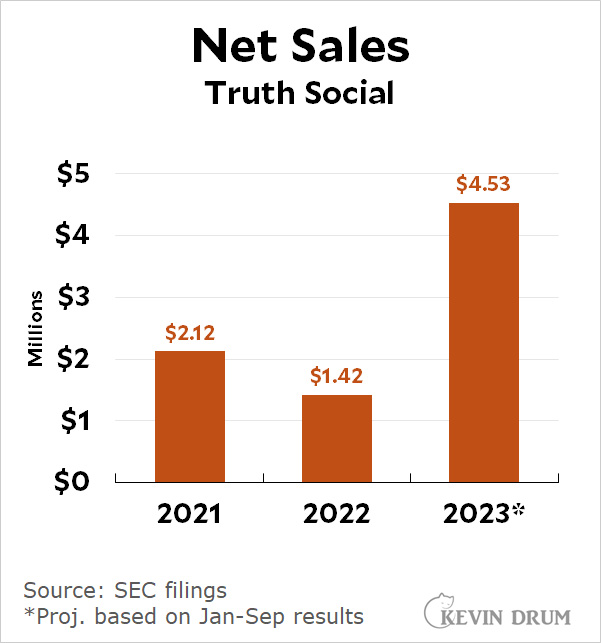

How much is Donald Trump's social media company, Truth Social, really worth? It's never made money, so you can't judge it that way. But lots of startup companies are unprofitable in their early years, and venture capitalists figure out values for them anyway.

The most common alternative is to look at net sales. Generally speaking, a startup with slow growth might be valued at about 3x revenue while a startup with faster growth would be around 7x or so. A skyrocketing startup might command 15x.

The most common alternative is to look at net sales. Generally speaking, a startup with slow growth might be valued at about 3x revenue while a startup with faster growth would be around 7x or so. A skyrocketing startup might command 15x.

Truth Social only has three years of results with inconsistent growth. In 2022 growth was negative and in 2023 it grew 200%. Investors are hoping that Trump will win the presidency and growth will continue at a high rate. Based on that, you might aggressively but plausibly value Truth Social at 15x revenue, or around $70 million. If you're a real true believer you might push that as high as $100 million. That's kind of crazy, but social media is a crazy kind of space.

Now, pay attention to some arithmetic. Today Truth Social will merge with a vehicle called DWAC, which currently has $300 million in cash and nothing else. So it's worth $300 million. Truth Social is worth (at a stretch) $100 million.

After the merger DWAC will have 188 million shares of stock outstanding. This means the cash is worth $1.60 per share and Truth Social is worth about $0.53 per share, for a total share value of $2.13. And yet the stock is currently trading at nearly $50 per share:

Question: Since the value of the cash is $1.60 per share no matter what, this means that Truth Social is being effectively valued at $49.95 - $1.60 = $48.35 per share. This is nearly 100 times its maximum plausible value. Why?

Question: Since the value of the cash is $1.60 per share no matter what, this means that Truth Social is being effectively valued at $49.95 - $1.60 = $48.35 per share. This is nearly 100 times its maximum plausible value. Why?

Once you figure that out, you know who's being scammed in this deal. The answer is: anyone who buys stock in DWAC.

UPDATE: After DWAC stock began trading on Tuesday morning under the DJT ticker symbol, the price soared above $70. In other words, Truth Social is now trading at an implicit value of 131 times its maximum plausible value.

OTOH, if all MAGA folks invest their life savings into Truth Social, they will stabilize the stock price, giving us liberals a middle finger. 😉

Don't tell them! 😉

Are you going to sell it short?

Can you afford to stay in the game until the MAGAts stop being irrational?

Especially since it just takes a couple billionaires wanting to funnel bribes to Trump to keep it propped up

If you had a good guess as to how long the mania can last, short selling is a way to make money. The problem is, the gain is a maximum of $49.95 per share (you borrow the shares at that price and sell them, getting cash, and then the enterprise goes bankrupt so the shares are worthless so you owe nothing at the end of the short sale period. But your risks are unlimited. If it goes all memeish and shoots up to $200/share, you have to buy those shares at $200 to return them. If you have a big enough cash balance, you can do it again and again, and if the stock finally goes down below where you bought it, you can cash out.

I believe the Keynes' quote is: "The market can remain irrational longer than you can remain solvent."

and conservatives will remain irrational until heat death of the universe

Welcome to the world of speculation.

"Once you figure that out, you know who's being scammed in this deal. The answer is: anyone who buys stock in DWAC."

Scammed? Or laundering bribe money?

Some of both, I expect.

This is the purpose of SPACs, to be able to lie about the financials. The SEC imposes all sorts of horrible restrictions like requiring promoters to tell the truth. SPACs let them get around this nasty, horrible government imposition on free enterprise.

This is utterly wrong

The SPAC as a listed company remains subject to SEC regulation.

The purpose of SPAC is to sneak around the requirements to do an INITIAL public offering - by an already listed company buying out an unlisted.

After the transaction occurs this entity is entirely subject to market regulations, SEC etc. (of which financial reporting as a listed company).

But dodges IPO requirements.

The House of Cards, the Pump & Dump will start to shake when the reporting kicks in, but that's quite enough time to fleece some rubes.

DWAC has been admirably honest in its disclosures, freely admitting Truth Social isn't worth much and its value depends almost entirely on Trump staying alive and capable of speech. The people investing in the company clearly don't care.

Their stock price shot up once people knew it was going to merge (or try to) with "Truth" Social. SPAC's are not allowed to be formed for expressly merging with a given entity (in lieu of a standard IPO), but...

Trump's casinos all over again?

~11% of the shares were short so part of the current action will be shorts covering. When that is over ... I was watching the individual trades and most were in single digits with a lot of one share purchases. Front month options are IVs in the 200s and further out ones still have IVs in triple digits. Just checked again and DJT is trading faster then SPY and QQQ and as fast as NVDA or AMD. One share is NBD, of course, but folks buying 100 shares or so from their IRAs will soon be very sad.

As of about 1:00 p.m. EDT it's trading at 49.95.

and 57.99 at end of day...

If I got this right, the purchase meant a lot of share dilution, but those shares can not be sold. Any investors in DWAC should be slowing selling off stocks now--feed them to the MAGA crowd with causing the price to plummet.

So, for an extra $20, can I get the actual stock certificate suitable for framing? For an extra $60, can I get it with the frame (shipping and handling extra)? How about for an extra $100 it will come with the frame and the Donald's signature?

It’s more likely a venue for foreign money to get funneled to trump.

It's like Bitcoin, a placebo of daydreaming, ambition, greed, narcissism, and, as it were, faith.

Or NFT.

For a look at what may happen to DJT, you might look at the two most popular meme stocks during the pandemic, AMC and GameStop.

AMC

Jan 2021: 21

Peak 2021: 649 (July, up 31x)

Current: 4.25 (down 99.3%)

Extreme bubble duration: about 15 months

GME

Jan 2021: 4.27

Peak 2021: 81.25 (January, up 19x)

Current: 14.91 (down 81.6%)

Extreme bubble duration: 1 month (bubble 1); about 12 months (bubble 2)

DJT is now trading about 69, up from 17 in January (up 4x).

At least AMC and GME were once legit businesses before the pandemic craziness began. DJT is nothing more than scam to get Trump rich, with barely a fig leaf (if that much) of legal fiction to get OK'd. I don't know where the line is drawn between market speculation and manipulation, and I'm still surprised the SEC, whose job it is to protect investors, let this out the door.

Holy Freakin' Holy Week!

It's not enough to scam investors for a few bil, on this day Trump is also selling the "God Bless the USA" Bible.

https://x.com/drmoore/status/1772670008730013706?s=20

Yours, for the low, low price of $59.99. Please allow 4 to 6 weeks for delivery.

You can pretty well bet the maga crowd are in to again throw away their hard earned cash. Sad.

Sad. Is it really? Separating these fools from their money feels Darwinian.

Darwinism only applies if something keeps a person from reproducing. Separating old and middle aged people from their cash isn’t going to reduce the number of their stupid descendants.

Functionally this is a Trump cryptocurrency whose value reflects Trump fandom rather than the business prospects of Truth Social.

I would not advise anyone to invest in it; at the same time, I wouldn't short it. Bitcoin has lasted a good long time even though it has no function.

Bitcoin main function is money-laundering by criminals, and that will keep it alive and well until it becomes regulated.

This also implies TS's reported net sales figures are accurate and not fancy accounting manipulation or just out and out fraudulent. I wouldn't presume that.

Fancy account manipulation? 4 million dollars of revenue in 2023 with a loss of almost 50 million dollars? You underestimate how easy it is to take money from MAGAts.

I expect the thinking is that when Trump gets elected president, he won't return to Twitter, but instead everyone will be forced to get on Truth Social and this will drive its valuation way, way up.

There are a lot of things wrong with this reasoning, but I think there's a lot of people out there to whom it makes sense.

"venture capitalists figure out values anyway."

You're aware that they're wrong far more often than they're right, right?

Well, I think "right" vs. "worng" is not the best framing. I think the VCs work in a "works" vs. "doesn't work" framing.

And you know, they make money. Lots of it. So I would say that they are doing well at picking "works". They are not too concerned with "my valuation is the absolute correct one" because it's a moving target, and there are too many circumstances. They are concerned with making money, and they do that very well.

They way they do valuations is based on particular types of companies, all of which are pre-IPO and startups. Warren Buffet does valuations of non-IPO mature companies, which I'm sure works differently.

If you want someone who does valuations of publicly traded companies, you have to talk to a very different set of people.

In other words, who can I unload this onto....

Very weird situation.

Seems DJT has two choices -- first option is sell now and grab the cash while the price is high, but doesn't that mean he no longer controls the company?

Option 2 is hang on to the shares, which risks the value plunging.

From what we know of Trump, hard to believe he won't choose door 1.

What does he care about controlling the company? This is a cash grab plain and simple.

Rules say Trump cannot trade his shares for 6 months. (Oh, except for that fine print that says he can get a waiver from the board.)

But when he sells, the price will plummet. It remains to be seen how much cash he can get out of the deal.

Similar to idiots buying Trump bobbleheads, or frankly people buying bad Hunter Biden paintings, there are idiots born everyday.

The only way this company ever makes money is if future emperor trump requires all "real" americans to have an account, at penalty of death. There is a non-trivial chance that this happens.

Adoph Hitler made a lot of money as an author. At least he did once the Reich started giving every newly wed couple a copy of Mein Kampf.

Who and when will they pull the rug?

Ronna McDaniel unhoused by her talent agency,

https://www.yahoo.com/entertainment/caa-cuts-ties-ronna-mcdaniel-213310266.html

Now do Tesla.

they'd have an excellent P/E ratio--if they doubled earnings on each vehicle sold and had 80%+ market share (world wide).

Selling short requires borrowing the stock, which means someone has to be willing to lend it. Just to set a baseline, if you sell Microsoft shares short at Interactive Brokers, you will be charged an 0.25% borrow fee. That means that if you sell Microsoft shares short, you will receive interest on the proceeds of the sale (currently about 5% annually), but you will have to pay a borrow fee of 0.25% annually, so you will earn interest at a net rate of 4.75% if the stock price doesn't change.

For Truth Social, the borrow fee is currently 547.16%. This is the result of supply and demand; lots of people want to borrow the stock to sell it short, so lenders can charge a lot to lend the stock. Borrow fees are quite volatile (yesterday it was somewhere around 367%), but you can see the problem. That 547.16% comes out to about $1.50 per share per day. So depending on what happens with borrow fees, if you sell the stock short at a price of $67/share, you could easily spend $67 per share in borrow fees over the next 45 days.

An alternative to selling short is to buy an in the money put. For example, Microsoft is currently selling for about $420 per share, and you can buy a June 21, 2024 put with a strike price of 400 for about $131. If you buy these puts, then when June 21 roles around, you have the option of buying Microsoft shares at the current price and immediately selling them for $550 a share. If the price is unchanged, the difference is $130 per share. Since you paid $131 for the puts, the net result is a loss of $1 per share. ASn advantage of this over selling short is that your risk is capped. In the unlikely event that the stock goes over $550 per share, you don't exercise your options, and you only lose $131 per share (the cost of the options).

For Truth Social, the current stock price is about $67 per share and a June 21, 2024 option with a strike price of 90 is $61. That means that to make money, the stock price has to fall below $29 per share ($90 - $61) on or before June 21. Selecting a higher strike price doesn't help. I think the issue is that sellers of put options tend to be traders who use sophisticated strategies to limit their losses, which generally means selling short the underlying stock. (If the stock goes down, the trader loses money on the puts but makes money on the short sale.) So high borrow fees get translated into a high cost to buy a put.

The borrow fee for Truth Social is now 718.87%. The good news for short sellers is that the stock has fallen to about $50/share, so they have probably made money even after paying the borrow fees.

Pingback: Weekend link dump for March 31 | Off the Kuff