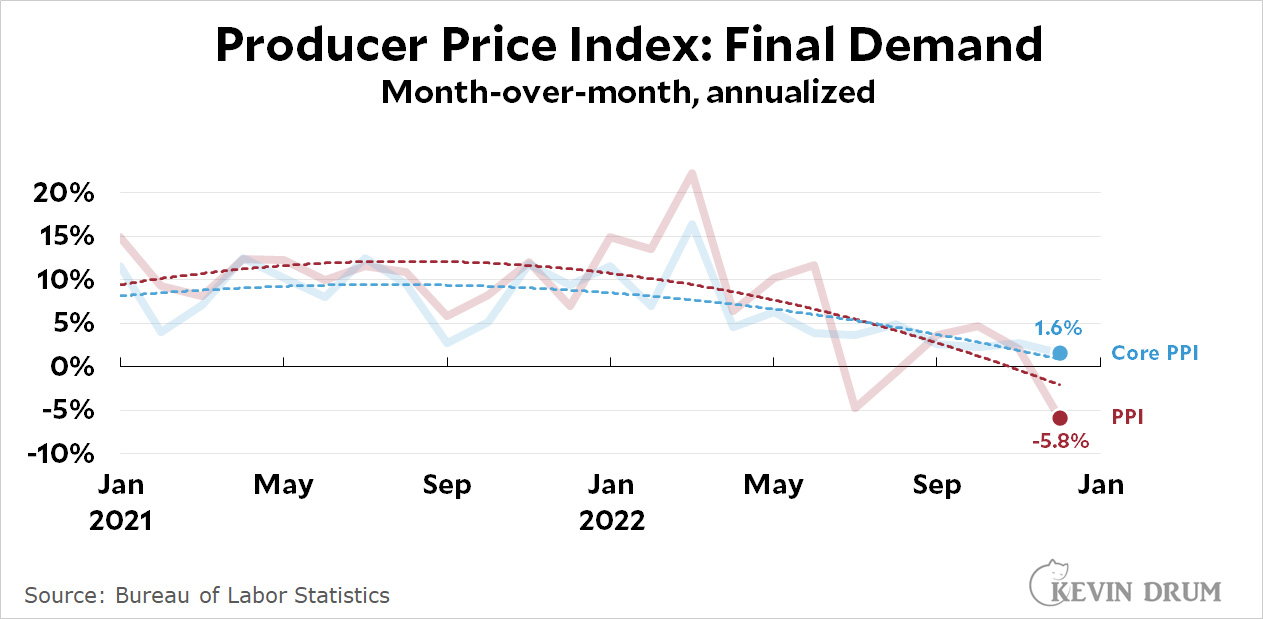

Check out the latest numbers for PPI inflation:

PPI is basically inflation at the wholesale level: it's the price that domestic producers get for the initial sale of their products, and it's often a forerunner of consumer inflation.

PPI is basically inflation at the wholesale level: it's the price that domestic producers get for the initial sale of their products, and it's often a forerunner of consumer inflation.

As usual, I'm showing monthly inflation that's been annualized. Headline PPI came in at -5.8% and core PPI stood at +1.6%—well below the Fed target of 2%.

(If you insist on year-over-year figures—which you shouldn't—headline PPI in December was 6.2% and core PPI was 5.5%.)

This is good news, confirming the dramatic drop in inflation that we've already seen in both the CPI and PCE indexes. In a few more months inflation will seem like a mirage.

POSTSCRIPT: I've never noticed this before, but PPI is reported as a month-over-month number while CPI is reported as a year-over-year number. I don't know why.

It's almost like the bubble got blown up to a point where all the WSJ readers agree it's time to take profits and fire uppity employees. It really just does seem like mean girls rating someone's fashion. "Oh yes, complaining about inflation is very in this winter. We will have to fire employees [something we totally didn't want to do anyway]."

This was always transient, you and Krugman were always right, and the response is more a measure of how long we can sustain a long term view, which isn't long. The 2020-2022 period was of course an anomaly and everyone acting like extrapolating from 2020 to the future was totally sane.

The problem with Team Transient was you made the mistake of specifying or making it sound like it was a short-term (i.e. less than a year) issue when it was short-medium termish.

But facts don't matter. The financial news zeitgeist says we're in for high interest rates so that's what we're going to get and that's what we're going to do, because that's what the mean girls are saying and no one wants to get made fun of.

Start making more money weekly. This is valuable part time work for everyone. The best part ,work from the comfort of your house and get paid from $10k-$20k each week . Start today and have your first cash at the end of this week. Visit this article

for more details.. https://GetdreamJobs1.blogspot.com/

Well then, at least a .25 point increase in Fed Rates then...and more to follow...must make sure inflation is most sincerely dead.

At this point, the Fed needs to backtrack, and quickly. Problem is, they are so far over their skies that we're all going to the take the bumble with them. But they can never admit it. Getting back to 0 Fed rates (or negative?) and quantitative easing is bad--businesses are reckless with free money, bubbles grow, and consolidation and rent seeking take hold.

The last time I heard, the "neutral" fed rate is around 3%. We had stimulative interest rates for so long that became the expectation, but the stimulation has to stop some time. The current rate will tend to slow the economy, but it won't slow it a lot.

Given the lack of inflation in the 2000s, it's hard to say that sub 3% interest rates were 'stimulative rate levels that had to stop sometime' . That seems to be contradicted by what has actually happened in the economy over the last 2+ decades.

OTOH, near-zero interest rates encourage excessive risk-taking, not just among corporations but among regular people with their savings.

That’s the theory. Reality begs to differ: https://www.federalreserve.gov/pubs/feds/2014/201402/201402pap.pdf

Apparently changes in the interest rate have no consistent effect on any kind of investment, let alone risky ones.

Having a Fed rate in the 2 to 3% range would be ok. The current rate is ca. 4.5% and I believe the goal was to raise it up above 5%. The effect of the stimulus packages is winding down and the effect of the Fed rate hikes are kicking in, so the economy is being squeezed.

The Fed needs to start lowering rates now--not wait until we're in a full on recession.

I doubt inflation will seem like a mirage as long as gas is over $3 a gallon and grocery prices are high and/or rising. They don't count those when figuring inflation.

Actually, they do. Core inflation excludes food and fuel, but he headline number does not. Go back to the top and see how PPI has performed relative to Core PPI.

If you take the Fed at its word and assume that they are primarily concerned with the tight labor market and wages, the higher rates make more sense and will likely continue until we see a recession and some good old-fashioned, healthy job losses. Gotta keep workers in line.

Gee, it's almost like it wasn't actually inflation in the first place, but a narrative from the WSJ/business crowd that finally caught fire among the pearl-clutching MSM and broader cultural awareness - which gave cover to corporations to goose profits at the expense of everyone else.

Rep. Porter did a good presentation (and others chimed in) showing that manufacturers raised prices way above any increase it the cost of inputs to production.

Of course, hitting the debt ceiling today might have weird, probably not good effects on inflation. I shouldn't speculate, because my economics knowledge is pre-K level.

Start making more money weekly. This is valuable part time work for everyone. The best part ,work from the comfort of your house and get paid from $10k-$20k each week . Start today and have your first cash at the end of this week. Visit this article

for more details..