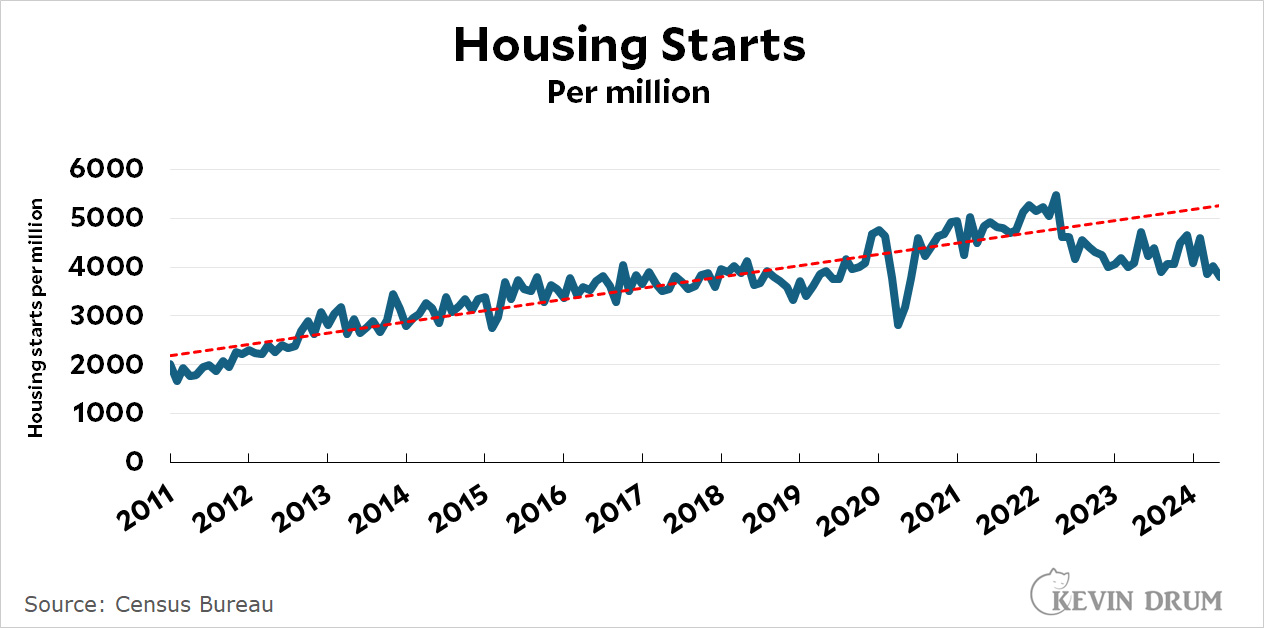

Housing starts were down in May, continuing a trend since the construction peak of early 2022:

It's not as if housing starts have collapsed: they're now at the same level as they were right before the pandemic, following a decade-long rise after the housing bust of 2006-09.

It's not as if housing starts have collapsed: they're now at the same level as they were right before the pandemic, following a decade-long rise after the housing bust of 2006-09.

This slowdown is one of the things that makes me skeptical of the "housing crisis" narrative. We clearly have the ability to build more houses—land use regulations or no—and the price of housing continues to be high. This means new construction is profitable. But for some reason homebuilders have nevertheless slowed down the pace of new residential construction. I'm not sure what could account for this nationwide aside from relatively weak demand.

There's a housing shortage in California for sure, but it's mostly thanks to strong opposition to new homebuilding. The rest of the country doesn't generally share California's chilly attitude toward more people. Outside of the Golden State, I'm skeptical that homes are really in short supply.

Here in the Allentown, Pennsylvania area we are definitely seeing a housing shortages due to proximity to NJ, NYC, and Philly; dramatic improvements in Allentown, Bethlehem, Easton; and huge increases in the healthcare and warehouse industries. With high land prices and higher interest rates, costs/risks for builders have gone up. And there are still labor shortages after the housing bust. Of course, they are plenty of homes in smaller towns all over PA.

There's a boom in the warehouses through out PA, well, at least the eastern half. I wonder how many are sustainable. Maybe the ones in the cities are being converted to lofts.

"The rest of the country doesn't generally share California's chilly attitude toward more people."

...have you never attended a zoning board community meeting anywhere else? It's a pretty universally held attitude. The only real variable is how much political power folks have to deter development, which is not as universal.

Also the cause is pretty clearly a direct result of the Fed's interest rate hikes, since new construction is generally financed through debt rather than cash on hand. Demand for housing hasn't weakened, which is why prices continue to climb. Being sheltered from the elements continues to remain desirable.

"Also the cause is pretty clearly a direct result of the Fed's interest rate hikes, since new construction is generally financed through debt rather than cash on hand."

Indeed, the drop in housing starts at the beginning of 2022, right when the rate hikes started. This shouldn't be hard to understand...

Kevin is determined not to understand anything that contradicts his radical centrist worldview.

The drop in housing has to do with prices. They shot up massively. Everyone is pointing at rates but the real reason is the prices. Low rates do nothing but support higher prices.

If the only thing that changed was prices, then you would expect housing *starts* would increase. Projects that previously didn't pencil out would make sense when housing got more expensive (i.e. more profitable for the builders).

But if financing costs go up at the same time as home prices, then you don't get the increase in supply, because it becomes more expensive to build at the same time that the amount you can get for building goes up. So those projects that didn't pencil out still don't pencil out.

Yes, but if the price of the land factors into that.

Indeed. Fed policy is driving the recent slowdown. High interest rates make building more costly for homebuilders. Also, they make current homeowners less likely to move. Who wants to trade an existing 3% mortgage for a new one that's 7.5%?

The housing component in monthly inflation numbers would likely come down if the Fed actually lowered interest rates. Someone should tell Jay Powell.

Demographics point to housing demand staying strong for another decade. Millennials are entering that age.

That might be true for some people, but the exorbitant prices are the real reason people aren't buying. Everyone in the Real Estate industry avoids discussing this problem. If you look at pricing charts, the asks on property escalated massively starting in 2022.

We're looking to move in the next year and have been tracking prices for some time, you can see a clear pattern of flippers buying in 2021-22, sitting on the property and attempting to sell at a vastly increased price here in 2024. We laugh at the all the price decreases...

More than one factor at play but still an important factor. Existing homeowners are both sellers and buyers if they move, so high prices are roughly a wash for them, yet sales of existing homes are 1/3 to 1/2 what they were in the past.

NYT:

"...sales of existing homes are 1/3 to 1/2 what they were in the past..."

That is not "sales" but "homes for sale." IOW, supply.

I think the specific nature of the housing crisis is the inability to easily build where people would like to live or where many of the best opportunities exist.

I don’t think his data doesn’t contradict that.

There is an effective labor shortage, at least at the rate day laborers are being paid.

How many of the housing starts are in the starter home or "affordable" range? That's a bit hard to come by, but I did run across this:

https://constructioncoverage.com/research/counties-with-the-most-housing-growth-last-decade

And here's a blame immigrants take:

https://mishtalk.com/economics/housing-starts-and-permits-drop-to-the-lowest-level-in-four-years/

But they do have this observation:

"Don’t worry, LA has the affordable housing solution starting with “affordable housing units at $600,000 each to house 278 homeless out of 75,518 in the county.""

"This slowdown is one of the things that makes me skeptical of the "housing crisis" narrative."

What the fuck are you smoking?

I know you have very weird blinders about the housing crisis, but the slowdown (from already low levels of supply!) is one of the causes of the crisis.

As other commenters have noted, the inability to build as much as is needed is why we are where we are. Reasons for that inability can be financing, labor, or material before you even get to zoning and NIMBYs and exclusively-SFH-death-culters, all 3 of which Orange County is a notorious example of.

Housing, at some point, became a financial product and not a product made for people who are in the market for housing. Chuck Marohn does a great job of pointing this out. Housing is now a commodity and an investment rather than a place for people to live. The housing part is secondary to the financial transaction that occurs. I'm undecided as yet on whether that's a symptom or a cause, but I'm kind of leaning both nowadays (i.e., feedback loop) and that it doesn't really matter which came first (although I think probably it was a symptom first). But supply is determined more by capital flow and asset values than it is by the demand for housing.

"Outside of the Golden State, I'm skeptical that homes are really in short supply."

A simple principal of calculus: area under the curve (or between a curve and an axis/line) is the sum/total of each point on the curve. This means that the area between the curve and the trend line is the total number of housing units built that exceeded or fell short of the trend line.

https://fred.stlouisfed.org/graph/fredgraph.png?g=1phQk

Took a look at that and the area under the curve (the integral!). The trend line, given the past two decades of terrible production numbers, is slanted downwards and is therefore tilted towards your argument that there isn't a crisis. However, even with that bias, it blows your argument out of the water. Really, that trend line should be sloping slightly upwards to match population growth and replacing housing that ages out (i.e., needs to be demolished and rebuilt). And that's before you even get to the urbanization trend, which leads to lots of housing where it's not needed (Bumblefuck, Nowhere) and even less available housing where it's needed (literally any city).

Even if you assume that we overbuilt in the financial bubble (it WAS a financial bubble, not a housing bubble) in the early 2000s, we UNDERBUILT by at least 2x as much during the aftermath of the financial crisis. This has led directly to skyrocketing home prices, and at this point it's a feature and not a bug because it's one more vehicle of wealth stratification. Just one more way investment and private equity firms hoover up more wealth, and one more way people like you (who presumably have mutual funds and other retirement vehicles that depend on investment earnings) benefit from fucking over everybody else who doesn't own a home yet.

Radical centrist takes like yours just help cement this hardening of America into haves and have-nots, given that homeownership is the ONLY method of long term fiscal independence that is even conceivable to the vast majority of the population.

But hey, you got yours and you don't have kids, so why should you care?

I need a bigger soapbox, but this is pretty basic stuff here. It's not hard to understand, especially considering that one chart plus a basic knowledge of housing (and rent!) prices illustrates the problem fucking perfectly.

"This slowdown is one of the things that makes me skeptical of the "housing crisis" narrative. We clearly have the ability to build more houses—land use regulations or no—and the price of housing continues to be high. This means new construction is profitable. But for some reason homebuilders have nevertheless slowed down the pace of new residential construction. I'm not sure what could account for this nationwide aside from relatively weak demand."

-----

Uhh, this is nuts.

You spell out the housing crisis perfectly: High prices, ability to build more houses, yet supply is stalled and not keeping up with the strong demand signals (high prices) that you tell us are present.

Somehow you conclude that there must not be a housing crisis because you have a belief that there is not be a crisis. Evidence of the housing crisis makes you more certain that there is no housing crisis because maybe there is weak demand even though we actually see demand outstripping supply (prices!!).

Totally insane interpretation.

jdubs, you and I have sparred before, and so I want to take this moment to say you and I are in perfect agreement here.

Headline in June 20th NYT: The Housing Market Is Weird and Ugly. These 5 Charts Explain Why.

Chart 5 shows that "New single-family homes completed but not yet sold" has been steadily rising since about 2022. So, housing starts are probably declining because builders are having trouble selling what they've built. Affordability, interest rates, the usual suspects.

They want the highest profit margin, so build "luxury" housing.

We're not seeing anymore Levittowns.

I don't have any specific data but I'm pretty sure that the average size of a single-family dwelling has increased considerably over the last 70 years. Of course the real average price of a house has increased considerably and is now just off the all-time high:

https://fred.stlouisfed.org/graph/fredgraph.png?g=1pibb

Good luck finding a house for $200k anywhere now (near good jobs). Since 1973 real wages have not increased:

https://fred.stlouisfed.org/graph/fredgraph.png?g=1pibT

So of course houses continue to be less affordable for working people. Whether this is a shortage is a matter of definition.

Apparently there are fewer of the post-WWII Levitown-type of low-price developments. Is this because of land-use restrictions or because developers just decided that they could make more money selling the higher-priced houses?

These graphs use the CPI but the ratio of home price to wages is the same whatever index is used.

Just out of curiosity, what would be the ideal house size for a 1-person household, in your (and everyone else's) opinion?

I was pretty happy with around 900 sqft as a single person. That gave me an extra room for an office, one bathroom, small kitchen and dining room.

I think home office space is a must today if you work from home.

I recently lived in a 1000 sqft condo. It was ground level, so I had a patio and a small amount of green space, but I was renting so couldn't do much with that.

I needed more space than that. Not a lot more, but more. The main bedroom and secondary bedroom (office) were the right size, as was the living area, but the bathroom and kitchen space was way too small and the closets were small (but numerous).

I think about 1200 sqft for 1 person is adequate, assuming WFH. Currently sharing about 1800 sqft as a 2-person household and it's barely enough given the configuration of the rooms.

Yes, the size has tripled. https://compasscaliforniablog.com/have-american-homes-changed-much-over-the-years-take-a-look/

From your link:

2010s: The average new home ($292,700) offers 924 square feet per person (2.59 people per household, 2,392 total square feet)

In the 1790s:

Average home was 831 square feet and housed almost 6 people.

That's kinda crazy. Maybe deodorant worked much better in George Washington's time.

I'm in the not-so-sweet spot in the Boston area. My condo is worth a lot more now than when I bought it, but even the big down payment wouldn't enable me to buy anything because my income couldn't cover payments at 7%+. I'm OK for now but if health or whatever requires me to move out of here, options are limited to say the least.

> mostly thanks to strong opposition to new homebuilding

Evidence?