In an interview with Ezra Klein, economist Larry Summers says there are two things that he thinks are likely to produce a long-term inflation crisis. The first is that demand is too high. The second is that if wages go up too much (hooray!) they will eventually produce even higher inflation and before long the purchasing power of workers starts to decline (boo!).

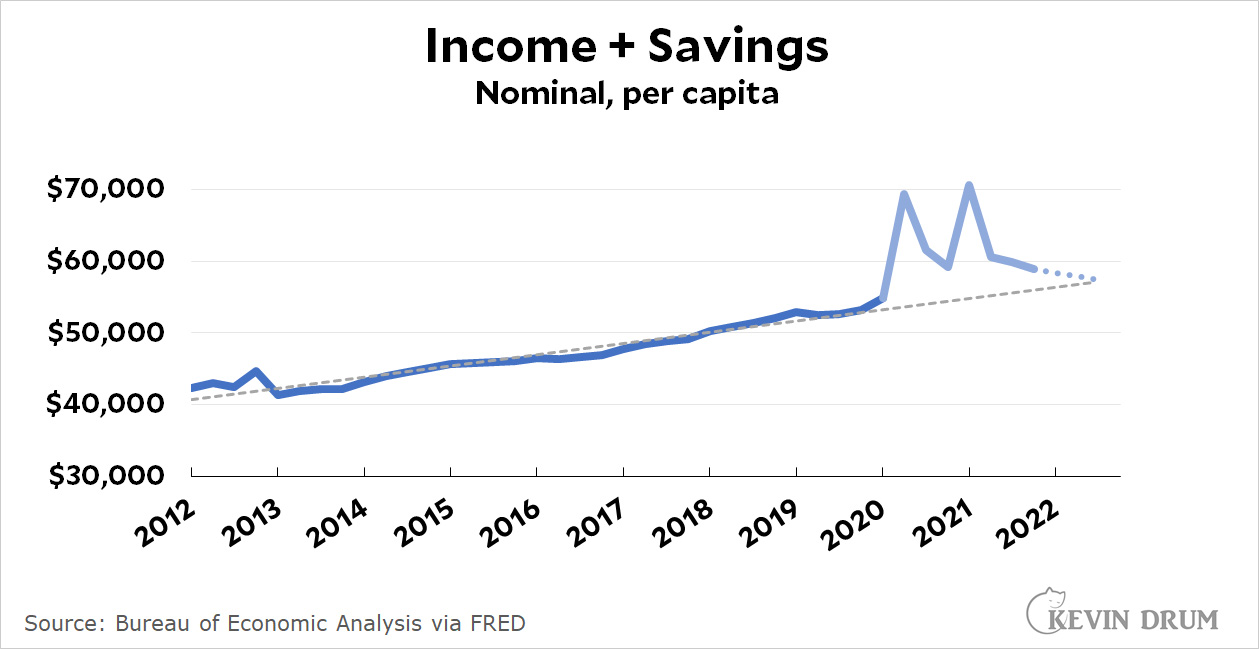

So let's take a look. On the demand side, consumers have two main sources of income: wages and savings. Here's what that looks like:

The spikes coincide with the two big COVID rescue bills, which filled up household savings accounts. But as you can see, that money has largely been spent and there's no more on the way. If we follow the current trend, we're likely to revert to our pre-pandemic trendline in a few more months.

The spikes coincide with the two big COVID rescue bills, which filled up household savings accounts. But as you can see, that money has largely been spent and there's no more on the way. If we follow the current trend, we're likely to revert to our pre-pandemic trendline in a few more months.

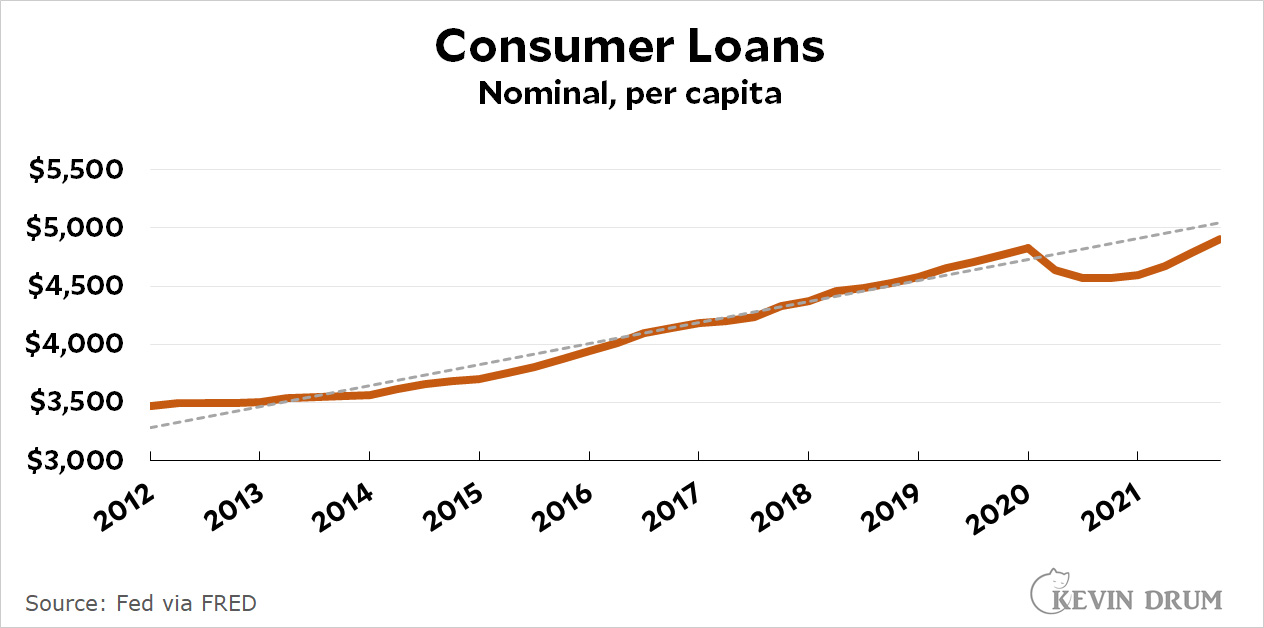

Another possible source of money for households is consumer loans. Even if wages and savings are falling, a frenzy of loan activity could produce higher household spending and goose demand dangerously. But that's not happening:

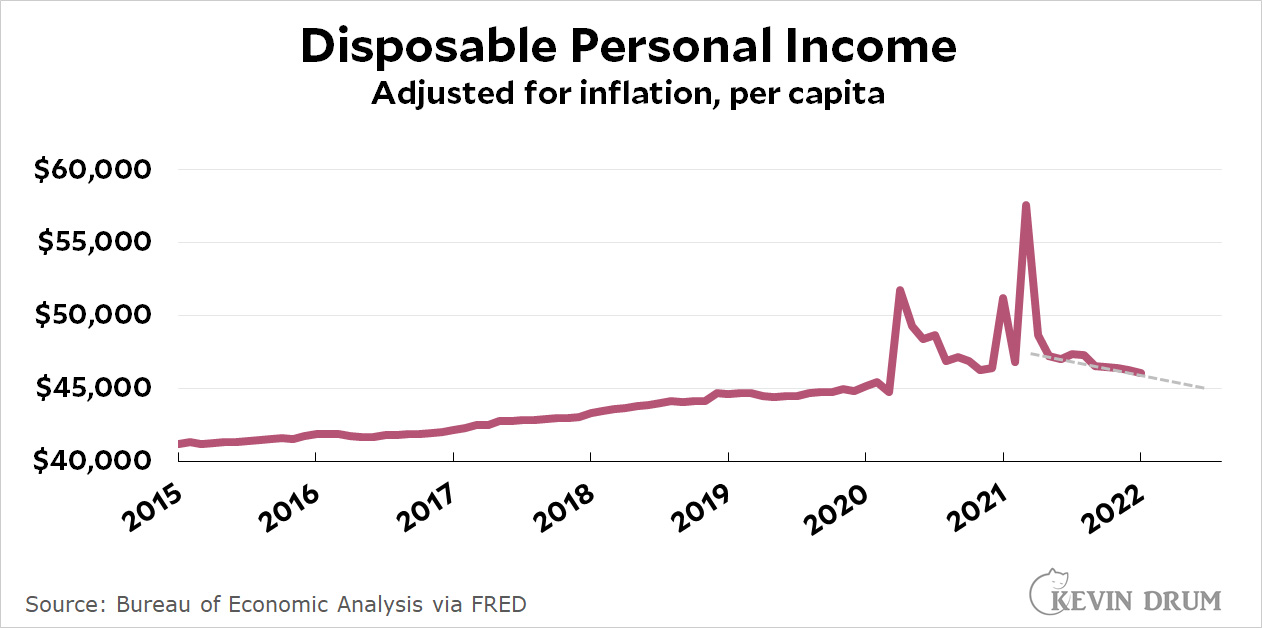

Finally, on the wage side, I'm a little puzzled about what the problem is supposed to be:

Finally, on the wage side, I'm a little puzzled about what the problem is supposed to be:

A '70s-style wage-price spiral happens when wage demands outpace inflation, which then forces companies to raise their prices above the inflation rate, rinse and repeat. But that's not what's happening today. Wage increases have been below the inflation rate for nearly a year.

A '70s-style wage-price spiral happens when wage demands outpace inflation, which then forces companies to raise their prices above the inflation rate, rinse and repeat. But that's not what's happening today. Wage increases have been below the inflation rate for nearly a year.

So we have declining real wages, declining household resources, and a restrained consumer loan environment. Beyond that, there's no special reason (is there?) to think that our supply chain shortages will last much longer now that everyone is back to work.

IANAE, and I understand that this is a simplistic, 100,000 foot view of things. But if it's wrong, I'd sure like to see a more detailed exposition of where inflationary pressures are supposed to come from.

My conclusions…

1. The liberal project to improve the lives of the poor is complete. To attempt further improvements would do more harm than good. See… we need millions of people wallowing in abject poverty so the upper middle class can afford install a pool and a deck on their McMansion.

2. You can’t take on “income inequality” because if you give poor people money and they will spend it. See #1.

3. You can’t invest in communities to “create jobs” either…

4. You can’t invest in infrastructure because it will creat unsustainable demand for construction materials and workers which we don’t have. (I guess you could import more illegals from Mexico and pay them shit wages.)

5. And on and on…

We won! Those who are still suffering are out of luck. Maybe they can get jobs working for the merchants of death. Spending on war materials is OK!

Nuke Russia! Ok - that doesn’t follow from the Klein piece but it sure seems like a good idea to me!

Uh, what?

No, it wouldn't. It ("it" being almost everything on your list) would just require taxing rich people. Gods forbid, we can't do that!

So I know you’re a hard-nosed economist who looks at the numbers here. But I want to locate, I think, the emotional and to some degree even political frustration of this conversation, because a lot of the dynamics you’re talking about that then get framed as excess demand, there are things that feel just, that many of us have wanted for a long time. More hiring, wage increases, particularly at the bottom end, stimulus checks for people who have had a lot of bad years and didn’t have a lot of cushion behind them, child tax credit for families that could really use that. And so there are a lot of policies that came together— I mean, there was a reason the Biden administration wanted to run the economy hot. There was a long period when it didn’t just feel, the economic data showed, that expansions were not reaching people on the margins. And it felt, finally, like we were reaching people on the margins. We were putting a lot of firepower to do that. But even in this terrible time, this horrifying pandemic, we were giving people who needed it quite a bit of help.

And then for that to then turn into this horrifying inflation problem, which is now eating back those wage increases, potentially going to require much sharper action from the Fed— I recognize the world doesn’t have to please me, but it is maddening. And I think one of the hard questions, before we even get into Ukraine and China— I think one of the hard questions is, does it have to be this way? Did it have to be this way? Is there some way for this to end without the people we were finally helping suffering?

The short answer is that it doesn't have to be this way, except for Americans. It's quite simple; deficits are inflationary. The US can provide quite a lot more social benefits, but it would have to raise taxes to pay for them and American voters won't accept that. The US can engage in massive infrastructure spending, provided it's paid for, without causing inflation, if the spending occurs when the economy is NOT booming, in order to avoid those worker/materials shortages of which you spoke. The problem, of course, is that major infrastructure projects tend to have long planning periods so you don't what the state of the economy will be when construction actually starts.

Incidentally, having lived through the '70s and '80s, I would not describe the current inflation rate as "horrifying"; I think the strongest descriptive I would apply is "a bit too high but not a good reason to get your knickers knotted".

it would have to raise taxes to pay for them and American voters won't accept that.

Seems doubtful the way you've structured this sentence. I think more accurate would be to write "the substantial supermajorities of voters that would be required because of our explicitly vetocratic constitution can't be found to raise taxes." Or something to that effect. Lots of "American voters" (I suspect a majority) do support social democracy.

When you have a constitution that requires you to get 60%+ of the vote to command the margins necessary to enact popular policies, it's a problem!

When you can't get a 60% margin, you should probably be careful about making major changes, since a small pendulum swing results in those changes being swiftly reversed because they no longer have popular support.

The majority rules, but a small majority needs to rule carefully. In a closely divided society, little will get done; this is just as true in parliamentary democracies where in principle a simple majority can do anything as it is in the US.

Take it up with Larry…

So I share completely the emotional feelings that you describe around the benefits of a strong economy. But I think it’s very important not to be shortsighted and to recognize that what we care about is not just the level of employment this year, but the level of employment averaged over the next 10 years. That we care not just about wages and opportunities this year, but we care about wages and opportunities over the long-term.

And the doctor who prescribes you painkillers that make you feel good to which you become addicted is generous and compassionate, but ultimately is very damaging to you.

1) Gibberish. 'Experiment'? How does that even follow that people need to be in poverty?

2) Gibberish. Poor people not being poor is bad because they'll eat and want stuff? What?

3) Gibberish. Statement without any evidence, but when you invest in a community... https://www.city-data.com/city/Quinault-Reservation-Washington.html

4) Gibberish. Infrastructure what? Infrastructure creates the supply, it doesn't just consume supply.

Why do we let racists post, again?

Sweetie… that is Larry’s argument not mine. But, of course, you are clueless and unable to understand the arguments presented. So yes. Larry’s arguments are not compelling, but sadly, they will prevail.

I often listen to Ezra Klein, but I looked at his latest podcast and saw Larry Summers and in the description it looks like Summers hasn’t changed his views at all and I decided to pass. I strongly suspected (before the Ukraine invasion) that most people would go back to buying services and back orders would get filled and by summer inflation would be noticeably lower.

I found Krugman’s comparison of the current situation with the late 40s to be much more compelling than Summers’ arguments. Demand became high for things that weren’t being produced at high levels and it took a couple of years for capitalism to adjust. All without massive interest rate hikes. That sure sounds like a match for today.

Of course, I have no idea what Putin’s folly bodes for the future.

Yeah. This can be summarized as "member of rentier class makes rentier-friendly pronouncements."

Or: Larry Summers gonna be Larry Summers.

+1!

+1

Exactly.

Also, it doesn't help that we make core measurements on stuff that has supply constraints.

Anyone notice that tomatoes have fallen to a price unseen for years, yet we're six months early for the peak of the season? No?

I'm not the biggest fan of Summers's view either, but like it or not he's pretty influential. So I'll probably give it a listen. Also, it wouldn't violate the laws of physics for him to be correct and Krugman to be wrong. And I'm interested in the policy and political implication flowing from the possibility.

Larry Summers says ... The first is that demand is too high.

"Too high?" That's not the terminology of an economist. That's the terminology of a politician disguised as an economist. The adverb "too" must be relative to something. The phrase "too high" must be relative to a specific thing--supply.

If the demand it too high for the supply, there are two corrective actions that could get them back in balance--reduce demand or increase supply.

Which would you choose?

Hold the phone! You mean Larry Summers ISN'T an economist? I've been wrong in thinking he's a disinterested economist this whole time, and not just some rich asshole with an axe to grind?!?

Inflation expectations are meaningful chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/viewer.html?pdfurl=https%3A%2F%2Fwww.federalreserve.gov%2Feconres%2Ffeds%2Ffiles%2F2021062pap.pdf&clen=309093&chunk=true

While it would be great if inflation was just a temporary result of supply chain challenges, I believe the data shows something else. If you look items such as rent (or home prices) , raw materials or wages, you see increases that will definitely impact future prices. Basically, even if the supply chain returns to 'normal' my landlord is not going to lower my rent, my employer will not likely reduce my wage etc.

One can have a robust conversation about what caused US inflation to be higher than Europe and much higher than OECD countries in Asia; however, the transitory/its all the supply chain concept appears to be dramatically inadequate as a full explanation for inflation.

"Basically, even if the supply chain returns to 'normal' my landlord is not going to lower my rent, my employer will not likely reduce my wage etc."

Well yes, of course. Nobody was thinking that "transitory" inflation meant inflation followed by compensating deflation.

Re: If the supply chain returns to 'normal' my landlord is not going to lower my rent, my employer will not likely reduce my wage etc.

Right, but if those and all other prices stayed the same, neither increasing nor decreasing but just stabilizing where they are at, then the inflation rate would be 0

Many 10s of millions of people (like me) can afford to pay more for the junk we want and need. We’ve had a good run of cheap manufactured goods. As I write this comment, my sister is on vacation at a Mexican resort. Her two adult kids are on spring break with their kids in Florida at resorts. Many of my professional work colleagues have already taken or are planning cruises and trips this spring. This is the upper middle class life. We don’t care about inflation. I made more money 8n 2021 than ever before and will exceed it again in 2022. I don’t give a shit if my chicken costs an extra $1 per pound or gas costs $4.15 a gallon. It’s nothing.

Bring on the higher prices and let the upper half pay for all the crap they want.

I got mine, screw the rest.

I’m not going to go off partying, but lots of you will. Take it up with them.

Price increases will eventually work through the economy. What one should be concerned about is self-sustaining inflation. That requires a positive-feedback loop, such as the notorious wage-price spiral. As Kevin has charted for us multiple times, real wages are stable or falling, so there is no spiral, no positive feedback. The burden of proof is on those who claim that the current price increases are not exogenous and therefore transitory, to identify a positive-feedback mechanism sufficiently strong to sustain general price increases. Also, Kevin (and I) never ascribed all price increases to supply-chain problems; clearly, the Covid-19 economic-impact payouts drove spikes in demand, while illness absences, shutdowns, and other public-health measures constrained supply.

Middle, you threw the word "chain" in there after I cited supply shortages. I never said "supply chain."

Why are housing prices going up so fast? Because the supply of available houses is smaller than the demand for them. Is that a "supply chain" problem. No, it's a supply problem. The price of hamburger meat is going up. Is that a "supply chain" problem? No, the chain where I live is about 20 miles long, right here in Augusta County. It's simply the supply that is not enough to meet the current demand. When more people want to eat beef, the farmers can't simply turn up the counter on the cow-assembly-line. It takes some time to make more cows, y'know.

There's a lot of pent-up demand, because people are (a) feeling more confident that we are headed back to a more normal life, and (b) to a significant degree, people have used the money they got in the past two years to pay down debt and increase savings, so now that (a) is true, they want to get the things they denied themselves the past two years. Tightening the credit market is exactly backwards! These people who are creating demand aren't doing it because interest rates are too low; they're doing it because they've become able to do it. The enemy isn't easy money; the enemy is impatience, and that problem will cure itself over time, as the supply side catches up.

Well stated.

Am I wrong in thinking that, had the Democrats managed to raise the minimum wage to $15 an hour, Larry Summers and everyone else would blame every inflationary problem on that raise?

Well, Dean Baker wouldn’t. Neither would any serious student of productivity and wages.

After selling my house in San Jose I will be doing my damndest to boost inflation.

Gonna buy a new truck to haul the horses. Got rid of the two old diesel trucks. The new one will get much better mileage so I will be fighting global warming. WhoRAW! for me!!!

Perhaps inflation is high because "we" have cut taxes too much for business and the upperest incomes. All that unproductive money floating around for stock buy backs and executive bonuses and leveraged buyouts and hedge fund purchases is causing inflation.

Perhaps rescinding the Trump tax cuts would slow down inflation.

(Only a little /s)

Where is our inflation crisis supposed to come from?

Fox News, of course.

BINGO!!!

GPU's and graphics cards are not becoming available, and there are even some price drops....OMG....

https://www.cnet.com/tech/computing/gpu-stock-begins-to-normalize-with-price-cuts-on-the-horizon/

Companies are raising prices because they can. Increasing capacity? Well this just might be a "short" spike in demand, so not worth it, esp. if we are raking in profits now that prices are up.

"because they can" ... and because everybody is talking how bad inflation is, so why not up your own prices and increase your profit margin? Best of all, this makes Joe Biden and the Democrats look bad, so the odds of getting a "business-friendly" Republican Congress this fall go up!

Win-Win!

true...the full phrase should be "because they can...blame someone else"

Exactly.

Don’t take the bait. Don’t buy the expensive crap from China.

China makes the expensive stuff?? Then why are so many outside corporations using them as suppliers?

Expensive… inflated. This is the debate. Why pay more for junk than we did last year?

Good luck surviving as a consumer of goods anywhere in the world these days without indirectly buying loads of Chinese parts and components. That "Made in America" item in the vast majority of cases has a lot of inputs from China.

"Beyond that, there's no special reason (is there?) to think that our supply chain shortages will last much longer now that everyone is back to work"

I'm not sure about this assumption at all. It takes forever for chip fabrication capacity to come online and a lot of the real bottlenecks driving inflation on the demand side right now are "semiconductor adjacent". Sprinkle in higher-than-normal inflation expectations and an energy supply reduction and we could be seeing supply issues for another couple of years.

The concern at that point would be whether growth can keep pace or whether we'll have to monetarily induce a recession to fully reset things.

Stop buying stuff you don’t need. Problem solved. But of course… I can afford stuff I don’t need so… to heck with it.

And really…just stop giving a crap about the so called average Russian whore.

The crime first came to light last week, when Ukraine’s prosecutor general, Iryna Venediktova, said in a Facebook post that a Russian soldier had killed an unarmed civilian and then repeatedly raped his wife. Days later, the White House said it was concerned about emerging reports of sexual violence in Ukraine.

That’s who they are. Exterminate them.

"And the worms ate into his brain..."

Assumes amoral monsters have brains for worms to eat…

My moral center is well established and justified. If you’d like to explore the topic, just ask.

There was absolutly no "wage-price spiral" during the inflation spikes of 1975 and 1980. Real wages actually crashed badly as inflation rose 1973-75 and 1978-80:

https://fred.stlouisfed.org/graph/fredgraph.png?g=N7Yb

Why do people who claim to be liberals keep repeating the nonsensical claim that uppity workers demanding higher wages were responsible for inflation at that time?

Of course what did cause those inflation spikes was mostly the huge and unprecedented raises in oil price, and inflation plunged when oil price quite rising, not when the Fed raised interest rates. Somehow the fact that the Fed failed to prevent inflation in the 70's doesn't seem to have registered with economists. Current views on what happened then are mostly fantasy.

Economies are better prepared for these price shocks now, but if oil price keeps rising we can expect inflation and the Fed will be able to do nothing about it. Of course there could be more supply-chain problems, but as Kevin says the stimulus money is gone and apparently will not be replenished and more pandemic problems could even lead to drop in oil demand and price, as it did in 2020.

Of course what did cause those inflation spikes was mostly the huge and unprecedented raises in oil price...

This is almost certainly wrong. We've seen other episodes of oil price spikes, and the trend is usually dampening with respect to growth, with very little effect on inflation. Why were the late 70s different? Policy-making and labor market structures conducive to growth in the money supply, that's why! Also, not sure why you think wage increases would have to be real (ie, higher than inflation) to stoke price increases. Given enough time, eroding household purchasing power will indeed eventually exert downward pressure on growth (we saw this in 1980). But that "eventually" can take some time to unfold, as it indeed did in the late 70s.

Oil prices are toast. 50$ by May???

We need to stop using any phrase similar to,

'they were trying to overturn our democracy'

It's too polite. When people on tv talk about 'our democracy' there's a huge mass of the dim who will hear that and think it doesn't mean their democracy.

We need the stupid to be certain what is meant,

The Republican party was trying to overthrow the government and establish a dictatorship.

The Republican party wanted to set up something exactly like Putin's Russia.

We need to show footage of the destitution that is ordinary for Russians and the carnage they cause in Ukraine and anywhere else they can because that is the Republican plan for America.

The Republican plan is to create dictatorship and poverty, and nothing else.

The end of the dollar as the world reserve currency will be the source of inflation in the US.

huh what now?

So, how's that gonna happen, exactly? In the foreseeable future, please.

Why are you paying attention to a useless grifter like Summers?

I honestly don’t find Larry Summers credible at all on this.

Atrios is extremely acerbic in his takes these days. But he’s right about Summers.

Agreed. He's only invited on the talk circuit because he says the things that the owners want to hear. TL;DR: Summers doesn't have to worry about losing his reputation with these antics because he has no reputation to lose. IMHO, of course.

Any sign the surge in rates may have peaked, or will soon?

1. Interest rates about to hit major long-term resistance

2. Cass Freight Index (leading indicator of CPI) has had big drop recently

At video:

https://youtu.be/vjWNybGp5xI?t=1428

Way surge??? This is normal, on the low side.

See: https://bityl.co/BXC4

Re chart A, note how the Core CPI in the US was higher than Eurozone even before the pandemic. But of course, note how the gap of ~1.25 points is now ~2 points. This gap is probably generally explained by the difference in federal expenditures the US made, relative to Eurozone countries in aggregate. But other than that, the big picture is that the pandemic has affected inflation around the world.

Re chart B, note the change of "items affected by supply disruptions and bottlenecks". I continue to believe that we're (the US foremost) still feeling the effects of global (and local) supply chain disruptions. Why is the US worse off than the Eurozone? Perhaps it's the knock-on effects of the tariffs. BLS does not impute tariffs into the price of imported goods, which makes the total value of imports seem only slightly more than the Eurozone, but the prices paid at the store is where inflation is measured -- that's where tariffs show up. Tariffs, as designed, have price equilibrium effects, so that if a cost of an imported pencil at the store is $1, then domestic manufacturers will raise their prices to $1.

Count me in the "high inflation is caused by exogenous shock (and the US response)" camp, and not the "Larry Summers was right and we're seeing runaway inflation" camp.

Policy-wise, to address core CPI inflation you'd want to hit the pause button on tariffs if you think inflation is caused by the lingering effects of exogenous shock.

Or you know, trust Larry Summers and deliver a shock to the economy by dramatically increasing the cost of money and see where we end up on the other side in the midterms and 2024.

Tariffs are irrelevant.

That time when Republican Herbert Hoover signed Smoot–Hawley to address the deepening economic crisis in 1930, pushing all other countries to enact their own tariffs. Great times. Triggered an economic recovery overnight and everyone celebrated Hoover's brilliant corporate rescue.

My memory is bad. Didn't it happen that way, more or less?

Richest politician in each state,

https://i.redd.it/xs0kt6b8tbq81.png

Funny how the only way to protect the American economy is to cut wages.

Inflation is fiction propped up by propaganda. If the US economy quit growing right now, so GNP is 0% and Inflation was 0% what would happen?

Answer: Nothing because it is not possible for GNP to be 0%, it can be negative or positive but never 0.

Inflation, deflation or stagflation, which would be better?

Answer: Depends on where you are in the economic cycle and economic class.

If you are rich and want to be richer which is better or does it matter at all? Really doesn't matter at all if gas is 5 bucks or 10 bucks you probably don't even know what the price of gas is because you don't fill up your own car.

If you are retired and poor or middle class on a fixed income which do you think would be better? Deflation or stagflation, prices go down or stay the same so your money buys more or the same amount.

If you carry any amount of debt we all know Inflation is better for you.

If you are a careful consumer and try to save money which is better? We end up back at it depends on what the rate of return is for the savings you are creating.

For the last 20 years the US has enjoyed a low inflation economy that has also created massive amounts of surplus borrowed capital due to artificially created low interest rates. This surplus of capital has created an artificial surplus of non employment income. Workers have not benefited from any of the supposed low inflation low borrowing costs due to artificial employee surpluses caused by offshoring.

The old saying nothing in this life is free is true and we are seeing the beginning of the costs of our economic overlords hubris. The Fed has been handing out money at or near 0% for 14 years trying to get inflation to be 2% well guess what folks, have a pandemics and throw in a war in Europe and all of a sudden Inflation is out of control and I do not really see any way to stop it until all the artificial aspects of the economy are burnt to ashes. The Fed funds rate is going to go from 0% to 5% in pretty short order if the Fed actually cares about 7-10% inflation. If the Fed doesn't care about high inflation then that could be rather troubling for the world. Good luck folks, it going to be a hell of a ride.

Maybe, but price creation has always been a double edges sword. If people keep buying the stuff......

Just a reminder, once again, that much of the standard dogma about inflation is falsified by the history of Japan since 1991. Japan has spent enormous amounts on infrastructure, leading to debt/GDP of over 250%, but has often had (minor) deflation rather than inflation over the last 30 years. It has kept interest rates very low and and BoJ has been buying up most of the longer-term bond issues. Why has this not led to major inflation? Rather than try to figure out what makes Japan so different, US economists mostly continue to believe in the dogma that the Fed can control inflation by raising interest rates, despite the failure of this dogma in the 70's.

The inflation hawks have always, always, always struggled to explain where the runaway inflation will come from and how the economy will suffer if moderate inflation continues for long periods.

The long stretch of low, sub 2% inflation is associated with anemic economic growth, wage growth, productivity and increases in well being....but we are assured that this inflation state is optimal.

Historically (including recently) moderately higher rates of inflation are associated with better economic outcomes.

If in the recent past you had predicted that we would see 7% inflation along with booming job growth, wage growth, new business creation, productivity, stock prices, bank account balances and equity levels.......your prediction would have been laughed at because moderate inflation can't coexist with these factors.

But yet.....

Lets face it: Inflation hawks NEVER give us a detailed picture on how inflation was going to rise. Instead they keep invoking the ONLY time since WW2 that they were actually correct.

Reminds me of the foreign policy crowd that looks at every event from the point of view of the Munich 1938 agreement that let the Nazis keep Czechoslowakia.

One could of course fight inflation also by cracking down on company profits. But that would lower the stock market indices and the Larry Summers's of this world won't have that.