Once again I have a chart-a-rama for you. Here are four charts all related to the employment rate:

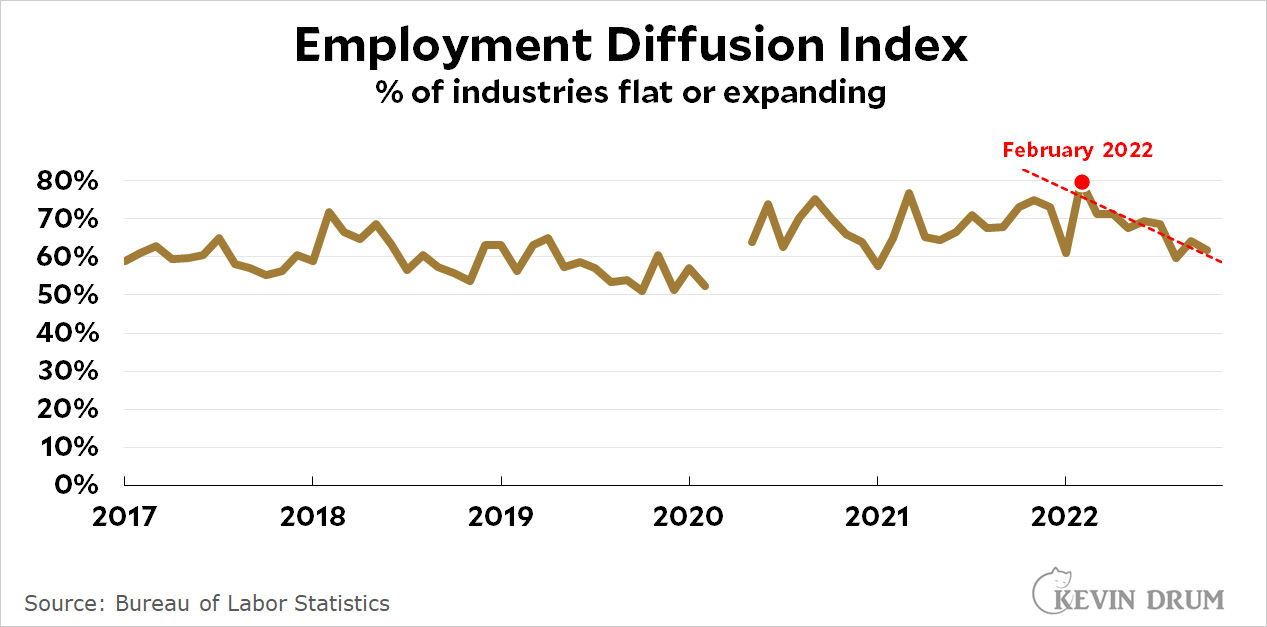

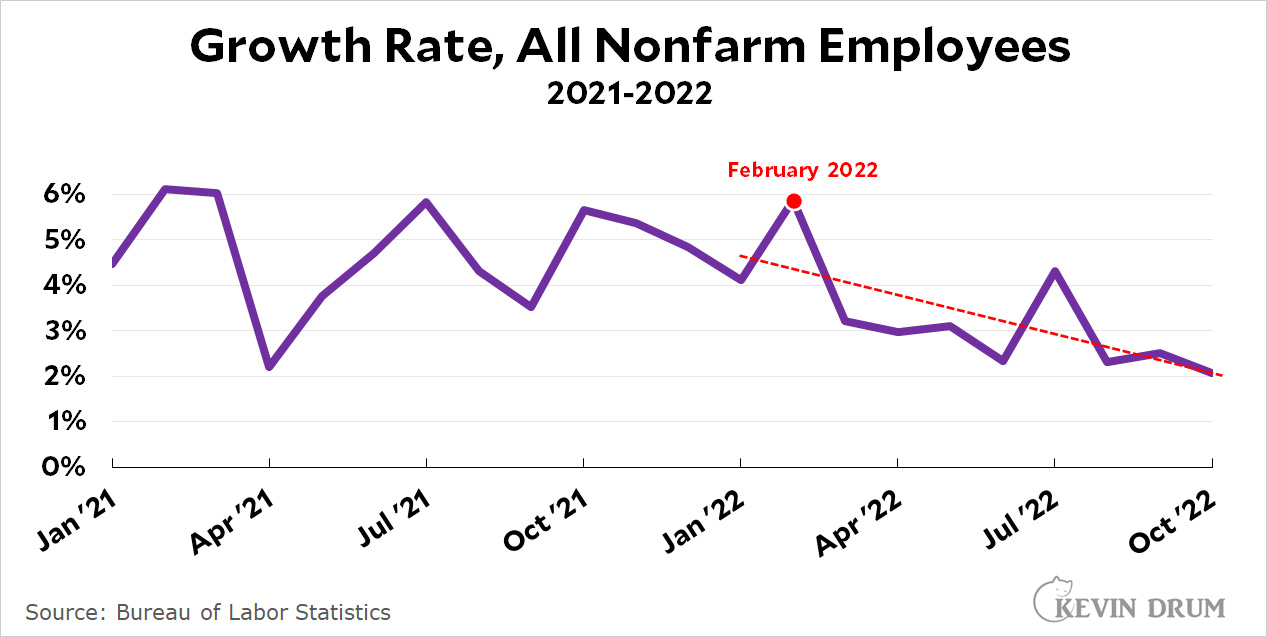

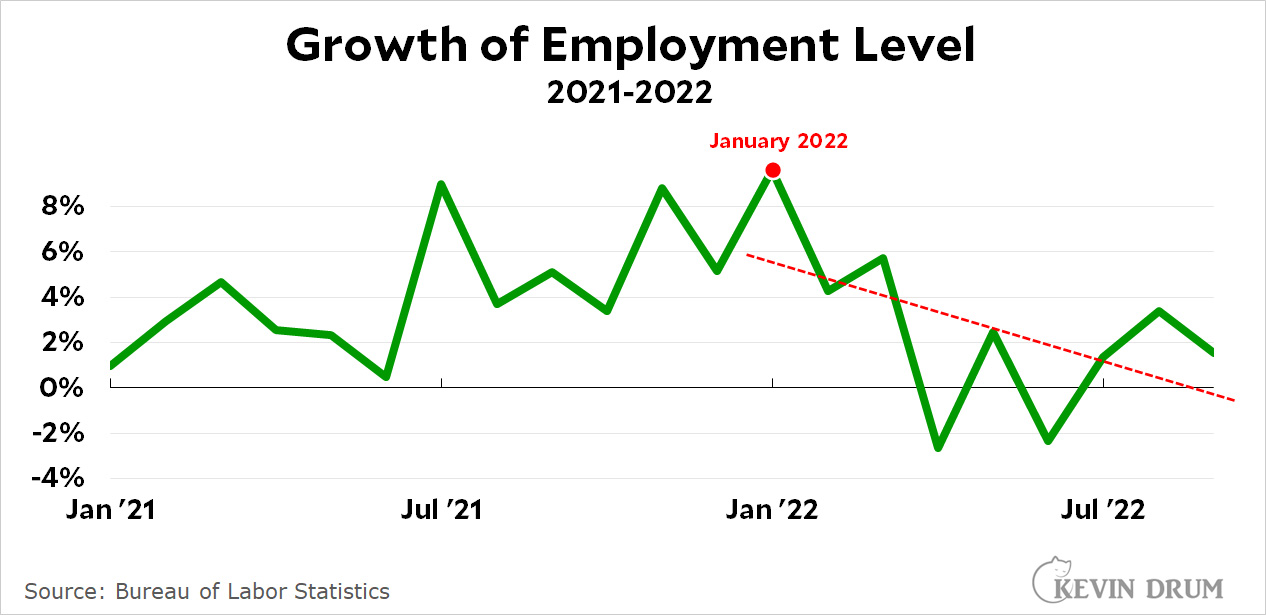

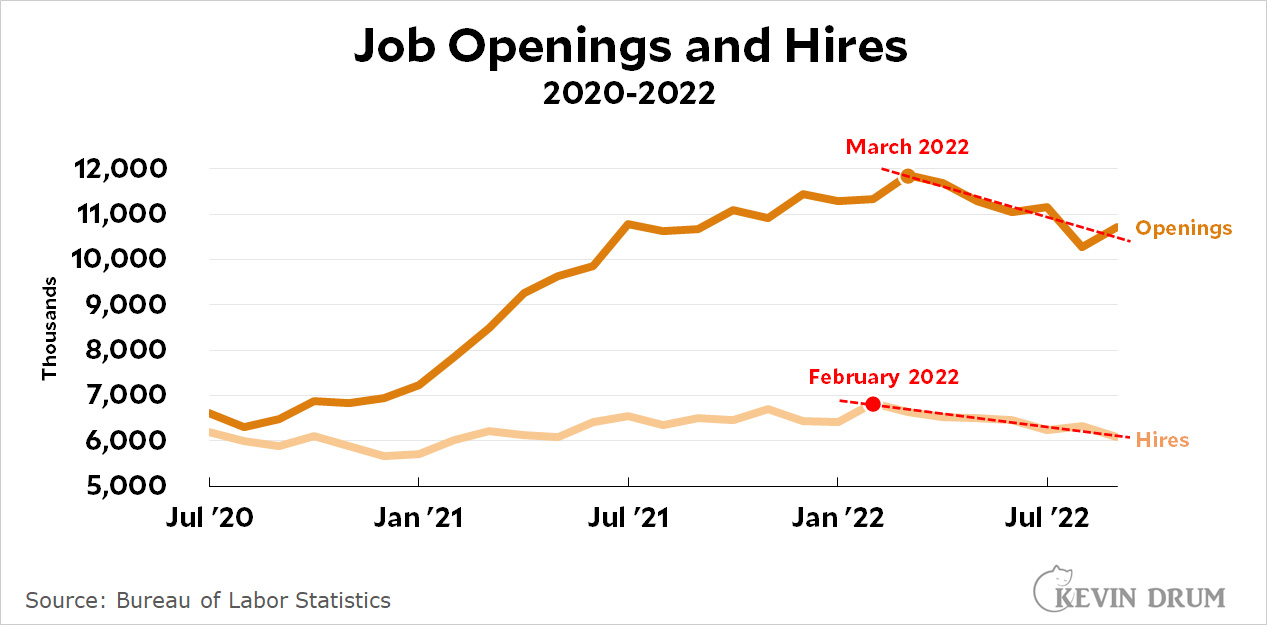

All of these metrics are in agreement: Starting around January employment growth started to fall steadily. Since then, the number of job openings has dropped by nearly 2 million; the growth of the employment level has declined from 8% to nothing; and the number of industries that are expanding their workforce has fallen by 20 percentage points.

All of these metrics are in agreement: Starting around January employment growth started to fall steadily. Since then, the number of job openings has dropped by nearly 2 million; the growth of the employment level has declined from 8% to nothing; and the number of industries that are expanding their workforce has fallen by 20 percentage points.

My point here is the usual one: these are signs that the economy is cooling, and all of them started well before the Fed began raising interest rates. We didn't need those big increases—maybe a slow and steady series of small ones instead—but we got them anyway and now they're starting to produce a headwind against an already slowing economy. Remember the big shortage of computer chips, for example? All gone:

Chip companies in recent weeks have instituted hiring freezes and layoffs, slashed capital spending plans, reduced factory output and warned investors of a stark reversal in their customers’ buying habits....Many chip executives don’t see a near-term reprieve. “We are planning for the economic uncertainty to persist into 2023,” Intel CEO Pat Gelsinger said on an earnings call last week. “It’s just hard to see any points of good news on the horizon.”

Buckle up, folks, the flight is about to get bumpy.

Trump's tax cut and actions of the Fed have led to asset inflation. Stock market goes up--but P/E's are un-sustainable. House prices go up--but first time buyers increasingly locked out. And, of course, Crypto! Now with the Fed increasing rates, the bubbles have deflated a bit--so people lose the wealth effect, i.e. their 401Ks are down as in the value on their homes. That part was good....then they kept raising rates. As for the effect of inflation--the Fed chair acknowledges rate increases won't help directly--but apparently it's being done to show he's an inflation hawk. Or maybe hurt labor???

There are problems in the US economy--and The Guardian has a good piece:

https://www.theguardian.com/business/2022/nov/05/fed-reserve-jerome-powell-paul-volcker

And Slate has an article going after problems as reflected in the super market merger:

https://slate.com/business/2022/11/albertsons-kroger-apollo-cerberus-private-equity.html

We are about to discover that the zero interest-rate policies of the last decade made a lot of eccentric weirdos look like they were business geniuses.

Ok…I’ll think about buying a new car next year. For cash of course.

Drum, who has spent 1.5 years being wrong, and not admitting it, about inflation (continuance, level, persistant drivers), attacks again the US Fed for doing what all competent central banks are doing - and argues for a replication of the exact errors of the early 1970s that led to entrenched inflation (and eventual long political weakness for the Democrats).

He would apparently be rather happier with Turkish central bank policy, of low rates and asserting future trends. Of course Turkish policy gets Turkish results...

It is further the case that

(1) simplistic trendlines (of dubious analytical basis) are not causation arguments, there is zero basis to assert that Fed rate rises are not effecting a cooling

(2) Sustained upwards pressures are still evident broadly in pricing - and this will continue to feed through multiple channels - a reduction of increasing pressure is not a reduction in overall pricing pressures - making that error in repeated stop-go interventions, declaring inflation victory too early was a key pattern of the 1970s. Avoiding that is capital. (and so no for the reading comprehension challenged this is not a prediction of a rerun of the 1970s, that because in fact Central Banks learned a lesson there - but if one were to adopt Drum's approach yes, you would likely run a repeat).

The argument is that the Fed starting raising rates after the economy started contracting. They were unwinding the quantitative easing along with bumping up rates without waiting to see how their actions affect the economy.

Yes, the steps the Fed has taken has contributed to the slow down. But there's a lag--full effects won't hit until next April or May. Instead of countering the business cycle, the Fed will be making the fall deeper this time.

Raising rates a bit was justified. The steps the Fed have taken will make the coming recession worse and will hurt the rest of the world too

The Fed didn't defeat inflation in the 70's - it went to over 14% despite many years of high interest rates and came down only when oil price quit rising. The Fed hasn't prevented it this time either. There is actually no sign that they have learned from experience - they just keep repeating what didn't work before.

Fed actions are not based on some super AI calculations based on all the factors that Kevin discusses, there is just a simple dogma that high interest rates defeat inflation. Some of the authorities actually admit that they don't really understand inflation, but the Fed goes through the motions anyway.

Lounsbury, with nothing to say, says it yet again.

The late 1940’s saw a period of high inflation that lasted IIRC, a bit over two years. The dogma (thanks for the appropriate term, skeptonomist) at the time was that steady moderate interest rates were best for businesses, so the Fed took no action. Inflation ran its course and settled back to a low rate.

WWII, the oil shocks, COVID-19 all had worldwide impact. The war and COVID were actually more similar in broadly restricting production, and disrupting global supply chains (remember natural rubber?); the oil shocks were confined to the world price of one commodity, which just happened to be an essential input to nearly every production system..

So the burden is on you, L, to explain to us why the present is more like the 70’s than the 40’s, and also to convince us that it was Volcker’s raising of interest rates to unprecedented highs, and not the stabilizing of oil prices, that brought inflation down.

Your statement, “a reduction of increasing pressure is not a reduction in overall pricing pressures” is just wrong. A reduction in x is a reduction in x whether x happens to be increasing, stable, or decreasing already.

I think a key statistic is one that Kevin has featured before, personal consumption expenditures:

https://fred.stlouisfed.org/graph/fredgraph.png?g=VqCf

Despite the stimulus payments and huge increase in the money supply, expenditures were below trend until early 2021. Expenditures didn't cause the increase in inflation at that time just by returning to trend, it was oil price (look it up) and other supply problems. Inflation is not being caused by excessive general demand from the stimulus or excessive spending for any reason. It is also not being caused by excessive wage increases, as nominal wages keep falling behind inflation.

The Fed has already had an effect on the housing market by causing mortgage rates to go up, but it remains to be seen what effect this will have on the cost of the housing component of the CPI. There seems to be a general housing shortage, and killing the construction of new units is not going to help this.

In short, inflation has been caused by supply problems, some of which may be getting solved by the natural operation of the economy, for example shipping and computer chips (car production). Cutting down on investment, which is the objective of rate raises by the Fed, is the wrong thing for supply problems.

The main wild card is oil and gas price. If those prices go up again, so will inflation. If they don't there is no reason to expect 70's-type inflation.

There may also be a food wild-card component, if the Ukrainian grain is kept off the market.

There seems to be a lot of price gouging going on. Raising interest rates is counterproductive to solving that problem. Higher rates potentially keep new entrants out of the market who would compete with the price gougers.

The jobs numbers are slightly misleading

A 70 year old person today was born in 1952 near the height of the boom

Very few work until they're 70.

We are so used to seeing "big numbers" and politicizing them that we are losing sight of the bigger picture here

Boomers are beginning to die off. The number of deaths (all deaths including old age) in the U.S. is up over the last decade and will continue to rise until the boomers are gone. At the same time our birth rate from 25 years ago is nowhere NEAR the baby boom rate and those folks are entering the work force NOW.

We should reach a state of equilibrium in the job market in about 20 years.

But given the wage situation? I don't think labor is playing near as big a role in inflation as many think. If the FED is using this data as part of the reason for fighting inflation they are probably not going about this the right way.

We shall see what happens