President Biden has proposed an increase in the capital gains tax to 43.4%. This produced a brief response on Wall Street and then everyone returned to their real business: namely that of piling every last cent they could lay their hands on into a SPAC.

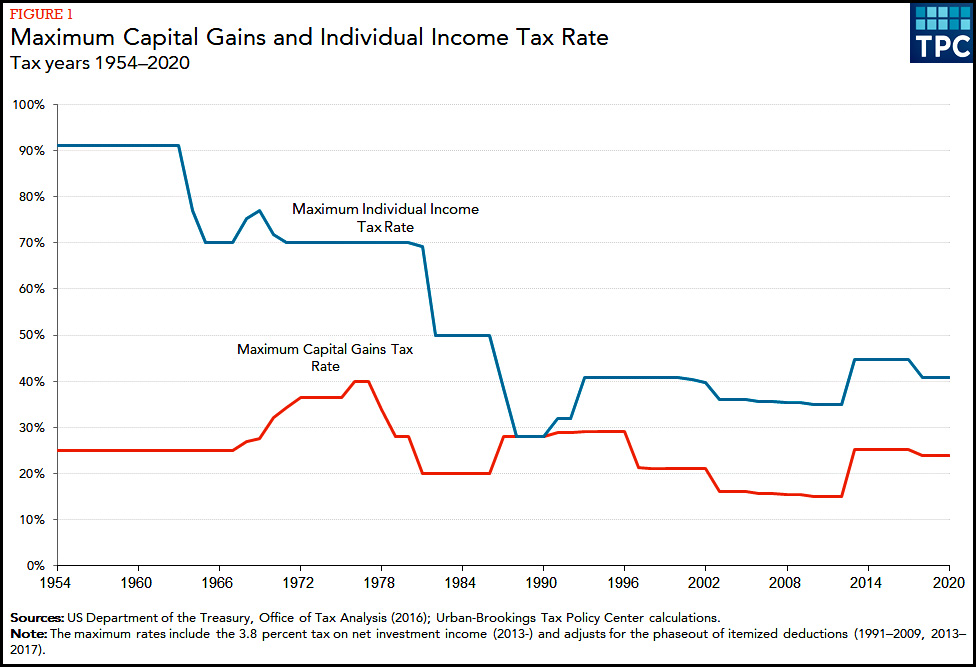

So what would a cap gains rate of 43.4% look like? The Tax Policy Center has you covered:

It would be high! On the other hand, during the early '90s the combined individual and cap gains rates were about 70%, while under Biden's proposal they'd be about 83%. So rich people wouldn't be all that badly off.

Of course, the real question is whether it's a good idea to tax capital at such a high rate. In theory it's a bad idea since it discourages investment. But does it?

It's hard to see much of an effect in either direction. This is, needless to say, not a sophisticated analysis, but at the very least we'd like to see a downward spike in investment when the cap gains rate increases, but we see no such thing. We'd also like to see an upward spike when the cap gains rate decreases, but again, there's no sign of that. The only things we see are brief pauses in the investment rate during economic recessions.

I'm enough of a neoliberal shill to be nervous about a high cap gains rate, but I'm also enough of a technocrat to want some serious evidence that a high cap gains rate has historically been bad for investment in the United States. So let's see it. Let the games begin.

The idea that capital will not be invested if it's taxed is The Big Lie. You want to be sensitive to not taxing inflationary gains, and perhaps something could be said for protecting true long term gains (10+ years) in order to incentivize folks to take a longer term outlook. But what else are rich people going to do with their money? Spend it? That would good for the economy too. Perhaps there's a capital gains rate that's too high, and it certainly shouldn't be taxed more than ordinary income, but if there is we haven't found it yet.

Completely agree, especially with regards to true long term gains (10+ years is a good barometer there, but perhaps there could be another tier at 5+ that gets a preference but not quite as much - for the riskier investments).

True, the rich are not about to stop investing. What else can they do? Stuff their dollars into mattresses?

The Tax Foundation (which should not be entirely trusted) says the Biden tax plan would lower income for the top 1% of earners by 7.7%. Someone making, say, $5 million / year after-tax currently would make $4.6 million if the plan is approved. Even the 1% are smart enough to know that $4.6 million is better than nothing.

Taxing capital gains like income might hurt gamblers, but why should it hurt investors? Indeed, taxing capital gains like income might discourage gambling, which would be good for an investment market. Do I have evidence for this speculation? Just as much evidence as there is that taxing capital gains like income discourages investing: zero.

Short-term capital gains are already treated as ordinary income at tax time. That hasn't stopped people from trading stocks. The Biden proposal on capital gains is for long-term gains only.

One quirk of the Biden plan is that the max rate on capital gains would be slightly higher than his max rate on ordinary income. That could encourage an investor to sell an asset in the first year rather than pay a higher tax rate on capital gains in the future. But many big-time investors would probably rather delay paying the tax by not selling the asset.

The biggest change in behavior would be this year. If taxes were due to nearly double next year, many investors would want to lock in a new cost basis now.

Worth noting: the proposal affects taxpayers making more than $1 million per year only. No one else. If you're not among the 1%, no change.

minor detail 😉

And I'd guess little to no effect on 401/403K's...

On benefit is that corporations will stop trying to jack up share prices and pay out dividends?

My understanding is that distributions on 401K/403b,c are taxed as regular income.

You understand correctly.

Dividends are taxed at their own rate. A disadvantage of dividends is that they are paid with after tax money, so in a sense they get taxed twice. On the other hand, I think long term dividends are taxed at less than earned income.

Depending on the stock buy backs can be very effective. They cause the stock price to go up more than the amount expended, maybe.

Plus there are ways to avoid paying the capital gains altogether. You could donate the stock and get credit for the current price as a tax deduction without paying the gains since you purchased the stock. (I think this is correct.)

Let me spring an associated idea on you - that we have too much investment capital sloshing around, taking more and more high risk options because it has to go somewhere.

I believe there has been too much cash floating around for a long time and that is why the stock market rises even on bad news and why there could be a housing bubble and why foreigners are buying US assets.

Governments need to tax it away from them and put it to good public uses.

Let the rich keep money, but somewhat less of it. Then we'll see them competing to make more, rather than to hide it and shelter it.

Yeah, but this housing bubble is a illusion due to the pandemic and indeed, it is starting to slow down. Real prices are likely to decline over the decade.

Well, too much is going into risky (and esoteric/derivative/misconceived) investments, because corporations aren’t borrowing enough to invest in research and development. I think the biggest shortfall is in production processes — global labor and environmental arbitrage is more attractive to executives than investment in automation, materials science, and sustainable processes (Partly because it’s cheaper, partly because they can’t understand the technical issues). Tax policy on capital gains isn’t going to change the short-term incentives of executives.

I think the British never had a separate capital gains tax rate, so they'd be a good example to look at in terms of incentives.

I do think it's rather perverse to have the capital gains rate be higher than the income tax rate. That does disproportionately punish investment (especially since future income is discounted), and it will probably lead to a greater shift into privately held companies and pass-through firms where they can take it at the lower income rate.

The real losers here would be California and New York. With no SALT cap, capital gains taxes in those states would approach 60%. Pretty strong incentive for investors to move out before cashing out.

Wonder if that’s just a bargaining chip?

It is and the Administration admitted it.

I think it's fairly obvious that we have way, way too much capital just sitting around looking for a place to be parked while the rest of our economy, particularly workers, suffers. And what do you do with something when there is too much of it? Taxing it is a great place to start.

I'm willing to accept the idea that the tax code should make some gesture toward encouraging investment.

But I've always wondered about the desirability of simply using a decent-sized exemption for investment income, and then taxing everything above the threshold at the same rate as wage/salary income. By setting the exemption at, say (for argument's sake, I haven't done the actual calculations) $50,000, you could provide a fair degree of relief for non-rich Americans, but fat cats receiving millions annually in dividends, interest and capital gains would no longer be paying lower tax rates than truck drivers and teachers.

FYI: the tax rate today on long-term capital gains is already 0% for income up to $40K (single) or $80K (married couple).

"Long-term capital gains are taxed according to graduated thresholds for taxable income at 0%, 15%, or 20%. The tax rate on most taxpayers who report long-term capital gains is 15% or lower."

https://www.investopedia.com/articles/personal-finance/101515/comparing-longterm-vs-shortterm-capital-gain-tax-rates.asp

Most capital gains are not earned from investments in reproduction. They are returns on speculative bets where money is traded only in financial markets that have no connection to the markets for goods and services. The tax rate on financial speculative capital gains should be confiscatory.

The tax rate on short term capital (assuming we're talking stocks/securities) is whatever income bracket you're in. That's just fine, although we do have some income bracket issues as well.

Kevin, you appear to be assuming that more money put into investment is necessarily a good thing.

We've had forty years of supply-side economics, privileging investment and figuring demand will magically appear to meet supply. It has put us into a nasty spiral that I don't see us getting out of any time soon, particularly since most people believe the mythology that investment makes everyone richer and unions make everyone poorer.

Demand only exists when people have money to buy things. But paying a living wage will take away money that could be invested, we can't have that. We certainly can't tax the rich to pay for good roads and good education (you know, societal investments). As a result, the majority of people spend a lot on repairing their car shocks and paying off mountains of student debt. They don't have much left to buy stuff.

The rich have plenty of money, but they are going to buy only so many luxury yachts, and building luxury yachts will only employ a small number of people. Demand for everything except luxury goods withers, while the rich run out of things to buy.

What to do with the rest of the money? Invest it! But what can they invest in? Producing things gives a poor return on investment. They turn to the stock market, and an ever-growing amount of money chases a limited number of stocks.

This is classic inflation, but somehow it's a good thing in the stock market.

Price-to-earnings ratios become farcically high. Stocks become collectibles -- you don't expect to earn money by holding them, but by waiting a little while then selling them for a higher price to someone who plans to do the same. The stock market churns, with the financial market taking its cut every time the money sloshes past.

A contract to buy all of a farm's production changes hands five times between planting and harvest. The farmer got only the amount in the contract. In order to make money the final investor has to sell the produce for a lot more than the initial one could have sold it for. The price of food goes up, not because of increased demand, but because of all the middlemen, rent-seeking. When food costs more, people who aren't rich have even less money to spend on anything else, harming demand.

And on and on it goes.

Neoliberal shills want the advantages of their numeracy institutionalized in the tax codes.

Capital gains ONLY occur when there is DISINVESTMENT: people sell investments. Ergo, high capital gains taxes discourage disinvestment not investment. There should be an adjustment for inflationary gains, but otherwise high capital gains taxes encourages long term investments.

Exactly this.

Yes.

I don't completely get the logic of this statement: "during the early 90s the combined individual and cap gains rates were about 70%, while under Biden's proposal they'd be about 83%". No one pays both income and capital gains taxes on any dollars they earn (by work or in the stock market), though I guess you could say that's a general measure of whether taxes are high for rich folks no matter how they make their money.

Seems more relevant to me to note that the early 90s was the start of long economic boom, so maybe that combination was a good thing. At the very least, it doesn't seem to have been a bad thing.

A long economic boom??? Compared to the post-war growth rate, nope. It much like the 2010's was a long period of expansion, that peaked during the Y2K build up and overheated as earnings showed by 1999. The expansion ended.

Growth has slowed since then with the still low capital gains.

The bigger question in my mind is whether a higher capital gains tax rate for people who make over $1 million will actually raise any significant money. There are lots of ways to avoid paying capital gains taxes, and lots of very clever people at big law firms and investment banks eager to help with that project. The required financial engineering is usually too expensive for middle or upper middle class investors, but it is certainly cost-justified for the very rich.

"The bigger question in my mind is whether a higher capital gains tax rate for people who make over $1 million will actually raise any significant money"

Considering that 8% of the population here in the U.S. are millionaires maybe it would raise a good deal of money. 8% is about 20Million folks

nbc.com/2021/02/09/more-than-8-percent-of-american-adults-are-millionaires-heres-how-they-got-wealthy.html#:~:text=More%20than%208%25%20of%20American,Here's%20how%20they%20got%20wealthy&text=Invest%20in%20You%3A%20Ready.,-Set.

{snip}

Odds are you know at least one millionaire.

More than 8% of adults in the U.S. have enough assets to fit the definition, according to the Global Wealth Report 2020 by Credit Suisse. That works out to more than 20 million Americans.

{snip}

Lets note US GDP slowed down to 3.2% in the 70's and basically stayed that same spot in the 80's and 90's. The myth the 90's had some huge "growth boom" is lolz. The main difference was the Boomer surge ended and that dropped NAIRU. Similarly like the Boomers retirement origins in the 2000's further dropped NAIRU.

Now to hit the 4% unemployment rate of 2000, it would probably need to drop to 2%........no wonder Clinton struggled in 2016 with Reagan and LaFollete Democrats. Even then, the Trump pre-pandemic peak was hardly better than pre-1997 Clinton when adjusted for population growth. The echo Boomers didn't create a new population boom, but just filled in the gap, meaning no real population growth since 2000.

The economy must grow in the capitalist system. If it stops growing, the casino will collapse and debt liquidation will begin. A real socialist would say "bring it on baby". When white workers are losing social security, corporation after corporation goes bk, agribusiness collapses and fields don't get planted, it will be a glorious disaster of shortages, famine and disease. Exposing capitalism for what it is: a ponzi scheme of debt. Then comes the revolution.

And a pony!

The echo Boomers didn't create a new population boom, but just filled in the gap, meaning no real population growth since 2000.

If, by "no real population growth" you actually mean "50 million," sure!

What is this business about a "combined income and capital gains rate"? On any dollar of income people pay EITHER capital gains tax OR income tax. What they get hit with for their total income is a weighted average of those two rates; not the sum of them.

Personally I find capital gains tax rates that are lower than income tax rates morally wrong. Money earned by buying some asset and then waiting around until it appreciates and then cashing in is easier to get then money earned on a job. There is no reason to privilege capital gains. There is no evidence that lower rates benefit the economy as whole. If there were it would be fair to tolerate the injustice. But there isn't.

Never fail to call cap gains, rents, and the like "unearned income."

I have a pretty simple view of this. Some of the accounting-savvy commenters here might say I'm naïve, but so be it.

1) I think the notion that higher capital gains rates discourage "investing" is baloney.

2) There is a big difference between a) when a large corporation invests in new product development , a new line, or in infrastructure to enter a new market niche and b) when an individual (or a financial entity like a pension fund or mutual fund) "invests" in stocks or bonds through the markets, which someone above, correctly, labelled as "speculation" not "investment".

3) The only real dis-incentives to either kind of investing in #2 above are a) not having disposable cash available for it or b) believing the potential reward is not worth the risk. Sitting on cash in a MM fund is stupid unless it is a planned temporary strategy.

4) Capital gains are income. Period. Should be taxed as income, with only one exception: the exception we already have as one-time-in-lifetime exemption of primary residence capital gains. Why in heaven's name would we want to charge higher tax rates on actually working for income than on speculating? That is basically asking for trouble.

5) The wealthy are going to deem it useful to spend a significant part of their disposable wealth on hiding both "income" and capital gains from the IRS. They're going to engage in tax avoidance regardless of what the rates are.

There are a lot of tax avoidance schemes that work by converting what should be ordinary income into long term capital gains which was assumed to be taxed at a much lower rate.

Take for example rental property. If you own rental property you can depreciate the value of the building (not the land) over 27.5 years. Now some buildings are in fact worthless after 30 years, but many are worth more than what you paid for them. By depreciating a building that may not actually be depreciating in value, you convert ordinary rental income into a long term capital gain when you sell the building.

The "theoretical" result that the optimal capital gains rate is 0% is derived from economic models that essentially start out with something like "Assume the optimal capital gains rate is 0%". You could just as easily assume that the optimal capital gains rate is 40% because government will "invest" the money more wisely. With people willing to "invest" 10s of millions of dollars for jpeg files, it's hard to see how government could do worse (other than by spending it on wars).

The ideas that there is a shortage of capital, that increasing the amount of capital would increase investment, and that decreasing the cost of borrowing money (interest rates) would spur investment have been thoroughly tested and are clearly false. The huge drops in income tax rates since 1964 have increased wealth at the top, but there is no sign that they cause increased investment. The 2018 corporate tax cut clearly did not produce an increase in investment - Kevin has shown the evidence on this and it is perfectly straightforward. Record-low interest rates in the US, Europe and Japan have not produced a flood of investment. The problem with the US economy is not shortage or expense of capital, it is shortage of demand. Corporations do not see sufficient demand for constructive investment so they use the money to buy back their own stock. Demand can't increase if real wages don't.

At this point only neoliberal shills think that the economy can be improved by feeding more money to the top and expecting it somehow to trickle down. Unfortunately it is not only Kevin who still has neoliberal (supply-side, trickle-down) tendencies, but many self-described "liberal" economists do also despite the evidence. Of course it is in the personal interest of politicians of both parties to favor these ideas.

I have a joke about trickle down economics,

https://i.redd.it/tidckt58dqr61.jpg

If you really want to simplify the US Tax Code, you simply must treat income as income, with no cap gains vs. earned income distinction. This would immediately put a huge percentage of the pool of tax attorneys in search of other lines of business.

"would put a huge percentage of tax attorneys in search of [hopefully more productive] lines of business."

Yup. No mortgage interest deduction, no 'charitable' deductions to PBS/NPR.

The Virginia Wolfs of Wall Street of course...

There was a lot of money looking around for something to do the last 15 years. Instead of going into subprime scams or robotic juicers the government should take it and use it for actual stuff. I've said as much for years.

It doesn't drop investment because there's not that much to invest in that isn't already invested.

Short-term capital gains isn't an "investment"; it's a gamble.

The idea that taxing capital gains reduces overall investment assumes that most government spending isn't investment. Right now, it looks as though government spending is going to include LOTS MORE investment, investment in things that the private sector won't invest in, but which will spur economic development.

Soaking the rich and investing in social goods is a win/win.

You know what's wrong with this country? We used to make things, now we just play financial games.

It's generally assumed that there will be capital gains, and that taxes on them will be a cost for whoever realizes them.

There's another end of the story: capital LOSSES.

Really, depending upon how it is applied (which I'd have to do real work to figure out in very much detail, and I'm not planning on doing that) a capital "gains" tax is the government sharing risk: yes, if your investments pan out, the government takes a share; but if they do poorly, the government lets you reduce your income by your losses.

Naturally, the Trumpublican corporatists want to have their cake and eat it, too: low tax on gains but full write-off of losses.

Compounding the situation is that, to a fair degree, investors get to choose when they realize capital gains (or losses), and can do so with tax consequences in mind. So roughly a quarter of the value of my main investment account is unrealized capital gains that I have paid no taxes on, and generally when I decide to switch out of an investment and realize a capital gain, I try to find an investment with a loss that I can also liquidate and offset the gain.

This has the added cost of adding inertia to investing: if I have an investment that has gained a lot in the past but that I don't like the future prospects of, I have to consider that I'll have to pay tax on the past gains if I want to shift to something else. So I keep my buggy whip manufacturer shares and the warp drive start up is deprived of my potential investment.

It would be better to tax property ... as someone whose name rhymes with Welizabeth Arren has suggested.

At the very least 'investment' should be logged. It's the nature of money/interest related things that they grow exponentially. You also have to lag...it takes time for people to adjust to new circumstances.

You know what should be completely eliminated though...not just nibbled at? The mortgage interest deduction.