inflation are you incorporating CPI, CPI core, PCE, PCE core, or trimmed mean PCE index? I imagine you used PCE core to your spending subcategory analysis, right?

Separately, usually I'd always use inflation-adjusted data. Not right now, in the middle of what I continue to believe is overlapping exogenous shocks that are leading to relatively temporary, high inflation. If you use inflation-adjusted data, it'll give people the wrong sense that the economy is in recession, and it creates contradictions that shouldn't exist: lower wages and low unemployment rate, lower GDP and increasing employment. If for the time being you use nominal data instead of inflation-adjusted data, there is no contradiction -- your policy choices are clearer.

And by policy choices, I'm saying that it's going to be okay for the Feds to raise the central rate. The nominal data shows that the economy can accommodate it.

But, Summers is probably wrong-headed if he sees a NAIRU target of ~5% as the goal of raising the Fed central rate. That is to say, the Fed should only concern itself with this temporary inflation insofar that the economy can accommodate rising rates without causing a nominal contraction in GDP. If there is a nominal contraction of GDP, they've gone too far.

Finally a good post

Intriguing slant I haven’t heard before. Can you elaborate with some numbers?

I’m referring to using nominal numbers.

Nominal v real GDP: https://fred.stlouisfed.org/graph/?g=RQtL

(indexed, Q1 2020 = 100)

Nominal v real wages: https://fred.stlouisfed.org/graph/?g=RQtB

(adjusted to headline inflation, indexed to 2020-01-01)

Inflexion point is the start of the pandemic, Jan 2020.

It is always well to remember that both nominal and real values for economic data are subject to artifacts; that both can grossly misrepresent the actual outputs of physical goods and delivered services, which tend to be less volatile than prices. If an agreement is reached allowing Ukraine’s grain to be shipped from Black Sea ports, the value of every wheat farmer’s crop in the world will fall, though they will harvest the same number of bushels as they would have without an agreement.

I keep saying that my preferred inflation index is trimmed mean PCE. Why do you suppose that is? 🤔

One of the consequences of inequality of incomes and wealth is that fairly small changes in supply can lead to larger changes in price, exacerbating inequality in the distribution of goods. So those of us in upper quantiles bid up prices of meat or eggs, making them less affordable to those in lower quantiles. Trimmed-mean PCE, or any other less-volatile measure, tends to obscure more than illuminate this …

Kevin, does it concern you that you've been on "Team Temporary" for a year now?

Considering real inflation is declining........

The post-World-War-II inflation lasted two years and ended without significant change in monetary or fiscal policy. Two years is well short of ‘permanent’.