The Washington Post informs us that Millennials are screwed:

Homeownership — the main driver of wealth for most Americans — is out of reach for large swaths of the population. But the pinch is most pronounced for millennials, who are buying homes at a slower pace than those before them.

....Those born between 1981 to 1996 have been called the “unluckiest generation.” Since entering the workforce, they’ve experienced the slowest economic growth of any age group. They’ve also been weighed down by student debt and child-care costs, Lautz said.

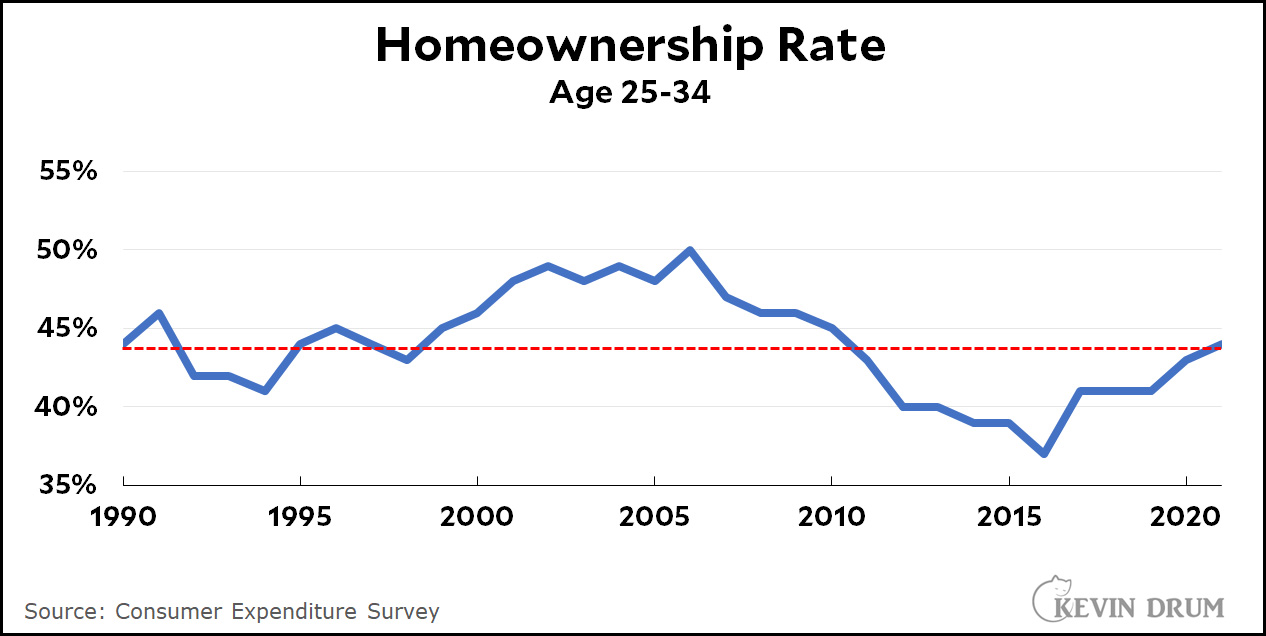

I'll spare you the usual rant about this. Instead I'll just show you a few simple charts. For 30-somethings here is homeownership:

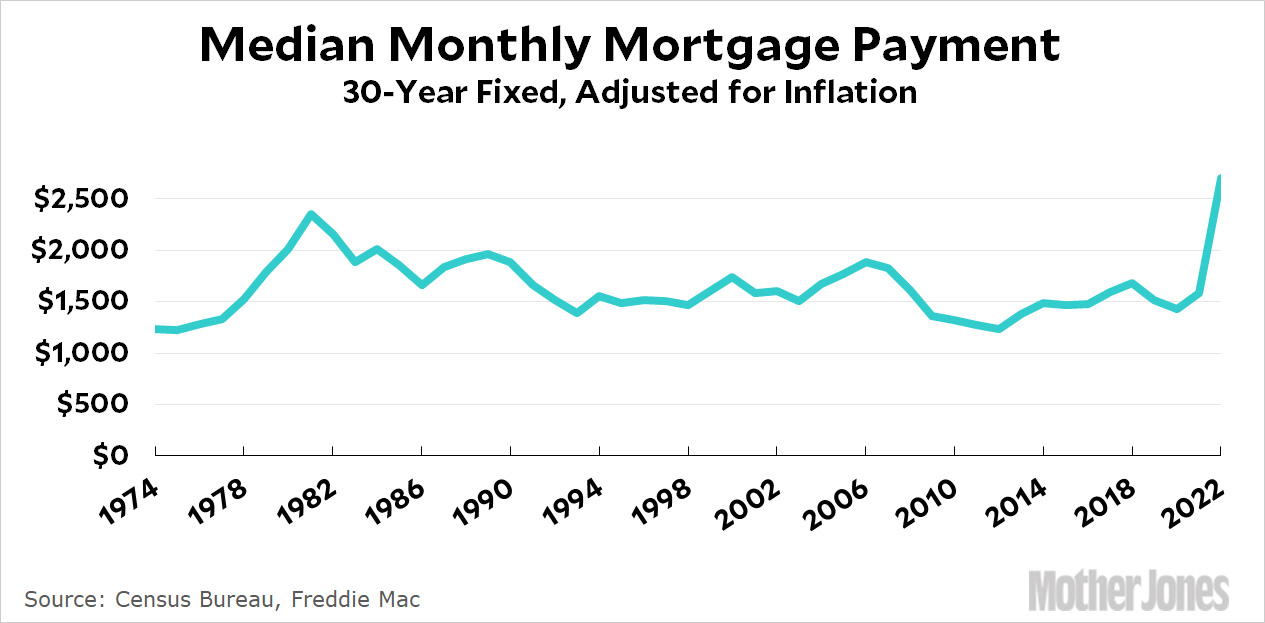

Here is the average cost of a house over the past 40 years:

Here is the average cost of a house over the past 40 years:

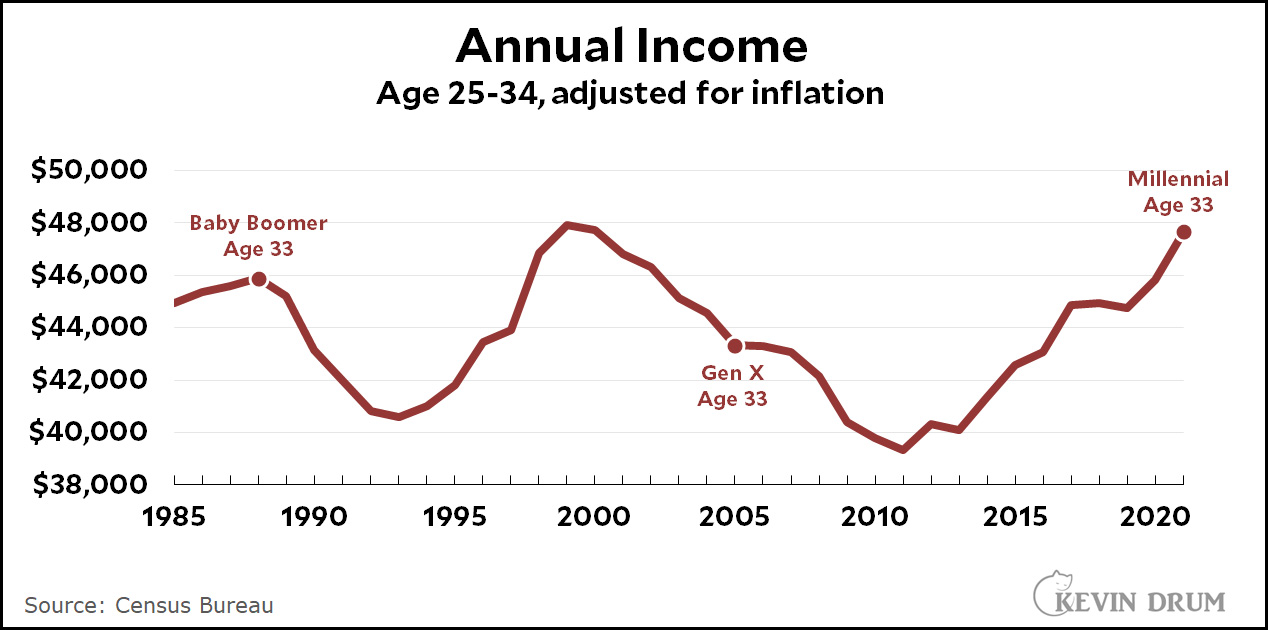

Here is income:

Here is income:

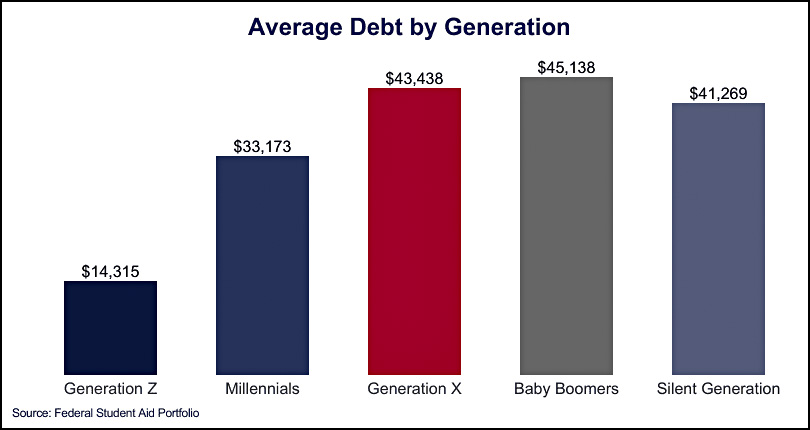

And here is student debt:

And here is student debt:

Through 2021, Millennial homeownership is at its average for the past 30 years. The average mortgage payment is the same as it was for Boomers and Gen X. Income is higher than both Gen X and Baby Boomers at the same age. And average student debt is lower than either Gen X or Baby Boomers (although only 10% of Boomers have student debt compared to 20% of Millennials).

Through 2021, Millennial homeownership is at its average for the past 30 years. The average mortgage payment is the same as it was for Boomers and Gen X. Income is higher than both Gen X and Baby Boomers at the same age. And average student debt is lower than either Gen X or Baby Boomers (although only 10% of Boomers have student debt compared to 20% of Millennials).

The average mortgage has increased and the homeownership rate has undoubtedly decreased since 2021 thanks to our recent housing boom and interest rate spike. And while it's true that this affects young families the worst, it's also (a) temporary and (b) something that every generation has gone through (Boomers got the 1981 Volcker recession and Gen X got the 2001 dotcom crash as well as the 2008 Great Recession). It's nothing unique to Millennials.

Millennials are doing fine. There's a small and vocal subset who are unhappy that they can't afford to live by themselves in a spacious apartment in Manhattan, but the vast majority are faring as well as previous generations and better than Millennials in any other country in the world. Someday a reporter from the Washington Post will read this and pass the news along to the rest of the country.