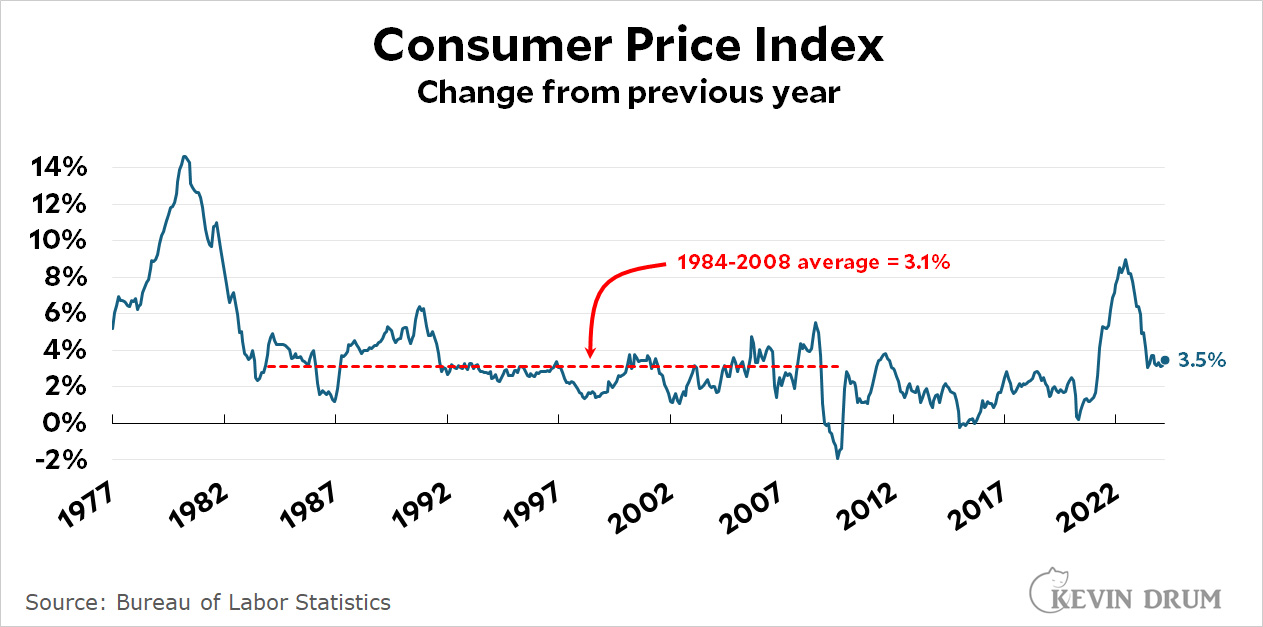

No one likes a high inflation report, but the panic over yesterday's number is a little out of hand. Here is CPI inflation since the late '70s:

There's a huge amount of noise in the monthly CPI numbers. What's more, we got used to ultra-low inflation in the decade following the financial crisis. Average CPI from the end of the '70s inflation to the start of the financial crisis was 3.1%. We're only barely above that right now. It's hardly a crisis.

There's a huge amount of noise in the monthly CPI numbers. What's more, we got used to ultra-low inflation in the decade following the financial crisis. Average CPI from the end of the '70s inflation to the start of the financial crisis was 3.1%. We're only barely above that right now. It's hardly a crisis.

Still, why the flattening over the past half year? Aside from noise, my guess is pretty simple: wages generally lag inflation, and lately they've been growing a couple of points above CPI. That pulls up the inflation rate a bit, but it will calm down before long and inflation will continue to decline.

Also housing prices, which are stubbornly staying fairly high. That can't last forever, can it?

This is entirely wrong! There is nothing ELSE to do about inflation except panic! It's WAY too high and everyone is going to be immiserated and it's the End Of America As We Know It, and it's all Joe Biden's fault! Have you SEEN the price of [cherry-picked commodity] lately? But it's also too low, and the economy is going to crash and everyone is going to be immiserated and China is going to conquer the world, and it's all Joe Biden's fault!

That things are actually remarkably stable, that we are somehow managing (1) historically fairly low inflation, (2) wage growth that exceeds inflation (real wage growth) at ALL income levels, and (3) effectively full employment simultaneously, which is little less than an economic miracle, is just a bunch of "facts" and therefore entirely beside the point.

The NYSE and NASDAQ lost their minds over the difference of 0.1%

It's what they do.

The trading moves are from short term positions that were betting on rate reduction - which now can be fairly excluded.

So people with those bets are selling. It's not the market reacting to a .1% it's a certain set of traders with a certain bet.

Incomprehension oft leads to losing one mind via half-understood reaction.

The people who sold their stocks were not directly betting on interest rates going down. Exactly why they lost confidence in stocks is not easy to determine.

"There’s no need to panic over inflation" - I say it depends on how you define the situation.

1) Agreed, economically, the new inflation report is a minor blip/not a big deal

2) In contrast, politically for Biden, the new report is problematic. Let me expand

- higher than expected inflation slows, maybe even stops, the Fed from near term rate reductions. Low rates would likely stimulate real estate and the equities markets.

- higher than expected inflation cuts into a key Biden line. Basically, 'inflation was a challenge, but look at the trend. Inflation is now under control/not a problem.' Harder to make that argument if the trend is now rising inflation.

- higher than expected inflation hurts the Biden personal appearance strategy. Biden wants to appear at the openings of plants and bridges based on his infrastructure legislation. Harder to sell a new bridge as a clear win, if some tie the bridge to inflation, which is exactly how Fox News will report the situation.

True that a Fed rate cut likely would cause the stock market to jump, but it's been going gangbusters recently anyway (the nonsense the last few days notwithstanding). Returns this year are at like 20-30% annualized. Another month or two of steady rates ain't gonna hurt things.

As to the R/E market, it's already really hot: it doesn't need stimulus. If anything it could use a little cooling.

The whole situation is even MORE absurd when you consider that the recent PANIC!! occurred because a couple of aggregate measures were 0.1% -- one tenth of one percentage point -- away from "expectations," which themselves are aggregate and not at all particularly accurate. A tenth of a percent is truly meaningless in this context.

And who cares what Fox says? If it rains, it's Joe Biden's fault for spoiling picnics, and if it doesn't rain, it's Joe Biden's fault for wilting the flowers.

"And who cares what Fox says? If it rains, it's Joe Biden's fault for spoiling picnics, and if it doesn't rain, it's Joe Biden's fault for wilting the flowers."

+10 or more

Thanks

It should be who the fuck cares what Fox News says? With stronger emphasis.

Financial and commodity markets are built on short-term variances and small contextual changes. Those twitches are what moves them. People in them also like to over-dramatize themselves (looking at you, Jamie Dimon) and media need things and people to dramatize. A perfect self-reinforcing ouroboros (or something kind of like that) so even insignificant changes need to be in ALL CAPS!!

The political side is described well by other posters.

By design, higher interest rates increase the cost of housing (both purchases and rentals)....so its certainly possible for housing costs to remain stubbornly high for a long time. This is working as intended absent other changes/influences.

Back in the wake of the Great Recession, there was lots of commentary to the effect that we needed to run the economy hotter. Well, this is what that looks like. Three.point.five percent inflation is fine. Preferable, really, unless you're a billionaire, in which case low inflation enables you to work a bit less hard to preserve your capital (or expand it).

So, why 1984 to 2008 for the average? It can't be to avoid recessions because there were two recessions in that timeframe. So, why not 1984 to just before the Pandemic?

And many got used to cheap money...

Depends. Is the population going to continue to increase? Will we demolish detached, single-family homes for communal apartment blocks?