The Wall Street Journal has a longish piece today on what it's like to retire on $1 million in these parlous times. "Once a symbol of extravagant wealth," the authors say, "$1 million is now the retirement-savings goal for millions of Americans."

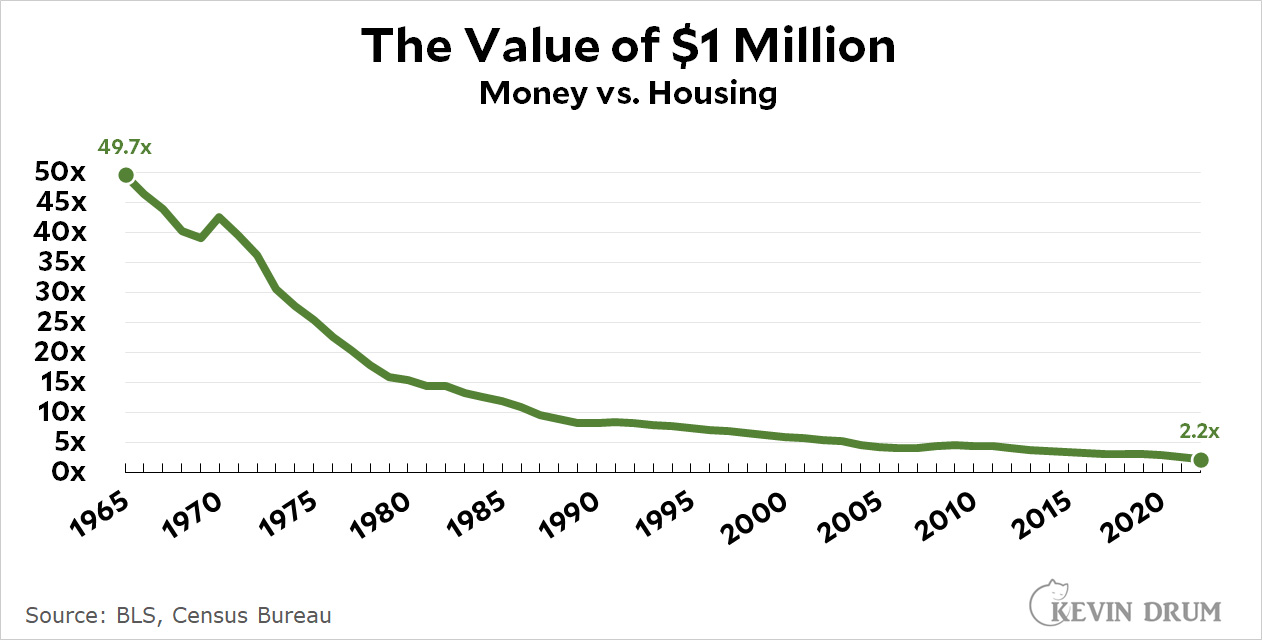

True enough. And since a picture is worth a thousand words, here's what $1 million will buy you today vs. half a century ago:

Back in 1965, $1 million would buy you a whole neighborhood of median houses. Today you can buy two, if you're lucky enough to live in a median place.

Back in 1965, $1 million would buy you a whole neighborhood of median houses. Today you can buy two, if you're lucky enough to live in a median place.

Put a different way, for a 1965 millionaire an average house would amount to only a paltry 2% of his assets. For today's sham millionaires it's half their total wealth.

The median house has vastly increased in size in that same period.

And yet my small house built in 1953 still costs about a quarter of a million these days.

Location, location, location. I recall when the news spread that an empty lot in Palo Alto sold for over $1M. The lot was more expensive than a small home because of the hassle in getting permits to tear down an old home and rebuild.

Still don't have a flying car. And to the point, yes, that is the system, always inching ahead to shave more off and into certain pockets.

This is why so many people feel that the middle class is having to struggle more than it used to. Sure, incomes were lower back then, but if you look at the ratio of median house price to median household income, you see the ratio rising. It was about two in the 1980s, then it went to three by 2000, then past four in 2012 and is now over five:

https://fred.stlouisfed.org/graph/?g=YbnQ

Houses were even cheaper with respect to earnings back in the 1960s and 1970s, so buying a house has gotten more and more costly in terms of what one could earn. Sure, a million dollars isn't what it used to be. Sure, it is easier to earn a larger fraction of million dollars nowadays than at one time. Still, buying a house takes a bigger chunk of one's earning capacity than ever.

My buddy's mother makes $50 per hour working on the computer (Personal Computer). She hasn’t had a job for a long, yet this month she earned $11,500 by working just on her computer for 9 hours every day.

Read this article for more details.. https://payathome.blogspot.com/

Typically a "million dollars" means savings and stocks and bonds. Typically not equity in one's home, though there are those reverse mortgages.

Of course, now people need higher incomes to keep up with property taxes. If overall home values increase more than business properties, then taxes on homes go up relatively speaking. If the cost of living goes up in an area, then taxes have to go up so you can keep people working for your city.

As far as owning homes is concerned the problem is not inflation, it is the unequal distribution of the increase in production. Real GDP has increased steadily, but home ownership is not above what it was around 1980 (after the 2006 bubble popped):

https://dqydj.com/historical-homeownership-rate-united-states/

Houses have gotten bigger, but that's part of the problem - builders cater to the people who have the money rather than build starter homes.

It’s not just that some homes are larger, the construction techniques have changed a lot. Zoning codes require much better engineering to withstand weather or earthquakes. Electrical codes have been updated a lot. We just built a home and had to add wired in smoke and carbon monoxide detectors all over plus sprinklers to suppress fire. Lots of things like this drive up the cost per square foot of building in an urban area.

I literally have that amount in investments and am running the calculation on retirement now. I hate my job.

It's a surprisingly hard calculation on the spreadsheet, with inflation, investment returns, pension, SS, Medicare, life expectancy, etc. Working another 5-years, at my salary, it's a no-brainer but not working is a definite, maybe, but messy because the pension drops some, and I burn through a surprisingly large amount of cash here in California.

Sure, I'm overthinking it, but hey, between Covid and a couple of other fun things, I'm not going anywhere for a few days.

And, I'm definitely not buying 2 houses for $1M in these parts, barely one, in fact.

I still remember the story from the time of Covid about the drunk angry young man acting out on an airplane. As they duct taped him to his seat, he was yelling words to the effect "You don't know who you are dealing with. My dad is worth $2,000,000". I couldn't help but think of Dr. Evil and laugh.

In Silly Con Valley 1mil was worth only 30x.

Forgot to add in 1970.

The term "millionaire" as most people use it is hugely outdated. Back when the now retiring baby boomers were children, assets of a million dollars really did mean that a person was independently wealthy - i.e. able to live out a lifetime in comfort or even opulence, and take care of any family responsibilities, without ever having to work or develop new sources of income unless you wanted to.

Many people still think of "millionaires" as inhabiting this level of wealth, but as you point out, it's not even close. A million represents 10-15 years of a middling middle class income - it certainly doesn't put you in the jet set and it's rather meager as a base for retirement, particularly if there are any family responsibilities involved.

Now it we redefine millionaire to mean having an annual income of a million dollars, that would be closer. That would imply assets in the 20-30 million range which I would say is now about the minimum point to be considered independently wealthy in a way equivalent to a 1950 millionaire.

"Once a symbol of extravagant wealth," the authors say, "$1 million is now the retirement-savings goal for millions of Americans."

How many American will never get close to half that much? That's the problem no one has an answer for.

Comedy!

Cassidy Hutchinson saw Mark Meadows burning documents in his fireplace 'once or twice a week',

https://www.rawstory.com/mark-meadows-burning-documents/

No big deal. Doesn't rise to the level of an email server in the house.

After running the numbers, a million is enough to retire. I would burn a lot of it over the next 5 years, over $400K, and it would be smarter to not retire, but it's doable. I have also have a pension, that would double sticking it out a few more years.

What people miss about it is that even with modest rates of return (say 4%*), assuming you don't get killed by inflation, which Kevin assures us we will not, returns a fair amount of money. Anything resembling a sane lifestyle and economy can get it done, at least at my age.

I'll probably just take my time, look for another job, one that doesn't wreck people, even if it's a pay cut. I can't do what I did the last 7 years, there won't be another 7 for me if I do.

* And the irony is that you'll still pay more taxes than Trump did in some years.

The important thing to remember is that the current high cost of housing is the result of increased population/density and limits in available housing where businesses are located.

It was completely avoidable but national policy, post-1965, dramatically changed the number of people in this country and coming in to this country. California nearly doubled in population in 50 years, a 1.5% annual increase.

Those with real assets hade out like bandits. Everyone else? Work harder!

If you just look at inflation rather than housing prices, $1 million in 1950 is equivalent to about $12.6 million today, which is still a significant chunk of change. With that much invested, you can safely spend $400/year indefinitely.

Social Security and pension income streams are annuities with asset values that can and should be calculated, in the alternative, for a coherent analysis of a retirement financial situation. The same applies to home equity, which can provide a non-cash but valuable rent-substitute income equivalent, and/or an investment asset down the road. It's complicated, but that' reality for anyone who really wants to know their true retirement financial picture. Just saying "a million dollars" without that context is not illuminating.

Good points.

So if you do account for inflation the graph is not so dramatic. From 1965 to the present prices went up a little less than 10x. That puts the right side number at a little over 20, so we get about a factor of two drop from 1965 till now. Not so surprising.

There was a program from 1955 to 1960 called The Millionaire. In this a guy would give someone a cashiers check for $1,000,000 and the program would explore how it changed their life. That would be about $12M in today’s money. A good piece of change.

There were 207 episodes. In today’s money that would be over $5B so only a few could participate in that game.