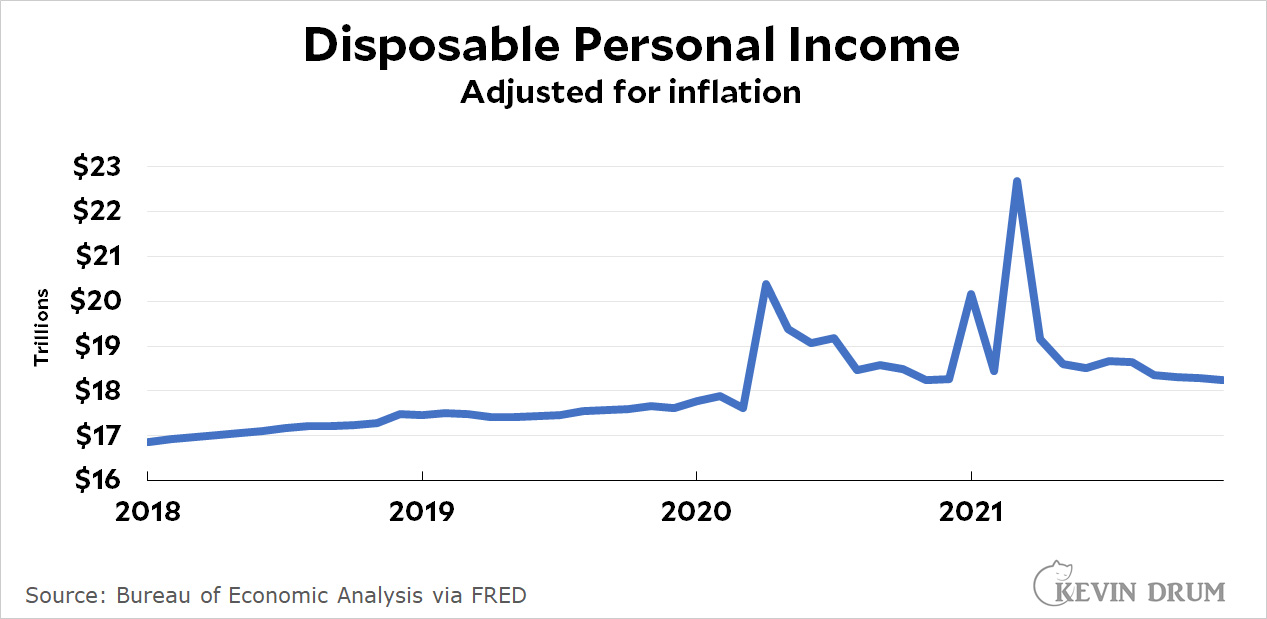

The Bureau of Economic Analysis released a bunch of new data this morning and it looks to me like everything is going according to plan. First off, disposable personal income is losing ground to inflation:

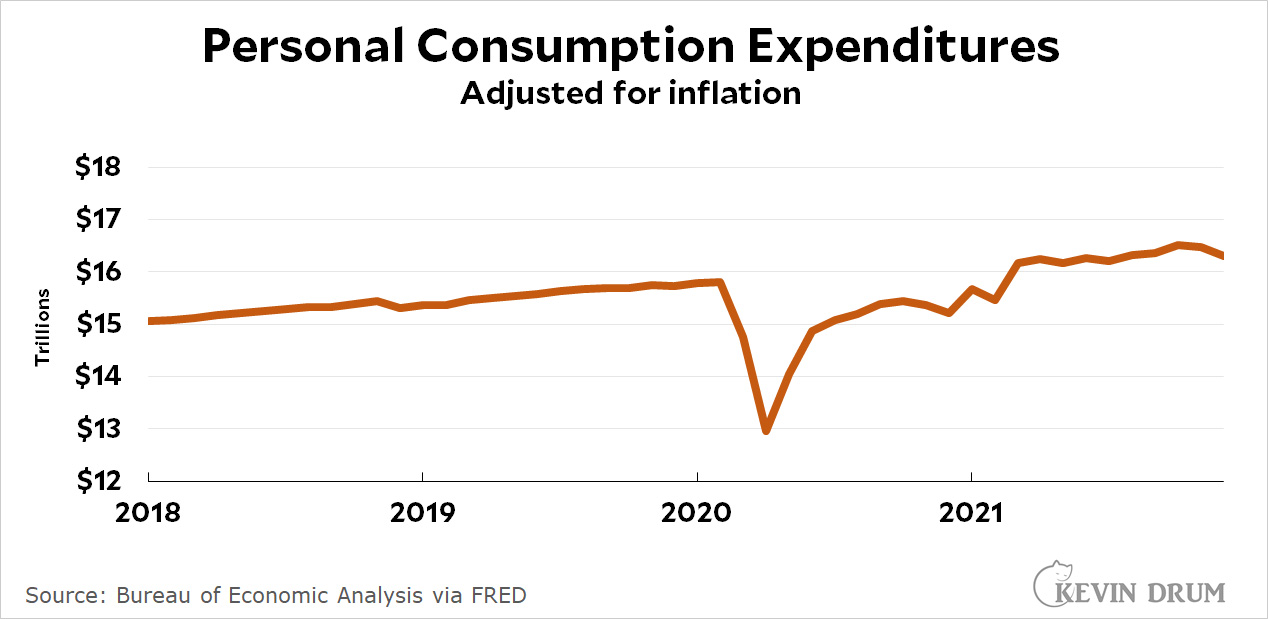

With personal savings from the stimulus bills now used up, this means that personal expenditures are also declining:

With personal savings from the stimulus bills now used up, this means that personal expenditures are also declining:

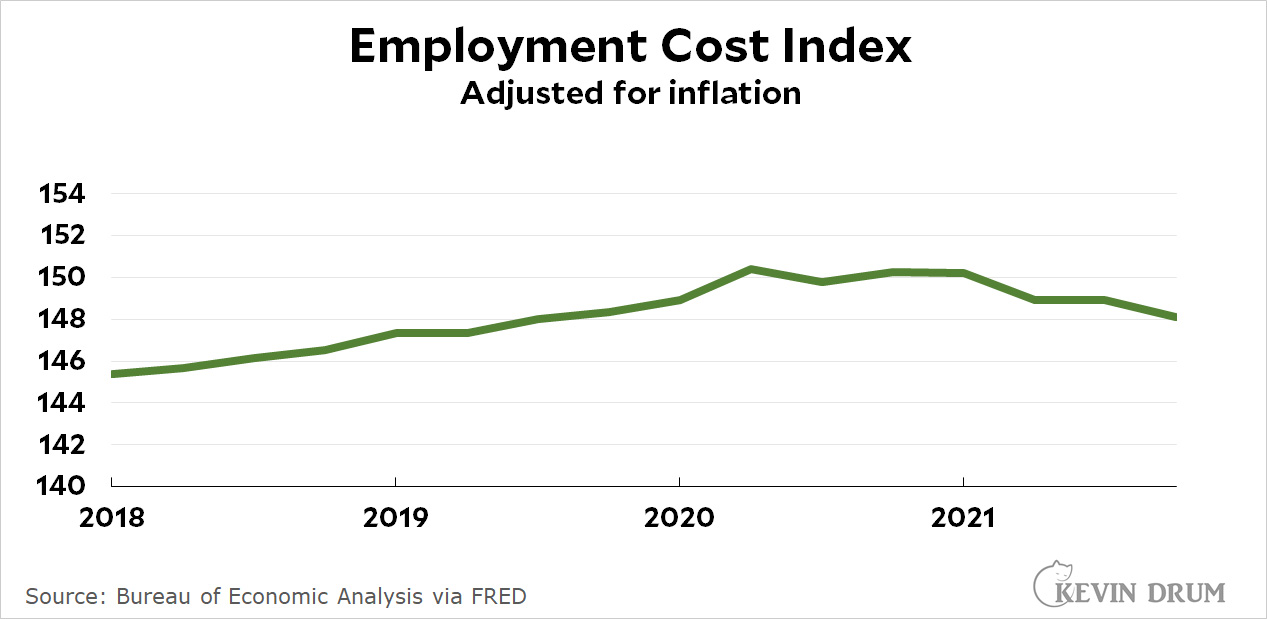

And despite everything you've heard about workers demanding 20 bucks an hour for flipping burgers, the cost of employment is continuing to decline as well:

And despite everything you've heard about workers demanding 20 bucks an hour for flipping burgers, the cost of employment is continuing to decline as well:

All of this puts a damper on demand, which in turn should put a damper on inflation. And with the Fed committed to interest rate increases later in the year, I'd say the risk right now is less inflation than it is killing off the recovery altogether. But I'm not the Fed chairman, am I?

All of this puts a damper on demand, which in turn should put a damper on inflation. And with the Fed committed to interest rate increases later in the year, I'd say the risk right now is less inflation than it is killing off the recovery altogether. But I'm not the Fed chairman, am I?

Great. Now the Treason Party will say "Joe is killing economic growth!"

"Vote for us so we can cut taxes for the top so we supercharge the economy!"

Screaming about inflation will be replaced by screaming about slower growth....

And stocks are down--but no screaming about that yet since they could jump back up just as quickly--though probably not.

The BBB plan, or at least some parts of it, were expected to survive and baked into the the stock market bubble. Without it, we'll lose ca. 0.5% point of GDP growth (if I remember correctly) which will cut back on profits. Most headlines blamed inflation fears--ignoring Ukraine and the fact that BBB didn't pass. If some form of the child tax credit gets re-instated, expect market to jump up a bit, though not back up to bubbly highs (at least not for a while). Of course, the stock market can remain irrational longer than you can stay solvent (paraphrasing Keynes via GoodReads)

Seems about right.

Chairman Powell does seem to be maintaining as much maneuvering space as he can:

Fed Chair Powell leaves optionality open on rate hikes, balance sheet

Or try

https://finance.yahoo.com/video/fed-chair-powell-leaves-optionality-204836695.html

Read the NYT story on this this morning, which takes the view "inflation is out of control and workers are losing"! Thank god for Kevin Drum explaining this stuff in an understandable, and persuasive, and inflation-adjusted(!) way.

Yeah I hate to be negative but it seems pretty certain that the fed will overreact to the scary inflation headlines.

The goofy thing is that it's all about gas prices, honestly, which the fed can do nothing about.

Kevin claims "cost of employment is continuing to decline", but this is inaccurate.

The cost of employment actually increased, but at a slower rate than the overall rate of inflation. Right?

These are wildly different claims....have to be careful with inflation adjustments, likely to end up with bad conclusions.

Kevin’s default is to consistently report economic data in real (i.e. inflation-adjusted) terms, so I don’t see the problem. And since inflation is measured as increases in price indexes, this chart shows that, in aggregate, price increases have more than covered the cost of labor; equivalently, the labor-cost fraction of production costs has declined.

Auto sales have distorted real pce. Let's just say January is getting a kick up.

That's not really a good thing. Millions of jobs have not been restored to pre-pandemic period.

If you think inflation is caused solely by excess disposable income and not by exogenous shock, you might be right. But, if you're wrong, then, poor policy choices will send us into the ZLB and a technical recession where those millions of jobs are, for all intents and purposes, permanently eliminated.

You have no personal responsibility for staking your claim -- people will still embrace your blog. But, think about the destruction this policy choice will do if you're wrong.

This is your FDR moment.