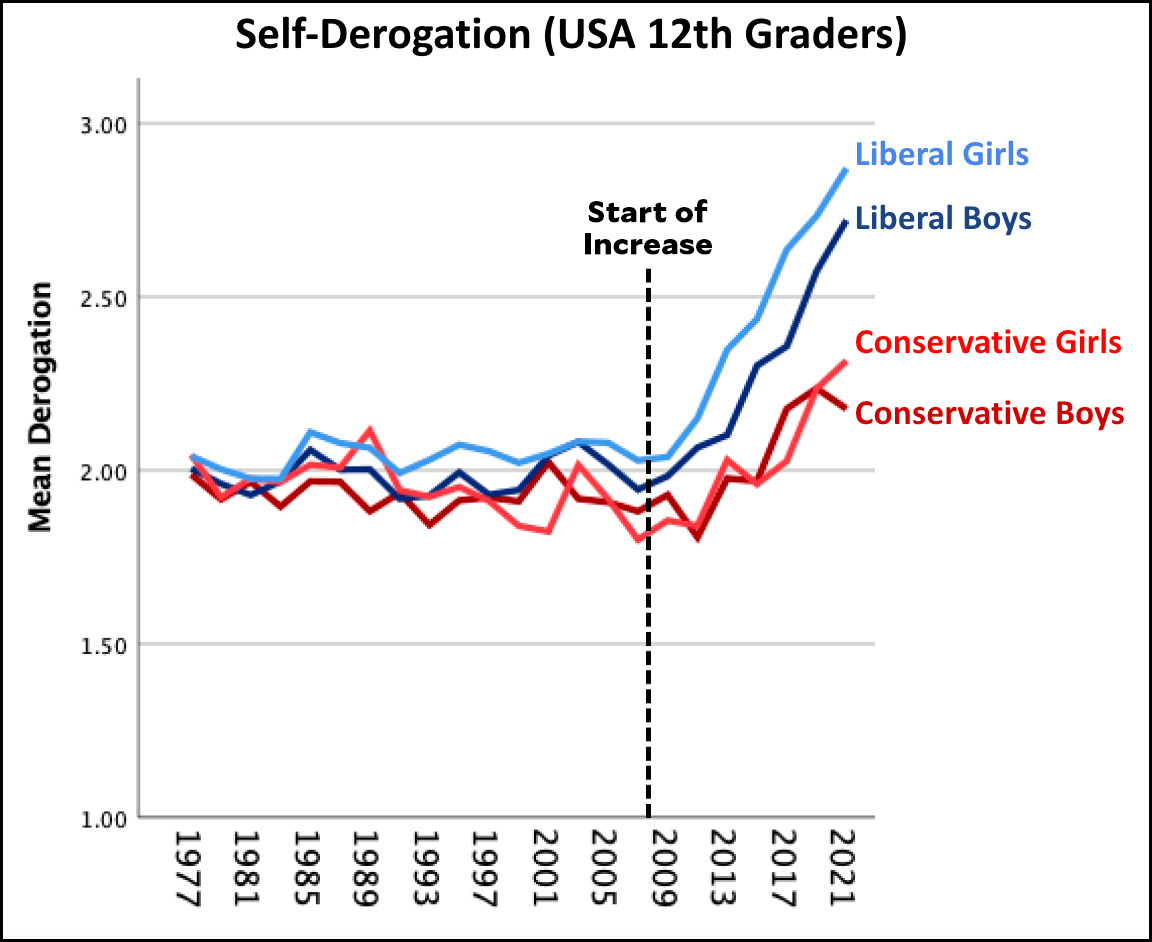

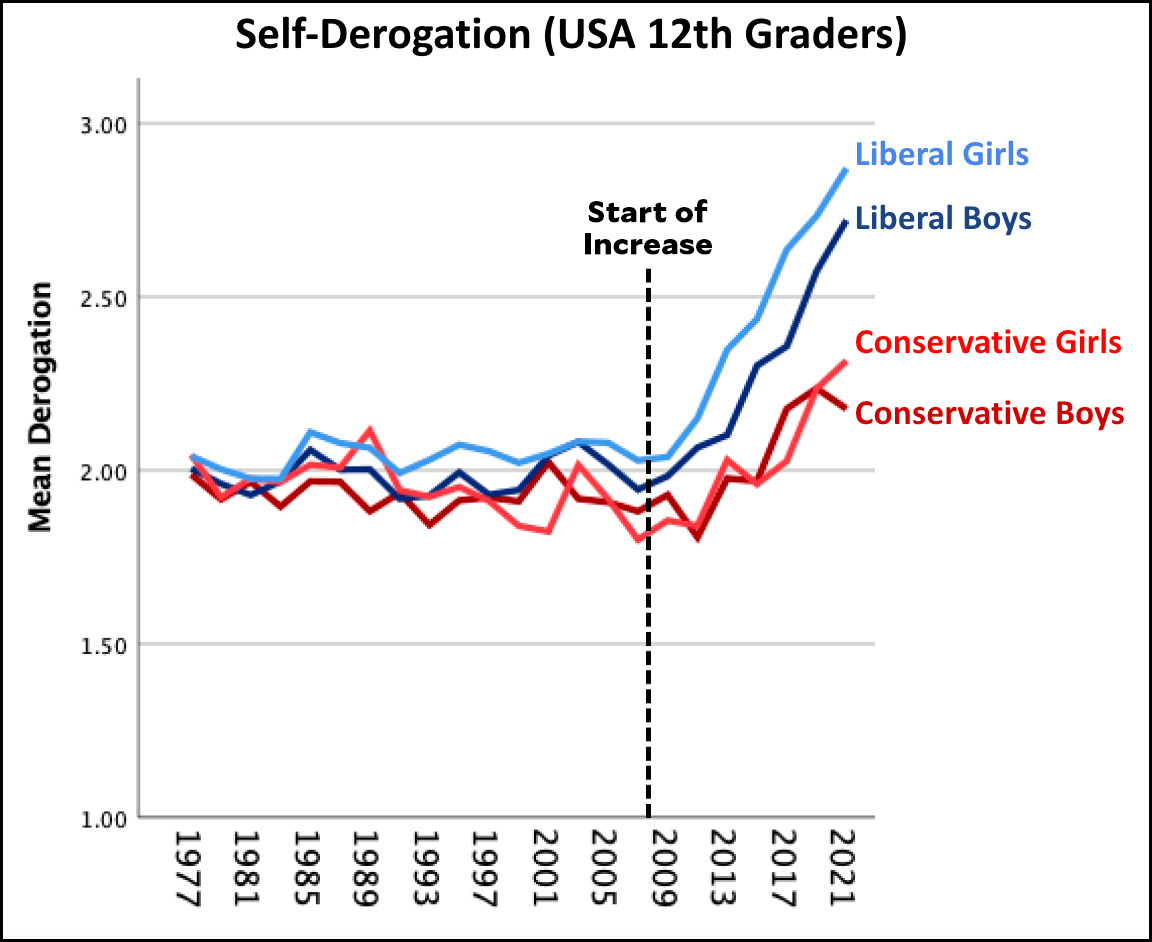

Why are teen girls so depressed these days. Jonathan Haidt thinks the answer is smartphones and social media, and I expressed some doubts about that a few weeks ago. Haidt is back today and, among other things, shows us this chart:

You can see one of the reasons for my skepticism here: the starting point for the rise in "self-derogation" is around 2009, not 2012, the year that Haidt has always focused on. This may seem trivial, but it's not. If a trend started in 2009, it's all but impossible for the cause to be something that didn't start until 2012.¹

You can see one of the reasons for my skepticism here: the starting point for the rise in "self-derogation" is around 2009, not 2012, the year that Haidt has always focused on. This may seem trivial, but it's not. If a trend started in 2009, it's all but impossible for the cause to be something that didn't start until 2012.¹

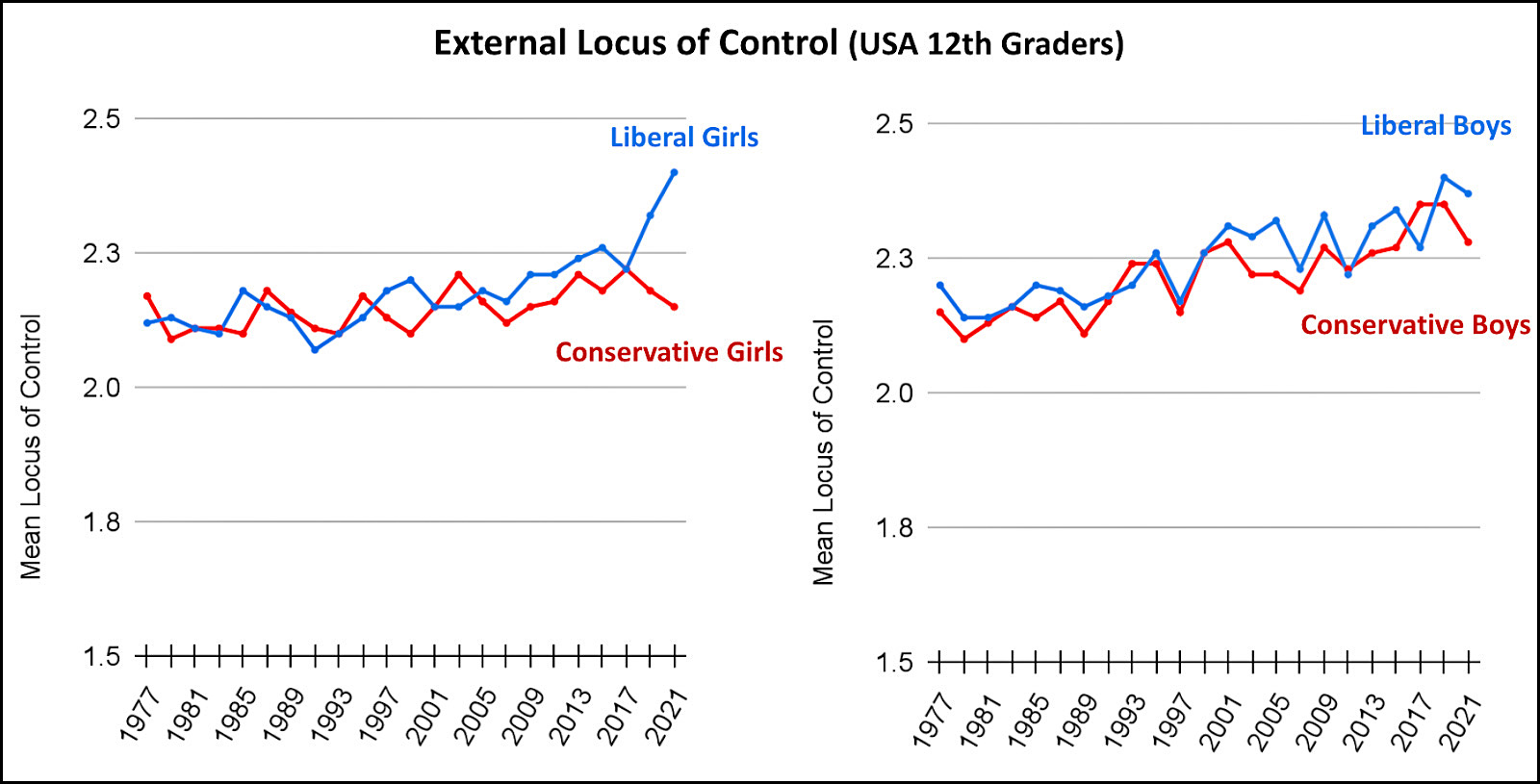

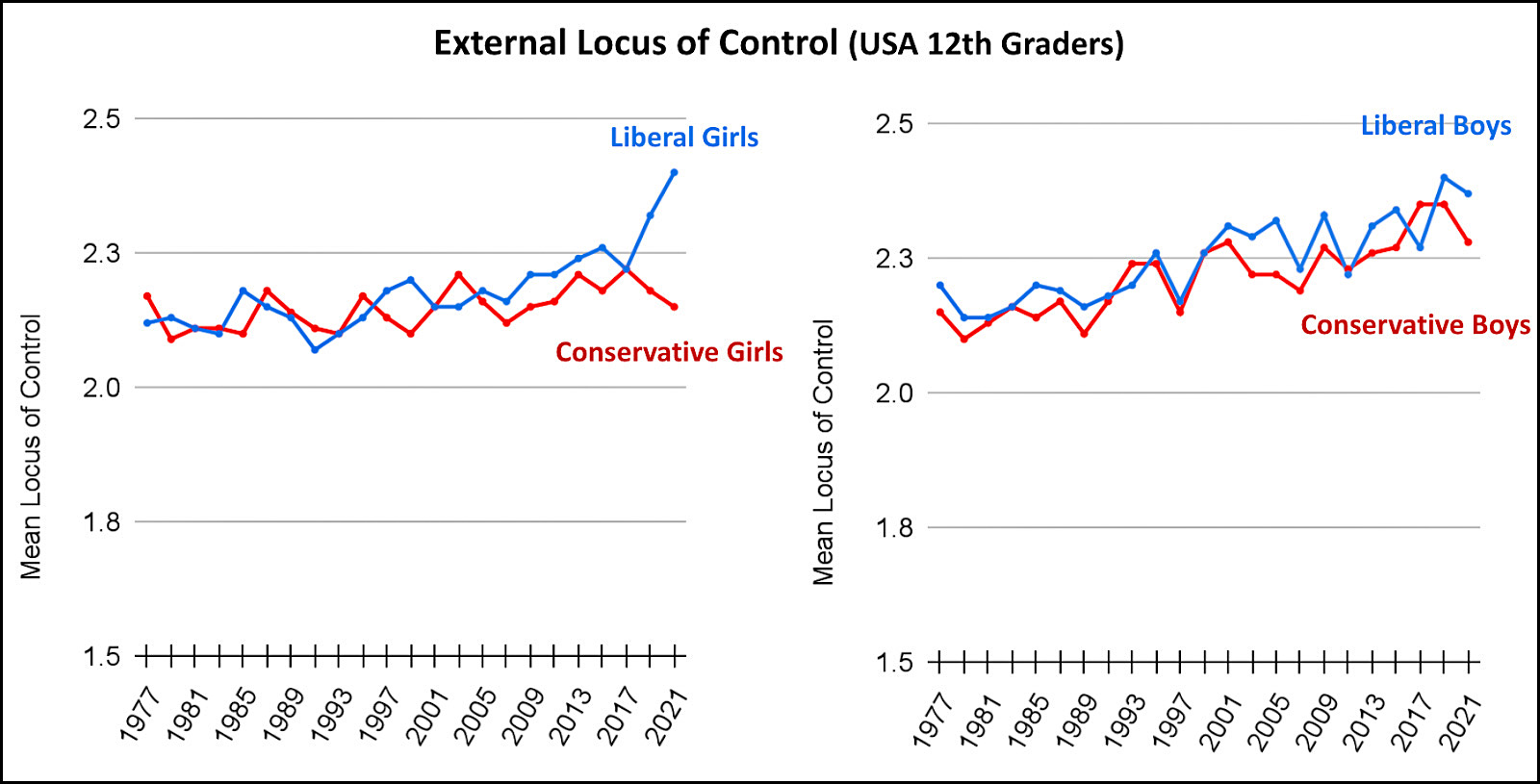

So what do we make of this? Haidt suggests that a big part of the problem is an increasing feeling of not being in control of your life. In psychology-ese, this is referred to as having an external locus of control:

After trying a few different graphing strategies, and after seeing if there was a good statistical justification for dropping any items, we reached the tentative conclusion that the big story about locus of control is not about liberal girls, it’s about Gen Z as a whole. Everyone—boys and girls, left and right—developed a more external locus of control gradually, beginning in the 1990s. I’ll come back to this finding in future posts as I explore the second strand of the After Babel Substack: the loss of “play-based childhood” which happened in the 1990s when American parents (and British, and Canadian) stopped letting their children out to play and explore, unsupervised.

Haidt thinks this began in the 1990s and then accelerated after 2012 when smartphones became widespread. I'm inclined to believe this, mainly because I've long been astonished at the suffocating amount of control that parents apparently have over their kids these days. And the worst part of this, in my view, isn't even the control per se. It's the motivation for the control: fear. Modern parents seem to be extraordinarily sensitive to even the tiniest potential danger to their children, and it's hard to believe that this constant fear doesn't get picked up by the kids. It's probably not even conscious.

But either way, it can't be healthy. If you live in a bubble of fear and control, what happens when you start to move outside of that bubble in your teenage years? My guess is that the answer is increased stress and depression, which is exactly what we see. Smartphones and social media might give this an extra push, but I'll bet they aren't the primary source.

¹I say "all but" because there could, by coincidence, be something else that happened during 2008-12 and then smartphones picked up the ball in 2012. Unlikely, but not impossible.

All told, the market was up 1.4% for the week. Some panic.

All told, the market was up 1.4% for the week. Some panic.